Weird Events, Part 3: Lifeway's family drama $LWAY

The third (and final) in a series on the weirder corners of the event-driven market.

TL;DR: The ongoing family drama at Lifeway belongs on the Mount Rushmore of weird public market events. In the span of ~3 years, you get ~5 proxy battles (including one right now!), a hostile-ish strategic takeout offer, allegations of a “shadow executive” submitting “multiple false sworn affidavits” on the company’s behalf, and multiple intra-family lawsuits. Grab your popcorn, sit back, and enjoy.

This is the third (ad likely final) in a series of posts exploring the weirder side of the event driven markets. Please see part 1 for an overview of the series and the first weird event, STAA, and part 2 on a run through of multiple situations here.

For part three, we turn to probably the weirdest ongoing saga in the public markets: the "family feud” at Lifeway (LWAY).

Honestly this feud runs so long and has so many proxy battles (including an ongoing one, with a shareholder meeting set for the end of the year!) and different lawsuits that it’s hard to summarize it all even in a fully dedicated article (this Barron’s article goes into even more depth, as does this Forbes article)… but I’m going to do my best, because I’ve had a few takeaways from the whole saga and I think they’re interesting / wanted to share them. So I’m going to break the article up into these four points:

A quick overview of the key players just so you know who I’m talking about

Background, part 1: The family drama (2022 - mid-2024)

Background, part 2: Danone enters the chat (mid-2024 - present)

My takeaway: when family situations get completely out of control, you can’t trust anyone / shareholder value will implode

Let’s dive in!

A quick overview of the key players just so you know who I’m talking about

There are five key players you need to know in this whole drama

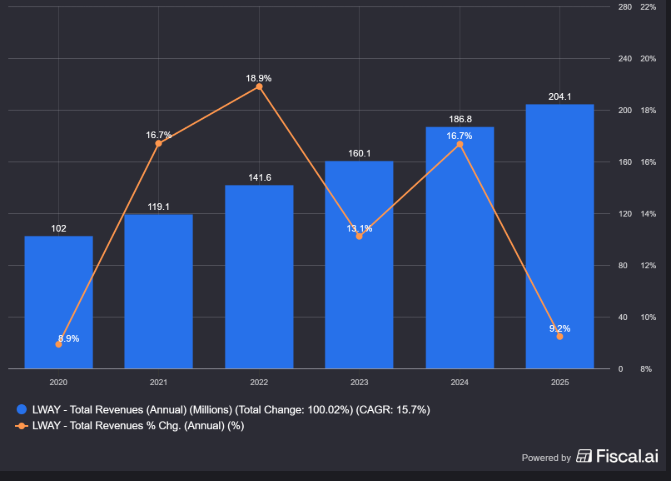

Lifeway itself: Lifeway is the largest brand of Kefir in America (seriously, just search Kefir on Amazon and you get blasted with Lifeway products). Kefir is a “tangy, drinkable fermented milk beverage, similar to a thin yogurt, packed with probiotics, protein, and nutrients,” though if you listen to Lifeway it’s either the “cousin of yogurt” or “the champagne of dairy.” Whatever it is, kefir is a tiny industry; despite being the largest player, Lifeway’s revenues barely surpass $200m/year. Still, Kefir has (somewhat improbably) become a growth industry in a consumer goods landscape that is kind of devoid of growth, driving Lifeway to ~double their revenue over the past few years:

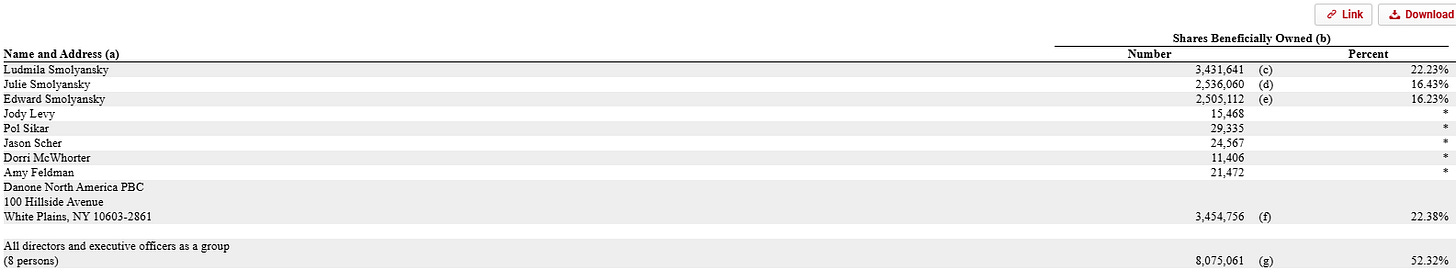

Ludmila Smolyansky (I believe she goes by Lucy): Ludmila founded Lifeway with her husband in the 70s. She was Chairwoman of Lifeway for ~20 years after her husband’s death (from ~2002 to ~2023). She’s the mother of Julie (Lifeway’s current CEO) and Edward (Lifeway’s former COO). When this drama ramps up back in late 2021, Ludmila owned ~22% of LWAY’s stock. Today, she’s around 6%.

Julie Smolyansky: CEO of Lifeway since 2002. Sister to Edward (Lifeway’s former COO) and daughter of Ludmila (Lifeway’s former chair / founder). When the drama is ramping in 2021, Julie owned ~15% of LWAY’s stock. She’s approaching 18% ownership today.

Edward Smolyansky: Lifeway’s former COO. Julie’s brother / Ludmila’s son. Edward owns 16% of LWAY’s stock when the battle heats up in 2021; today he’s around 20% ownership.

Danone: Consumer food giant. Back in 1999, Danone invested ~$6.5m into Lifeway in return for a 15% stake. They’d buy a few more shares in late 1999; combine those shares with Lifeway’s later stock repurchases and today Danone owns just shy of 25% of Lifeway.

Key players described, let’s move on to the drama:

Background, part 1: The family drama (2022 - mid-2024)

The drama dates back to late 2021 when Edward and Lucy file a 13-D noting Edward “intends to nominate up to three directors at the 2021 Annual Meeting of Shareholders”.

If you were an avid watcher of Lifeway, that 13-d would have set off some alarm bells. Why? The Smolyansky family had historically filed 13Ds together, and those combined 13-D’s showed the family controlled >50% of the vote. Given they controlled >50% of the vote, there was really no need for them to file a 13-D and nominate directors. If they were all working together, they could simply go to the board and say “here’s who we want as directors; y’all can either get on board (pun intended) or we’ll replace you.”…. but, for some reason, the 2021 13D dropped Julia from the group and noted that the brother and mother controlled only ~35% of the stock together.

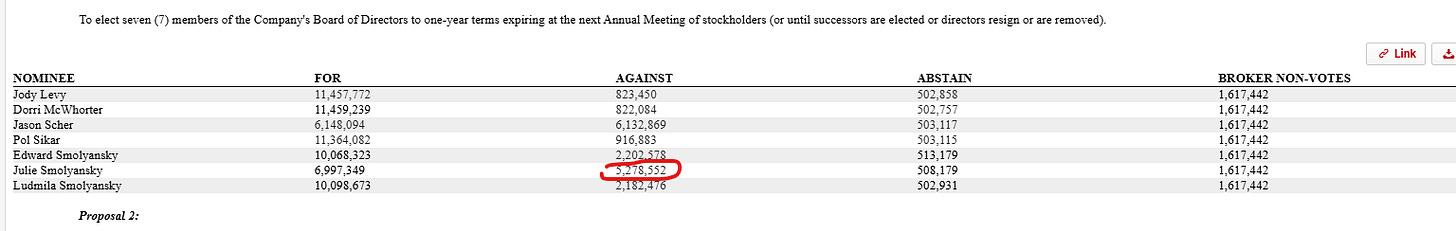

Things heat up a little more a week later, when the company’s annual meeting results come out and the CEO receives ~3m more “against” votes than her brother and mother. Incredibly, the difference in “against” votes between the two groups basically works out to what would happen if the brother and mother voted against the daughter while she, in turn, voted against her brother and mother.1

Things are quiet on the (literal) LWAY home front for the next few months…. until early 2022, when LWAY quietly files an 8K that consolidates Julia’s (the daughter) power by ending her mother’s consulting contract and firing her brother from the COO role (in a later lawsuit and recent press releases, Julia would suggest Edward was dismissed for showing up to a board meeting intoxicated and passing out / “Intoxicated on multiple occasions” while working; Edward suggested he was dismissed for pushing for change). While both of them were fired from their operating / consulting roles, they did maintain significant power: Lucy remained Chairwoman, Edward remained a director, and they (of course) remained significant shareholders. They also did not take the firings sitting down, as they quickly responded by amending their 13D to call for Julia to be replaced and asking the company to run a strategic process. This skirmish quickly morphs into a contested annual meeting, but in July the two sides would settle with Lucy remaining on the board and the company agreeing to run a strategic review.

But that settlement would prove short lived; in early 2023, Lucy and Edward would file another 13-D suggesting the company had breached the settlement because LWAY hadn’t really pursued strategic alts. This would lead to Lucy resigning as a director and yet another proxy fight in mid 2023. Julie and the company would win that battle over the summer; humorously, after they won, they announced that they had finally hired a financial advisor for the strategic review.

The battle picked up again in 2024; Lifeway sued Lucy and Edward for stealing trade secrets. After that suit was dismissed, Lucy and Edward filed a 13-D to try to remove the entire board.

Danone enters the chat (mid-2024 - present)

Through all of the family intra-fighting, Danone (an almost 25% shareholder) had been completely quiet…. they had not filed a 13-D or (to my knowledge) mentioned anything about their Lifeway investment since early 2000. After almost 25 years of silence, Danone launched an unsolicited offer to buyout Lifeway in September 2024. Lifeway would reject this offer in November, leading to a quick bump from Danone a few days later… which Lifeway would reject just as quickly. Things deteriorated quickly from there; right before Christmas, Lifeway issued Julie RSUs even though the shareholder agreement with Danone prevented them from doing so without Danone’s permission. Lifeway argued the Danone agreement was onerous and void. Danone was not happy with that decision; they quickly threatened a lawsuit (which they would file in March).

Danone and Lifeway agreed to “reset” their relationship in August 2025. That reset included Danone getting access to diligence Lifeway to support a potential acquisition; however, in mid-September Danone noted that their diligence turned something up that would preclude an acquisition and that they were considering supporting Edward’s director slate at the next meeting. In late September, Danone entered a settlement and agreed to support Julie / the company’s board slate in exchange for registration rights and a bunch of fresh directors.

Of course, the family drama continues even with the Danone stuff seemingly settled; as I wrap this up, Lifeway and Edward/Lucy are in the midst of yet another proxy fight, and this fight seems even more bitter than the last. On the company side, this quote blasting Edward isn’t the type of quote that makes for a fun thanksgiving (or really offer the possibility of a happy settlement): “The Dissident has not secured employment since his removal from Lifeway and claims to have made a substantial investment in a new venture he has alternated between calling ‘a joke’ and describing as a kefir company intended to compete directly with Lifeway.”). On the Edward / Ludmila side, they are increasingly blasting the board; I’m honestly not sure I’ve ever seen an 8-k that makes a board seem more out to lunch / captured by management than this week’s from Edward. I’d particularly note the testimony that management informed the board about an acquisition after signing the deal, and the board testifying that they were completely unfamiliar with shareholder concerns express over the years.

My takeaways: when situations get completely out of control, you can’t trust anyone

This is the real reason I wanted to write up Lifeway. To put it simply, at every turn, I would have guessed wrong about what would happen next at Lifeway; the incentives constantly seemed to suggest everyone should “kumbaya”, get along, and sell Lifeway for a huge premium to Danone….. but, at every turn, the family infighting and drama has led to a wildly suboptimal outcome (in my opinion, at least!), with huge value leakage to lawyers and legal fees.

If you rewound the clock to late 2021 (before all the drama we’ll talk about started), the Smolyansky family controls >50% of Lifeway’s stock. Danone controls another >20%.

In 2021, Lifeway did ~$120m of sales and ~$6m of EBIT.

If I was looking at Lifeway around that time, I probably would have thought “ok, interesting little company. Market leader in a weird niche. Maybe the niche takes off, maybe it doesn’t….. but between the insider ownership and the shareholder rights Danone has, I can feel pretty confident that everyone here will row the ship in the same direction / work to maximize shareholder value.”

And boy would I have been wrong! Insiders rapidly devolved into a huge amount of infighting that has seen the company run up millions of dollars of unnecessary legal fees (it’s hard to give an exact number as it gets buried in the SG&A number, but I don’t think it’s crazy to say the whole ordeal has cost the company more than $10m over the past few years2).

So my first takeaway is that any situation can devolve rapidly…. but my second takeaway is that there can be no good players on either side when things start to devolve. Both sides can just be wrong / value destructive.

Consider the state of play at Lifeway right now.

On one side, you have Julie (the current CEO). She was so desperate to get paid / remain in control that she (and the board) claimed a >20 year shareholder agreement with Danone was void in order to issue a huge pay package, and she’s hired her husband as chief of staff and is paying him >$300k/year (the same husband who is getting flagged as a “shadow executive”). Speaking of remain in control, it should be lost on no shareholders that, as part of a settlement in July 2022, she agreed to run a strategic process…. but the company didn’t hire a financial advisor for the process until June 2023 as part of a contested annual meeting. That is just a wild timeline that screams “we don’t want to lose our jobs / sell the company.” Even ignoring that desire to remain in control, Julie’s her pay package is pretty wild; Danone noted her “total all-in compensation so outsized that it represented 45% of Lifeway’s total reported net income in 20231 and, per ISS, is 2.75 times the median of peers.” Plus, between the lawsuits with Danone and her mother/brother, she (and the company) have also now managed to have legal fights with >50% of the shares outstanding inside of a year. Hard to say you’re working for shareholders when you’re suing the literal majority of them!

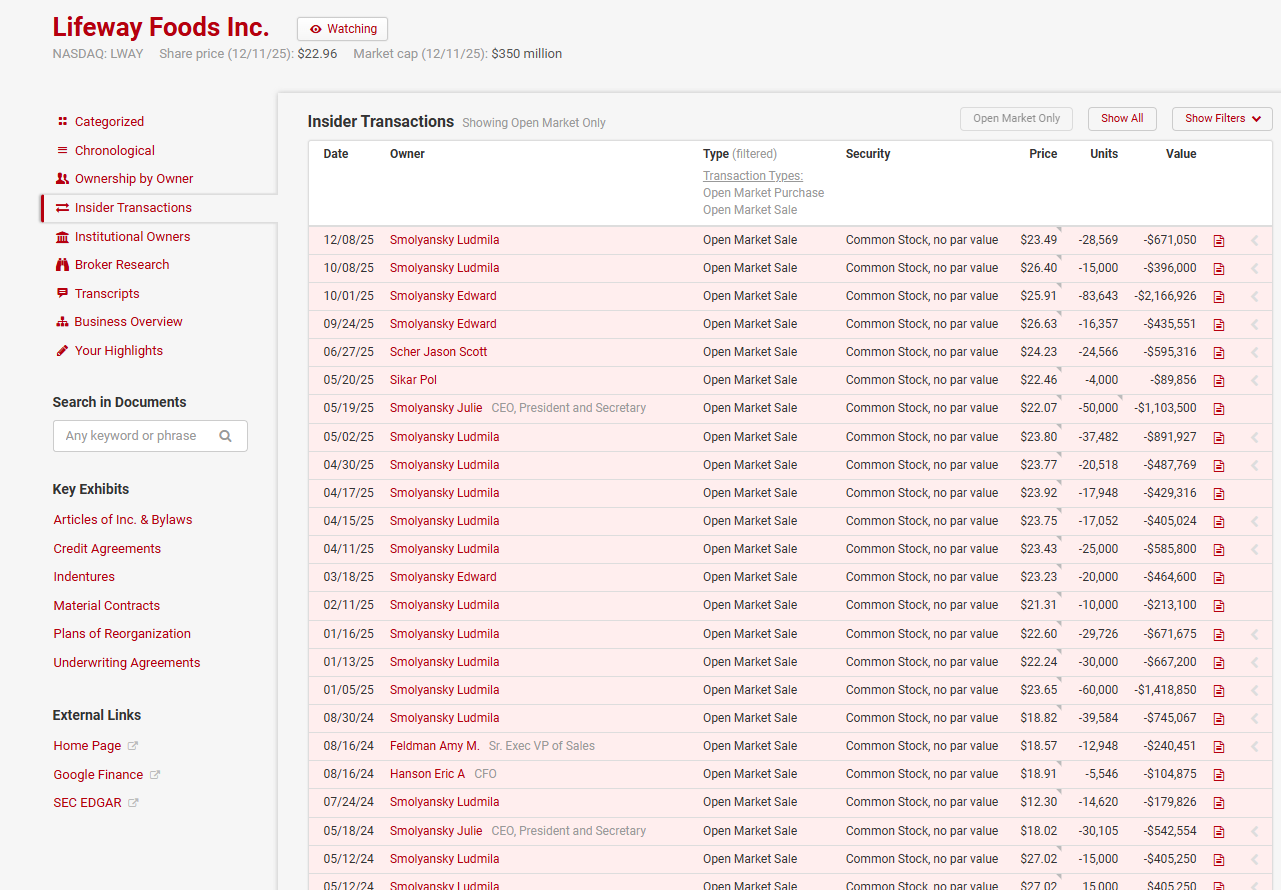

But there are no heroes on the other side. Edward and his mother have been pushing the company to sell itself for years…. is that because they believe a sale is the best course of action for Lifeway, or is it because they’re cash strapped? Lifeway claims that both of them are facing mortgage defaults and tax liens, and Ludmila in particular has been a consistent and aggressive seller of Lifeway stock over the past few years (all while waging an activist campaign centered on Lifeway being undermanaged and undervalued). It seems pretty clear they’ve been putting their own (liquidity) needs over what’s best for the business.

Anyway, I’ll wrap it up here. The LWAY saga has been absolutely wild; I’ve been following it for four years, and at every twist and turn it seems to reveal something new and outrageous. To be honest, I’m not sure if I’m a skilled enough recapper to highlight just how insane some of the moves / claims have been in real time.

But it is also a nice reminder: there are real people with real egos at these companies. And, often, those people and egos get in the way of what would ultimately be best for the business. In Lifeway’s case, they’ve done well over the past few years despite the constant distraction of the family drama….. but I’d note that Danone dropped their bid for Lifeway after due diligence, and the company trades for a pretty aggressive multiple today. Perhaps Kefir and Lifeway can continue to grow…. but if that growth ever stalls, I wonder if the family looks back on all of the fighting and how they handled the Danone offer and realize they fumbled a golden opportunity.

PS- Just to build on the last takeaway: the wildest fights I’ve seen at companies have generally come at companies with family control or heavy family influence. Often, the fighting (and legal costs) overwhelm the amount of money that everyone would have gotten if they had just sold the company in the first place. Companies with controlling shareholders often trade for a discount because people realize the control shareholder cannot be forced off a path if they don’t want to be (remember when people worried Zuck would bankrupt Facebook to pursue the Metaverse); perhaps companies with family control need an even larger discount just because family fights seem to break out so frequently. The recent proxy fight at UNF probably fits this mold perfectly; I’d argue the family would be much better off selling today than running a subscale, subpar operation for another five years and hoping for the best, but family pride and control seem to be standing in the way….

Humorously, LWAY’s 2021 proxy was filed just a few months before all this drama started and noted the mother and daughter had “an excellent working relationship and offer Lifeway a complementary array of skills, knowledge, and abilities”

Danone agrees; one of their letters to Lifeway mentioned the company “wasted millions of dollars of the shareholders’ money to support Ms. Smolyansky in her years-long litigation against her family”

The company's been creating value and the Danone offer isn't much above the current price. Not sure why the status quo is so bad.

As a long-term shareholder I would like to see Julie removed, her hubby jailed, and the company sold. It's obvious if you listen to Julie's grating voice on LWAY's pre-recorded earnings "calls" that Julie considers shareholders' funds to be her personal property and herself answerable to no-one.