Weekend thoughts: what's the most hated sector today that will outperform tomorrow?

Friday I posted my interview with Tidewater’s (TDW) management team. The offshore space in general is really interesting right now, and they did a great job of walking through the current dynamics (stay tuned for more posts / pods from me on the offshore space….).

Anyway, I’m not going to dive into the offshore thesis (you can listen to the pod or upcoming posts for that!), but the offshore thesis strikes me as a textbook example of capital markets driving a boom/bust/boom cycle in action. The sector had a massive boom ~10 years ago. That boom resulted in massive oversupply, and almost literally every single player in the industry went bankrupt as the the industry worked through the supply issues. Now we’re ~10 years out from the boom, and demand is starting to return. Supply is much tighter, the economic rationale for going and building new supply still isn’t there, and even if it was management teams and investors are so terrified from the last cycle that they probably won’t start building new supply until the returns are really juicy.

To be fair, the supply / demand dynamic for the offshore space has been aided not just by the limited supply but a big return in demand… we would not be seeing the same rising rate dynamic in offshore if oil was forever plateaued in the mid-$40s and there was literally no new exploration (though I do think you could argue the lack of supply is in part why oil could not plateau at $40!). But I think the general point still holds!

The combination of tight-ish supply and rising demand has resulted in some pretty strong stock returns over the past 18 months (and, given the rate dynamics and still quite low multiples, I’d guess the returns will be pretty good going forward as well).

I was prepping the TDW podcast as I was thinking about my plans for 2023: what sectors I wanted to focus on researching, where I thought there could be alpha hiding, etc.

And the combo made me think: what sectors could be the “next” offshore? Places where supply has been limited, investors have been destroyed and are terrified to touch the sector / will revolt if cash flow is put into growth capex, valuations are low, and demand is sneakily rising in a way that could create an interesting inflection point?

Off the top of my head, I had three different sector thoughts that are hated / could do well going forward: cable/media, public REITs, and FANG stocks. None of them fit perfectly with as clean a story as offshore for a bunch of reasons…. but history doesn’t repeat, it rhymes, and I can see a lot of rhythm in the comparison between each of those sectors and offshore ~18 months ago.

I’m going to walk through my quick(ish) thoughts on why each of those sectors could be interesting, but before I do I’ll throw out one thing: the world is big, and there’s a lot of sectors out there! I came up with those three sectors while I was having coffee yesterday morning; if you’ve got a sector you think fits the thesis here better, I’m all ears! Reply to the Twitter poll or hit me up in the comments below; there’s a good chance I’ll chose one of these sectors for my next Tegus deep dive (I did one on cable last year that was…. poorly timed). (PS- it’s early, but some of the replies to that poll include cannabis and gold stocks, which would definitely fit the theme here squarely)

That out the way, let’s dive into the sectors.

Sector #1: Cable / Media

Obviously this is a very, very broad category. The dynamics at play at a cable company like CHTR are very different than the dynamics at a media / streaming company like NFLX.

But you could be forgiven for thinking they had pretty similar drivers over the past year, as all of their stock prices basically mirrored each other on their way to massive, massive underperformance in 2022.

Maybe you’re thinking, “Of course the stocks mirrored each other! They went down as interest rates went up!” And there’s probably quite a bit of truth to that statement…. but NFLX is (was?) a higher multiple stock where investors were betting on world streaming domination. Cable is a boring, steady growth business where investors had a current stream of cash flow that they were betting on boring growth going forward. You would think the two would have very different responses to interest rate changes (higher growth companies, where the value is further in the future, should have more interest sensitivity).

Cable and media sectors probably aren’t quite cheap enough to fit the offshore levels of hatred…. but I think we’re getting there. Literally every investor in the sector is begging management teams to pull back on spending, and companies that don’t are getting slaughtered. When Disney didn’t address their streaming spend on their Q4’22 earnings call, their stock dropped >10% in a day and their CEO was quickly replaced. When Charter guided for increased capex over the next three years in their December analyst day, their stock cratered by 16%. Charter management was pretty clear that the capex spend was in large part either an acceleration of money that would need to be spent in the out years (i.e. they were pulling spending forward from 2028 to 2025) or being used to support growth initiatives (passing new rural homes). Either way, management tried to convince the market that the money they spent would generate really attractive returns… and the market had absolutely no cares.

A year ago, investors were begging legacy telecom companies to upgrade their copper lines to fiber lines and cheering on companies for announcing greenfield fiber/cable expansion. Today, valuations are low enough that you’re seeing investors ask companies if it wouldn’t make more sense to stop fiber upgrades and instead use the capital for buying back stock or deleveraging (quote below from CNSL’s Q3 call).

Turning back to the media sector, ~18 months ago all that mattered for media companies was how quickly they could grow their streaming sub numbers. It’s funny to think about now, but back in 2019 DIS’s stock jumped >10% (its best day since the GFC!) when they announced they’d charge just $6.99/month for Disney+. That pricing was way below what the market had expected Disney to charge, and the thinking at the time was pricing well under Netflix would let Disney turbocharge growth, and investors rewarded DIS for that. Investors also cheered every time a streaming service announced a big content spend. Today, with streaming services bleeding money, all investors care about is how quickly the streamers can stem the losses and raise prices.

So, put it together, and I could see some offshore like dynamics happening here. New supply has been crushed: investors aren’t going to allow companies to pursue new builds or massive streaming spends anymore (even if the companies wanted to, their cost of capital is too high for them to raise the money to do so!). Demand continues to increase (demand for data rises at an incredible rate as our homes get more connected and we get more online, and while Americans already spend most of their time outside of sleeping watching TV, I’d guess work from home / hybrid working and ease of streaming keeps demand for streaming and TV high), and valuations are pretty cheap across the board (valuations vary widely on the media side, but most of the more legacy type players trade for double digit cash flow yields, and almost every telecom player is trading for a double digit cash flow yield if you adjust some growth capex out). It’s tough to pencil out an offshore like “up 150% in 18 months” return with these names, but I wouldn’t be surprised if the set up leads to several years of excess returns for the whole space.

Sector #2: Public REITs

Cable/Media was a very broad space. The dynamics driving a scaled streamer like Netflix versus a small legacy media company like AMC or a staid telecom company like AT&T are very different.

Public REITs might be even broader. Yes, they all own real estate, but real estate can be very broad. Consider these three companies; all REITs yet wildly different

SLG is a self managed REIT that owns (or owns interests in) just 59 buildings, mainly NYC focused office space. Each of these buildings are worth tens or hundreds of millions of dollars and operate on a handful of very long term leases with giant corporate customers. So, on the demand side, you’re generally not going to be worried about day to day to demand / rates; you’re more focused on what rates will look like as a few big contracts expire. And, on the supply side, it would take absolute ages for a new Manhattan skyscrapper to be built. So you’ve got a reasonably good idea what supply and near term earnings look like; you’re really just trying to forecast medium and long term demand.

AHT is an externally managed REIT focused on high end hotels. They have ~100 hotels spread all throughout the country. Hotels are much different than offices; their rooms reprice basically every day, so they’re very exposed to the economy, luxury travel, etc.

Realty Income (O) is a self managed REIT that owns over 11k properties. Their focus is triple net leases to retail companies. If you drive by a standalone Starbucks or Walgreens, there’s a decent chance O owns the building and has leased it back to them. This is an incredibly stable business with insane visibility, and the company is really run as bond proxy for dividend focuses retail investors (they call themselves “The Monthly Dividend Company”). It’s hard for me to imagine an investor who’s really looking to generate alpha owning O, but it’s an incredibly stable business that has done really well overtime (likely aided by interest rates declining!) and you could probably sleep very well at night owning O.

There you have three REITs. Yes, they all own real estate, but the underlying drivers and issues effecting all of them couldn’t be more different.

So REITs encompass a really, really broad range of different real estate…. but what they all have in common is they were hammered last year.

REITs are sensitive to interest rates, so to some extent you’d expect them to underperform as interest rates rose…. but real estate should be an inflation hedge, and many of them have lots of fixed cost debt, so the degree of underperformance here is pretty surprising.

I’d guess that hammering has created opportunity. A lot of REITs are trading well below public market comps; below is a quote from Blackstone’s Q3’22 earnings call. Obviously Blackstone is the largest investor in real estate, so they’ve got a little bit of something to sell…. but I think they’re probably directionally correct that public market REITs in general present some opportunity after the most recent shellacking.

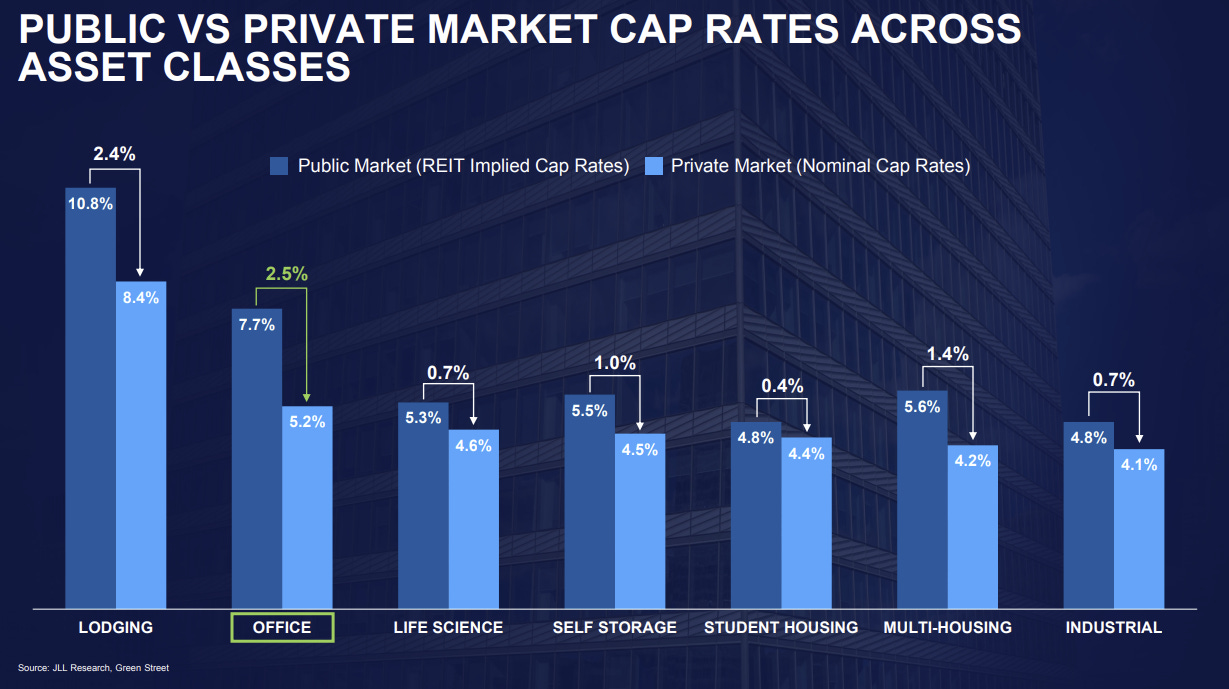

SLG’s December investor day had a slide that backed that up; cap rates are much higher in the public markets than in the private markets, particularly for lodging and office.

So, overall, public real estate is hated. That hatred is probably where the similarities to the offshore space ends for most of the sector….

Except for maybe the NYC office towers. I could see hints of rhymes to the offshore space there.

I’m going to show this with three quotes from the SLG December investor day.

The first one is just a general state of the market. NYC overall had a bounce back year in 2022, and SLG notes the 2022 is the first year the NYC economy was healthy and NYC office didn’t have a good year.

Last year, at this time, I talked about New York City's resilience and resurgence, a city that was on the comeback trail after 2 very difficult years. And in many ways, our hometown continued its upward trajectory this year with young people and tourists flocking back to New York and office using job employment actually reaching new highs relative to pre-pandemic.

But 2022 was also the first year where healthy New York City economy didn't align with the health of the overall office sector, it was rapidly rising interest rates, escalating utility costs and persistent remote work patterns made for a difficult operating environment for us and all other New York City-based commercial owners.

Ok, that’s a pretty interesting divergence…. but it gets even more interesting with this stat. Office-using jobs are now above pre-pandemic levels, but office occupancy is hovering at 60% of pre-pandemic levels (according to SLG).

Despite these exceptional efforts, this market is challenging in a way that no one could have predicted pre-COVID. While office-using jobs are now 104% of pre-pandemic levels, there is no denying that day-to-day office occupancy remains stubbornly low, with most days hovering around 60% of pre-pandemic physical occupancy.

Those are really interesting stats. Yes, work from home and flex working are real…. but if you think workers eventually return to the office for whatever reason (the optimist might say because we’re social creatures who like to connect with our collegues; the pessimist might say because managers are control freaks and softness in the labor market will let them force workers into the office where the managers can keep a closer eye on them), then eventually office occupancy should match the jobs recover, and that should lead to demand picking back up.

So right now, NYC is over-officed and under demanded. The “return to the office” could eventually take the demand side back, and in the mean time it looks like the office space is doing something about supply. SLG noted they’re trying to take excess office space and convert it into affordable housing:

One focus of that effort is the thinking about the levers that the state and the city have available to help alleviate the current oversupply of office space while also addressing New York's dire shortage of affordable housing. An effort is already underway with our industry partners to create a new blueprint for the conversion of existing office to residential.

The blueprint must be both physically and economically feasible. So as to incentivize and allow for conversions of tens of millions of square feet of office to residential dwellings and to do so on an expedited basis to help address an ongoing housing crisis. We believe in New York City's future, we expect it to continue to grow as the leading center of culture, entertainment, business and education. But this growth means that we will have an almost endless need for more affordable housing, a need that will hamper our growth, if not addressed quickly and intelligently.

Maybe that works, maybe it doesn’t….. but physical space is at a premium in NYC, and office buildings take up a lot of space. If demand remains low, I wouldn’t be surprised if we see building owners getting very creative with taking buildings and looking for alternative plans for them. Yes, there are usage and zoning issues, but if you have vacant offices everywhere and a massive housing shortage eventually I’d have to think there are some solutions to turn vacant office buildings into housing (whether it’s affordable housing or high-end residential).

Anyway, a lot of the offshore inflection seems to have been caused by demand rising over ~2 years and all alternative supply having been scrapped / no way to get new boats built. This NYC office cycle probably runs on a pretty long timeline, but I don’t think it’s crazy to think that a few years down the road you could all the sudden be looking at an NYC market where a few buildings have been taken down, demand has come back to pre-pandemic levels (and above), and all the sudden we’re looking at a really tight office market with rapidly rising rates.

One last comp: part of the offshore thesis is you’re buying the companies’ fleets below replacement cost. Given construction and zoning issues, I think “replacement” cost for NYC office is pretty tough to calculate / likely above where buildings trade (I’m not an expert; that’s just my gut), but SLG does trade far below their NAV estimate despite continued outperformance on asset sales.

Sector #3: FANG

I’m not going to spend too much time here; these are the largest companies in the world. I’m sure most readers are well aware what’s going on with them!

But after years of world beating returns, FANG stocks (and FANG-like stocks) finally stumbled in 2022. All but Apple (yes, I know it’s not technically a FANG; call it FANG adjacent!) underperformed the indices, and most of them materially underperformed.

For years, owning FANG stock was a guide to outperforming the markets… but that recent underperformance has erased most of that outperformance. On a five year basis, only MSFT and AAPL are outperforming the index.

That said, the FANGS are generally still smashing the index on a 10 year mark!

Anyway, probably too many charts, but here’s what I’m trying to drive at: despite the recent stock market performance, a lot of these FANG stocks are performing really well:

AWS for Amazon continues to kill it, and I don’t think their retail moat has gotten any smaller.

Facebook’s problems are mainly self inflicted / capital allocation worries. Those worries can change in a hurry if the company stops burning money on the Metaverse and returns a bunch of capital to shareholders.

Google’s stock might have been down ~30% in 2022, but you’d probably be surprised by that if you were just looking at their income statement. Just glancing at Q3’22, constant currency revenue was up ~11%. Yes, operating income was down, but the company continues to gush free cash flow.

Speaking of margins down, we’re generally seeing a round of layoffs in tech. It’s been pointed out before, but a lot of these companies are really fat. I think there will be a lot of eyes on Twitter and how big margins could get there with Elon running a skeleton crew. If any of the tech companies (particularly Google and Facebook) ever got serious about running lean, I think the market would be shocked at how high margins could get and how cheap the companies would look on a pro-forma basis.

Anyway, if I was looking at this from an “offshore” perspective, I’d see a group of companies where demand is absolutely continuing to grow (people are always spending more time online / doing more business online; all of these companies are beneficiaries of that trend in a variety of ways). From a supply standpoint, I see companies that are just starting to get religion on margin discipline, and a ton of their would-be competitors are going bankrupt / the funding environment for new supply is drying up rapidly.

The FANG case is probably the weakest of the three here, but if you look it’s there. These companies no longer trade with nosebleed multiples, and you hear a lot less people talking about buying them and holding forever at any valuation than you did three years ago. The absolute destruction of hyper growth companies is going to make it a lot harder to fund a scaled competitor to any of these companies.

Conclusion

Alright, that’s it for me. Again, I’m not saying these sectors are the only or even best examples of the “offshore supply demand inflection” thesis; none of them are a clean fit into the inflection thesis, but all have interesting angles and similarities, and all certainly have some degree of hatred right now. If you’ve got a sector you think fits the thesis here better, I’m all ears! Reply to the Twitter poll or hit me up in the comments below; there’s a good chance I’ll chose one of these sectors for my next Tegus deep dive (again, I did one on cable last year that was…. poorly timed; I’ll probably have to do an update post to that one at some point).

Cannabis is reviled----worth holding your nose and taking a look---institions can't/won't buy it---and historic holders are exhausted and dejected.......

On REITs, industrial REIT can be pretty good for playing a reshoring strategy, and less dependent on work from home no staying a thing

offices REITs for me is too high risk, yes recession might forced workers back in office, but will also make demand for office space lower, so it's kinda a lose-lose situation to me.