Some things and ideas: November 2025

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2025 vision and goals for the empire here. If you like the blog / free site, I’d encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

A bonus note: I get asked from lots of people about how to break into the finance industry. I’ve done an entire podcast on how to get a job in investing I’d encourage you to listen to…. but my top advice would be to go out and start a substack yourself! If you do launch a substack, please let me know so I can try to be helpful.

I’m out of my mind right now

We had baby #2 last weekend. Everyone is doing great…. but between the prep for the baby and then the lack of sleep once the baby got here, I’m not sure what mental space I was in while I was putting this article together.

Prediction markets and the wrong side of a trade

Hot take: I think prediction markets are both pretty cool and really dangerous.

Why cool? I do believe that markets are the best way to look at / predict events; particularly when it comes to elections, it’s really cool to be able to look in real time and see how the markets are pricing things. If there’s some scandal that comes out, why should we have to wait for five days to see how the scandal moves “the polls” for an election?

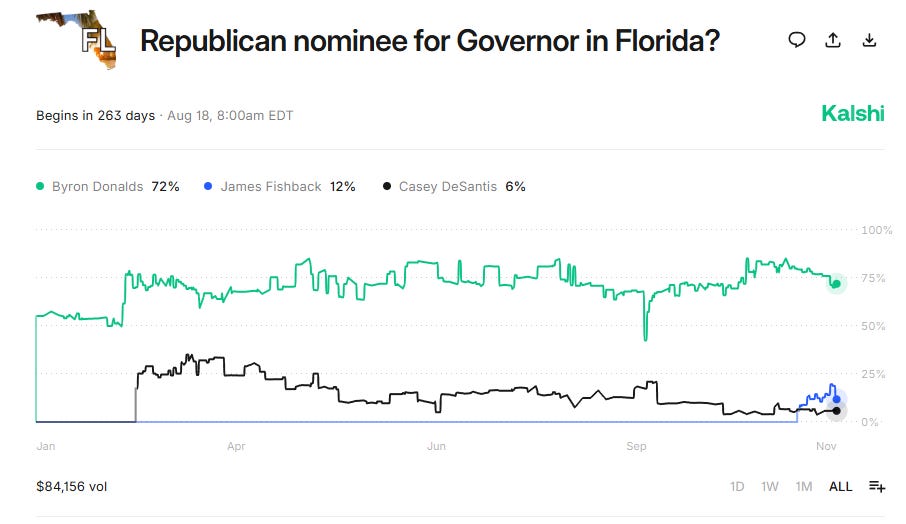

Why dangerous? These markets can be really, really thin. Consider the market for Republican nominee for Florida Governor. There’s been $85k in volume on that market… that’s almost nothing, and even ignoring the total volume the market is really, really thin. How hard would it be to announce you’re running for governor, jam the market with $100k betting you’ll win, and then do a news circuit while proclaiming you’re the favorite? Is there the potential for some reflexivity to kick in for the right candidate with that strategy as they gain increasing amounts of news coverage? I don’t think it’s insane to think so, and given the second leading candidate is tweeting out their Kalshi odds, candidates are already clearly seeing some marketing value here.

You could also see a world where a candidate jams polymarket in order to suppress their opponents turnout (“why bother voting? My preferred candidate only has a 2% chance on polymarket; it’s a waste of time”); Ackman basically suggested this before the NYC mayor election

The other worry I have is the potential for gaming the system. Consider this story of a Kalshi market on a Trump interview. I will admit I don’t know if the story is true or not, but even if it’s fake I think it nicely illustrates the perils of prediction markets. Basically, Kalshi had a prediction market for what Trump would say in an interview. Seems simple, right? Well, there was huge debate over if only things Trump said during the actual interview counted or if things Trump said in recording played during the interview counted. Now, you could just say “read the fine print before you bet”…. and I’m all for people getting paid on deep reading of the fine print! But (ignoring that Kalshi appears to have changed the fine print, so you do exchange interpretation risk) you worry that the fine print makes this even more prone for gaming. Could you imagine a low level editor making a confusing edit to game the prediction market, buying one side after the crash, alerting the market that technically the way the interview was produced triggered one side or the other, and then making a fortune? How do you police that when everything starts to have prediction markets?

To bring this back to the title: one thing every investor worries about is being on the wrong side of a trade from someone who has inside info. Say a stock you own randomly spikes 20% intraday on no news…. it can be tempting to sell some or all of it, but in the back of your mind there’s always the question, “is this spiking because someone knows something.” And there are some markets where the bar for trading is just much, much higher because you can be the “patsy at the poker table” and trade against people who have better information than you (which is generally very, very negative EV!)1. I worry that prediction markets could evolve in a way where most of the markets have that exact “I’m probably trading against someone with way better info than me, or perhaps even someone who can manipulate the market to their benefit.”

One article that caught my eye (New monthly recurring piece)

Why this article?

First, it’s an incredible piece of journalism!

Second, it gave me a weird thought. When the first Trump administration was coming into power, Peter Thiel had a somewhat infamous line talking about corruption, “there’s a point where no corruption can be a bad thing.”2 For some reason every time I read about a decision that seems to be driven as much by lobbying and conflicts of interest as anything else, I think about that quote….

Third, it did awaken the libertarian in me. There’s no doubt in my mind we’ve been too tough on nuclear projects and basically regulated it out of existence, but I wonder where the right middle ground is. I struggle to believe that even the most ardent libertarian wouldn’t want some form of regulation when it comes to nuclear power and waste management (both of which have heavy potential negative externalities, which is generally where the government’s power is called for!), but how do you structure an agency whose one goal is “don’t let accidents happen” so that they can achieve that without destroying entrepreneurship?

There’s a fantasy book about AI called “after on” I read about ten years ago. I’m not going to claim it was the greatest work of literature in history but it was a fun / breezy read IMO. It goes through the different ways AI could awaken, and one of the scenarios is you generate an AI whose one goal is to produce the best handwritten thank you cards…. and the first thing it does on gaining sentience is kill all the humans because it realizes humans take up resources that could be devoted to making thank you cards and that humans eventually might try to stop it from making thank you cards. I kind of think about that when it comes to nuclear safety: if your one goal is “don’t have a nuclear accident”, the easiest way to do that is to have no nuclear whatsoever, even if that’s not what the regulators intended to set up!

State of markets (Monthly recurring piece)

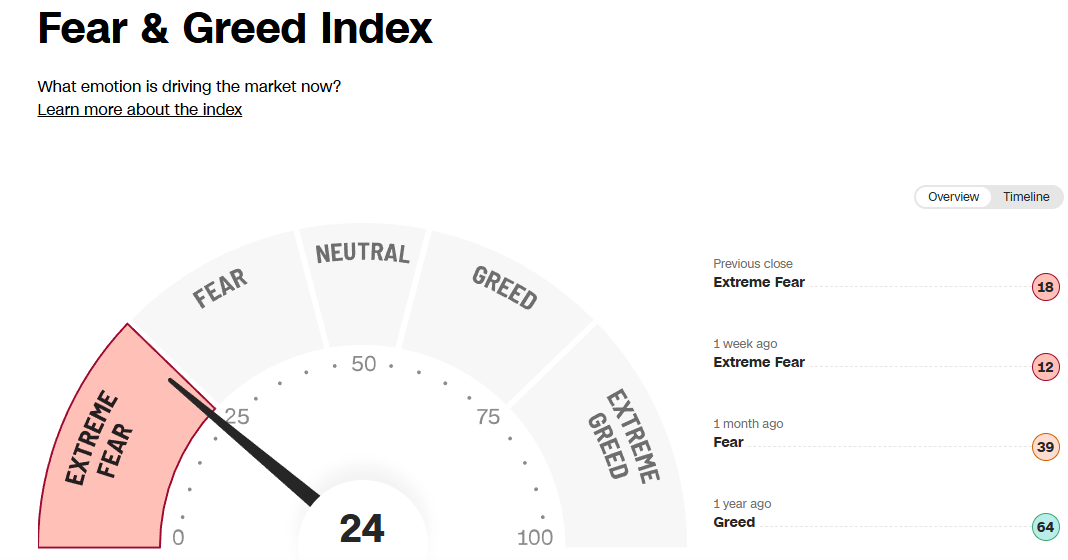

It’s not a perfect indicator, but I like to use the CNN “Fear & Greed” Index just to quickly quantify where the markets are.

Last month, the indicator said we were in fear territory (and I firmly disagreed). This month, the indicator says we’re dipping into extreme fear territory…

To which I say: get the fudge out of here. Markets (at least domestic ones) are at all time highs across the board and you think we’re in extreme fear? Come on!

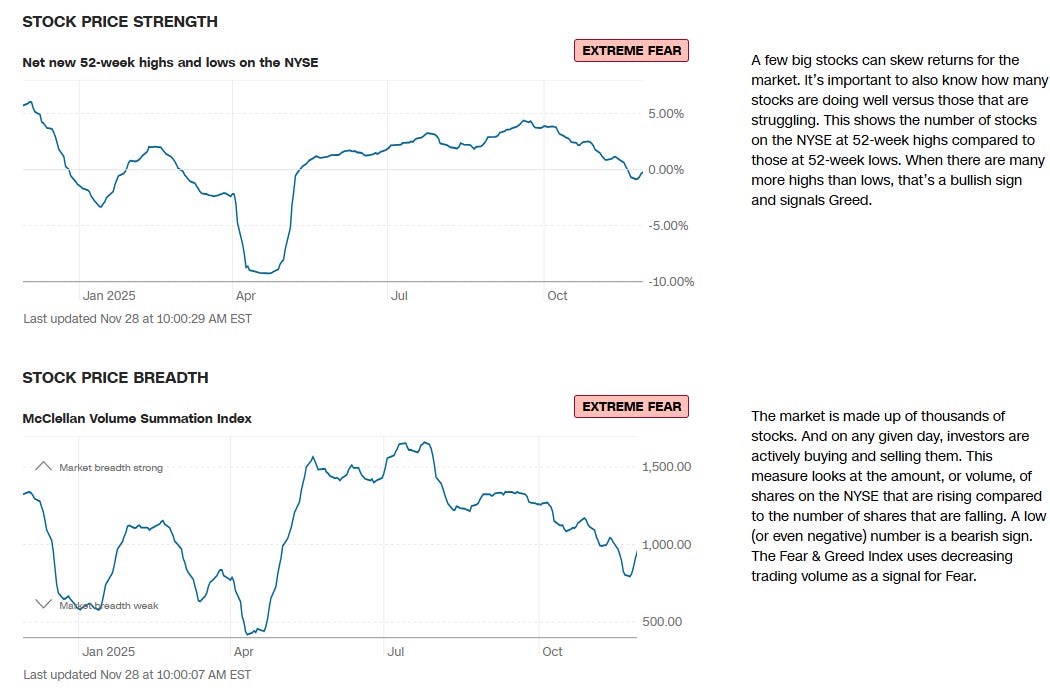

That said, just like with the terms of the Kalshi contract mentioned earlier, sometimes it pays to read the fine print (or, in this case, understand how the index is put together). And the major reason we’re touching “extreme fear” in the index is because stock price strength and breadth is awful.

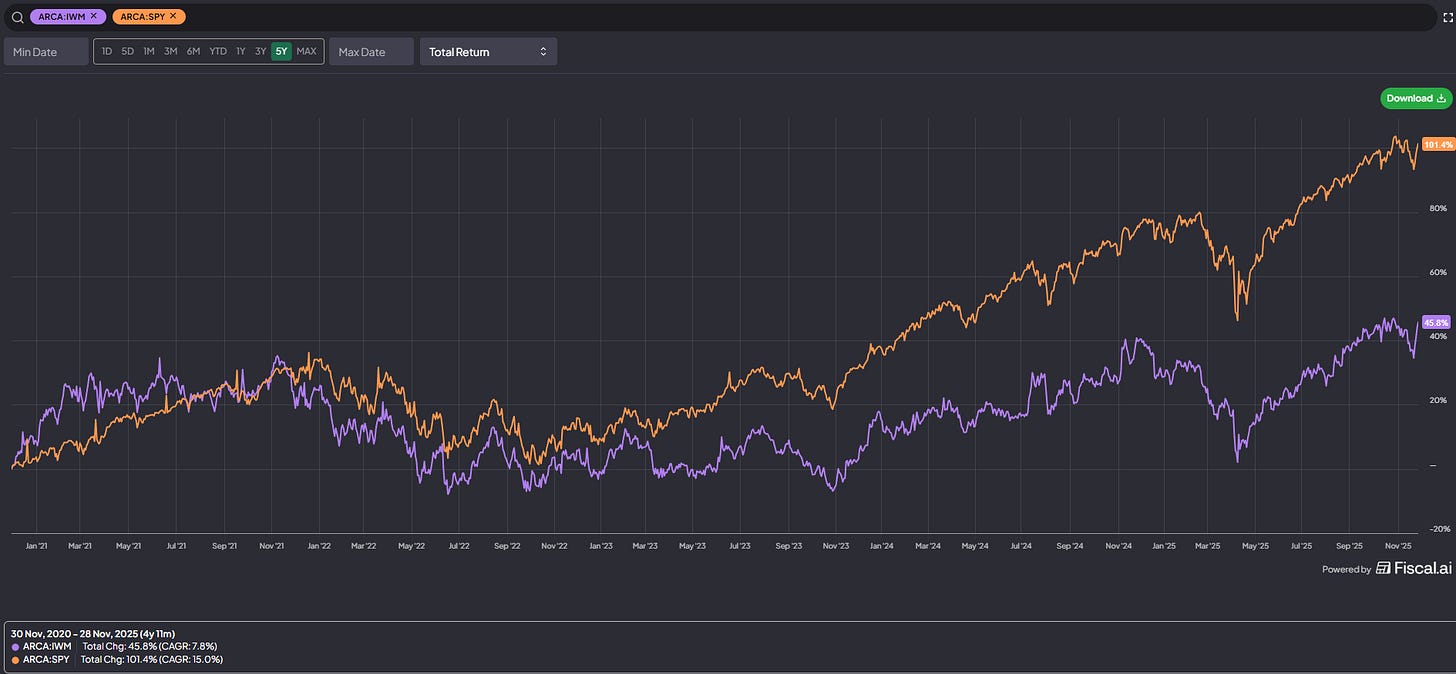

For almost all of the past year, I’ve been saying that this is a tale of two markets. If your stock touches anything AI related, your stock seemingly can do nothing but go up. But if you have any exposure to non-AI business, the macro is rocky and your stock is constantly hammered. I’m far from the first to say this, but it does have a lot of rhymes with the dotcom bubble. Am I saying we’re in a bubble? Absolutely not! Another reason the indices are so strong is that they’re dominated by the largest businesses (Google, Amazon, Facebook, etc), and it just so happens that the largest businesses double as the best businesses the world has ever seen….. but, all in, just a weird market.

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I was an eager supporter of the Brandon Sanderson (original) Kickstarter (yes, I splurged and went for the hardcover books).

I didn’t support Sanderson’s DND-style board game…. but only because my wife would murder me if I bought another board game when I have a whole Dungeon Master kit collecting dust. Still, I wanted to highlight it because between the two Kickstarters Sanderson will have raised >$50m for new projects; if you’re a fan of fantasy and that type of fan enthusiasm doesn’t encourage you to give him a try, I don’t know what will! As I mention below, if you’re trying him out, I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written

This month, I’ve finished HuntSong. It’s book #2 in the Singer of Terandria series, which is a spin off of the Wandering Inn (now up to 17 books and my favorite series of all time by far). It’s not quite as good as Wandering Inn…. but that’s probably cause it’s early in the story. I just love this world. If you’re really into fantasy, it’s hard for me to believe you wouldn’t love it too.

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read. Most of his works are interconnected through something called “the cosmere;” if you’re feeling crazy, here’s how to read the cosmere in order.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

The Wandering Inn series isn’t for everyone, and the first ~150 pages of the first book need to get powered through…. but, if you can power through them, the world building here is incredible, and I’ve had so many friends get hooked by this series. If you like hard fantasy, I can near guarantee you’ll like it.

Similarly, Dungeon Crawler Carl won’t be for everyone, but it’s probably the most fun series of books I’ve ever read, and some of the scenes in the later books carry a surprising amount of emotional weight.

The Silvers Epic (Flight of the Silvers, Song of the Orphans, War of the Givens) is more sci-fi than fantasy, but it’s one of my favorite series I’ve ever read and I think is wildly creative in how they use time travel / multiverse as a plot point (the last book was a little slow, but the ending wrapped everything up beautifully / it got a little dusty in the room I was reading).

A lot of crytpo markets have this problem to me, though that problem is just one of many!

For some reason, I remember this quote as something along the line of “what if there’s not enough fraud in the government,” but it appears I was off. Perhaps it’s because there are plenty of variations on the line; for example, “the optimal amount of fraud is not zero” from this WSJ article.

Good recommendations, have read most of them. Will try Tress (not Tess). Just read a couple of good books in the Hierarchy series (now waiting for number 3), very good. Congrats on your second child, kids are what it's all about.