(Premium) history repeats itself again

Invest long enough, and you’ll have a story about selling something right before a big move up happens. It’s inevitable. Doesn’t make you want to metaphorically throw yourself off a bridge any less, but it is inevitable.

I have plenty of these stories… but probably the one that bothers me the most this year is INBX1. I had written INBX up on the premium side when it did its big merger / spinoff back in 2024, The thesis was simple: INBX was BHVN 2.0. As part of the deal, INBX management would move over to the new spinco. Now, INBX management had already struck it rich with the initial sale; the only reason they’d stick around and take over the new spinco is if they saw massive upside for the assets inside spinco. Not only that, but insiders were even pretty aggressive buyers of the stock post spin:

So the thesis was pretty simple…. but then April 2025 happened. The entire biotech sector got destroyed, creating countless opportunities to buy biotechs below cash….. and I sold INBX in favor of some other biotechs that were cheaper on a cash basis.

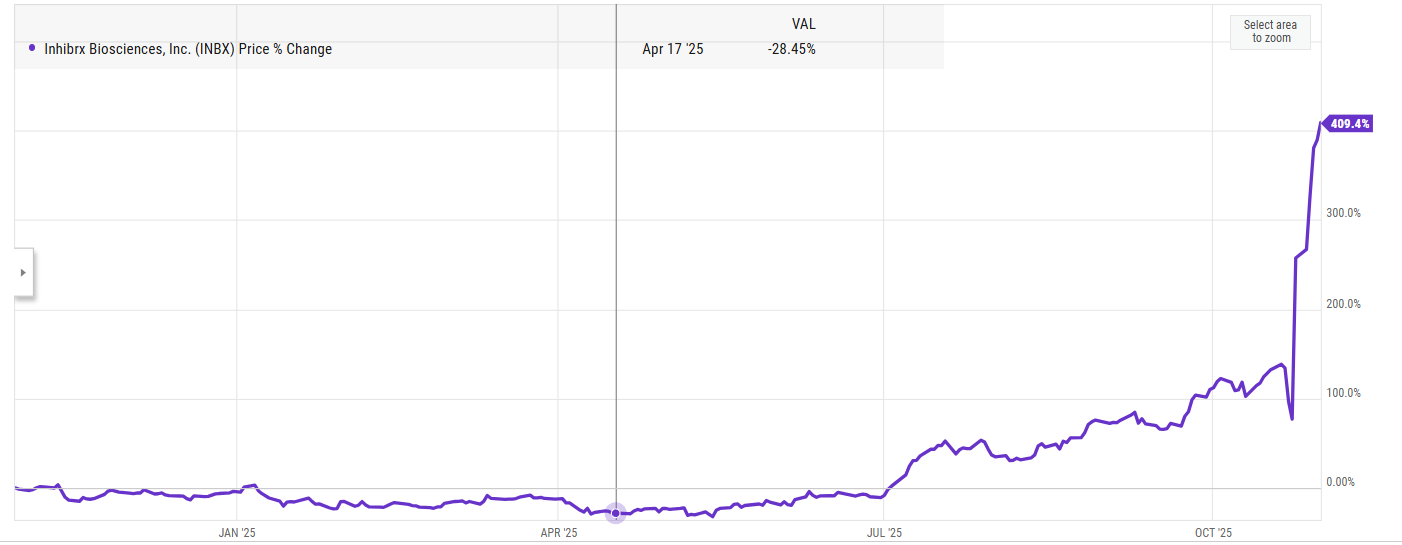

Hindsight is 20/20, and fortunately those other biotechs have generally (but not always!) worked very well…. but selling INBX was clearly not the right call:

Why do I mention INBX? Am I trying to drag my nose through the mud (as I did recently with MTSR)? No (ok, maybe a little).

The main reason I mention INBX is because I think we have another bite at that apple / event set up. There’s a current deal that has all of the rhymes and rhythms of INBX (and all the aspects of a “no-lose” set up2)…. but, perhaps even better, a quirk in the structure of the deal could accelerate the value realization.