More SaaSpocalypse at $WIX (plus: "why has this opportunity stumbled into my lap?")

It will come as no surprise to regular readers of the blog/ listeners to the podcast that I’ve been thinking about software quite a bit recently given the recent SaaSpocalypse. I’m starting from a cold start as a generalist and always worried about being the patsy at the poker table against a field full of specialists; given that concern, one company that has been pitched to me quite a few times in the SaaS selloff is cheap and easy to understand is WIX (I mentioned them in the SaaSpocalypse article given their huge buyback). There are multiple angles to WIX that hit on a bunch of different things I’ve been meaning to write about, so I figured I’d put some thoughts down.

(Side note: Trata is obviously a sponsor of the podcast1, and the founder is a friend…. but I wanted to note one way I’ve been thinking through the SaaSpocalypse in general and WIX in particular is by reading trata transcripts. They’ve got a ton of SaaS coverage, including a good recent one on WIX, and seeing all of the transcripts and reading other investors (who are often sector specialists) talking through the risks and what they’re seeing and hearing in real time has really opened my eyes to a bunch of things I personally would not have thought of as a generalist coming into the sector from a bit of a cold start. Trata is absolutely worth checking out in my admittedly biased opinion, but here’s a little piece of the WIX call that really worked for me simply because I often think in analogies and comparing WIX (which just announced a buyback worth half their market cap) with television broadcasters (which have generally been cash flow return monsters) matches a lot of different puzzle pieces for me (even if it is a little apples to oranges))

Back to the topic at hand: WIX. There are two really interesting angles I want to talk about at Wix:

Opportunity in the SaaSpocalypse

Why did this opportunity fall into my lap and Base44

While the second (Base44) is easier to talk about, let’s start with the first (Opportunity in the SaaSpocalypse) because it sets the stage for the second.

I’d guess most readers are familiar with Wix, either from the product or their Superbowl ads. Basically, a few decades ago, in order to launch a website you needed to know how to code / write html. Wix (and competitors like squarespace) changed that; they gave you off-the-shelf tools that you could use to build simple “no code” websites. No code websites were a godsend for small businesses that didn’t have the technical expertise to build a website themselves; with Wix, small businesses didn’t need to hire a website designer. For ~$20/bucks a month, they could get a professional looking website that they could easily modify / update.

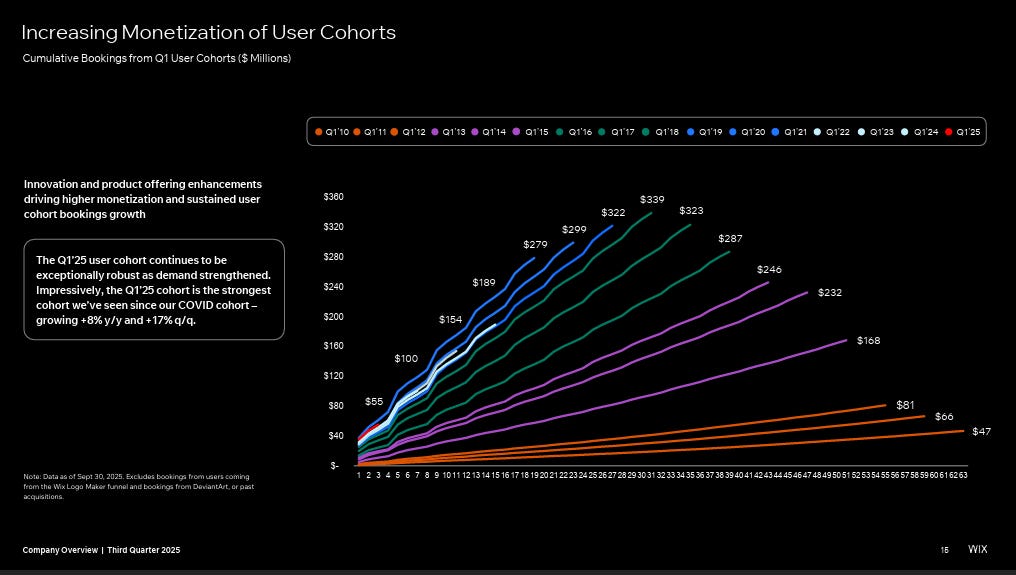

This was a great business for Wix too. It turned out that a small business that didn’t have the technical chops to build their own website was also a small business that didn’t have the technical chops to move their website off Wix once the website was built and running. Wix was thus a very sticky product with a lot of pricing power. In addition, Wix had lots of upsell capabilities; if someone used you to design a website, it turns out there’s a good chance they’ll turn to you for hosting, payments, security, analytics, etc. That combination has turned WIX into a cash flow machine with an incredibly sticky product that continuously improves its monetization of its users (Slide below from WIX’s Q3’25 earnings:)

So WIX is an asset light business with high stickiness, constant upsells, and solid growth. Combine all of that with some capital returns through share repurchases, and you’ve got the recipe for a fantastic GARP-y compounder. It was the perfect stock for the late 2010s / early 2020s, and of course it smashed even the NASDAQ over that time period:

But all of that has changed quickly as AI has evolved. Wix is website building for dummies…. I don’t think we’ve seen a huge shift in usage yet, but it’s not hard to imagine a world in the near future where a small business looking to build a website skips Wix and just asks ChatGPT to do it for them. Or perhaps the small business owner doesn’t use ChatGPT themselves; designing a website is not crazy complicated, perhaps AI simply enables a slew of competitors to build Wix-like products and enter a pricing war. Or perhaps AI makes it much easier to move your website from one domain host to another, and Wix’s product becomes much, much less sticky (and thus can realize much less pricing power) fast (in prepping for this post, I had several people mention to me that they had a website built on Wix years ago but AI tools have made them consider how easy it would be to move and save hundreds of dollars per year).

Whatever the case, it’s not hard to imagine a world where AI products truly impair the Wix business…. but the stock market is a competitive place, and the stock price has dropped quickly to reflect that risk / there are obviously some interesting pieces to the bull case despite the looming AI risk. I think the three major points I’m interested in are:

AI overblown? If you believe AI adoption is going to be slower than the rapid adoption the market is implying right now for any reasons, WIX’s stock is primed for a snap back

I personally like this argument the least; I think you could make the “it’s going to take a lot longer to adopt” argument for a lot of tech and software that sells to enterprises or does really mission critical stuff. It’s hard for me not to see AI taking a lot of share quickly in website design; I tried a few vibe code website builders as part of writing this article and got some pretty interesting stuff really quickly (though, to be fair, I wasn’t interested enough in switching to pursue them further than a quick mock up!)

Valuation: Wix’s current market cap is ~$4B. They just announced a $2B buyback, and they guided to $600m in free cash flow for 2025 (and that number includes investment into Base44). Wix is a very cheap company, and even if you think AI makes a lot of inroads into Wix’s product we’ve already discussed how Wix is a sticky product as well. There’s a decent chance a private equity firm could put Wix into run-off and make a decent bit of money from today’s prices.

Base44: Base44 is a vibe coding platform that is growing fast. Wix bought it for $80m in June 2025 when it was just 6 months old; it was doing $3m in ARR when WIX bought them and the company is guiding to $50m of ARR by the end of 2025 with a near term path to $100m. Just insane. Bulls would say that when you buy Wix you get the core business at a value multiple and get this “hidden” hypergrowth asset that might be a unicorn if it was a standalone business putting up these growth metrics for free.

That Base44 piece brings me nicely to the other point I wanted to discuss: Why did this opportunity fall into my lap and Base44

Remember that Wix bought Base44 back in June for ~$80m. When I talk to a lot of Wix bulls on Base44, they’ll suggest it’s some insane asset based on the growth rates Base44 is putting up. Perhaps they are correct, but I think that’s too simplistic on two lines.

First, I do think it’s worth thinking through the implications of Base44 to the core Wix business. If Wix felt the need to buy a vibe-coding business for ~30x ARR, what do you think that implies about their internal view of the long term for their business?

But the more important point is the secondary one: Wix bought Base44 last summer. For those of you with very short memories, the market was very open to funding anything that touched AI last summer (and it still is today!). If you’re going to argue Base44 is a hidden jewel within Wix’s portfolio right now, you also need to explain why Base44 sold to Wix instead of staying independent and capturing all of that value for themselves.

Now, there are ways to make that argument. Acquisitions can create value; often a large tech company can create a lot of value by buying a small tech company and blasting the smaller tech company’s product through the larger tech company’s distribution. But it’s really hard to look at Base44 and see how Wix could have created unique value for Base44. It is true that Wix has massively increased the marketing budget for Base44, but the ability to blast a ton of ad dollars isn’t exactly unique to Wix (VC firms are very happy to fund big marketing budgets; remember back in 2021 where you could get basically everything for free as VC firms funded growth at any cost?)…. in fact, given the focus on ARR and hypergrowth, I think it’s fair to question if Wix is being too aggressive in blasting Base44 ads and is actually pursuing negative value growth. Wix bought Base44 a Super Bowl ad this year; that probably cost them ~$8m. That’s more than a month’s worth of ARR at Base44’s 2025 year end runrate; it’s just really hard for me to look at that level of marketing spend and say that there’s going to be a positive ROI there.

Anyway, the point I’m trying to make is this: I’ll see a lot of bulls on Wix making arguments around Base44’s value. And I can never get a good answer for why Base44 is worth so much more than it sold for last summer, why Base44’s business isn’t easily replicable, how Wix has created value from buying Base44, why Base44’s founders would have sold if there was so much upside there, or if there’s a way to determine if Wix is actually creating value with the massive marketing blast they’re spending (it’s very easy to grow revenue to infinity if you’re selling a dollar for ninety cents; I worry Base44s rapid growth is in part driven by negative ROI marketing spend and bulls valuing Base44 on a revenue multiple are capitalizing selling a dollar for ninety cents!).

It’s a mistake I see (and can make) a lot in investing: just looking at a company and saying “it’s cheap” and failing to recognize that “cheap” does not make for alpha on its own. The market is a competitive place; taking a breath to step back and ask “why is the market offering me such a gift” can be a really useful way to think about the risks and rewards in an investment, whether its buying Wix at <7x free cash flow, thinking about the “free” call option at Base44, thinking about why Wix got to buy Base44 so cheaply, or some other investment…..

I’m always worried about being the patsy at the poker table. I’m worried that investors buying Wix with Base44 as a core thesis are getting “patsied” on multiple angles. But I hope to be proven wrong; it’s a fun product that I’ve enjoyed tinkering with!

Hi Andrew, interesting article. I recently was reading one of Rob Vinall's letters from RV capital (https://www.rvcapital.ch/). They are owners of Wix. Would be interesting if you two could do a podcast together!