Going back to the (premium) zombie bio well

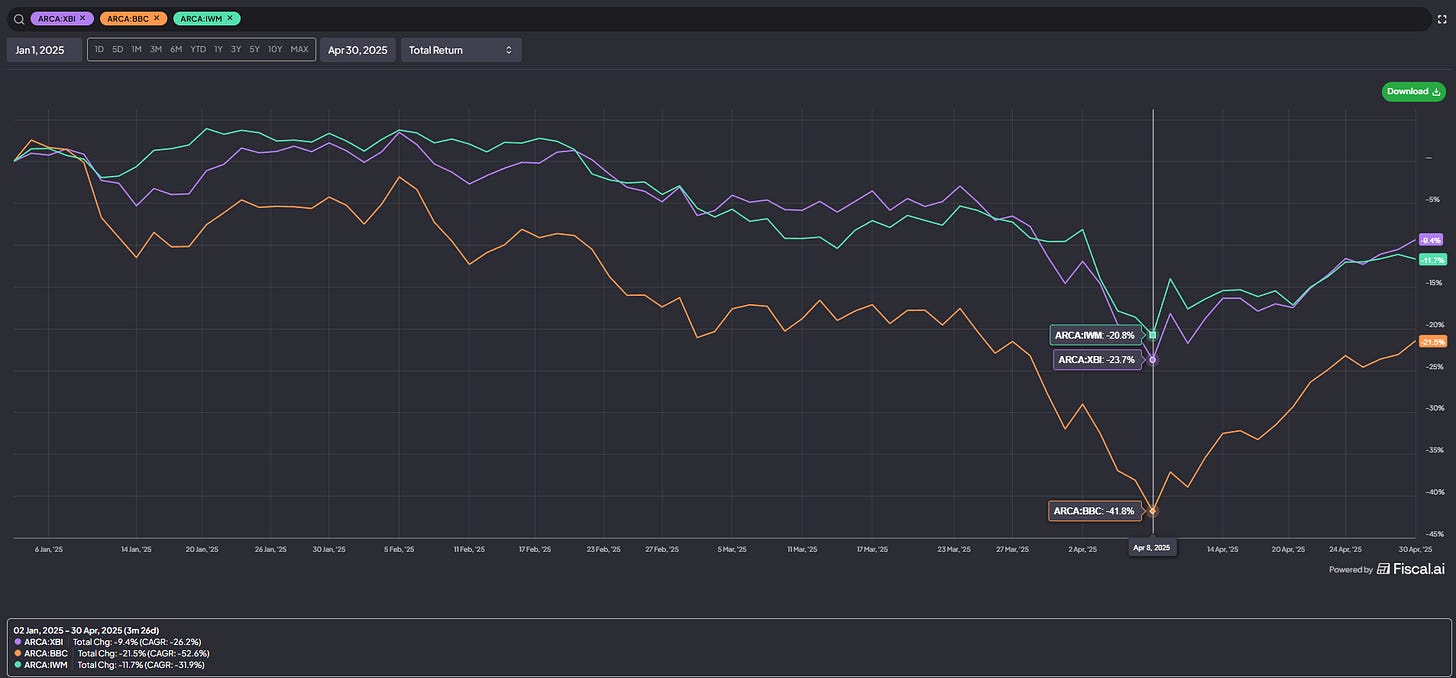

~Last March, we saw a massive selloff in the pharma and biotechs indices. The selloff was driven by the combination of rapid changes at the FDA under RFK and the “tarrif tantrum;” at its nadir, wide swaths of the industry were trading for well less than the net cash on their balance sheet.

For most of the past year, a major focus of the blog (both the premium and free side) has been the “busted biotechs1” trade that was in large part driven by that sell off. That includes:

Multiple premium side ideas on public biotechs trading below cash (in addition to SAGE and KROS, there was SEPN, KURA, ITOS, and several others)

I’ve been very clear through all of these write ups: I’m a mouth breather when it comes to the science. My interest in the biotechs comes from buying assets for well under cash value and working corporate governance angles / betting the company won’t light it all on fire on negative EV R&D, not betting on next cure for cancer.

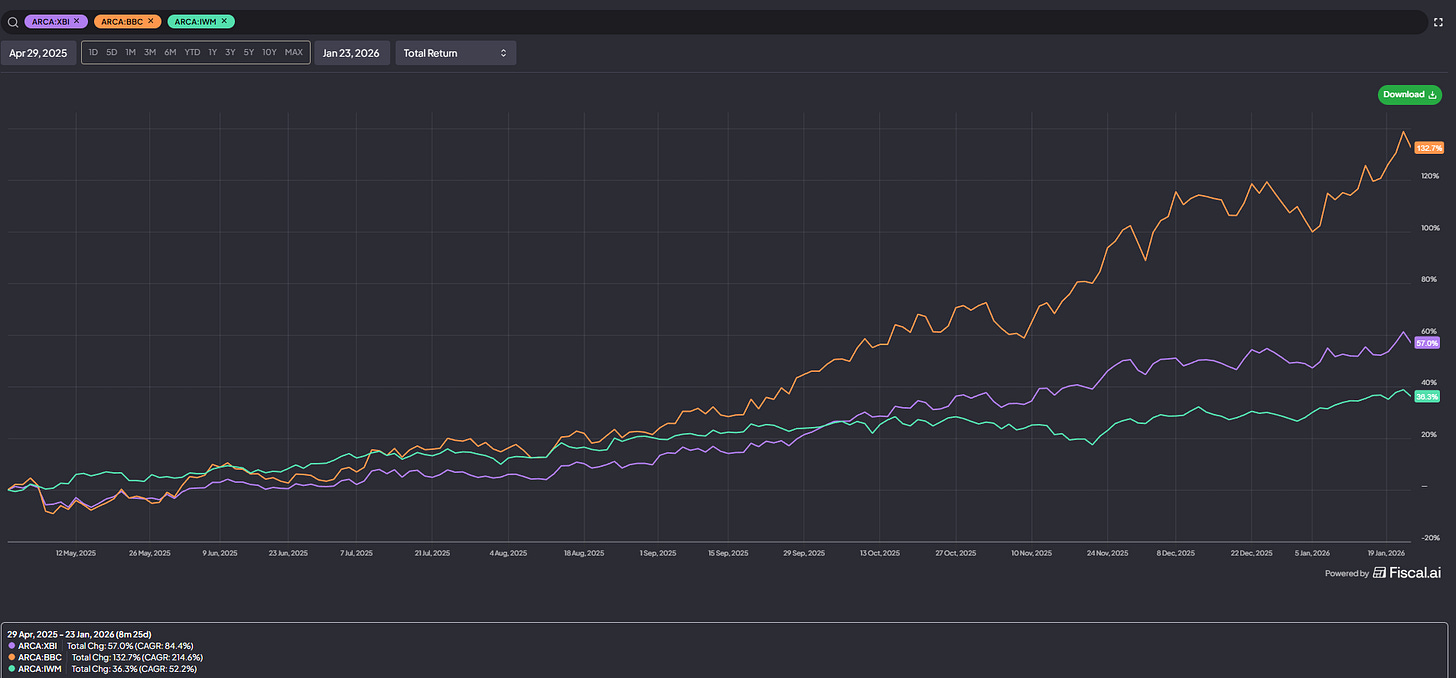

That “busted biotech” focus has played out well over the past year; some biotechs returned capital, some announced blockbuster data out of nowhere, and some got taken out. It didn’t hurt that the whole sector rose from the ashes like a Phoenix:

Unfortunately, that massive rise had largely demolished the “busted biotech” trade; while there are still companies trading below cash, there are much fewer and the quality of the companies trading below cash is much lower than it was last year.

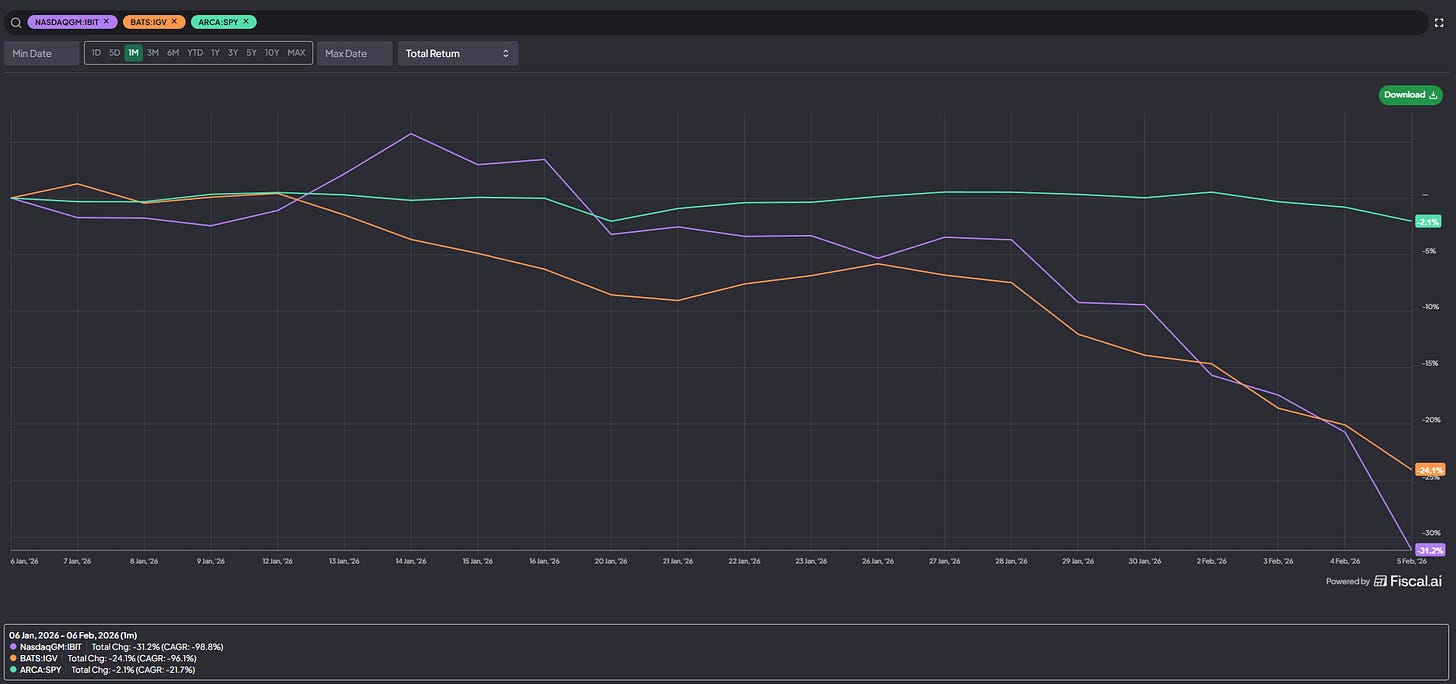

However, over the past few weeks, smaller biotechs have traded like all of their cash is in bitcoin or they’re in clinical trials to discover a SaaS company. I’ve seen multiple companies trading around net cash see their stocks sell off 20-30% (or more) in the span of a few days on no news as the SaaS contagion has gotten a little more widespread.

That’s created pockets of value again; I’ve got ~5 that I’m pretty excited for right now / think present a bunch of upside with minimal downside. I may write all up in time, but for now let me focus on my favorite of the bunch: