Will this be a different $TRIP?

It didn't work for them, but maybe this time....

There are a few trades that have been “widow makers” for investors for years.

The most famous is probably Japanese bonds: for decades, investors would short Japanese bonds in a bet that yields would rise, and for decades investors would get their face ripped off as yields somehow always found a way to go lower…. though, to be fair, that trade finally worked (a bit) in 2025!

There are a few other widow makers out there, but for value investors I would contend that Tripadvisor (TRIP) is among the most popular / most destructive. Investors of all ilk have been attracted to TRIP over the past decade:

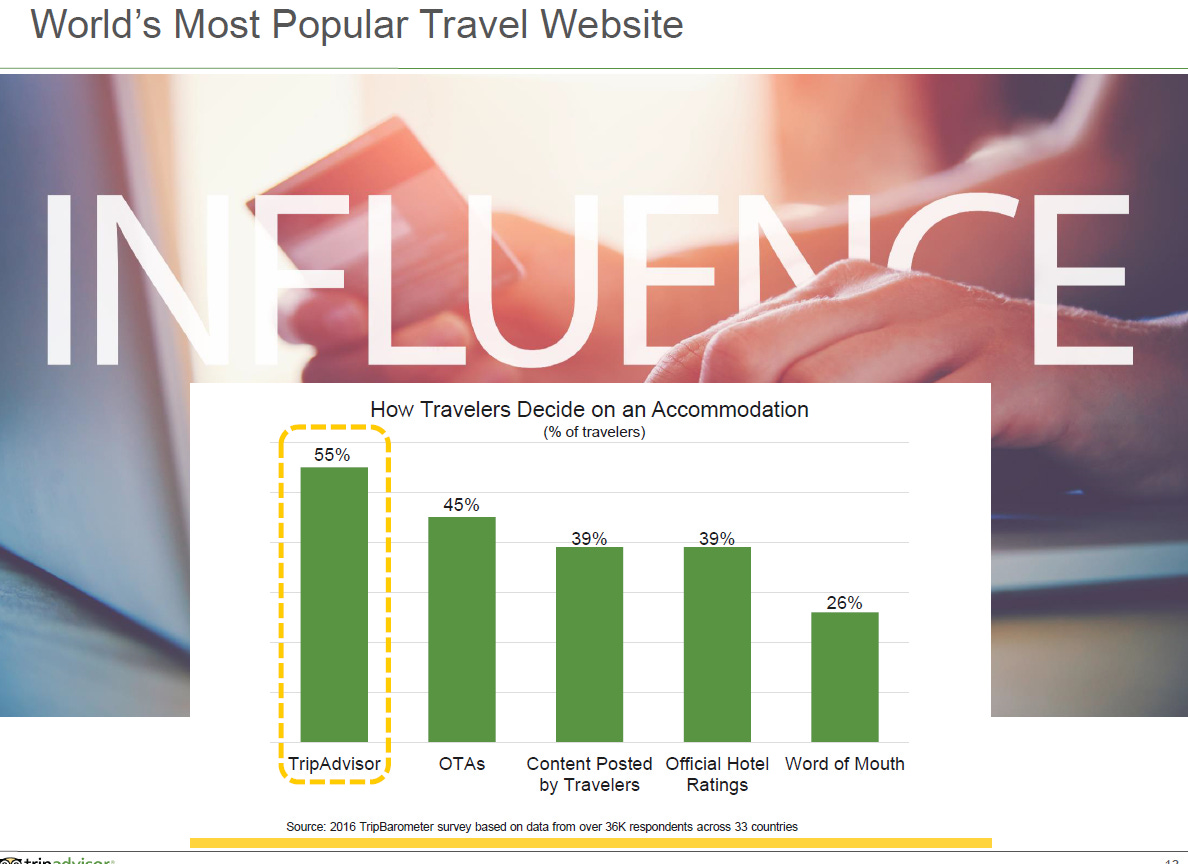

Growth investors have been attracted to TRIP because it attacked a huge market (worldwide travel spend) that had a growth tailwind (offline to online dollar shift plus increasing global wealth driving more leisure spending) plus TRIP’s “share” of travel spend was clearly much, much lower than the value of their reviews (i.e. their reviews moved huge amounts of travel dollars (TRIP estimated more than half of travelers used their reviews for hotels, which made TRIP the most popular way to decide on hotels), but TRIP captured only a fraction of them…. if they could just capture a tiny fraction more of the spend they influenced, the upside was enormous). TRIP made multiple attempts to increase their share of spend (including instant book and Tripadvisor Plus); all of them failed, but all of them generally got investors pretty excited for a hot second as they had dreams of massive growth.

Value investors were attracted because TRIP often (but not always!) traded at a discount to “peers” like EXPE and BKNG, and TRIP also was a reasonably consistent share repurchaser

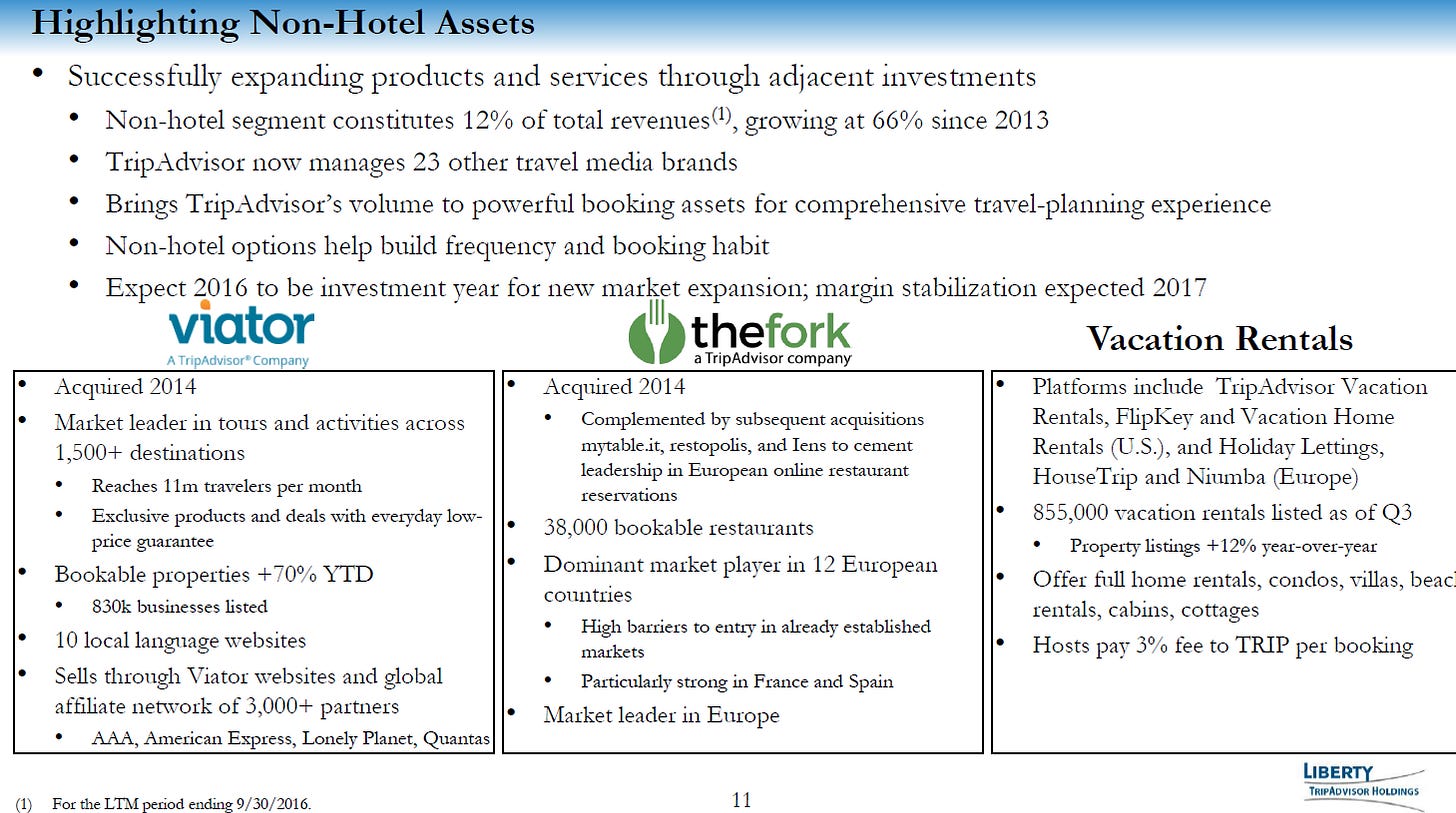

Special situation investors have been attracted to TRIP because of the potential hidden value / SOTP math for Viator and The Fork as well as the occasional rumors of a strategic process. Here’s the beginning of an SOTP pitch from the Liberty investor day all the way back in 2016!

John Malone fanboys liked that he controlled the company through Liberty Trip, so you got that special “Liberty” magic. In 2016, you could feel pretty confident the Liberty magic meant continued levered share repurchases and eventually selling the company to a strategic when it made sense.

So at various times over the past ten years, you could talk yourself into an investment in TRIP on a growth thesis, a value thesis, a special situation thesis, or a “coattail John Malone” thesis. Often, you could talk yourself into an investment in TRIP on a combination of all of those theses!

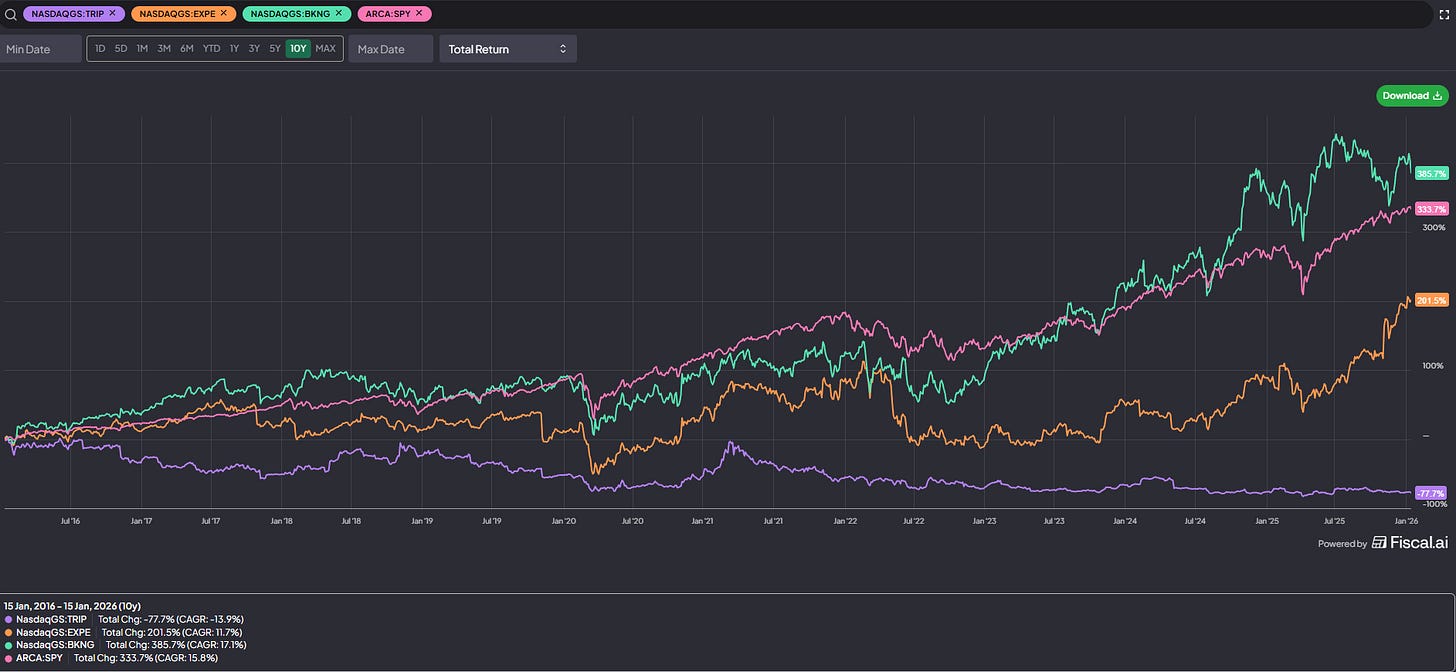

Of course, if you did talk yourself into any of these theses over the past decade, you generally had your face ripped off. Over the past ~10 years, TRIP’s stock is down ~80%, which lags both the indices and their loose peers (EXPE and BKNG) so much that’s honestly hard to visualize, though I will make an attempt:

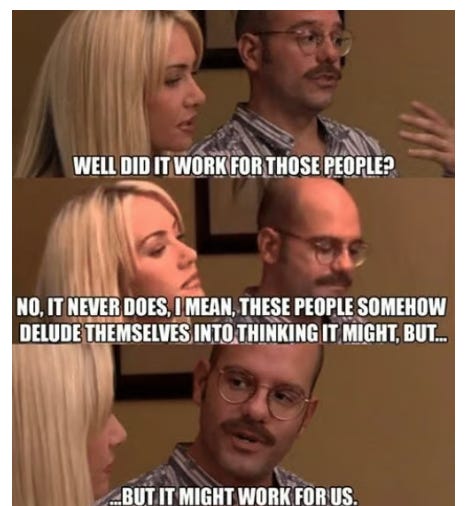

So, with all of that background in mind, I’ve found myself thinking about TRIP quite a bit recently (in part because I’ve had a few friends pinging me about it, including this nice write up / background from my friend Alex Morris). The basic thesis can be summed up pretty simply: over the past ten years, you’ve gotten your face ripped off investing in TRIP at any time on any thesis….. but this time things are different. That’s right; the thesis is basically the most dangerous words in finance1 / this meme:

So why do I think now might be the time for TRIP? I think there are five bullish (and somewhat interconnected!) themes:

The Goodco / Badco “Flip”

M&A optionality

Activism

Generic Cheapness

AI Potential?

I’ll spend the rest of this article expanding on each of those points (and then a quick summary of my overall thoughts at the end). Let’s dive in:

The Goodco / Badco “Flip”

There are a lot of businesses out there where you have two segments: a “goodco” growth segment that has a bright future, and a “badco” legacy segment that is in terminal decline. That goodco/badco set up makes for an interesting set up because the two segments often deserve wildly different multiples and need to be evaluated using a completely different lens, but often the company will be followed by the same analysts who have covered them for years (or decades) and haven’t updated their mental models for the new segment or have kind of just given up as the whole sector has been destroyed.

Now, this sounds trite, but most investors have learned the hard way that the goodco / badco set up generally doesn’t work until the goodco’s revenues are larger than the badco. Again, this is just a rule of thumb, but it’s crazy how often that rule of thumb works. For example, consider cable a few years ago. Everyone knew the internet business was the future of cable and would serve as the growth segment going forward (Liberty named their cable spinout Liberty Broadband all the way back in 2014!), but the revenues from the internet business (the good co) didn’t pull even with the revenues from the badco (the video business) until 2019/2020…..

And, right in line with that rule of thumb, the cable stocks started to really work right when the revenues from the goodco were pulling even with the badco2:

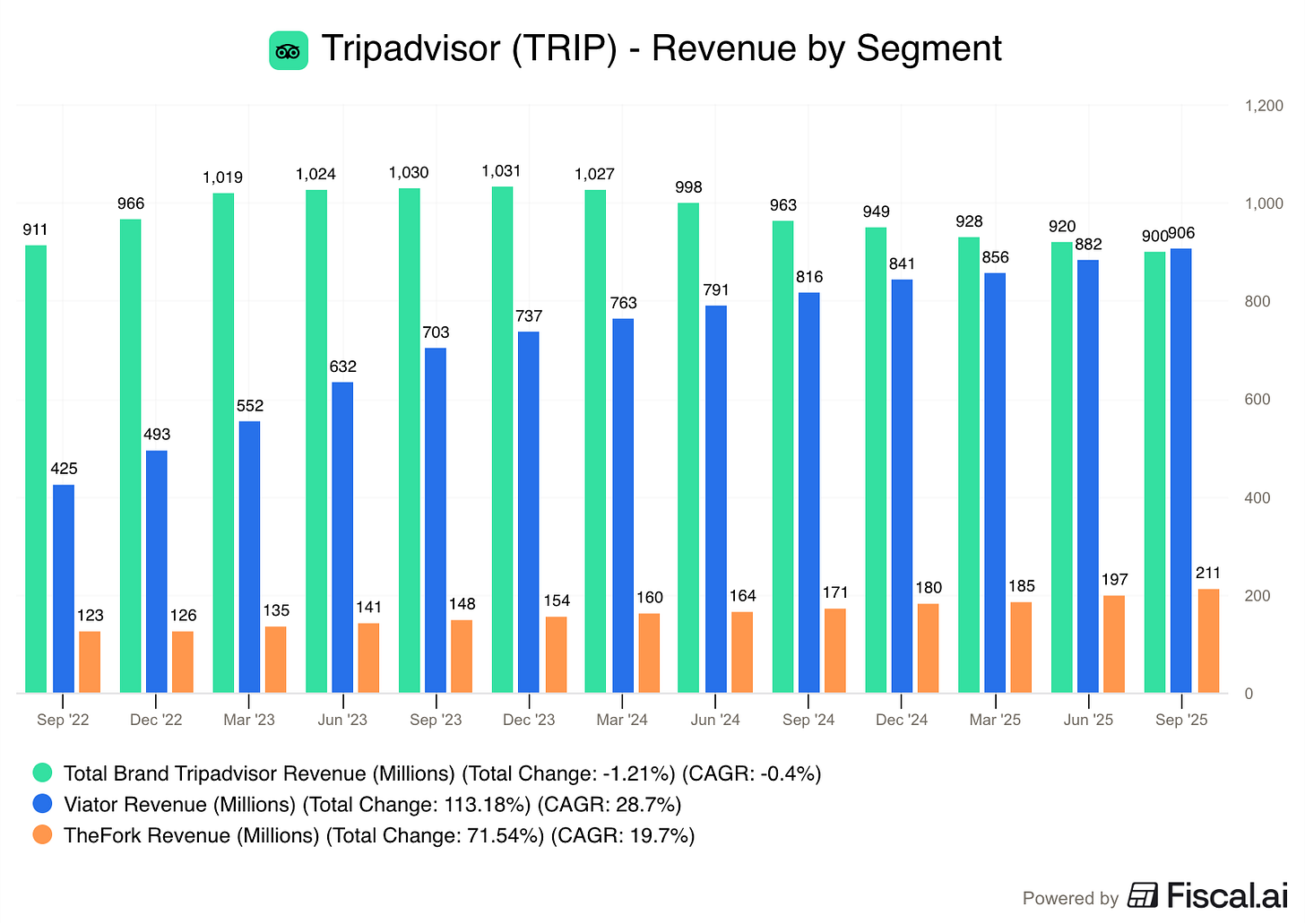

You could argue you’re in a similar place with TripAdvisor right now. Q3’25 was the first time the goodco (Viator) had more revenue than the badco (the legacy TRIP business):

That type of flip is the thing that can lead to a rerating / rethinking of the stock, and it’s happening literally as we speak.

M&A optionality: