Risking a zero: payments and stablecoins (Alphasense Webinar)

Back in the go-go days of 2021, I remember people predicting crypto would replace…. well, basically everything. I had a friend explain to me how crypto was going to revolutionize mortgages by eating into the big banks’ profit pool (never mind that mortgages are already an extraordinarily competitive basically commodity business!).

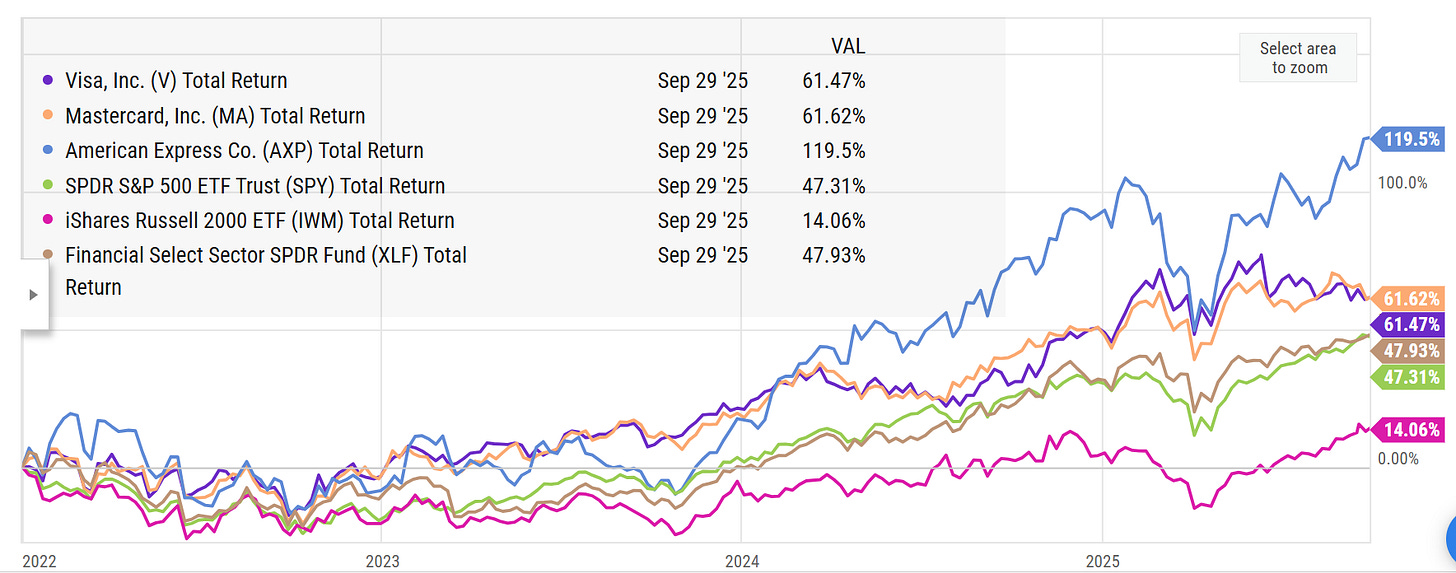

But this “crypto will eat the world” mindset was probably most famously (or infamously) immortalized by Chamath’s prediction for 2022 that crypto would eat the payment rails, making Visa and Mastercard epic shorts (he described short V / MA; long the web3 payment pioneers as “the ‘most profitable spread trade’ of his lifetime.” This prediction has not worked out well; regardless of your index, the payment companies (Visa, Mastercard, Amex) have outperformed over the ~4 years since Chamath’s prediction.

I’ve been thinking about those 2021 “crypto will eat the world” predictions a lot recently. It was pretty clear to me back in 2021 that crypto didn’t stand a chance in a lot of the domains they were looking to attack, and I think subsequent history (and the crypto winter of 2022) bore that out.

But, as 2025 has played out, I’ve been wondering a lot if crypto was in a classic gartner hype cycle back in 2021. 2021 was the peak of inflated expectations; we’ll certainly never come close to the crypto hype of that year. 2022 would be the trough of disillusionment (with the FTX bankruptcy probably marking the trough)…. but in that winter we’ve started to see some actual use cases emerge for crypto (entering our slope of enlightenment and perhaps the plateau of productivity).

I tend to be a crypto skeptic, and I remain skeptical on a lot of the areas where crypto claims to offer improvement. However, even as a skeptic, it’s hard to ignore the growing business of stablecoins. Just this summer, you saw:

Scott Bessenet (the U.S. Treasury Secretary) release a statement calling stablecoins “a revolution in digital finance,”

Visa and Mastercard’s stock drop ~5% intraday on the threat of Walmart and Amazon issuing their own stablecoin

Personally, I had always viewed the rise of stablecoins as silly; instantly settleable currency transactions sound like a money launderers dream but it’s hard for me to imagine that there’s a huge amount of real world projects that could create significant economic value but are getting gated by the 48 hour delay from the legacy banking system.

But when the facts change, I try to change my mind, and all summer the market has been screaming at me that stablecoins are real businesses with real world implications. And, while I don’t think Mastercard and Visa are “risking a zero” from stablecoins like some of the media companies from the 90s I’ve mentioned, it’s become increasingly clear that stablecoins could materially change the economics of payment companies as well as have big impacts on remittance companies like Remitly.

Given all that, when AlphaSense offered to sponsor a free expert call / webinar for me, I decided to step out of my comfort zone a little bit and try to learn a little more about stablecoins and payments. That expert call is now live; you can sign up for it here:

I’m not going to claim the expert call is perfect. It’s not! But that’s because I’m a generalist, so a lot of my questions are much more high level than if I had spent my life emersed in payments. If you’re a sector expert who has been following payments and stablecoins nonstop for the past five years, you’re probably not going to learn a ton. However, if (like me!) you’re a generalist who has loosely followed Visa and Mastercard offer the years and been shocked by the rapid rise of stablecoins over the past year, I think you’re going to learn a lot from that call / find it really entertaining.

I won’t spoil the whole call, but I’ll just note one of the things that I went in really curious about. If you listen to Mastercard and Visa, they’ll tell you that stablecoins are “additive” for their business:

Stablecoins being additive is kind of surprising to me; again, Visa and Mastercard were down ~5% on Walmart and Amazon talking about stablecoins, and I know that most restaurants around me offer a decent sized discount if you pay in cash. It seems to me that a stablecoin could take significant share as it would have basically all of the benefits that attract small merchants to cash (in particular, extremely low costs) with none of the downsides (difficulty keeping track of flows1, need for physical security, etc).

So I wanted to talk to Umar about what the truth was? Are stablecoins a risk to the processors or an opportunity?

That piece of the conversation happens about halfway through the webinar, and I think it’s one of the best pieces of the call.

Of course, that’s not all we talk about. We talk about if instantaneous settlement can really create value, why USD is so dominant in stablecoins, and (of course) if an Amazon / Walmart stablecoin would have an impact on the rails.

I found the conversation really insightful, and I hope you’ll check it out. You can sign up for it here.

PS- I believe I’ll be doing another expert webinar with AlphaSense early next year. If you’ve got a topic you think I should cover, please let me know and there’s a decent chance I’ll make that the next webinar series!

Some might argue this is a feature, not a bug, as cash payments can be “forgotten” when it comes to taxes