"Risk Riding" at Berkshire and Buffett's 2025 Thanksgiving Message $BRK

Risk riding: when great returns hide a tail risk

Earlier this week, Warren Buffett released his (apparently now annual?) Thanksgiving Berkshire Hathaway message.

It was a thoughtful message that made me sad. I realize saying something makes you feel sad has negative connotations, but I don’t mean it that way! Sometimes it’s nice to feel something, even sad! Like most investors, Buffett’s had a big impact on my life, and in some ways he’s always seemed like a superhero to me. So reading about him talking about his own mortality hit me in the feels, in large part because it made me nostalgic / made me think about how he’s impacted me over the years.

I was touched by multiple things in the letter, but this line in particular grabbed me:

Father Time, to the contrary, now finds me more interesting as I age. And he is undefeated; for him, everyone ends up on his score card as “wins.” When balance, sight, hearing and memory are all on a persistently downward slope, you know Father Time is in the neighborhood. I was late in becoming old – its onset materially varies – but once it appears, it is not to be denied. To my surprise, I generally feel good. Though I move slowly and read with increasing difficulty

Again, the letter and that line in particular mainly brought up warm (if somewhat sad/nostalgic) feelings about Buffett… but that line also touched upon something that’s been tickling my brain for a while (I mentioned it in my October random ramblings): did Berkshire shareholders over the past 30 years get lucky with how age treated Buffett?

I don’t mean they got lucky in a “Buffett outlived the actuarial tables, so shareholders got lucky they got his service for a decade or two longer than they could have expected” way (though that’s true too!). I mean this in a “are shareholders lucky that Buffett didn’t show material mental decline a lot earlier?”

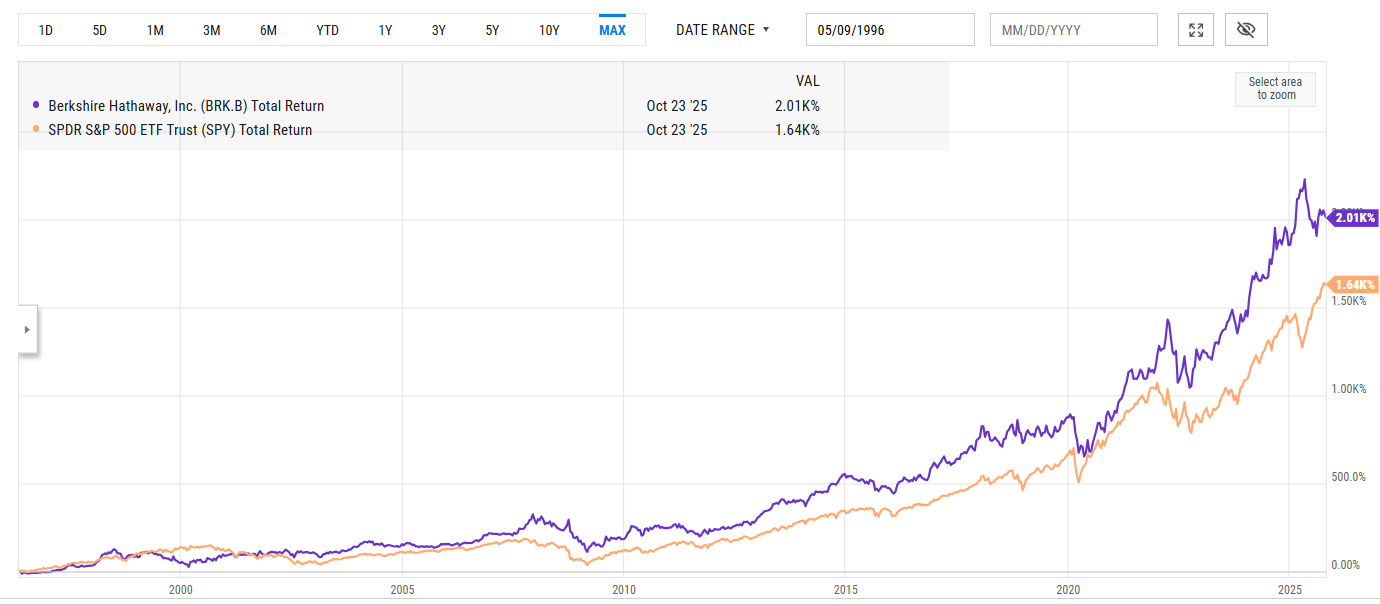

Let me back up a bit. If you invested in Berkshire1 ~30 years ago, you’re a pretty happy camper:

Now, you’re not as happy a camper if you had invested in Berkshire, say, 50 years ago2, but you’re still doing pretty well. Not only have you beaten the S&P 500, but you probably slept well at night knowing that you had Buffett at the helm the whole time and maybe you even had a fun few weekends in Omaha for the annual meeting along the way.

There’s a concept3 in investing that I’ve coined “risk riding.” Basically, it’s that you can generate what looks like alpha every year by taking on some type of risk that doesn’t show up in your reported numbers…. but when the risk hits, you’ll realize you were just getting paid to take a huge risk all along.

An example might show this really well: say someone pays you $10 for $100 of hurricane insurance coverage in Florida, and no hurricane hits Florida. For that year, your annual report will show a 10% return…. but clearly there was some chance that a hurricane could have hit Florida, so the 10% isn’t pure return (even though it would be reported as such).

The real return / alpha would be generated in the difference between how likely it was a hurricane hit Florida and what you got paid for in the insurance. In this example, you basically underwrote a 10% chance of a hurricane hitting; if the real odds were 5%, that was a very profitable insurance contract regardless of outcome. If the real odds were 20%, that’s an awful contract to write even if it worked this year! But the 10% “profit” that you report every year a hurricane doesn’t hit is “risk riding” in that you’re underwriting some risk and getting paid for it, and you just kind of don’t see that risk in the returns unless it actually hits at some point.

The concept of “risk riding” can be applied to a lot of businesses with tail risk. Here’s an extreme example that I think highlights the concept nicely: I wonder how much of the Mag 7s incredible return over the past decade comes from “risk riding” the chance that there’s a huge government crackdown / breakup of them, and every year the government does nothing you earn a little alpha.

Anyway, to bring this back to Berkshire, one thing I’ve wondered is if investors were “risk riding” Buffett’s potential mental decline over the past few decades. Consider the GFC: Berkshire generally did well during the crisis (though they certainly did not emerge completely unscathed!), and much of Berkshire doing well during the GFC was because Buffett was at the top of his game. Berkshire entered the GFC with a reasonably strong balance sheet, and Buffett was able to quickly structure creative deals that would create enormous optionality and eventually upside for Berkshire.

Buffett was ~78 during the GFC. That’s the same age that Biden was when he took the presidency; it was pretty clear that Biden was already slowing down at that time. Buffett’s letter notes that he was “late in becoming old”; what if, like Biden, Buffett had “become” old in his mid-70s instead of in his 90s? How would Berkshire have performed during the GFC with a slower Buffett?

Perhaps they would have done fine! Buffett always said the board was fully empowered to remove him if he started slipping….. but Buffett was a literal living investing legend and the controlling shareholder / founder of Berkshire. How far do you think Buffett would have had to decline for a board to actually remove him? I’d suggest the decline would have had to be extreme for a board to act.

I don’t think this is the world we live in, because Buffett still seems pretty sharp to me, but there’s certainly a world where Buffett began showing the effects of aging ~20 years ago and Berkshire kind of muddled along for the past 20 years. It wouldn’t have taken much decline to substantially diminish Berkshire’s returns over the past two decades; for example, consider Berkshire’s IBM and Apple investments. In our world, Berkshire buys IBM in 2011, quickly realizes it’s a mistake, sells it, and a few years later makes a huge bet on Apple. Is there a world where a slightly diminished Buffett buys IBM in 2011 but never admits he made a mistake? Instead of selling and being mentally flexible enough to still buy Apple, does that Buffett stubbornly hold on to IBM and, because of the poor experience in tech / continued bet on IBM that version of Berkshire never makes the Apple investment? How much worse off is that Berkshire than our world’s?

And there’s an even worse world where Buffett showed signs of aging 20 years ago and made actively bad decisions that harmed Berkshire because he was no longer pitching his fastball. For example, Buffett’s always been a bit of an inflation hawk and energy-curious, and his energy curiosity generally hasn’t worked out well. He had a big Conoco bet on before the GFC and he’s been a long time supporter of OXY4. Is there a world where Buffett losses his fastball and gets over his skis investing in energy companies at the top of an energy cycle? There were plenty of opportunities for that; the pre-GFC peak oil boom, the mid-2010s shale boom, or the post-COVID / Russia invasion commodity spike. Considering Buffett was buying oil equities in two of those three spikes, it’s certainly not hard to imagine a world where he leans a little more heavily into the investment thesis and Berkshire is dramatically worse off because of it!

It’s an interesting thought experiment, and I know Buffett stans will read a lot of this and say “Buffett is the GOAT; how dare you?” But I think running this thought experiment reveals both how lucky Buffett / Berkshire have been over the past 20 years that Buffett didn’t decline and how extraordinary Buffett’s past 20 years have been.

Berkshire’s past 20 years have been very good; not extraordinary by Buffett’s early career standards, but Berkshire has somehow managed to perform in line to slightly better than the indices despite Berkshire’s size, Buffett’s age, and the enormous tech tailwind powering the overall market. Compare Berkshire’s performance to a lot of Buffett’s would be contemporaries: Icahn, Malone, Diller, etc…. all of them have massively underperformed the indices as they’ve aged and the world has changed. Somehow Buffett has managed to keep on outperforming (despite Berkshire’s enormous size serving as a much larger drag for Berkshire than his peers).

What a legend. I’m sad to see him step aside, but I’m thankful5 to have had him as a mentor for 20+ years and that I’m still learning a little bit from him.

Disclosure: A small position in BRK

Berkshire’s performance from ~1975-2000 was other worldly; size really caught up to Berkshire in 2000 and it’s just been good / slightly better than the S&P since.

Maybe concept is generous since it’s more a thought in my head!

To be fair, he made a killing in PetroChina!

Yes, callback to the thanksgiving letter intentional!

The real risk 30 years ago was that he dies from all the McDonalds Sees and Coke 29 years ago.

Buffet and Munger were a team. The risk riding was on both...