We are SO back: time to build the SPAC basket

I’ll admit upfront that this is a little bit of a meandering post…. but I think the pay off is worth it, and I think the opportunity is unique enough that it’s worth a long, meandering post.

But if you want the tl;dr: I think the market is feeling a little manic these days… and that mania creates an incredible opportunity in pre-deal SPACs. That’s right: SPACs are back!

The thesis is simple: if the market stays manic (or gets more so!), pre-deal SPACs could go parabolic. If the market falls apart, pre-deal SPACs will be protected by their trust value. The combination creates a “heads I win; tails I don’t lose” dynamic. I say all this with my eyes very open about nature of SPACs: post-deal SPACs (“deSPACs”1) are subject to enormous adverse selection bias that result in a track record of just abysmal performance, but that’s a problem for some other shareholder in the future. In the here and now (and until the SPACs deSPAC), pre-deal SPACs represent a wonderful opportunity IMO, and one that I’m heavily involved in and looking to dive into further2.

TL;DR over, back to the meandering article

I mentioned this in my recent trite Munger / Berkshire’s good at doing nothing piece, but I’ve been having some trouble finding value recently. I’m sure a huge part of that is the recent market rip up has made stocks, in general, more expensive, and I think a medium part of that is my recent experience with busted biotechs. It’s really, really hard to think about risk / reward in buying an actual business to the opportunity to buy a biotech trading at 50% of net cash when you think there’s some way for the biotech to return the cash to shareholders, whether that’s through their own accord (a la THRD) or through shareholder pressure (a la KROS)…. to say nothing of the upside if they have value above and beyond their cash (a la SAGE)3.

But there’s also a part of me that just struggles to buy stocks that have gone up. I know there’s a lot of anchoring in that struggle…. it’s unfortunate I didn’t buy stock XYZ at $20 and now it’s at $30…. but if I think it’s worth $50 (and hopefully growing) it’s still a screaming buy, and I should be able to ignore where the stock is coming from and focus on where (I think) it’s going! But, in practice, it’s difficult for me to do (particularly if the rip up has been really fast).

Anyway, a few months ago I felt like I was just swimming in ideas, and basically every company I looked at seemed interesting at a glance. I’d actually felt that way for most of the past ~year, but it got particularly pronounced in March / early April with the huge “Liberation day” sell down. Right now, I’m not that excited about most of the stuff I’m researching…. many of the businesses seem interesting, but it’s hard for me to scream “mispriced!” at any of their valuations, and I think a lot of the special situation well is currently running dry. Again, not sure if that’s because markets are fully valued or if it’s my own aversion from rising stock prices.

That type of feeling can put you in a bit of a “damned if I do, damned if I don’t” scenario: If you don’t buy anything and markets keep ripping, you’re a basket case prone to suddenly throwing in the towel and trying to chase / catch up as your underperformance continues. If you do buy something, there’s a decent you’re stretching and ignoring risks that you otherwise wouldn’t take on in order to get capital deployed.

Fortunately, there’s one investment I know of that offers a nice combination of downside protection (in case the market stalls out / falls) with a baked in call option (that should pay off if the market keeps ripping): pre-deal SPACs. The thesis here is simple: SPACs (and the market in general) are starting to show some signs of mania. If markets stay ebullient, SPACs could go parabolic. If markets slow down or crack, pre-deal SPACs offer limited downside because they’re protected by their trust / eventual liquidation value. Heads SPACs win; tails SPACs don’t lose.

That’s the simple thesis. I’m going to break this article into three (interconnected) parts from here:

I’m going to talk about why a company would want to go public through a SPAC.

That will bleed nicely into my next point: why pre-deal SPACs are so interesting right now

Finally, I’m going to wrap up with a quick conclusion

Part 1: Why would a company go public through a SPAC

Let’s be blunt: SPACs themselves are an awful product once they complete a deal / deSPAC. There’s now decades of research showing that companies that go public through SPACs underperform. Why? A huge combination of interlocking factors, including:

Adverse selection bias: in general, top tier companies can go public through an IPO, which is both cheaper and more prestigious than a SPAC deal. If they don’t want to IPO, they could raise another big private round of funding, or if they want to exit they can sell to a private equity fund or a strategic buyer and generally get better terms and/or a higher multiple than a SPAC. The only companies that chose the SPAC routes are companies that can’t go any of those routes for some reason.

Enormous (somewhat hidden) expenses: SPACs are an incredibly expensive way to go public because, if a SPAC successfully completes a deal, the SPAC’s sponsors will see their founder’s shares go into the money, resulting in massive dilution to the SPAC shareholders and, ultimately, the company. People love to bemoan IPO fees, but if you really weigh the all-in costs of going public through a SPAC they make IPO fees look like peanuts.

Forced buyers: as I’ll discuss in a second, SPACs have a limited time frame to do a deal or else they need to return capital to their shareholders. That creates a forced buying dynamic, which means SPACs are generally willing to overlook risks that other buyers would not in their quest to get a deal done.

The combination of these three factors is a major reasons deSPACs underperform over the long term: you have below average companies assuming well above average fees to go public, and buyers that might be willing to overlook some issues to get deals done. That’s a recipe for underperformance if I’ve ever seen some.

So, given that history of underperformance, why would a company chose to go public through a SPAC?

SPACs historically have three major advantages over other options; one of those advantages (projections) is now largely retired but the other two remain open:

Projections: Until recently, companies that went public through a SPAC could provide long term guidance and projections (something that cannot be done in a traditional IPO). However, on the heels of the 2021 SPAC boom/bust, the SEC modified the rules to largely close that loophole. SPACs can still probably provide a little more future disclosure / conjecture than an IPO, but the projection loophole has closed.

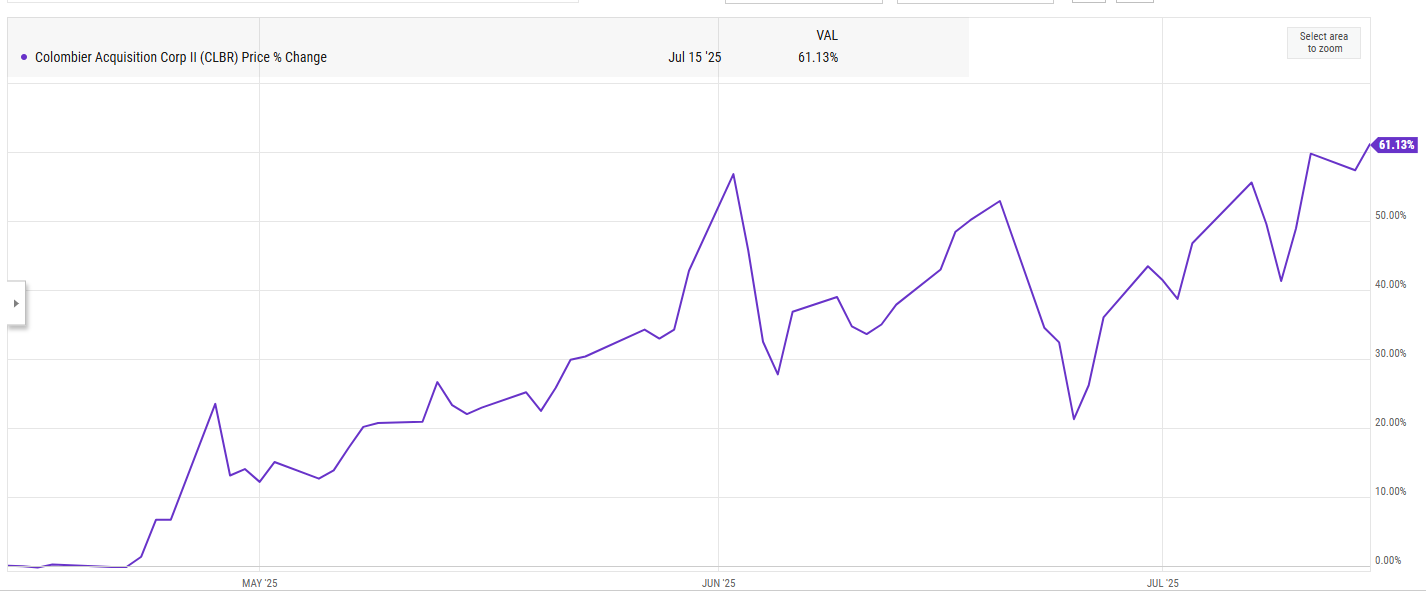

Speed, ease, and (some) certainty to market: A company can announce a SPAC deal and come to market pretty quickly. PEW (formerly CLBR) announced a deal in January and was fully public by July, and I think that’s on the slower side. A SPAC also offers some certainty of going public; if you announce one, you can be reasonably certain you’ll be public once the process is done. Now, there is the question of how many shareholders redeem (and thus a question of how much money the SPAC will actually bring the target), but if you bring a decent sized PIPE alongside the de-SPAC you can hedge that problem too. Finally, I believe the accounting / financial headache associated with a deSPAC is much, much lower than an IPO, making the SPAC a perfect product for…. let’s be generous and say less seasoned companies that are looking to go public with maybe a less than perfect financial reporting team in place. That combination of speed, ease, and certainty can have two big benefits:

Eliminating market risk: if you do an IPO and the market crashes halfway through your process, your IPO is near certainly getting pulled. Not so with a SPAC! You might have 99% of your shareholders redeem, but you’ll still be able to go public if you want to!

Taking advantage of mania: Say that you’re a company that needs to go public now for some reason (hypothetically, you’re trying to cash in on a crypto bubble). Getting a buzzy announcement today and shaving a month or two off the go private process could be enormously valuable; in addition, if you do a buzzy announcement today and see a big share price pop, you could use that to go raise a big PIPE, thus guaranteeing you liquidity even if the market goes to heck4.

Access to retail: Most forms of corporate exit (selling to a strategic investor, selling to private equity, or pursuing an IPO) involve exiting largely to an institutional investor group. If you’re a company that suspects retail would give you a higher multiple than institutional investors (for example, if you have a tie to a politician or a celebrity with a cult following), then using a SPAC to directly go to retail can have huge appeal and result in much lower cost of capital / a higher equity price.

So, yes, the history of deSPACs is pretty poor…. but, given the points laid out above, I think you can see why a certain type of company might be interested in pursuing a SPAC deal!

But I’m not really interested in talking about adverse selection, and I’m sure you’re not either. I’m interested in risk-adjusted opportunity! And, given I just discussed how the history of SPACs is rocky (at best), why deSPACs underperform, and the huge (negative) selection bias in the types of companies that go public through SPACs, I’m sure you’re wondering…..

Why are pre-deal SPACs so interesting?

To answer that question, let’s first start with an overview of SPACs.

The basic way a SPAC works is they raise a bunch of money (generally $100-200m), which goes into a trust account (SPACs almost universally chose a share count that gets them to $10/share in trust). The SPAC then gets some time (normally 18-24 months) to go look for a deal. When they find one, they need to bring the deal to shareholders, and shareholders can either vote to get their money back from the trust account (including the interest that money has earned while sitting in the bank!) or roll their shares into the new company. If the SPAC doesn’t find a deal in the prescribed time frame, the money (and the interest on the money!) get returned to shareholders5.

That structure makes pre-deal SPACs a call option. If the SPAC announces a buzzy deal and the stock races, the returns can be incredible… it’s not unheard of for a SPAC to pop 2-3x on a buzzy enough deal, leaving pre-deal shareholders with an enormous windfall. If the SPAC announces a poorly received deal or fails to find one, shareholders can just redeem their shares and get T-Bill-ish returns. That “heads I win a ton; tails I don’t lose” combination makes for a great cash alternative IMO (remember that I am talking my book / not giving investing advice / check out our legal disclaimer).

The issue with SPACs is that, in normal times, that call option generally isn’t valuable. Investors realize that SPACs mostly announce really bad deals (for all of the reasons I already mentioned), so SPACs generally don’t pop on deal announcements, and most SPACs struggle to get their deals over the finish lines. Bottom line: in normal times, SPAC investors basically spend a bunch of time researching, buying, and monitoring a bunch of SPACs for T-Bill like returns.

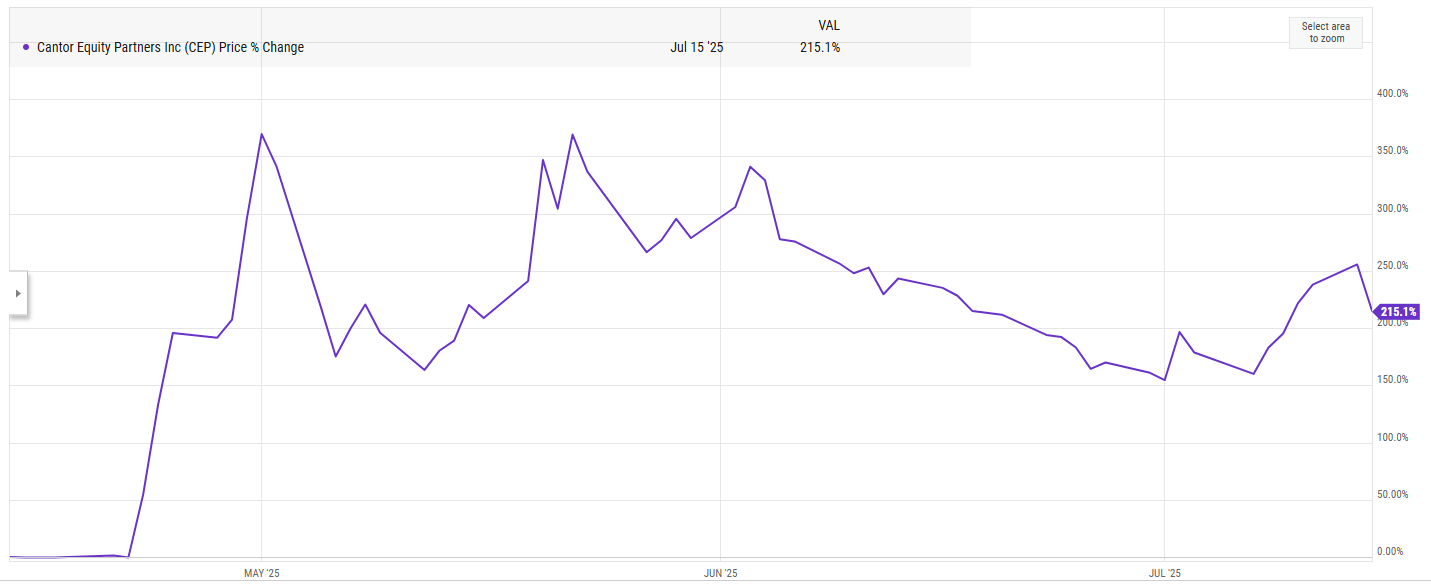

But when the markets get euphoric, that call option can be very, very valuable. We saw it in early 2021, when SPACs were popping 50% plus on basically any deal announcement. And we’re seeing signs of it happening again now; multiple SPACs have announced deals and seen their stocks take off. The headliner here is CEP, which announced a deal to become a bitcoin treasury company and saw their stock triple / now trades for more than 3x NAV.

CEP is the standout, but there are plenty of others. As I write this, CLBR is about to complete their de-SPAC and will soon trade under “PEW”. The stock trades for >$17/share, a very nice premium to NAV / return to shareholders who bought in pre-deal.

My theory here is simple: the SPAC call option is getting increasingly valuable as the market gets more and more frothy. There are plenty of companies out there that touch AI, crypto, or the Trump family. The market is rewarding companies (and SPACs) that announce deals with one of those players with huge multiples. SPAC sponsors are very responsive to market signals; if the market is rewarding SPACs that do deals in those spaces with big multiples, SPACs are going to keep announcing deals in those spaces until the market can’t handle it / the bubble pops.

The evolution of that theory into an investment thesis is simple: pick a handful of pre-deal SPACs and hope to get lucky. As long as you’re paying around trust value for the SPAC, your downside is covered by the liquidation value, and your upside is enormous. If just one of the SPACs announces a buzzy enough deal, the basket will likely prove the best risk adjusted returns you’ve ever made.

And if I’m wrong and the market cools off? No big deal. Again, the beauty of this trade is that the trust value protects you on the downside, and the trust accrues interest…. so worst case scenario you’ve just locked yourself into a cash equivalent for a little bit.

So that’s the thesis. Let’s talk numbers: There are between 150-200 pre-deal SPACs6 out there. You could go and buy pretty much any of them for around trust value and benefit from the call option…. but I think with some digging you can find some SPACs that, for one reason or another, are more likely to announce buzzy deals.

Now, the market can be wise to that “look for a company likely to do a buzzy deal” trade. Consider something like RTAC, which went public earlier this year. That SPAC is run by the DWAC / DJT7 team. It’s overwhelmingly likely that team does something Trump-related to cash in, and the stock will probably go wild if and when they do…. but the market is wise to that trade, and you’re really paying up for that optionality. RTAC trades for $11.85/share right now versus ~$10.05/share in trust (they IPO’d intra-quarter in Q1; I’m adjusting for the interest they’ve likely earned since IPO). That doesn’t mean it’s a bad bet; in fact, it’s probably a good one! If a buzzy transaction could send the stock to $30, you’re risking ~$2/share to make ~$18/share. Is there a >10% chance that they announce a buzzy deal? In this market, I’d say almost certainly! So probably a good bet8!

But I’ll be honest: it’s not the type of bet I’m looking to make. The way I play SPACs is I will not pay more than a token amount above trust9. I treat SPACs like cash equivalents, and I want them to really serve as cash equivalents. In a down market / if the SPAC boom wipes out quickly (and when a bubble bursts, it does tend to do so very quickly), RTAC could easily trade back towards trust, and an investor who paid 15-20% above trust would be facing real capital impairment. That’s not the risk and downside I’m looking to take. I generally want to buy pre-deal SPACs as a cash equivalent with a call option attached and hope that with some sleuthing I can find call options that the market is undervaluing, but above all I’m trying to protect downside / use SPACs as a cash alternative with a call option. RTAC does not fit that bill at all!

Conclusion

I’ve been following / investing in SPACs for a long time. I think I’ve always been pretty eyes wide open on the issues with deSPACs…. but I’ve also always thought the call option associated with pre-deal SPACs was enormously mispriced. That call option paid off in spades in early 2021…. but, with the benefit of hindsight, I did not swing close to hard enough at the opportunity set back then.

Today’s market reminds me of late 2020 / early 2021 in so many ways. Perhaps it end tomorrow. Perhaps it last for another year. There’s honestly no way to know.

But I do know one thing: I’m not going to make the same mistake I did in 2021. I’m going to swing hard at the opportunity set now and hope that we flip heads / the call option pays off….. if we flip tails and the insanity stops tomorrow, I’ll be bummed but I’ll be fine having invested my cash into (pre-deal) SPACs.

If you’re at all interested in SPACs, I’d love to swap notes / chat!

PS

You’ll note that I talked about SPACs (like RTAC) that the market has already given a big premium on a potential buzzy deal…. but did not talk about any SPACs that don’t have a premium that I think could land a buzzy deal. That was intentional! I might do a follow up article highlighting some, but I really just wanted to highlight the overall opportunity. Again, always happy to swap notes if you’re interested!

I try not to use too much jargon in my write ups, but it’s inevitable when dealing with SPACs. The three terms you need to know: a SPAC is a publicly traded cash shell searching for an acquisition. A “pre-deal SPAC” is simply a SPAC before it completes its acquisition, and a “deSPAC’ is a SPAC after it has completed its acquisition and become a different company (any company that went public through a SPAC is forever a deSPAC).

If you’re involved in the space, or looking to learn more, I’d certainly love to swap thoughts. Shoot me a note. And I’ll disclose that I’m very long a large basket of pre-deal SPACs, so I’m very much talking my own book!

Disclosure: I am long THRD, KROS, and SAGE

CEP serves as a nice example of this. They announced a buzzy deal and saw their stock shoot from ~$10 to ~$30, and they then raised a new PIPE money at $21/share even before completing their deSPAC’ing.

This is a simplification, and there all sorts of exceptions and the like. But it’s a pretty good primer!

It’s tough to give an exact number because some SPACs will have basically all their shareholders redeem but limp along as a tiny little SPAC shell with like $1m in trust hoping to strike a random deal with a really desperate asset. It’s hard to include that as a SPAC given you can’t really buy it and it’s really a strange vehicle, but it’s also hard to filter them out!

DWAC was the SPAC that took Truth Social public; it now trades under DJT.

I wrote this whole paragraph earlier this week…. right before CEPO announced a buzzy bitcoin deal that saw their stock trade to ~$15/share. CEPO already had some premium baked in due largely to its ties to the Trump Admin / successful CEP SPAC, so it’d serve as a perfect example of this type of “already trades for a premium but still announces a hugely buzzy deal” theme.

Note that I won’t split hairs. If a SPAC has great sponsors and ties to buzzy stuff, and the stock trades for $10.03 against $10/share in trust…. whatever. As long as we’re within a percent or three of trust, that’s within my margin of safety. But big premiums to trust are a no go for me personally.

Great article. We have mentioned this risk/reward dynamic with SPACs to our investors over the years. We aim to buy SPACs trading below trust value, that way the r/r dynamic is “heads you win a bit; tails you win a lot”.

RTAC now trading close to that 3% premium to trust value (10.55 vs 10.18). Are you taking any action Andrew?