Edge, Alpha, and the Enviri Strategic Review: What Actually Counts as Unique Insight? $NVRI

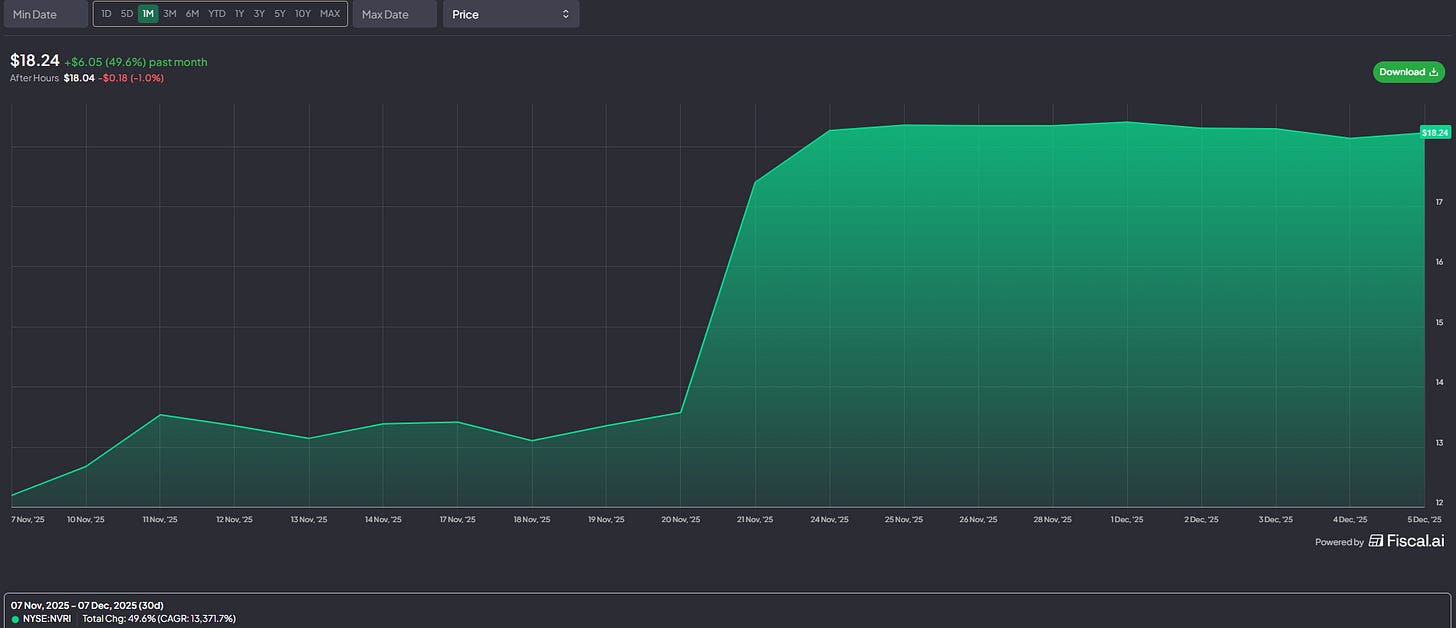

TL;DR: On their Q3’25 earnings call, Enviri (NVRI; disclosure: long) told you they were deep in a strategic review that suggested the company was worth more than the stock price. Less than two weeks later, the company completed the process and sold a division for a huge multiple, resulting in the stock shooting up ~30%. Here’s the question that I’ve been pondering: did buying NVRI on the heels of that earnings call constitute a unique insight or edge?

My personal belief is that alpha is generated through having some unique insight that the market does not have. That unique insight is generally generated through some form of edge; a capability that you have that the market does not.

In the moment, “unique insights” and “edge” are actually quite difficult to define. They kind of exist on a continuum. For example, on one end of the continuum, if I called you up and said, “I hacked the CEO’s email last night; the company is announcing a sale at a huge premium on Monday, we should buy some short-term calls,” it’s pretty easy to say that is a very unique and extremely edgy insight that would almost certainly generate loads of alpha…. but it would also get us sent to jail.

On the other end of the continuum, if I called you up and said, “I just ran a screen on Yahoo! Finance. This company has the highest trailing dividend yield in the public markets; we should buy it.”…. well, there is certainly insight in that statement (we have stated a fact!), but there is nothing unique about it. And there’s no “edge” in what we did; anyone with an internet connection could run that screen / reach that insight. So that’s a non-unique and non-edgy insight that would almost certainly generate no alpha.

So what we as investors are looking for is a unique and edgy insight that is generated through legal means. It’s why I try to start every podcast by asking, “The market is a competitive place—why is this idea a risk-adjusted alpha opportunity?” I’m trying to probe the guest for what they are seeing that the market isn’t / what their edge is.

But it’s really hard to know what counts as a unique and edgy insight in the moment.

Which brings me to my NVRI example; on their Q3’25 earnings call, NVRI led off with the following quote:

will take a moment to provide a brief update on our strategic review process that we announced a few months ago. Recall that this process is aimed at identifying and executing alternatives to unlock the inherent value of our business portfolio. In our view, this value is not yet reflected in our market value. Throughout our process and as expected, we have seen strong and definitive interest in our Clean Earth business from both strategic parties as well as others.

While nothing can be certain, we believe that there is a path to crystallizing its value in a tax-efficient manner for our shareholders. We have spent considerable time with our advisers thinking through structures that work, one of which involves a simultaneous sale of Clean Earth together with a taxable spin to our shareholders of our Harsco Environmental and Rail businesses. We believe this structure would result in minimal tax leakage for our investors and would allow for a sizable cash payment to shareholders upon the sale of Clean Earth. In fact, we have recently amended our credit agreement to allow for this transaction.

That is quite the quote. To quickly recap, NVRI leads off their earnings call by saying:

They are deep into a strategic process to sell Clean Earth

Their market value does not reflect the value they see in their portfolio through the strategic process

They are committed to returning the cash from the strategic process / asset sale to shareholders

Not only are they committed to returning that cash…. but they have actually amended their credit agreement to allow them to do exactly that

Here’s my question: was reading (and acting) on that quote (by buying the stock) edge?

On the one hand, it’s hard to say you have unique insight or edgy information when the CEO literally leads off a public company conference call saying that the stock is undervalued and they’re going to unlock that value through a sale in the near term.

On the other hand… scoreboard. NVRI announced a sale of their Clean Earth division less than two weeks after that conference call; sending the stock up ~30% on the day and ~50% over the past month. Kind of hard to say there was no edge to buying something on a thesis that played out and sent the stock up 50%!

So, I ask again: was reading and acting on that conference call edge?

I honestly don’t know the answer, but it’s something I’ve been thinking about a lot. Assuming that you’re not using illicit methods (in which case you certainly have edge but you also are certainly risking jail time), how can you know whether any investment you’re making is based on a truly unique insight? How do you know it’s edgy?

I’ll keep thinking about it, and I’ll let you know if I have any unique insights on it!

Odds and ends

I can’t emphasize this enough: if you have any situations that remind you of NVRI, I would love to look at them / swap thoughts with you on them! My inbox is always open for stocks that are going to gap up ~50% in a month (or you can toss them in the comments if you want other readers’ thoughts as well).

I suppose you could argue that NVRI going up 30% wasn’t pure alpha, but was perhaps four variables all getting resolved favorably. For example, maybe the market was discounting some chance that NVRI wouldn’t follow through on the sale, some chance the sale would have big negative tax implications, some chance that the sale wouldn’t come in at as big a multiple as NVRI was projecting, and some chance NVRI would not return the capital to shareholders (instead choosing to empire build). The big move up was all four of those variables getting resolved in a positive way.

I think this argument is a little bit of a stretch given that the company just did what they said they’d do and the stock gapped up, but I point out because if the stock had risen a lot less I’d say the pop was just uncertainty resolution versus alpha, and there is certainly a little of that built into the move here.

If I were a reader / subscriber to a blog that wrote up a stock they were long that had just ripped on positive news, my first thought would be “this arrogant butthole is taking a victory lap.” Let me assure you that I am not doing that! I had a small position in NVRI (extreme emphasis on small). NVRI announced their sale on November 21; on November 20th, I was actually trying to buy more NVRI but that was the day the market swung ~5% intraday on NVDA earnings (it started up ~2.5% and finished down ~2.5%). NVRI was weirdly strong throughout the day so I was kind of thinking to myself “don’t chase a stock up in a big down day; you can always buy more tomorrow….” and then NVRI announced a deal at a huge premium. The mental anguish of my missed orders is much, much greater than the very small dollar figure of profit on this deal.

If I had real conviction on this / maybe had a little more time to work on it, I would be writing this from a beach somewhere. And I probably would have written it up on the premium side of this blog too, so maybe some readers would be on the beach with me (disclosure: clear joke; I actually hate the beach. And certainly not investing advice, as nothing on this blog ever is!)!

Hat tip to Kingdom Capital, where I first saw this idea. I only wish I had seen it earlier / acted more decisively!

Two other historical winning trades I think about in relation to edge / unique insight: the trades worked out great, but in the moment, how would you have described them as edgy or unique?

With the benefit of hindsight, the market was way underpricing the risks of COVID in early 2020, and if you had the unique insight that things could get really bad (like Ackman did) you could have made a fortune monetizing that insight….. but hindsight is 20/20. In the moment, could you call that a unique insight? By the middle of February 2020, every company was talking about COVID impacts on their earnings calls…. I think it would have been natural to wonder if buying protection in February was akin to buying insurance after the house had already burnt down1? And if you didn’t have a background in public health or some type of disease study, could you really say you had a unique edge in understanding how the virus was likely to play out?

In ~2023, you could have had the insight that the AI buildout was going to create a shortage of electrical power and you could have done incredibly well monetizing that by buying independent power producers (like TLN) or companies that had access to a lot of power (the somewhat infamous bitcoin miner to data center trade). But power is a tough, tough industry; it’s really interesting that it seems like a lot of generalists made huge amounts of money on the trade, but many specialists in the sector—and even the companies themselves—seemed caught unaware or were very skeptical of the trade (something I might discuss in a future post!).

Perhaps a better way to frame it: given vol was already elevated in February, was it fair to wonder if buying protection then was akin to asking for an insurance quote while your house was already on fire? Sure, the protection is nice, but you’re going to pay through the nose for it!

In this case, if there is an alpha, it is that the odds (of sale) in your model are different from the implied odds in the market, and you have a good reason why you are right.

Not familiar with the case, one legit edge could be you followed the guy (mgt) in the past, and have a fairly confident read at how serious s/he is.

Having a better read on a key person sounds pretty unreliable, but, counterintuitively, it's one of the most reliable edges in my experience.

very likely underestimating the size\scale of people willing to act with nonpublic info in today's culture. it is no longer that unusual to see it retrospectively in share prices.

what if you directly knew days prior when trump announced a major tariff pause\change?