An open letter to the $SAGE board: it IS about the money

TL;DR: despite my hopes for the best, SAGE (disclosure: long) continues to burn cash at a level that would raise the eyebrows of even a comic book villain. I sent them the open letter below; if you’re a SAGE shareholder or just a fan of companies not spending money like drunken sailors, I’d encourage you to communicate your views to them as well (you can find their IR info here).

(Open letter begins below)

Dear SAGE board,

Not that you’re asking, but I’ll admit it: I’m a huge nerd, and I love comic book movies. One of my favorites is The Dark Knight. In it, there’s a famous scene where the Joker lights his share of a heist’s money on fire and notes “it’s not about the money; it’s about sending a message.” A fun fact about that scene is the amount of money you see the Joker burning would come out to over $6B dollars in cash; that’s quite the message!

I mention my love of movies because SAGE is on pace to burn over $300m in cash this year. SAGE is not quite at the Joker levels of cash burn, but I think even he would be impressed by a company of SAGE’s size managing to burn almost a million dollars per day. SAGE is a publicly traded company; while the Joker could light money on fire simply for the message, for SAGE and its shareholders there is no message…. SAGE’s cash burn is very much about the money.

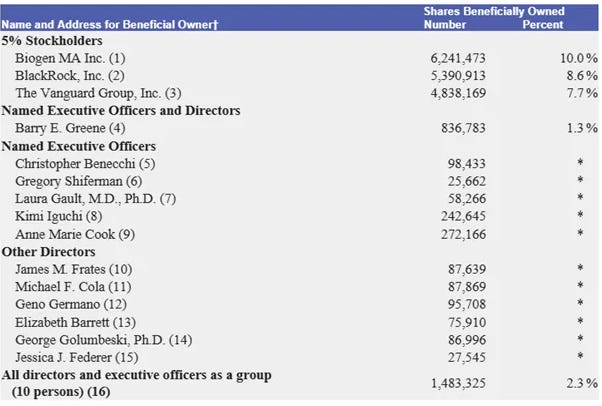

The fact is SAGE today is a single asset company (Zurzuvae), and that asset is partnered with a global behemoth in Biogen. There’s no world where it makes sense for SAGE to be a standalone public company anymore; even if SAGE were to cut costs to the bone, the minimal corporate overhead would be too much of a drag versus the efficiency of selling the company and cutting all of the standalone / overhead costs.

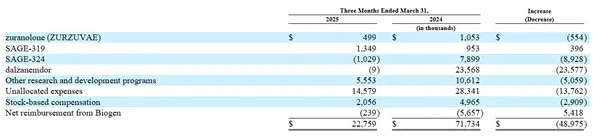

But that hypothetical assumes that SAGE cuts cost to the bone, and SAGE does not appear to have any commitment to bringing costs down. My eyes almost exploded when I saw the breakdown of the company’s R&D spending on p. 47 of your most recent 10-Q. With only a handful of phase 1 and preclinical assets, somehow SAGE managed to spend $22m on R&D in a quarter. How can a company with that asset profile justify more than $15m in unallocated spend and stock-based comp? I’ve been following busted biotechs for years, and I’ve never seen an R&D spend this out of control. Again, the Joker would be impressed.

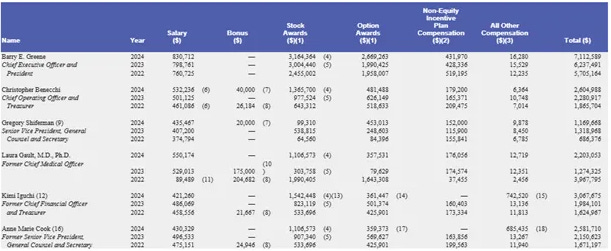

On top of that astronomical R&D spend, the company is spending almost $60m/quarter on SG&A. While some of that spend relates to supporting Zurzuvae’s growth, the company and its cost structure were clearly designed to develop a massive R&D pipeline that could propel SAGE to being a multi-billion dollar company (as it was before all of its key assets started failing trials). While SAGE is no longer a multi-billion dollar company (nor does it have a realistic hope of becoming one), it has not right sized its cost structure to support its current size / asset base / prospects. We’d particularly note that management has not only continued to pay themselves enormous amounts of money as the company’s stock (and prospects) have plummeted, but the payouts have escalated as the stock has gone down and trial after trial have failed! SAGE’s stock is down ~90% since Barry was appointed CEO in late 2020, yet somehow his salary and all in compensation go up year after year. I suspect even the mobsters of Gotham would be impressed with that racket!

SAGE today is faced with a clear choice; the company can continue along the current path for another year or two, and eventually SAGE will run out of cash and need to fire sell their core assets. Or SAGE can do the right thing and sell the company now while Zurzuvae is still growing and the bank account is still flush. Given board members and insiders own shockingly little stock (almost every share owned in the proxy comes from deep out of the money options that will never pay out…. And the stock ownership is abysmal even if you included those options! For example, Barry owns the most stock of any insider, but after getting paid mid-seven figures for years Barry owns less than 100k shares of stock directly, with almost all of the rest of his reported “ownership” coming from deep out of the money options and RSUs / PSUs that are unlikely to vest), board members’ incentives might be to maintain the current path and collect another few years of salary / board fees / bonuses.

We’d urge you not to go that status quo route; ignoring the fiduciary duty you have to shareholders to maximize value instead of pursuing vanity projects and paying lavish salaries, lighting hundreds of millions of shareholders’ money on fire will have reputational consequences for each and every one of you that will echo for the rest of your professional lives. Whether it’s as a board member or an executive, what shareholder would want any of you involved in any company in the future if you’re willing to let SAGE burn literal comic book levels of money while destroying every last drop of shareholder value?

Instead, the board should do what’s right. Announce an immediate cost cutting program, and then wind the company up in the way that maximizes shareholder value. That’s likely a sale to Biogen, but SAGE is fortunate to have other routes for value realization available if Biogen refuses to offer a fair price. The most important thing is urgency; the status quo cannot be maintained, and costs need to come down immediately. Every day that costs are not cut dramatically is a day of further value destruction.

Given the lack of urgency at the board so far, our plan is to vote against every director nominee and proposal (namely the executive compensation and ESPP) at the upcoming annual meeting. It’s unfortunate that the board is staggered and the nomination deadline has passed, as we suspect the outcome at SAGE would be better if we could turn the entire board over quickly by voting on a new slate this year. So for now we will limit ourselves to voting against this year’s crop of nominees, but should the board continue to fail to act to maximize shareholder value we will eagerly support any alternative slate that will look to maximize value at upcoming meetings.

Let me wrap this letter up with another famous quote from the Dark Knight: “you either die a hero or live long enough to see yourself become the villain.” Unfortunately, it’s pretty clear this board and management team are villains given the outlandish pay and the failure to cut costs over the past few months….. but the good news for the board is that if you do the right thing and sell the company now, SAGE’s corporate death will let the board be remembered as heroes. Fail to cut costs and sell the company, and you’ll (rightfully) be remembered as villains.

If anyone at the company would like to discuss any of the points in this note (whether it’s bringing down cash burn, maximizing shareholder value, or the future of Batman in the DCU), I would be happy to do so.

Sincerely,

Andrew Walker (Very concerned shareholder)

Post script: a bit of background on this letter

Earlier this year, I published a podcast on SAGE. SAGE was trading for a discount to their cash value despite having a buyout offer on the table and a clearly valuable asset in their partnered drug, Zurzuvae. My hope at the time was SAGE’s management and the board would take the shareholder friendly route, which entails drastically cutting costs to right size the company on the heels of multiple drug failures and fully exploring strategic alternative (likely leading in a sale to Biogen; with only one asset, it no longer made sense for the company to be a standalone). My hopes the board would take the shareholder friendly route were dashed on Tuesday, when SAGE reported Q1’25 earnings and I was mortified to see the company had burnt over $80m in Q1 / was operating with an R&D and SG&A budget that would be completely appropriate for a multi-billion dollar company running multiple phase 2 and 3 trials alongside several already commercialized drugs but was completely insane for SAGE (which is effectively a single asset company with only a handful of phase 1 and preclinical assets). Hilariously, the company had the gall to brag about bringing R&D expenses down 40% quarter over quarter in Q1; given the level of cash burn and overhead at SAGE, that brag would be akin to an NBA team bragging they had lost by “only” 40 points after being down 60 at halftime.

Given SAGE and the board appear dead set on lighting money on fire without regard to risk-adjusted returns or shareholder value, I have sent them several private notes, and I’m also sending them the open letter you just read. If you’re a SAGE shareholder or just a fan of companies not spending money like drunken sailors, I’d encourage you to reach out to the company and let them know how you feel / think.

Wouldn't have SAGE laid off at least a small percentage of their workforce if they were serious about doing shareholders right?

Why so serious?