Some ramblings on the SaaSpocalypse

About once a year, an entire sector will implode with “the world is ending” panic. For example:

In early 2023, you had regional banks imploding on the heels of SIVB’s failure.

In early 2025, you had the entire biopharm sector imploding on RFK / FDA fears1.

Now, those are not the only sector wide implosions we’ve seen (NYC commercial real estate in 2022 was pretty bleak, financials and homebuilders around the GFC were obviously bleak, and energy in the post-shale crash era after ~2015 was pretty bombed out… basically, think of any sector where the economist has published a front page “Death of XYZ” article right before the sector has ripped), but I chose those examples for two reasons. First, I was very involved in them, so I think on them very fondly / have a lot of posts to link to talking about the implosions in real time! But (my narcissism aside) the main reason I chose them is because they are a nice example of sector specific blow ups that didn’t have much (if any) contagion to the real world2. In contrast, you could say “airlines blew up in early 2020,” and that would certainly be true…. but the airlines were blowing up for the same reason (COVID) the stock market as a whole was imploding. And plenty of homebuilders and financials blew up in the GFC…. but (again) you had system wide contagion along with those implosions. In contrast, the biopharm sector imploding in early 2025 had nothing to do with the stock market as a whole, and literally every biotech could have gone to zero with limited repercussions for the economy overall3.

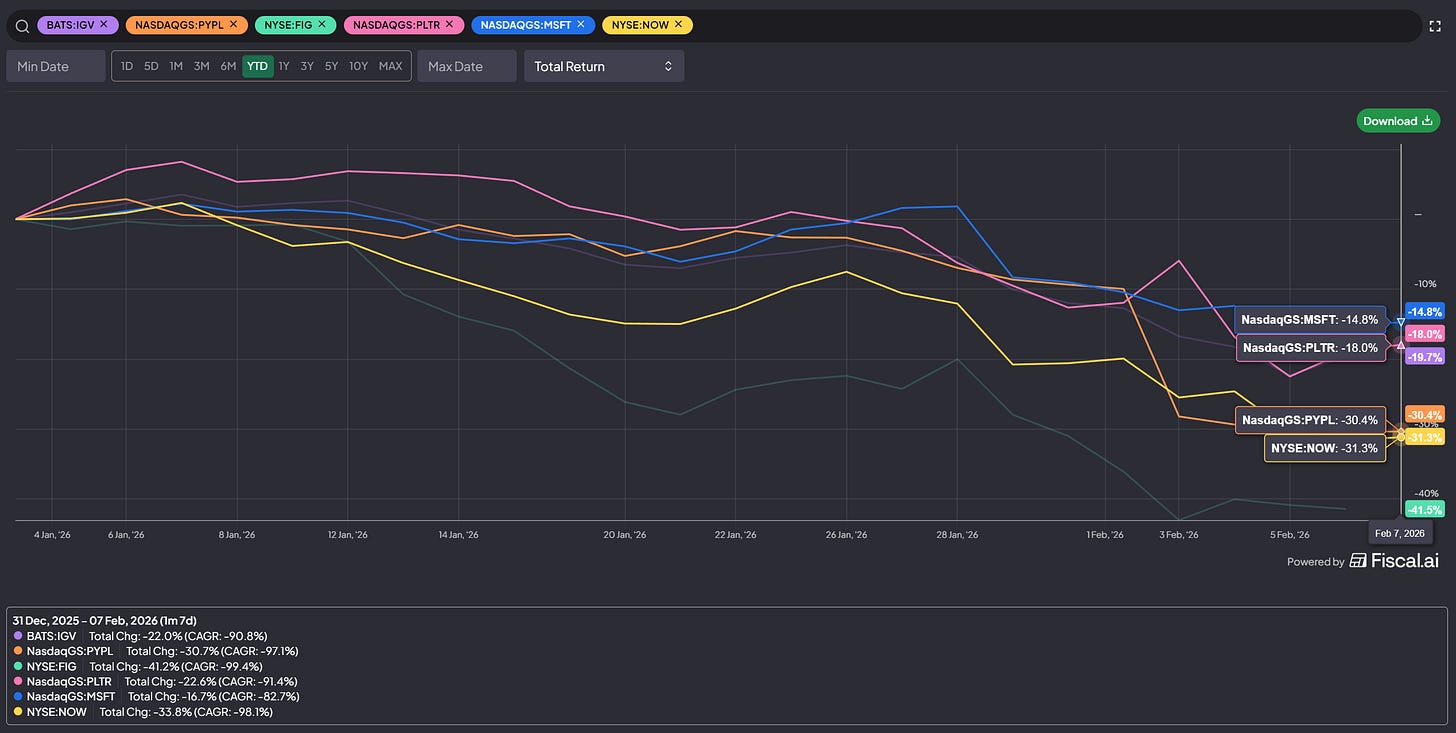

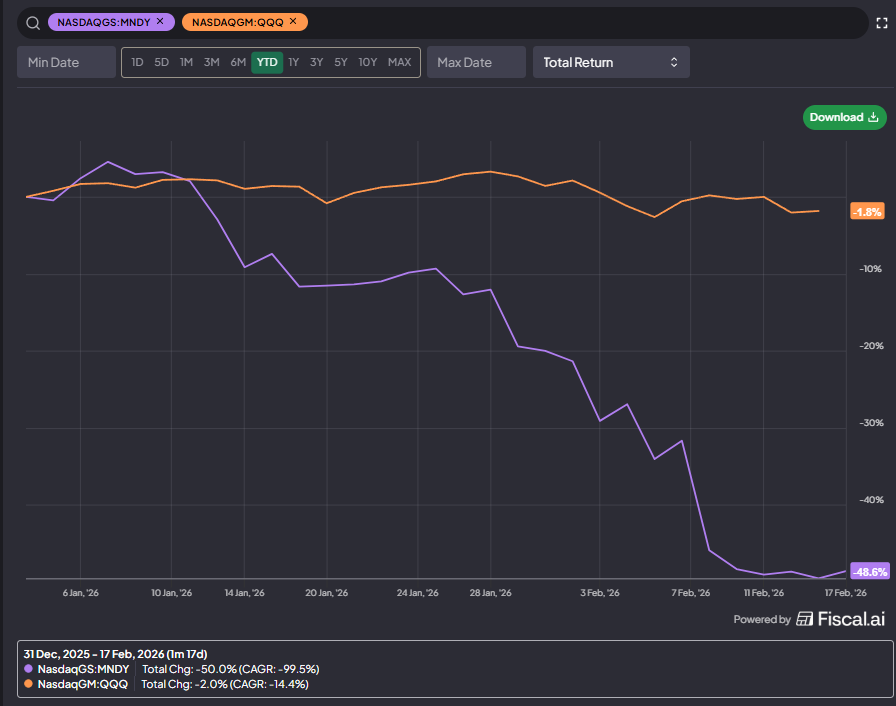

Right now4, we’re clearly seeing an industry implosion in the software (and payments) space5. IGV (the software ETF) was down ~10% last week and is down >20% on the year… but I don’t think that fully captures the pain in the space. IGV has a huge weighting in some large cap software names (PLTR, MSFT, ORCL). Those have certainly not had great starts to the year, but the real pain has been in the smaller and mid cap names, where just about every name is down 30%+ to start the year.

My favorite “pain in SaaS” fact? Figma IPO’d last July at $33/share and saw their shares quickly trade to ~$120/share. They closed at ~$22/share last week, so if you bought the IPO and held to today you went from up almost 400% to down 33% in roughly six months. Incredible!

Anyway, I centered my February ramblings around the SaaSpocalypse…. but I wanted to go further / ramble more and write something about the SaaS selloff because writing helps me clear my head / think, and I find throwing some random thoughts into the world often encourages good / interesting feedback and inbounds.

Thinking about the SaaS selloff kind of makes me feel like I’m Kronk with an angel on one shoulder telling me “don’t overthink this, buy the panic” and a devil on another shoulder saying “where there’s smoke, there’s fire. stay away.”…. though you could argue I should flip the label of angel and devil depending on how you feel about the opportunity!

So I’m going to structure this post a bit around what those angels and demons are saying, and I’m just going to kind of throw stuff out there. As I’ll discuss, I’m not a SaaS specialist by any means, so I’m really just trying to learn / think this through. If you have deep knowledge in the space and email me and say, “jesus you’re so dumb and you’re wrong on this, this, and this”, then honestly I will probably agree with you and try to learn / improve. So, with all that in mind…...

Angel: “don’t overthink it; buy dislocated sectors”

The angel is telling me “buying dislocated markets in panics generally works well.” And the SaaS market is clearly dislocated; last week there were multiple days where you would see basically every SaaS company6 have their stock drop 5-20% on no news. There is no clearer sign to me that a sector is going through some type of unwind / dislocation than basically the whole sector gapping up and down 10% multiple times in a week on no news / having the whole sector trade with a beta of 1 to each other even though every company will be impacted differently. Is AI going to impact SaaS companies? Sure! But you’re telling me that it’s going to impact every SaaS company in basically the same value destructive way, and the market woke up to every company having nearly the exact same amount of value destruction on the same day?

Sometimes the market can wake up to an entire sector being doomed on one key negative comment. For example, there’s the famous August 2015 earnings call when Disney noted they were seeing “some subscriber losses” at ESPN. ESPN was the crown jewel of the legacy cable bundle; when DIS said they were losing subs, that’s the moment it became clear to everyone that the legacy cable bundle was dead and not coming back. DIS’s stock was down ~10% that day, and they weren’t alone as almost every legacy media company (FOX, Scripps, Discovery, Time Warner) was down in lockstep with Disney. None of the stocks have ever recovered to be honest.

That sector wide selloff made sense; if ESPN was losing subs, it was safe to say/think that the same problems would apply to Fox or NBC or whoever you wanted to think about. They all relied on the same legacy media bundle; if one of them lost a sub, they basically all lost that sub.

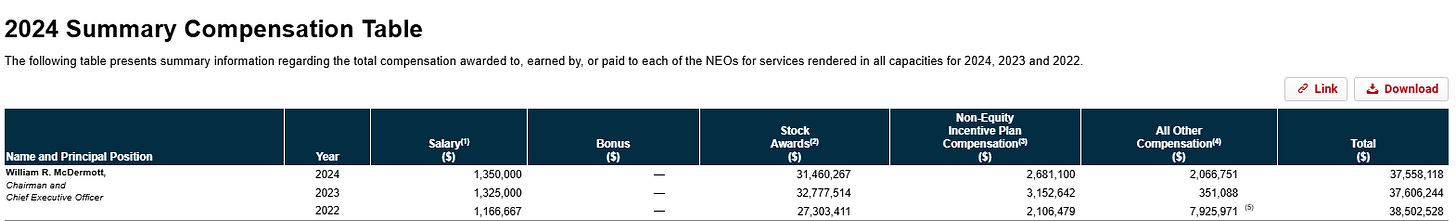

In contrast, the SaaS sector is really, really broad; this chart from my friend Compound illustrates the Software meltdown nicely:

It’s hard to think of three businesses more different than WIX (website building for small businesses), DUOL (“learning7” a new language for consumers), and TTD (DSP for advertising). Will all of them be affected by AI? Absolutely…. but the three have traded in virtual lockstep so far this year. It’s hard to imagine that AI is going to impact each of them equally, and the market is realizing that AI is going to impact each of them equally incrementally negative every day.

So SaaS clearly looks dislocated, and my shoulder angel is telling me to throw caution to the wind and buy…. but then the devil on my shoulder will chime in with some questions and words of caution. The main one is probably:

Devil: “competitive concerns will always be a drag going forward”

I am a long time cable bull. It was a massive drag on my returns over the past few years.

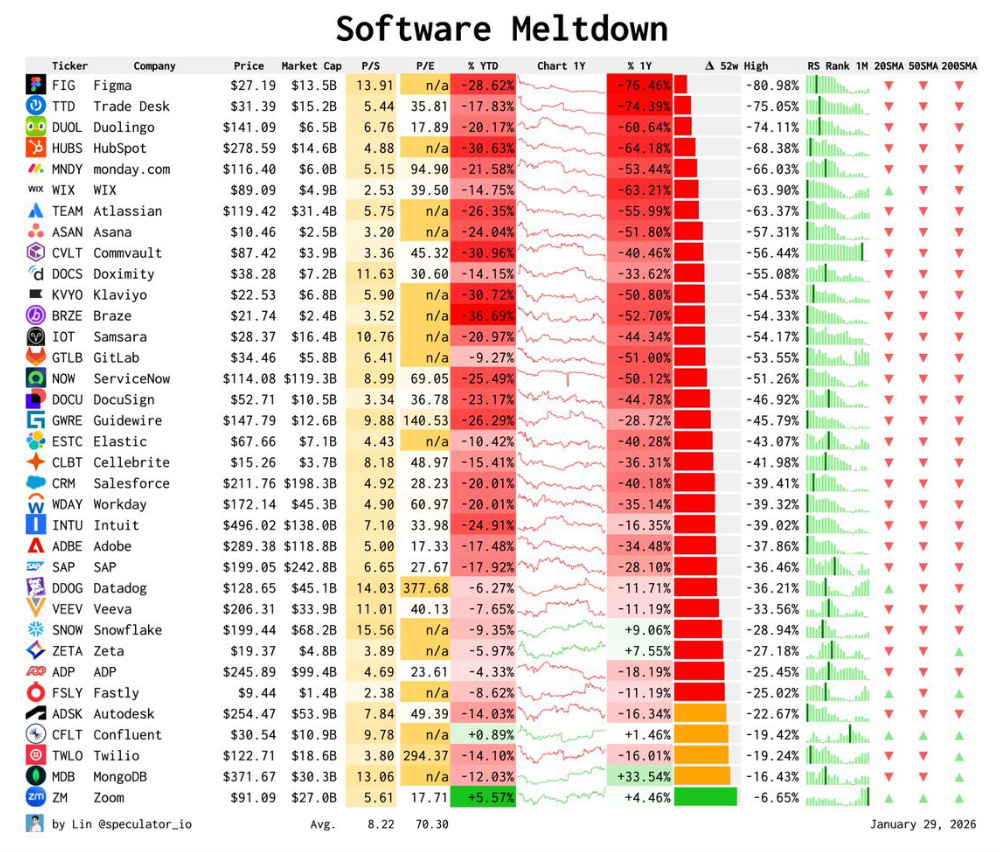

For those who don’t follow, cable’s core broadband had two burgeoning competitors over the past five years: fiber and fixed wireless (FWA). I thought (and continue to believe) that cable’s stock prices were pricing in absolute worst case outcomes for how that competition evolved. To be fair, the competitive concerns have probably played out in about a worst case manner, and the stocks have been absolutely decimated. However, if you looked at the financials of the cable companies, it would be hard to match them up with “worst case scenario” or the absolute devastation we’ve seen in the cable companies’ stock price. For example, CHTR’s adjusted EBITDA has grown ~10% (from ~$20.6B to ~$22.7B) from 2021 to 2025. Is that great? Absolutely not, particularly when you think about the capex they’ve been spending to defend that EBTIDA. But I think you’d be hard pressed to match “EBITDA slowly growing” with how CHTR’s stock has performed:

How does that apply to the software companies? AI has clearly introduced concerns about the terminal value and competition a few years out for these companies; I’m not saying the SaaSpocalypse is pure apples to oranges with the cable companies (again, the competition has really impacted the cable companies; maybe AI will be overblown here!), but it’s hard for me to see a world where SaaS companies fully brush off the AI terminal value questions going forward, and those concerns can weigh on stock prices for a long, long time.

Devil: numbers might not be low enough yet

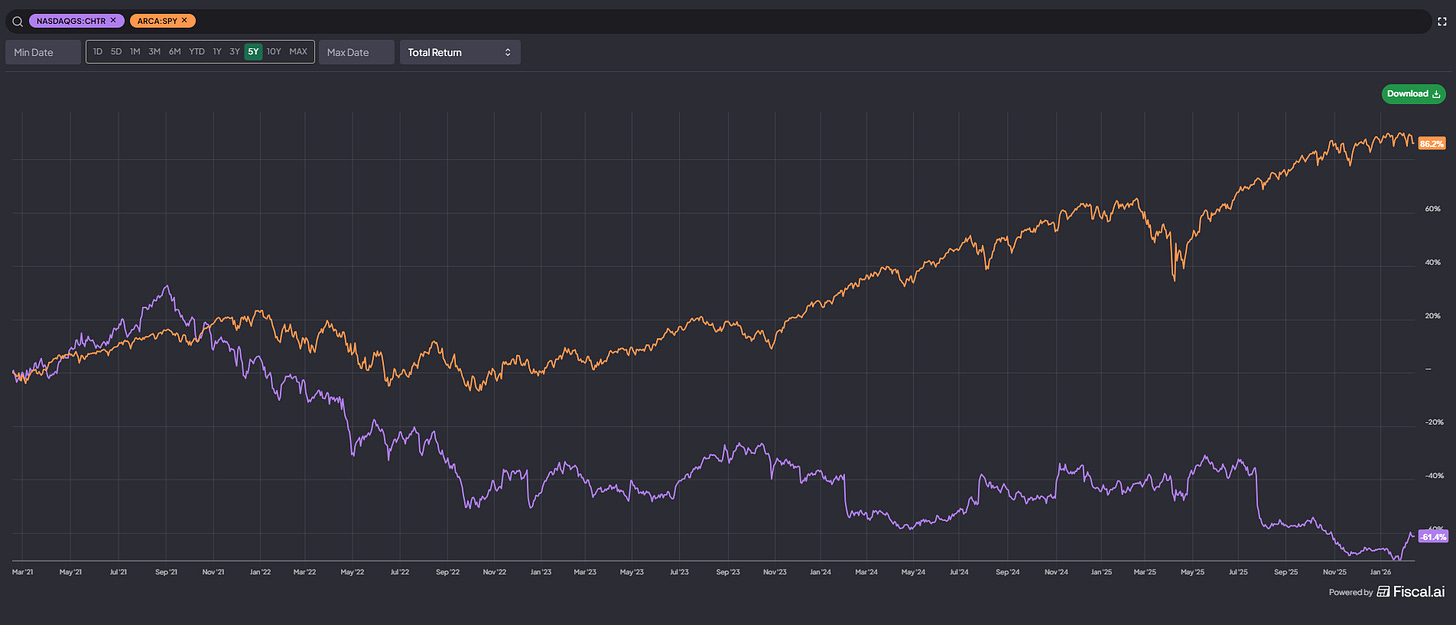

Here is the stock chart of Monday.com so far this year:

The stock had dropped by ~30% heading into earnings in early Feb…. and it proceeded to drop another ~25% on earnings. That’s not great Bob!

Obviously MNDY is a single (and exaggerated) example, but I’ve seen a lot of similar patterns in SaaS land so far this year. In fact, just as I was getting ready to post this, Fiverr (FVRR) reported earnings. FVRR is freelance design work; it’s hard to think of a business more exposed to AI. The stock was already down ~33% YTD and ~60% over the past year….. but earnings and guidance missed and the stock was down another 25%+ pre-market. I’d suggest that when companies are seeing 25%+ drops on earnings after their stocks have come down by ~30% in a month, it suggests that numbers have not come down enough / investors are still baking in a lot of optimism into near term numbers (said another way, investors have their heads in the sand about how quickly AI is eroding some of these businesses). You’d really like to see companies reporting awful numbers and having the stock trade flat / up to really start to think the market was on to how rocky things were going to get…

Devil: we haven’t seen insiders buys

There’s no one thing that ends a panic in a sector, but a really good starting spot is to see a bunch of insider purchases or some big buyouts in the sector. One of the things that got me so excited about regional banks in 2023 was almost every single stock in the sector had significant insider buying. For example, basically every board member bought a little VBTX in early 2023:

VBTX was acquired for ~$34/share in the summer of 2025; not a bad return on all of those insider buys in the high teens / low twenties!

To date, the insider buys at SaaS companies have been few and far between (and pretty damn small). If, after years of massive stock comp and sales, insiders aren’t now bullish enough on their stocks to come out of their pocket and buy stock on the open market after the huge drops year-to-date…. then why should we be?

Of course, the angel would have a counter here:

Angel- It’s too early for insider buys. They’re probably coming. The green shoots are there

Most companies have blackout policies associated with their earnings. Generally, the blackout prevents insiders from trading (buying or selling) two weeks before the quarter ends all the way until a day or two after earnings are announced.

Most companies run on a calendar year end, so the blackout period for insiders in Q4 would have started in mid-December. The massive sell-off in SaaS stocks started in early January, and many of these companies still haven’t reported Q4 earnings. So insiders have been blacked out for basically the entire selloff!

I think the angel would say “yes, we haven’t seen insiders buying yet…. but they’re probably coming, and there are small bullish signals if you look around.” For example:

Wix announced a new $2B repurchase program, not insignificant against a $4b market cap!

VYX increased their repo program given “the confidence of the Board and management in the strength and trajectory of the Company”

NOW filed an 8-k noting all of their top brass had cancelled their automated sales plans and that their chair/CEO had not just cancelled the automated sales plan but entered into an automated purchase plan (and this comes on the heels of him extending his contract to 2030, which apparently also shows how bullish he is)!

The devil on my shoulder would be remiss if it didn’t note something: this is a nice signal, but this is really small. The CEO sold like $75m of stock in 2024 at prices ~double today’s share price, and he’s made just shy of $40m/year the past three years. It’s definitely nice he’s flipping from seller to buyer, but you’d hope to see some meaningful buys for someone who got paid so well after their share price got hit this hard.

I’d also note that the rumors H&F is in talks to buy Bill.com would be broadly bullish for the sector; having a major PE player step into a dislocated space and write a big check would provide a lot of support that these businesses aren’t falling apart / that a sophisticated player sees terminal value.

Speaking of terminal value, here comes the devil on my should again….

Devil: “there are no hard assets at these businesses; trailing valuation support evaporates FAST”

If you ever run a quant screen for the cheapest stocks in the market, invariably every now and then you’ll have a pharmaceutical company pop up with stats that look almost too good to be true. It’ll be trading for something like four times trailing earnings with earnings growing 50% year over year and insane returns on capital. The reason that happens is because they have a core drug that drives the bulk of their earnings that is going off patent / going generic in a year, and the market is (properly) forecasting there’s not going to be much value once that goes away.

Software could have something similar if AI really takes off. All of the value in software is in the cash flows and intangibles; if AI comes along and threatens those cash flows / undercuts the pricing, these businesses go to zero real quick. It’s a bit of a stretch, but think about how many companies Google has undercut by giving away products for free (email, video hosting, analytics) or how Microsoft killed a string of competitors by bundling a free product into Windows in the 90s (Netscape, Real Player, etc.). Again, those are a little stretched, but I think they show how quickly really big software companies or categories can come crashing down when a competitive and cheap product is available.

One of the things I liked with buying the banks and biotechs in the panic was there were real hard assets there that created ways to win as a shareholder even if the businesses eventually didn’t work; banks obviously exist on their tangible equity (so if you assumed they didn’t have a run on the bank and their marks were good, you had real asset value), and the busted bios were trading way below cash (making them all potential liquidation plays). That’s absolutely not the case with software; if the businesses don’t work and these need to liquidate, they’re basically zeros.

Angel (and maybe devil): 2022 redux?

2022 was a disastrous year for tech stocks in general. Basically all of them got nuked. It was a great year for hard assets; if you were long anything that touched energy or most commodities, you did incredibly well.

2026 has started out basically as a mirror image of 2022. Cyclicals are ripping, software’s melting down.

Now, the reason behind the rips are different, but it’s not lost on me that the set up looks very similar. 2022 was followed by an unbelievable time for pretty much anything tech from 2022-2024.

I know this time seems a lot different; 2022’s tech crash out was generally driven by high starting valuations and a heck of a lot of corporate bloat from the COVID boom; 2026 seems to be driven by real terminal value questions. But it wouldn’t surprise me if we’re reading fund letters in ~18 months saying “in late Feb. 2026, we thought the tech was showing a similar bottoming pattern to what we saw in November 2022, so we went wildly long tech stocks and made a fortune.”

The devil and angel duke it out: “I can copy it” short thesis

Once a year, I’ll have someone (generally a college student) who will pitch some internet business (generally a consumer focused one) as a short on the theory “their website can be easily replicated.” The most common one I’d hear a few years ago was Twitter; I can’t tell you how many times I had a college senior send me a link to a Twitter knock-off they had spent an afternoon making alongside a “short Twitter” thesis.

Obviously, that “I can make a clone” short thesis is a bad thesis. It ignores how powerful the network and lock-in effects for these social networks are…. but there is a hint of insight to those pitches. It’s not hard to make a knock-off to an internet business; the issue is in the lock-in. If that lock-in ever starts to unwind, the company can be a zero in a hurry.

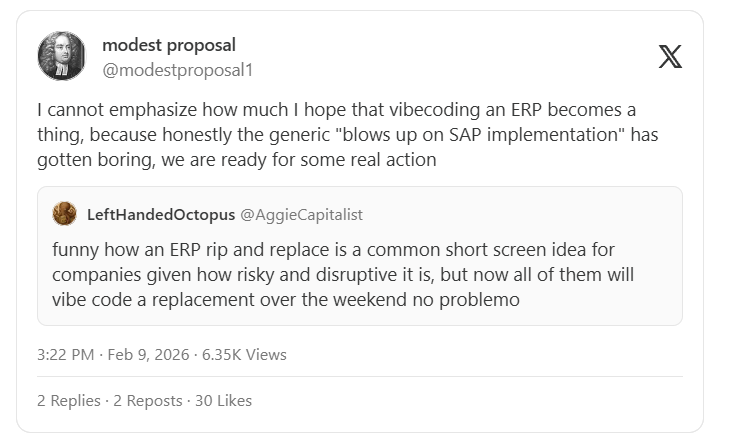

SaaS companies have never had to worry about the “I can copy it” short thesis; it took teams of software engineers to build and code these businesses. But suddenly you’ve got articles with financial journalist vibe coding working copies of multi-billion dollar businesses.

The angel on my shoulder is telling me that vibe coded SaaS tools are about as useful / as big a threat to SaaS companies as the Twitter knock-off a college student built was to Twitter. What company is going to trust a knock-off tool built over a weekend to run a critical piece of any of their business?

But the demon on my should is telling me the AI tools are only getting better and better, and the current generation of vibe coded software tools are the worst we’ll ever see. At a minimum, vibe coded tools massively bring down the barriers to entry or cost to compete in SaaS. In media, there used to be a massive barrier to entry: if you wanted to tell a story, you needed a studio to back you so you could buy expensive cameras, rent a studio, film a show, and then distribute it on linear television. Today, you can use an iPhone to film and distribute through YouTube. The networks have been broken, but thousands of creators are thriving making their own independent content. Could you see something happen like that in SaaS? The legacy players see their products broken by hundreds of developers making specialized AI tools and competing on hyper-personalization (i.e. hey, big company XYZ. Hire me and my team of three software friends and we will build a completely custom CRM for you, and we’ll spend all of our time updating and making it work just for your business). I have no idea, but it seems somewhat possible as a bear case / analogy for what happens here.

Angel- things are really sticky in the real world.

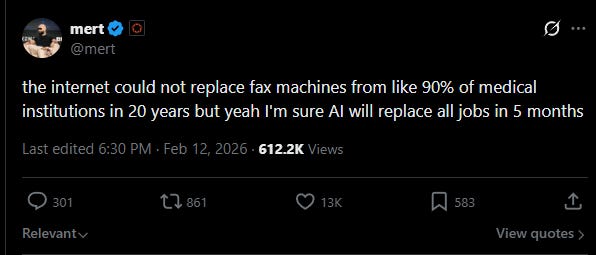

This tweet sums it up nicely:

One more I liked on similar lines

I don’t doubt AI is coming fast, but the real world moves really slow, and a lot of these SaaS businesses were valued so highly because their products were absolutely mission critical and an absolute beast to replace once installed. It’s hard for me to believe they’re going to get replaced in a month, three months, or even three years.

I do think there is an interesting way to think about this risk: the largest companies are generally going to be the slowest to replace mission critical stuff / have the largest tech debt. If you come to me and say “I just talked to JPMorgan’s CIO and Progressive’s CIO; they’re sticking with Salesforce, we’re in the clear to buy the stock” then I think you’re kind of missing it. What you really want is to check in with organizations right when they normally start hiring a SaaS firm. For example, say it’s well known that most organizations buy their first Salesforce license when they hit 30 salespeople. You want to start surveying organizations when they hit 30 sales people and see what they’re doing. If all of the sudden you see a ton of them using AI tools instead of Salesforce, then I’d say Salesforce has a real terminal value problem.

(PS- one more tweet I liked; particularly relevant given it comes from Microsoft and almost every Microsoft product I interact with has such horrific and basic operating problems that should have been solved decades ago that it’s comical they’re forecasting change of this scale happening this quickly)

Devil: “software is probably the sector with the most adverse selection for generalists”

Software is a big field, and it can move fast. There are also a lot of ways to get intra-quarter checks on it (there’s plenty of big conferences, intra-quarter surveying of CIOs, expert calls, web scraping, etc.).

When a field is moving really quickly (and, as discussed above, has no tangible downside support if the business implodes), I really worry about being a generalist against a bunch of specialist. I’m about as much of a generalist as it gets when it comes to software, and I’ve talked to industry experts about how they’re using AI and their answers have changed just from November to today. If I’m getting different answers in my handful of expert calls / industry contacts, what do you think sector specialists who spend all of their time focused on the sector are getting / seeing?

My worry is that if I step into the sector and buy something, I’m the patsy at the table / I’ll be buying what some specialist who got a check that a specific company is getting slaughtered by AI replacement is selling / shorting.

Devil: there’s a big comp reset that needs to happen; that takes a lot of time

Last year, I was really focused on the busted biotech trade. And I can’t tell you how many calls I had with boards and management teams that went something like this- “You hired your whole C-Suite when you were a $5B market cap company and paid them like such. The top 5 guys at your company are making $25m/year combined in stock comp. That’s fine when you’re a $5B company with a potential cure for cancer, but your cure for cancer failed and now you’re a $250m company. You can’t pay the top 5 guys $25m when you’re a $250m company; the dilution is too insane. Comp needs to come down across the board.”

I personally don’t think that’s a hard conversation to have, but it is difficult to change / fix for a whole host of reasons.

The situation might be even worse at SaaS companies. Many of these companies were paying employees all-in 10-20% of revenue as stock comp. That’s fine when the company trades for 10x revenues (you’re basically diluting shareholders 1-2%/year); it’s an emergency if the company is trading for 1-2x revenues (you’re now diluting shareholders 5-20%/year). That’s untenable, but the fix here is even harder. At the busted bio I mentioned earlier, you basically had to tell the CEO “hey man, the drug failed. Either you need to move on or you need to take a salary in line with the company’s new reality.” But if you’re a SaaS company, how do you say that to your entire engineering team? “Hey guys, our multiple has come down, so now instead of paying you $200k/year in stock comp we need you to take $20k?” That’s a wild convo to have, and it’s going to result in massive, massive turnover…. but, if you don’t have it, shareholders are quickly going to see themselves diluted into oblivion by the employee base.

Conclusion

Again, I have no firm conviction here. This post is truly just the ramblings of a man trying to figure out the world…. but it’s impossible for me to look at a sector imploding this rapidly and not try to find value, and this time the questions are looming really large for me.

Somewhat a simplification. The tariff tantrum certainly exacerbated the implosion, the sector had been having a multi-year drawdown even before RFK got elected, and the biopharms were doing themselves no favors in the drawdown with some truly horrific capital allocation.

If the regional banks had truly blown up, there would have been some risk of credit contagion, and I know a few true perma-bulls who were pitching a downside scenario of GFC 2.0. It’s not fair to say that there was no contagion possible there…. but banking crises spreading into the real economy generally happen when the large banks start failing, and that really wasn’t happening in the regional bank crisis.

Again, somewhat of an exaggeration; I’d obviously hate to lose all the science / potential cures if every biopharm went to zero!

Since I used “right now” in this sentence, a quick note on timing: I’ve been working on this article off and on for the past ~two weeks. I’ve tried to clean it all up, but completely possible I use the term “yesterday” to refer to something that happened last week at some point!

Humorously, I was seeing a ton of random bio I follow down 10-20% on no news last week, so it feels like the SaaS contagion was somehow connected to the biopharma space given all of those biopharms were basically trading at cash before the moves down.

Again, the same statement could apply to payments companies, though I tend to think those were a little harder tied to PYPL’s pooping themselves on earnings.

I put learning in quotes because I used it every day for almost 2 years for Polish and think I learned 20 words; I am extremely skeptical of the efficacy.