$WISH-ing for one more meme stock opportunity

Consider this a quick follow up to my post earlier this week on Clover.

The basics of that post were pretty simple: the implied volatility attached to meme stocks skyrockets as the shares rise, and that often presents opportunities to sell deep, deep out of the money puts at interesting prices / set ups.

I will pause here to remind that options are extremely risky. Nothing here is investing advice. Please consider all those risks and, if you are thinking about doing this, carefully consider sizing.

Anyway, I think deep out of the money puts on meme stocks are interesting across the board, but intellectually I just think they’re more interesting when they have a few extra things going for it:

You can get a juicy return selling puts at strikes at or below where the stock was before it turned into a meme

The company is not in immediate distress / an obvious zero if they can’t raise a bunch of money into the meme squeeze

The company has some optionality that could instantly make those options near worthless (i.e. while they don’t have to raise money to survive, they could quickly raise a ton of cash that would make the stock trading to that option strike unlikely)

They have a real business or a business that at least has some chance of becoming real / valuable.

Anyway, Clover earlier in the week hit most of those boxes. I think Wish’s stock/options hits them as well on the heels of it becoming a meme.

Some quick background: Wish IPO’d in December for ~$24/share, raising $1.1B. While the stock rose a little in the immediate aftermath of that IPO, it’s been pretty straight downhill since then; before turning into a meme, the stock was ~$8/share, and even after a nice run the stock is still barely breaking $10/share.

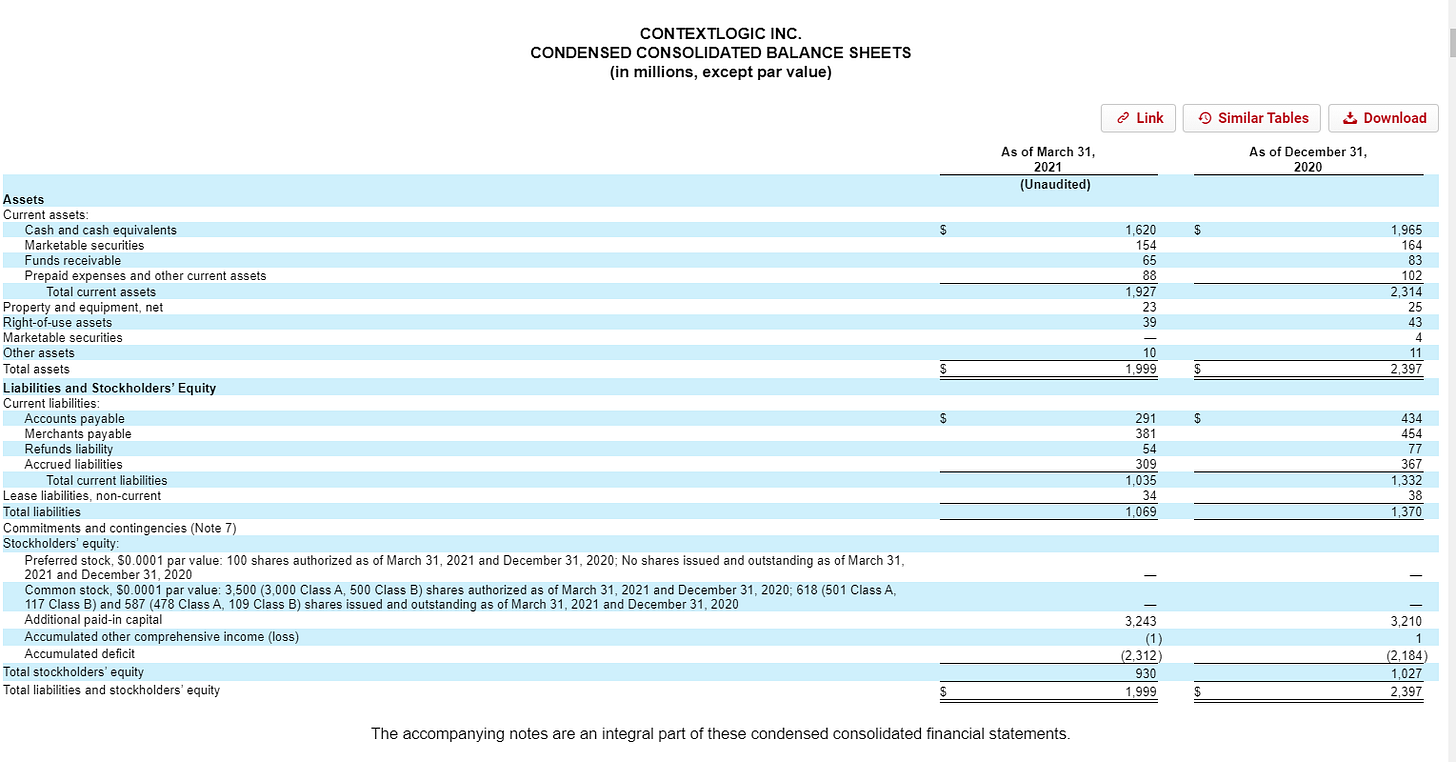

WISH’s IPO is important because the company raised ~$1.1B in it. That cash is currently mainly sitting on their balance sheet; cash + marketable securities comes out to ~$1.8B at the end of Q1’21, or just shy of $3/share.

Now, that cash balance might be a little overstated; the company runs substantially negative working capital and got some extended payment terms during the crisis, so in a flat liquidation a lot of that cash would be going to paydown accounts payable. And the company is burning a good deal of cash as they grow. Still, this is not a business that’s in any danger of shutting down tomorrow, and that cash provides some downside protection.

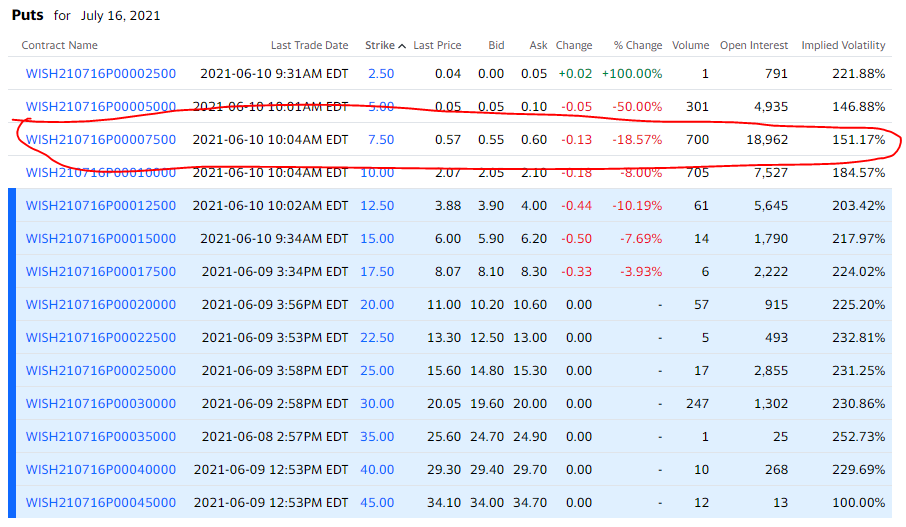

Anyway, that in mind, I think selling the July 2021 puts for ~$0.55 is interesting (though again reminding not investing advice and options are risky!). I’ve screenshotted the July option chain below.

Why the July $7.5 puts specifically? Well, they expire in roughly one month, and you’re getting paid >7% to write them. That works out to…. a pretty wild annualized return.

More importantly, even before the stock turned into a meme, it had never traded below $7.50. So you’re writing protection against the stock trading below where it traded before meme’ing within one month.

We’re early to this whole meme stock thing, but my experience has been that even after the meme mania dies down these stocks generally don’t touch their previous lows. Why? Because shorts are terrified to touch them again, and there’s a constant influx of “value” buyers looking to buy meme stocks as they fall / on the cheap on the hope the stock gets meme’d again (which seems to be happening with surprising frequency!).

That is the whole of the thesis. I can’t claim to be an expert on the business; it is growing quickly, but I will be honest that I am skeptical. However, I will leave you with one interesting bull case I don’t think I’ve seen discussed elsewhere. A bull case is kind of irrelevant to the selling a one month put thesis, as the whole thesis is based around the stock not crashing; however, the bull case is interesting to think about and it would generally be better for the puts if they bull case was right / if the stock went up (plus, if something goes wrong and the stock drops below the put prices / they get put to us, it’s nice to dream of some upside!).

The bull case centers around Wish’s new executive chair. She has an impressive background, but what’s really interesting is her pay package. I’ve pasted a screenshot of the most important below, but it’s very RSU and PSU heavy. In order to 100% vest those PSUs, the stock price would need to go up >2x from the company’s stock price on April 20, 2021 by May 15, 2023. On April 20, the stock closed at ~$12/share, so the stock needs to touch ~$25 for her to fully vest those PSU’s (it would need to hit ~$36 to max vest). There is never any guarantee that a stock hits the internal targets, but if my friend nongaap has taught me anything it’s that companies don’t give out big share awards to a new exec with a buzzy background without both parties believing there’s a very realistic chance that they hit some of the bear targets.

I’ll also note a WISH bull case on VIC, though it is more “cliff notes” of a bull case than actual thesis. The company’s most recent shareholder letter also lays out a lot of interesting optionality on the upside; again, I’m skeptical, but if this hits WISH could absolutely be a multi-bagger from here (consistent with the exec chair’s pay package!).

I like the idea, and have been doing similar ~1 month put sales for 7-10% returns in AMC, DNN, GME and MACK.

Been doing similar trades for the majority of this year. The best one I remember was selling front month $4 AMC puts for around $1 before it reached meme status in January. When the stock got meme'd to ~$20/sh, the value of the puts actually increased due to the IV spike and I sold more. Crazy annualized returns when IV is 800%+