More bad boards and awful deals $ALOT

Mainly driven by my obsession with the busted biotechs, I’ve been on quite the corporate governance kick lately; I’ve talked about the poor incentives that can lead to awful decision making, and a few weeks back I detailed the awful deals at GPN and FWRD that have lead to activism.

Today I wanted to highlight one more awful deal that has lead to some activism: my friend Samir Patel’s (from Askeladden Capital) activist slate at AstroNova (ALOT).

A quick disclosure: I have no position in ALOT1. Samir’s a friend and a past podcast guest, but I haven’t talked to him in at least a year (I checked my inbox; my last email to him was sent June 2024 and I believe he ghosted me).

Given the disclosure that I have no real horse in this race, why am I writing it up?

I like detailing clear examples of boards that have destroyed value and are trying to maintain the status quo when it’s clearly not working for shareholders, and I’ve found that readers enjoy learning about them too. The issue is that there are just so many examples of boards destroying value and continuing on like everything’s fine that I could turn detailing them into a full time job…

But one of the downsides of being my friend is that, if you have public filings, I will try to read / follow them all just so I can feel like I’m keeping up with you, and the Askeladden filings make AstroNova seem like such a clear cut case to me that I think it’s instructive and will be useful for future notes / examples!

The ALOT story has a lot (pun unintentional) of history; you can read Samir / Askeladden’s version in his letter here (and his vision for the company here), and AstroNova’s version here…. but, for my purposes / this post, I want to focus on one thing: ALOT’s MTEX acquisition.

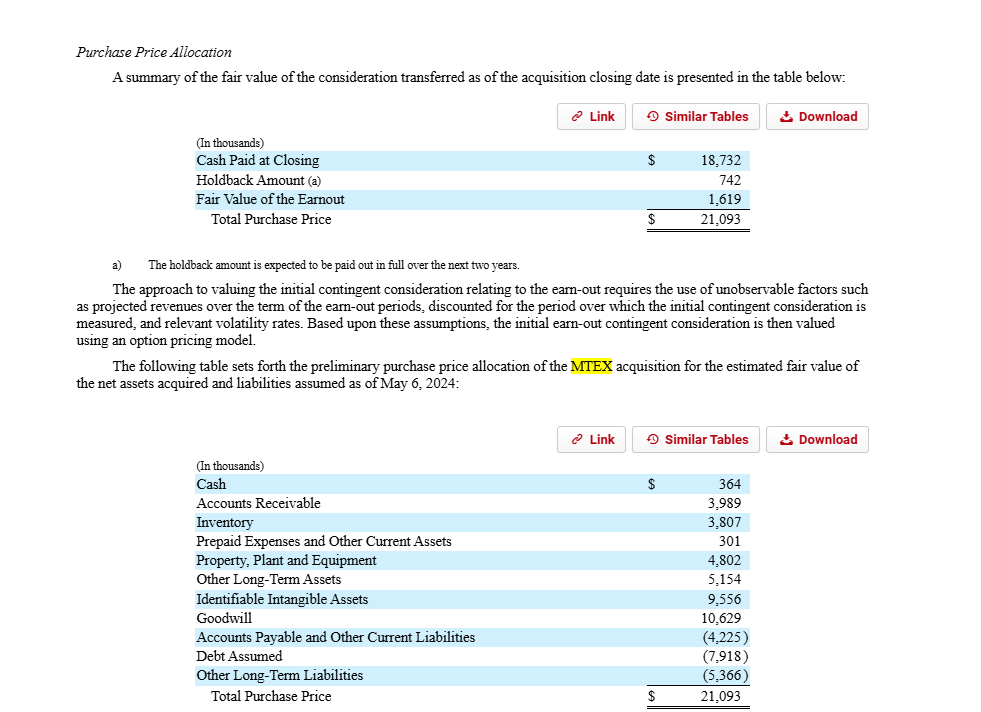

ALOT announced the acquisition of MTEX in May 2024. They paid ~$25m for the business (plus an earnout), though if you read their 10-Q it looks like the ultimate price paid was knocked down a bit to ~$21m (including the earnout’s fair value).

The MTEX deal was instantly a disaster. Remember, the deal was announced / closed in early May; in March (less than a year later!), they took a >$13m goodwill impairment “largely associated with the Company’s MTEX business”.

Human memory can be frail… but I’ve looked at thousands of public company acquisitions over the past ~decade, and I cannot remember another company writing off ~100% (actually more than 100%!) of the goodwill from an acquisition inside of a year. The speed of write off alone would qualify MTEX as one of the worst public market deals in history.

Again, absolute disaster.

Now, you might be thinking, “it’s just a $13m write off. Big deal.”

But ALOT’s market cap when they announced the MTEX deal was ~$130m (at the time, ~$17.50/share with ~7.5m shares out). So, in one bad deal, ALOT managed to destroy ~10% of their market cap in value.

Let’s fast forward to today. Askeladden, as a ~10% holder of ALOT stock, is trying to replace five of the six board members at ALOT. ALOT is saying Askeladden’s nominees are unqualified and asking shareholders to vote for the current board.

I will remind that I have no horse in this race / no position in ALOT and no plans to take one. But, as someone who has been appalled by disastrous corporate governance recently, here’s my question: how can the ALOT directors with a straight face go to shareholders and say “no change is needed here” after the disastrous MTEX acquisition? And, when a board goes to shareholders and says no change is needed after a disastrous acquisition, how can shareholders come to any conclusion other than the board is broken / needs some shaking up?

As detailed above, ALOT’s disastrous MTEX deal saw the company destroy at least 10% of their market cap in value (and probably more once you factor in management distraction, wasted resources, headaches, etc.). ALOT’s board is proposing 6 incumbent nominees in their current slate…

Of those six nominees, five were around for the disastrous MTEX deal, and one (Darius Nevin) was added this year (so his hands are clean of that deal!)

I’m not saying every directors’ head needs to (metaphorically) roll for approving the MTEX deal…. but if the definition of insanity is doing the same thing over and over again and expecting different results, surely it would be insane for shareholders to elect the exact slate of directors who approved the MTEX deal and expect the next deal to create value?

Look… bad deals happen. Buffett bought Dexter Shoes, and no one was calling for him or any of his directors to resign over that deal. But deals need to be looked at in context: the Dexter deal was small in comparison to Berkshire’s size, and Buffett’s overall track record obviously far, far outweighs that one mistake. In contrast, the MTEX deal was a big swing for ALOT, and all of the non-Nevin directors have been on the ALOT board for a decent length of time. Given ALOT’s historical poor stock price / performance over the past decade, it’s not like any of the directors / management can say “sure, we did one bad deal, but we’ve got a history of creating reams of value.”

I’ve engaged with a lot of boards recently. And the one consistent theme I get is that directors and boards think they know their business way, way better than their shareholders. And I have no doubt that’s true to some extent; shareholders aren’t getting internal reports or monthly budgets that directors see. But it’s just crazy to me how a board can approve a deal (like MTEX) that turns into a disaster on the heels of years of underperformance and then go to shareholders and say, “everything’s fine here. Keep voting for the status quo. Trust us to grow your money!”

Sure, the shareholders might not know the name of the CEO’s secretary, or where the bathroom on the third floor is located…. but shareholders are generally in the business of making profitable investments, and if a board has overseen a decade of value destruction, it might be high time to let some fresh faces with a shareholder mindset into the board room (and tell them where the bathroom is!).

I’ve seen that type of “who are these shareholders to tell us how to run the business” thinking at plenty of boards I’ve engaged with behind the scenes…. but ALOT is just a perfect example of this playing out in public in real time.

Again, I have no position in ALOT (nor do I have plans to take one), but I’ll have my popcorn out and be watching / rooting for any outcome that works for the company and its shareholders from the sidelines!

PS- I can’t claim to know the behind the scenes story or anything well enough to opine here, but in a vacuum if someone came up to me and asked what would make sense here, I’d suggest that, after a disastrous acquisition, a long term ~10% shareholder probably deserves to have one director spot they fully trust on the board. A settlement that sees maybe a current director or two retire and a director Askeladden trusts put in their place seems like a pretty fair compromise that would also avoid the ongoing (and escalating) cost of a proxy fight…. but, again, no horse in this race, and I don’t know enough about any of the personalities or fight here to know if that’s even feasible. In a vacuum it just seems like the best outcome to me!

PPS- Humorously, back in May 2024, ALOT published an investor deck the day before the MTEX acquisition… and included the slide below that suggested one of the reasons to invest in them was their “track record of Value-Generating M&A.” Whoops!

Again, I have no position in ALOT, but a quick reminder this is a very small stock with a market cap <$100m, so obviously do your own work / consult a financial advisor and all that jazz.

I've been a big fan of Samir Patel for several years.

I read his activist letter and believe the candidates to replace the Board are more than qualified, especially the person with a track record in turnarounds.

P.S. The Board's face tells investors not to listen to Samir's proposal is because they likely have a base of passive investors, the very ones Graham criticized so much.

Nice. I know acquired guys did an episode on 10 greatest acquisition of all time. Might be interesting to do a 10 most value destructive deals of all time.