Weekend thoughts: bad boards and awful deals $GPN $FWRD

I’ve mentioned my growing disillusionment with corporate governance a few times on the blog, particularly when it relates to the busted biotechs / pharmas. However, just because I’ve been focused on the busted bios doesn’t mean that’s the only space where there’s some really negative corporate governance / actions; today, I wanted to highlight just a few of my favorite examples from outside of the zombie bios.

Let me start with my personal favorite example: Forward Air (FWRD). FWRD is well known in event circles, so I won’t rehash too many details, but the basic set up is that Forward announced a deal to buy Omni Logistics in 2023. To say the deal was poorly received would be an understatement; Forward’s stock dropped by >50% between deal announcement and deal close (in an up market!).

It was a truly breathtaking destruction of shareholder value… but it was made worse by the structure of the deal. FWRD was buying OMNI with a lot of stock. Generally, when you buy something with a lot of stock, you need to have a shareholder vote.

However, most shareholders find the choice between “vote for a deal that cut your stock price in half” or “vote against the deal and save management from themselves by blocking this deal” to be a pretty simple decision. Realizing that a vote on the deal would likely fail, FWRD structured the deal in a way that avoided a shareholder vote. It’s hard for me to imagine worse corporate governance than announcing a deal that not only smashes the company’s stock price but puts financial distress into play for a company… and doing so in a way that intentionally dodges a shareholder vote that shareholders honestly deserved.

Anyway, that deal closed in early 2024. Why bring it up now?

Because it’s an exaggerated example of a trend I see over and over again: a board recommends a disastrous merger that sees the stock price decimated and often puts the entire business at risk…. and somehow the board members are never held accountable.

Businesses can be cyclical, and weird things can happen. I get that. So I’m not saying every company with a stock that is down 80% plus over a few years should see their entire board turned over…. but it does seem to me that if a company willingly makes an acquisition that immediately plunges them into financial distress and does so in a way that intentionally prevents shareholders from having a say, then maybe the directors don’t have shareholders’ best interests fully at heart? And maybe a whole new slate of directors should be overseeing the company?

Anyway, I have no horse in the FWRD race… but I was just shocked that any director from the whole Omni debacle was still involved in the company, or that the company would put up any resistance to a shareholder trying to get some fresh faces on the board. But I think the whole saga speaks to how much directors can be disattached from the business / stock price / shareholder returns, and how urgent it can be for shareholders to speak up when a company is clearly getting mismanaged (because a disinterested legacy board is certainly not going to do it for you!).

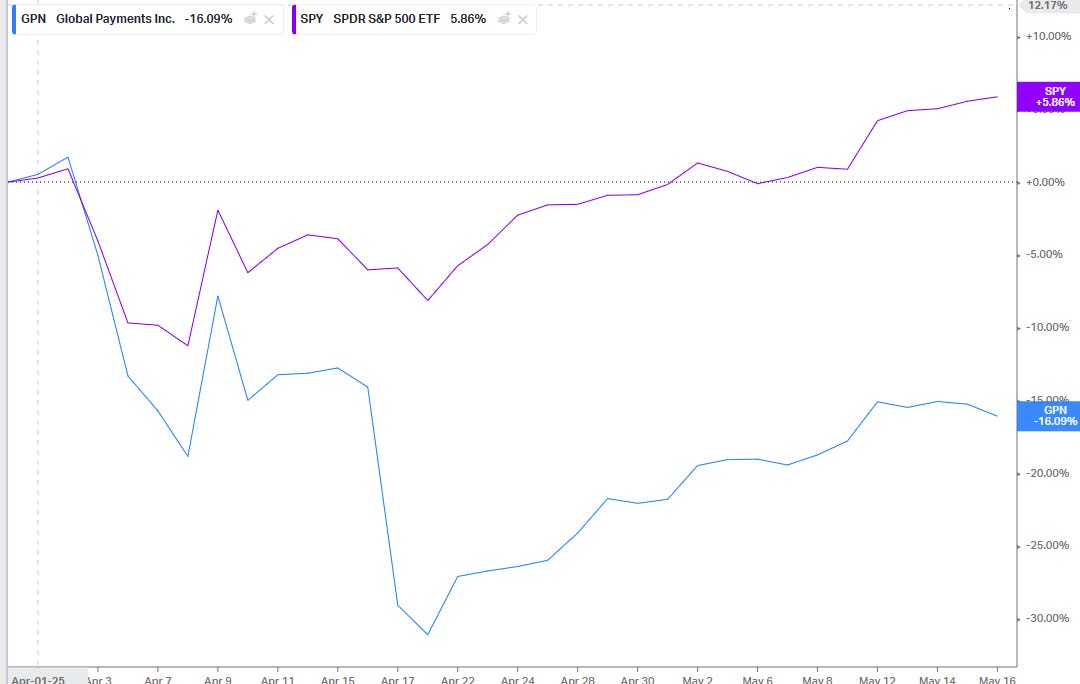

Speaking of bad M&A, let me turn to another fun one: Global Payments (GPN). Last month, GPN announced a deal to buy World Pay and divest their Issuer Solutions business. The market response has… not been kind; the stock has underperformed the index ~20% since the announcement and the deal triggered a slew of downgrades:

Why do I mention this deal? Well, GPN had just had an analyst / investor day back in September, and it’s really interesting to review what they were saying then. In particular, it’s hard to marry a focus on “modest tuck-in M&A”, “organic growth,” and “our top capital allocation priority going forward will be to return capital to shareholders” with GPN’s decision to pursue a strategic deal that paused shareholder returns and sent the stock down 20%!

Why did GPN do the deal? Heck if I know; they probably thought it was a good one. But you can tell they were surprised by how negatively the market and analysts took the deal; they spent basically all of their Q1 call explaining why they did the deal and why this wasn’t a huge change in their strategy. Still, as one commentator on VIC put it, “I'm left with no other choice but to conclude that management are sociopaths” after doing a deal that they promised a few months ago not to do!

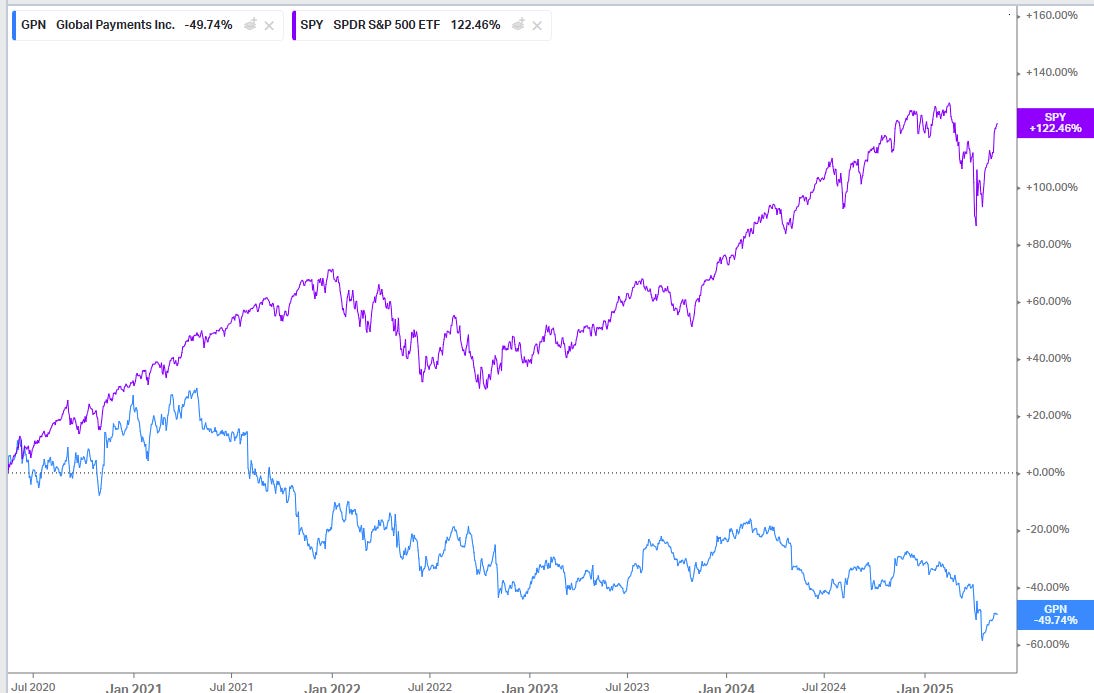

GPN’s stock has been a perennial underperformer. The current CEO took the job ~2 years ago, but he’s had C-level positions at GPN since ~2012, and GPN’s Chairman was appointed >5 years ago, so I think it’s fair to lay most of the medium to long term performance of GPN at their feet. If you held the stock over the past five years, you’ve massively underperformed, and the cherry on top is management just did a deal they promised they wouldn’t do and tanked the stock 20%.

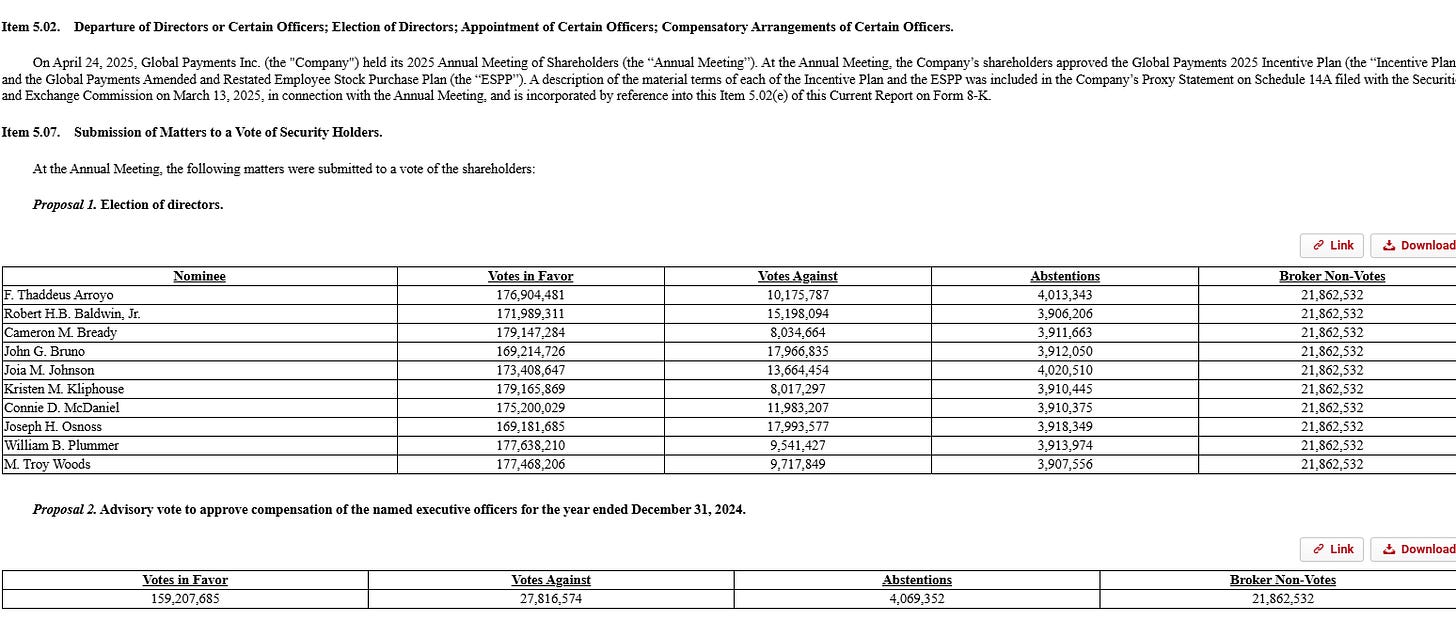

Will there be any consequences for management? Probably not! The shareholder meeting was held a few days after and, while the margins were a bit slimmer than your average uncontested election, every board member got reelected with overwhelming majorities and the compensation package sailed through. The gravy train for insiders keeps rolling, even as shareholders see their equity dwindle.

I’ve got no answers or solutions here. I don’t follow either of these companies closely enough to opine smartly on what the future holds for them. But if the definition of insanity is doing the same thing over and over and expecting different results, I’d probably suggest that letting these management teams / boards continue to run the companies as they have been without any shake up or push back is likely to lead to continued underperformance (and probably another awful deal or three along the way!).

PS- Completely unrelated, but my friends at AlphaSense are hosting a (free) webinar on AI and Data Centers; it’s obviously a hot topic among investors with impacts on lots of different parts of the economy. If you’re interested, you can sign up here.

Have you looked at $SONM? Talk about a dumpster fire, too! Terrible mgmt & no accountability by board. Had a takeover offer at $4/share last month (~80% premium), company decided to adopt a poison pill instead. New takeover offer is at $1.81/share…