Digital Asset Treasury companies and mNAV premiums (part 2: why these shouldn't trade at a premium)

Last week, I posted Digital Asset Treasury companies and mNAV premiums (part 1: overview + bull thesis). I’d obviously encourage you to read that post for background, as in today’s post I want to build on that post and dive into why I don’t think these companies should trade for a premium. And, if you missed part 1, I’d encourage you to sign up to not miss any more posts going forward:

This post will run long as I have tons of thoughts on the subject, so if you want to hit the restroom or grab a snack before diving in, now’s the time. If you want to jump to a section that particularly interests you, I’ll be covering:

A hypothetical: take DATs to their natural conclusion and buy all the crypto

DATs deserve a premium because they offer intelligent non-recourse leverage

The liquidity argument (trading on the stock market) and why it’s not a panacea: SPACs, Trusts, and closed end funds

“Intelligent leverage” part 2: closed end fund discounts and “free” converts

DATs aren’t cheap: management fees, commissions, hidden expenses, and perverse incentives

Why don’t all DATs trade at a premium?

Number go up?

Let’s dive in and start with:

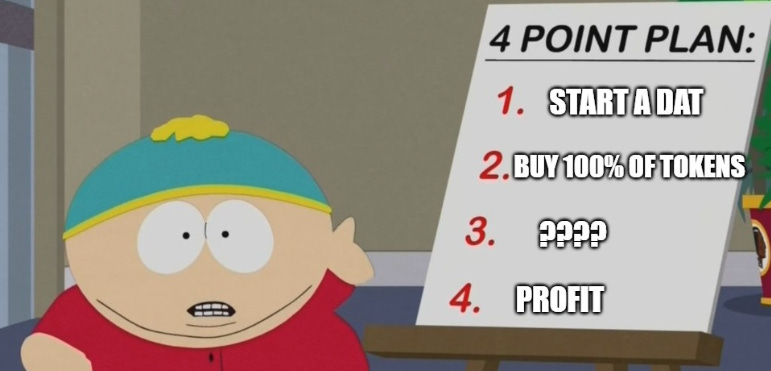

A hypothetical: take DATs to their natural conclusion and buy all the crypto

Consider this hypothetical: if you believe a Digital Asset Treasury (DAT) should trade at a premium to NAV, take that to its logical conclusion. The DAT would continue to issue its stock to buy more of its underlying asset, and it should and will attract copycats (in the same way MSTR has spawned dozens of copycats already). The underlying asset will become more and more illiquid over time as, eventually, all of the supply is owned by DATs1…. then what?

The DATs have effectively cornered the market for their underlying crypto in this scenario, and I’m sure the underlying’s price will have skyrocketed as the supply gets tighter and tighter2. DATs will now be sitting on an enormous pile of an asset that doesn’t really trade since they’ve all promised to never sell the crypto they buy (and perhaps they used leverage to purchase it as well, meaning they own all of an illiquid asset with no cash flow that they need to service debt on)... what’s next?

Or consider it this way: what would happen if Microstrategy3 bought all of the Bitcoin in the world and did so with leverage? What’s MSTR’s asset value at that point (remember, Bitcoin no longer floats, MSTR owns all of it now!)? What cash would MSTR use to pay their interest payments going forward (to say nothing of paying back their debt)?

Those are really interesting questions, but the one I was actually trying to drive to is that if MSTR bought all of the bitcoin in the world, it would no longer trade at a premium to bitcoin because bitcoin was now MSTR and MSTR is bitcoin. Taking both at their extreme, a DAT in its fully realized version can’t trade at a premium because it becomes the underlying asset4.

I think that hypothetical is really interesting to keep in mind; it’s the natural conclusion to DATs, and I think it shows how silly the “DAT should trade with a premium to NAV” argument is (and raises questions about where they get cash flow to pay overhead / interest as they continue to grow and own more of the underlying asset / the underlying gets more illiquid).

But, that hypothetical aside, there are plenty of other reasons a DAT should not trade at a premium to NAV! Let’s try to break down each and every reason that a DAT believes they should trade at a premium and why I don’t believe that’s applicable.

DATs deserve a premium because they offer intelligent non-recourse leverage

Let’s start with the argument I find most interesting: DATs should trade at a premium because they offer “intelligent leverage.” Intelligent leverage would generally have two underlying arguments:

Buying a DAT offers an investor a nonrecourse way to leverage crypto. Sure, an investor could buy crypto on margin (not investing advice!), but doing so risks a margin call if the crypto goes down. Buying a DAT and letting the DAT deploy leverage eliminates the individual investor’s margin call risk

DATs have access to all sorts of interesting leverage options (convertible debt, preferred equity, etc) that individual investors do not, so they have a cost of capital investment.

Obviously, I think both arguments are materially mistaken.

The simplest to rebut is that DATs should trade at a premium because they offer investors non-recourse leverage to digital assets. The thing is that, if investors want it, they already can get non-recourse leverage to crypto in several ways. For example, there are several double-leveraged ETFs on crypto (BITU offers 2x BTC returns); buying one of those allows for non-recourse leverage5!

Now, a DAT would probably argue that a double levered ETF is certainly nonrecourse, but it’s not intelligent, and DATs can use intelligent leverage through things like convertible bonds and preferreds to generate better equity returns. This is basically Saylor’s “refining” argument, which I quoted in part one but must again quote here because it’s so spectacular:

so what we're doing is refining and we're harnessing the power of the Bitcoin asset. And we're able to actually refine it into low volatility, low leverage, less risky financial products and then higher volatility, higher leverage financial products. So just like you might refine a barrel of crude oil into kerosene, which would be very, very pure and asphalt, which is not so much, we're basically providing a function that, say, an ETF cannot provide. You can see IBIT, the most famous example here in this chart. It basically wraps Bitcoin and it serves up a security flavor of raw Bitcoin to the investment community.

We, on the other hand, are offering stepped-down elements, convertible bonds, convertible preferred stock, senior fixed stock, junior high yield, preferred stock and of course, this treasury preferred stock in the form of Stretch. We're offering those. And those, in essence, we're stripping and modifying the duration of the asset. And we're also stepping down the volatility of the asset, and we're actually extracting the yield from the asset, which is Bitcoin, and we're serving it to each of these fixed income investors. But the excess yield, excess volatility, excess performance that does not go in those fixed income instruments goes into the MSTR common stock. And then, of course, that feeds to the MSTR-based ETFs and the MSTR options. So all of these are different instruments. They're all targeted at a different type of investor.

This is a really interesting argument for a whole bunch of reasons. Namely, if you’re familiar with your financial history, this type of “refining” is the type of financial engineering that generally precedes a blow up.

I can show this to you simply: replace Bitcoin in the quote above with “residential mortgages.” It doesn’t fit neatly into the Margot Robbie Big Short dialogue, but you’ve come pretty close to explaining the thesis behind different tranches of CMOs that fueled the subprime bubble.

I want to come back to this discussion of “intelligent” leverage in a bit, but let’s put a pin in it for now.

The liquidity argument (trading on the stock market) and why it’s not a panacea: SPACs, Trusts, and closed end funds

Another reasons DATs will argue they should trade for a premium is because they trade on the stock market. At its simplest, that means that they are easier to buy than crypto (you can one click buy in any brokerage account); however, DATs often expand this argument by noting that DATs are generally both marginable (i.e. able to be borrowed against) and eligible to be purchased in retirement accounts or get added to indices (and thus create forced buying), while the underlying crypto cannot.

In the early days of DATs, I could actually see how this argument made sense. If you were a public market stock investor when MSTR first became a DAT company, the only other way to get any crypto exposure through the stock market was to buy a bitcoin miner, and that was very indirect exposure (few, if any, held BTC on their balance sheets, and the core mining operations generally were quite capital intensive and burned cash). So, back then, I found the argument somewhat persuasive. Today, I find those explanations laughable and utterly unreconcilable with reality for many reasons.

To start, there’s just been an explosion of ways for public market investors to get crypto exposure. Not only were there few alternatives to MSTR in the early days of it becoming a DAT, it was actually pretty hard to buy crypto. Crypto was largely unregulated, and many of the best places to buy crypto wouldn’t custody for you, meaning you had to figure out how to buy and custody crypto yourself. So buying MSTR was a really simple and easy way to get exposure to crypto. Today, that argument holds no weight. If you want crypto exposure, Coinbase (or Robinhood, or IBKR, or just about any broker) will let you buy any crypto you want in a second, and if you want it in equity form there are multiple crypto ETFs you can chose from.

But, aside from the plethora of options, I’d note there are basically no other examples of asset classes where a company persistently trades at a premium simply by holding an asset and having a stock that trades publicly. The reason is simple: arbitrage and supply and demand. If any easily traded commodity trades at a premium in any form when it trades on an equity exchange, eventually enough supply (new stock from the company or copycats) will be brought online to meet that demand. This new supply will generate cash that will be used to by the underlying asset, and thus through some combination of the DAT’s prices falling (as all that new supply comes online) and the underlying’s price rising (as all of that cash is used to buy it), the two will trade at roughly parity / the premiums will disappear.

If you wanted to be really snarky, you could point to SPACs as a perfect example. If something could trade at a premium just because it listed on the equity market, then all SPACs would trade at a premium to NAV, but they do not because an equity listing in itself does not create a premium. In the early 2021 SPAC bubble, there was insane demand for SPACs and they all traded at a premium. That results in the market getting flooded with new supply until it simply overwhelmed the demand, eventually sending all the SPACs back to ~trust value. I suspect that is what will eventually happen with DATs.

But, if we wanted to put the SPAC snark aside, there are trusts of other commodities out there, and none of them trade for premiums to NAV. For example, Sprott has a physical gold trust and a physical uranium trust. I can assure you it is way easier to buy a uranium trust on the stock market than it is to buy physical uranium, yet despite that ease the uranium trust trades for a persistent discount to NAV.

DAT bulls might say that the Sprott Trusts aren’t included in indices, and that index buying can push a DAT above NAV. Perhaps! But Ackman thought something similar with PSH (his closed end fund) and celebrated when it got added to the FTSE 250 index, but that hasn’t done much for PSH’s discount to NAV.

“Intelligent leverage” part 2: closed end fund discounts and “free” converts

Speaking of PSH, I’d like to come back to the discussion of “intelligent leverage.” The DAT model of “buy a financial asset, toss it into a corporate structure, and perhaps throw on some ‘intelligent’ leverage” is not new. Closed end funds like PSH have existed for over 100 years; in general, closed end funds run a very DAT like process of buying public equities, tossing some leverage on them, and having their stocks trade on the open market. Almost all closed end funds trade at a discount to NAV, so much so that multiple specialized firms have popped up that focus only (or mainly) on investing in closed end funds and getting them to liquidate to unlock the discount (and thus generate uncorrelated alpha).

Now, a DAT bull might argue, “sure, closed end funds exist and use leverage…. but DATs take advantage of their high volatility to interest ‘free’ convertible debt, and they should trade at a premium because of that ‘free’ convert potential!”

Practically, I think that ignores real world evidence. For example, SPE trades at a discount to NAV despite having very low cost convertible preferreds .

And, realistically, I think the argument misses the mark as well. DATs are able to issue “free” convertible debt now because volatility on both their stock and the underlying digital asset is high…. but, if the digital asset is here to stay and the DATs are real, volatility will come down over time. Why? Lots of reasons, but here’s one simple one: a young crypto will naturally have higher volatility because people aren’t sure if it will catch on / exist in a few years. So there might be a chance for really low cost converts in the early stages just given that risk / high volatility allows creative structuring around converts…. but run it out a few years and if the crypto is still around vol has to have come down because now you have a track record of it existing.

And there’s one other thing I want to talk about convertible debt: DATs treat convertible debt like it’s “free” money, but it certainly is not free. Yes, a convert can be structured in a way so that it doesn’t have any interest expense, but it is a real debt that really needs to be paid back. And that raises the question: what happens when that debt comes due?

Now, if digital assets are screaming higher and everyone’s partying, paying the debt back is probably not an issue. But what happens if digital assets have stalled out? Well, volatility will come down (if the digital asset has stalled out, it has become a low volatility asset!), so the option to refi the debt with low cost convertible debt will be gone, leaving the company with the option of refi’ing the converts with “normal” debt (that carries a cash coupon) or paying off the debt with cash. If the company wants to pay off the debt with cash, they can either sell some of their digital assets to raise cash, or they can sell stock for cash. Here’s my question to you: if the company needs to raise debt that requires them to pay real interest expense, or the digital asset has stalled out for several years and they need to raise equity because they can’t raise convertible debt anymore…. what are the chances they’re still going to be trading at a NAV premium when that happens?

I would posit the answer is “absolutely none.” That’s going to leave the DATs faced with few options, and all of them will be very bad for their shareholders. The best way to pay off that debt would probably be to sell down crypto to raise cash, but I think that’s going to be really hard. All of these DATs have rushed head first into crypto; it’s really easy to buy price insensitively on the way in, but selling big blocks on the way out tends to require a haircut. And all of the DATs have raised converts that come due around the same time (~3-5 years from now), so it won’t just be one DAT trying to sell a block of crypto when these come due. Right now, crypto is in this fun up cycle where every DAT is raising money and buying crypto, thus supporting crypto prices. And that upcycle can go on for a long, long time…. but if the party stops and DATs need to sell their crypto en masse to pay off their converts, then crypto is going to be in for a world of hurt.

The other options DATs would face is to issue equity to pay off the converts. Again, this probably would not go well for them; I strongly doubt that DATs would trade at a premium in this world (remember, crypto has stalled and and “free” converts are gone), so DATs would need to massively dilute their shareholders in this world.

MSTR has a wonderful slide in their deck that talks about their capital allocation. In it, they say that if the stock trades below 1.0x NAV, they’ll “consider” issuing credit to buyback stock. It’s one of my favorite slides because it sounds so nice when you say it and so crazy when you think about it. MSTR is currently issuing preferred stock at ~10% interest rates to buy bitcoin while their stock is trading at a premium and their capital structure is like 90% straight equity. In other words, things now are about as good as they’re going to get from a credit perspective…. if you’re talking about a world where MSTR is trading below NAV, it’s a world where they’re more levered (because they’ve continued to issue credit / preferred to buy crypto) and have less options (because they are more levered and their stock has come down). Who is going to lend them money to buy back stock in that world? And, if they find someone to do it, what rate do you think they’re going to charge?

DATs aren’t cheap: management fees, commissions, hidden expenses, and perverse incentives

One thing I’ve noticed about DATs is that no one ever talks about the fees associated with them, and that makes sense when crypto is racing and all of them are trading for huge premiums.

But as someone who has followed closed end funds for a long time, I know that there are real expenses associated with these types of things, and I suspect if things cool off just a little bit people are going to be surprised by what they’re paying for at DATs.

Remember earlier I talked about closed end funds? Today, they almost all trade at a discount for two reasons:

Even if you ignore fees, mutual funds, ETFs, and several other strategic offer better ways to own stocks: better liquidity, taxes, etc.

But you shouldn’t ignore fees, and closed end funds normally charge well above average fees! Even worse, those fees often create very perverse incentives.

I’ve covered point number one as it relates to DATs already; it’s point number two I want to dive into: the fees that these DATs are paying are way above normal and will create perverse incentives in the long run.

Diving right into an example will illustrate this best. Consider Sharplink (SBET). SBET is an Ethereum Treasury company that kicked off their strategy in late May. Galaxy Digital is managing SBET’s ETH for an asset management fee that ranges from 0.25% to 1.25% of AUM with a minimum of $1.25m. That’s a heck of a fee to simply oversee a pile of Ethereum…. but on top of that management fee, you have to remember that there’s a whole leadership team at SBET. In late July, they announced a new Co-CEO, who will be getting $750k/year in salary. On top of that, he got $7m in RSUs as a signing bonus, plus another $4m in long term incentive payment next year, and a host of other goodies. And his Co-CEO signed a new deal around that time that gave him a similar (though slightly lower) payout, plus they got a CFO who will probably pull in ~$3m/year all in.

Look, it’s tough to add it all up and give a precise number for the corporate overhead here…. but you can just eyeball those numbers and realize those add up to real expenses, even on a massive pile of ETH like SBET is sitting on. And, even if you can scale up to make the costs of that huge CEO/CFO/corp overhead minimal, the asset management fee to Galaxy Digital is a real cost that does not scale.

You can buy ETH on Coinbase for effectively nothing, and the cost to hold it there is effectively nothing (I believe if you’re an institution, you need to pay maybe 10 bps). Given the cost drag I just laid out, SBET’s management team and Galaxy Digital need to create a whole bunch of value for owning SBET to be a better return in the long run than owning ETH directly; the history of asset management suggests it’s impossible to outrun fees that high.

I’ll note one other thing on the asset management agreement: at least SBET laid out (in very loose terms) the cost of their asset management agreement with Galaxy. I’ve looked at several other DATs trying to find how much they’re paying, and it’s almost always redacted or withheld. I suspect they’re all paying something in line with SBET (or perhaps higher)…. but I find it crazy that a DAT would withhold their asset management fee schedule given it’s likely to be the most important thing for shareholders going forward. It would be like if ETFs didn’t disclose their fees to investors and you just had to buy one and hope that it was a low cost one with a good fee schedule!

And the asset managers are not the only people getting paid at DATs. Bankers are getting paid too. MSTR pays bankers 2% of the gross proceeds from their preferred ATM programs; SBET paid placement agents 5% of the gross proceeds on their most recent big equity raise. Those are pretty standard fees, so I’m not saying they are overpaying bankers or anything…. I’m just noting that it’s yet another expense that comes alongside raising that “free” money. I’ve yet to see a DAT say, “hey, we’re going to raise $210m this year; $200m to buy bitcoin, and $10m to pay our bankers,” but that’s exactly what they’re doing, and that’s yet another drag that investors in DATs need to consider versus buying crypto directly on their own!

I’ll note there is one other place for hidden potential fees…. many of the DATs get formed by allowing investors to contribute crypto in-kind for shares. As an example, a bitcoin DAT might allow investors to contribute $10m in bitcoin for shares instead of $10m in cash. That’s a perfectly legitimate way start a DAT, and there are tax advantages for investors that would encourage them to make this exchange…. but the valuation of the crypto on the way in can be gamed in a variety of different ways. I’ll give you three examples: two hypothetical and one real.

Hypothetical: say you announce the DAT deal at the start of the month, and an investor agrees to contribute 100 bitcoin with bitcoin priced at $100k. If bitcoin rises to $150k by the end of the month, what price do you use for the contribution? What if it falls to $50k? I’m not saying that problem is unsolvable / unknown…. but I suspect in the rush to form DATs the companies are giving people very favorable terms on contributing a big block of crypto; in particular, I’d note that a few of these deals seem to give investors contributing crypto into the DAT PIPE all the upside if the price moves up (i.e. if BTC moves up 50%, they get ~50% more shares) but none of the downside if the price moves down (if BTC moves down 50%, they get the same amount of shares).

Hypothetical: A lot of the big holders of different tokens have tokens that are restricted for some reason; basically, these tokens cannot be sold in the near future…. however, I believe they can be used to swap into a DAT, so you could see people swapping restricted tokens into DATs in order to get immediate liquidity (thus sticking the DAT with the restricted tokens and the risk of the token tanking after the lock up / restriction ends).

Real world example: Consider ALTS, which is doing a World Liberty treasury strategy. If you read the fine print of the subscription agreement, investors can contribute cash or WLFI tokens to fund their PIPE agreement, and if they chose WLFI it will be valued at “a fixed exchange rate of $0.20 per $WLFI token.” I am not an expert on WLFI; I’ve literally never looked at it, and maybe I’m missing something here, but that fixed pricing appears to be…. just a slight premium to where WLFI is trading.

Roll it all together, and I’ll note one last thing: the potential for perverse incentives. DATs and everyone associated with them (management teams, asset managers, bankers) are getting paid on asset growth at DATs. When all the DATs are trading at huge premiums, paying for growth at any cost is fine…. but if the markets ever cool down, that incentive structure is going to create real conflicts between the DATs and there shareholders. Shareholders would be better served by capital returns if a DAT is trading below book, but any capital that a DAT management team returns would result in an immediate pay cut for them if they’re getting paid a percentage of AUM. Again, these are not unknown issues for other assets (closed end funds in particular), but to date DATs have not run into those problems and they’re almost certainly coming soon.

At this point, I’ve hopefully addressed the major points that you’ll hear bulls talking about when they tell you why a DAT should trade at a premium…. but I think it might be nice to talk about real world examples, so let’s discuss…

Why don’t all DATs trade at a premium?

There are plenty of companies that have pursued a DAT strategy and, despite following the DAT playbook, don’t trade for a premium to NAV. Consider, for example, Semler Scientific (SMLR). Semler was one of the earliest MSTR copycats, having decided to pursue a BTC treasury strategy all the way back in May 2024. Today, the company trades for roughly mNAV.

My question to DAT bulls would be simple: if DATs deserve to trade at a mNAV premium, why isn’t Semler?

Semler checks all the boxes that bulls use to argue for DATs to trade at a premium. SMLR’s been issuing shares to buy bitcoin, they’re utilizing “intelligent leverage (they’ve issued convert debt to lever up and buy bitcoin), their stock is included in several indices (including the Russell 2000), their stock trades on a public exchange and is thus marginable, their stock has options outstanding and thus can “refine” vol (again, they’ve already gone down this route by selling converts), their corporate deck talks about how bitcoin is the future (a necessity for a BTC DAT!)…. heck, they basically carbon copied the MSTR investor relations site for how they lay out their company’s capital structure (right down to stealing the fonts and colors!).

So why doesn’t Semler trade at a premium to mNAV, but both MSTR or CEPO do (Note I’m going apples to apples buy comparing BTC DATs here)?

And it’s not just Semler that’s trading at or below mNAV. I can find several other DATs that haven’t captured the trading zeitgeist that trade for similar discounts.

I personally believe that the reason these don’t trade for above mNAV is because mNAV premiums are driven not by science or any real math on value creation but by pure speculative frenzy and animal spirits. MSTR and a few others have captured the frenzy and thus get a premium; SMLR and the like have not (or they did for a brief, beautiful moment but have since lost it) and thus they languish at or below NAV.

I kind of suspect that deep down most sophisticated bulls would agree with me that mNAV premiums aren’t justified by anything but animal spirits, and all of the talk of “intelligent leverage” and everything is just designed to make them look less like cowboys betting that the speculative frenzy will get more intense / that there will be a “greater fool” down the line who will pay an even bigger premium for their DAT.

Speaking of speculative frenzy, I did want to end this post with one last argument I’ll sometime hear about investing in DATs:

Number go up?

I may do a follow up post discussing this issue a bit more, but sometimes I’ll hear from someone about DATs and they’ll say something like, “yeah, maybe the structure isn’t ideal, but BTC (or whatever crypto underlies the DAT) is going to the moon so you might as well buy a DAT to get exposure.”

Obviously that view expresses a ton of certainty in the future price action of whatever the underlying crypto is, but let’s put aside how uncertainty and risky I’ve generally found the future to be and address the underlying question: if you’re bullish on crypto, shouldn’t you just buy DATs6?

Look, I’m not saying DATs won’t do well if crypto skyrockets. If BTC is going to $1m, then I’m sure every BTC DAT is going to be a screamer.

But what this article was trying to highlight is that DATs are, in my opinion, a terrible way to express that bet. To me, they resemble closed end funds, except with much higher fees and worse corporate governance. You can make a lot of money buying closed end funds right before markets rip up…. but you’d generally have done a lot better with a lot less risk just buying mutual funds or ETFs to get your equity exposure.

And if closed end funds generally trade at a discount to NAV and still underperform equities in the long run given all the fees drags and other issues we’ve discussed so far, what happens to DATs if you buy them at a premium to NAV? I’d guess they far, far underperform the underlying.

So, if you’re really bullish crypto, I’d suggest the best way to express that is to skip the DATs and just buy crypto directly. Given the high fees and premium most DATs trade at, I’d expect crypto will substantially outperform DATs over the medium to long term in almost any scenario.

Odds and ends

I wrote most of this article over the past week. On Monday morning (when I was largely finished / editing), MSTR published an updated equity guidance slide. The only difference between the updated slide and the prior slide (which is screenshotted right above the “DATs aren’t cheap” bullet in the article) that i can see is the addition of “(3) when otherwise deemed advantageous to the company” in the “below 2.5x mNAV” section. That is an absolutely hilarious addition; I doubt there’s ever been a company that’s issued stock that they though was disadvantageous to issue! Perhaps I’m a jaded skeptic, but the whole slide seems to me to indicate MSTR (and other DATs) are very in on the joke; pretend to think your stock is worth a massive premium and pay lip service to that…. but leave yourself a whole bunch of room to issue a ton of shares at any premium to NAV.

I recently stumbled on bewater’s substack and I’ve really enjoyed their takes on bitcoin treasury companies; in fact, I’d say they’re much better than mine and would encourage you to read their pieces before my own!

One of the most frequent arguments you’ll hear for why DATs in general and MSTR in particular should trade for a premium is because they’ll eventually get added to indices and there will be constant forced buying that will support a premium (for MSTR, it’s already in the Nasdaq and they obviously are desperate to get into the S&P 500 given how much they talk about it / benchmark their fundamentals to it). I’d again point to the PSH example for why indices alone don’t guarantee the premium: PSH talked about how getting added to the FTSE would improve liquidity and valuation…. and they got added years ago and still trade at a huge discount to NAV. Sure, an index creates some forced buying and adds liquidity, but I think the suggestion that a DAT could get added to an index and then trade at a permanent premium to NAV is pretty silly and ignores a bunch of real world evidence as well as the possibility of arbitrage and the long term limitations of a DAT that big trading at a premium (see my hypothetical above).

More than that, I think it’s really strange how a lot of crypto has become focused on arguing for a big buyer to step in behind them. MSTR bulls argue for inclusion in the S&P to create forced buying, bitcoin bulls argue for the creation of a government strategic bitcoin (or crypto) reserve to create forced buying. It’s very strange thinking that has a lot of elements of a speculative bubble and with a bit of a pyramid scheme thrown in; we’ve gone from “buy crypto as digital gold as a hedge on government money printing / because it’s decentralized” to “buy crypto because the government will buy more of it in a few months and take us to the moon.”

I will admit that, benefit of hindsight, MSTR probably deserved to trade at a premium in 2020/2021 when it was one of the few public equity ways to get exposure to BTC. Again, we’ve seen this type of thing in closed end funds before; every now and then there will be a closed end fund or small BDC that will have a small investment in a buzzy tech stock, and it’ll trade at a big premium as investors want to bet that the investment (DXYZ is a great example (matt levine) covered it well, as were a few funds around the facebook IPO).

Maybe a discussion for another day, but I do think it’s interesting that the people who I see most aggressively pitching that DATs should trade at a premium are people who are investing in / creating DATs at NAV…. you very rarely see them put meaningful money to work in the structures while they’re trading at big premiums!

I’ll happily note I’m talking my own book here! I’m generally happy to invest in DATs with average structuring around NAV and have done so before; I’m just eyes wide open what I’m getting and the bets I’m making!

There is a rule in finance that is roughly: most financial engineering projects end in tears not because the underlying trade is bad, but because eventually too much leverage is applied to it. I don’t think DATs are a “good” financial engineering project, but even if you do you could certainly see the seeds of its downfall in this quote from Saylor- “when Bitcoin is highly volatile, it's very good for our equity. And when Bitcoin -- people go, "Aha, what happens when Bitcoin is not volatile." And what they don't realize is if you take that credit model I showed you and you crank in 20 vol and all of a sudden, we fall to 20 or 25 vol, you can go to 90% leverage. Because the credit looks like investment grade at 90% leverage.”

I’ve mentioned previously how entertained I am by MSTR conference calls. I wanted to wrap up with three things from their most recent earnings call / release I couldn’t quite fit into this series but that I thought were so wild that I couldn’t sign off without including them somewhere!

First, it remains just absolutely insane to me that they gave a forward guidance number that included an assumption that Bitcoin rose to $150k/share by year end. Imagine if oil companies started giving forward guidance that assumed oil prices rose 30% in ~4 months through year end?!?!

Second, the discussion of the preferred equity included the line: “So it's equity as opposed to debt, and yet, it's the best form of leverage, right? It's all the benefits of debt leverage, but none of the liabilities of debt leverage.” And that’s actually a very accurate statement; I have no qualms with it! But, every few years, some there’s some set of preferred equity where investors bought them reaching for yield despite the obvious risks and end up getting screwed. If BTC ever has a prolonged bear market, I suspect MSTR’s preferred will get thrown into that “screwed the preferred” bucket, and I would just love to show that quote and say “where were the signs” to anyone who finds themselves on the wrong side of the preferred trade.

Finally, this discussion of MSTR’s Strike preferred being their “iPhone” moment is so incredible that I just had to put it somewhere. It’s just incredible to see a company talking about a financing product going viral; is this Michael Scott not realizing he’s pitching a pyramid scheme in The Office? No, absolutely not for several reasons…. but honestly, if you told me this was the pitch that hooked Michael Scott into some scheme, I wouldn’t bat an eye. Thinking of a cleverly structured finance product as an iPhone moment is crazy; the iPhone literally fundamentally reshaped the world. This is financial engineering; in and of itself it creates basically no value7.

This could happen slowly (every DAT trades for 1.01x NAV, all of them slowly issue equity at a slight premium to buy crypto, and maybe 100 years from now they’ve bought up all of the asset) or quickly (every DAT trades for 10x NAV, they all issue shares like crazy, new DATs pop up every day, and they buy the last of the asset inside of six months) or anywhere in between, but if you believe that DATs should trade for a premium to NAV then at some point between now and the heat death of the universe every DAT will have fully absorbed their underlying asset and effectively have become the underlying asset

This scenario is not lost on Microstrategy or the analysts who follow them; it was the first question asked on the MSTR call and MSTR’s answer was literally “BTC will be $10m/coin when that happens.” This is what I’d call the number go up argument, and while it’s very interesting and certainly has trading repercussions, it doesn’t answer the questions about what a DAT does in that scenario!

Disclosure: I have a very small position in MSTR

I realize I sound like I just took a big bong hit and wrote that, and I kind of felt like I did as I was writing it. I promise I did not, though sometimes writing and thinking about DATs makes me feel that way

I’ll note I increasingly believe we will have a big bull run in crypto; it feels like there’s just too much money entering through DATs for us not to have one. So entirely possible we have a speculative mania in the near term…. but the bills will come due (and I mean that literally; as mentioned earlier, I shudder to think what happens when all this convert debt needs to be rolled)!

Financial engineering can create limited value, largely through tax shields, but that’s limited, small, and clearly not what they’re talking about here!

You link to the wrong WLFI token. The correct one trades at circa 20c. (Search on coinmarketcap to find the correct one)

Very interesting takes