Weekend thoughts: "What is Buffett seeing in energy?" follow up

I got lots of responses and feedback to yesterday’s post on “what is Buffett seeing in energy.” I wanted to start by thanking everyone for all of their responses (a big reason I write this blog is because I learn so much from the feedback!), and I also wanted to provide a few thoughts to some of those responses. (Also wanted to highlight friend of the podcast Josh Young has a post that looks further into Buffett’s history with energy companies).

The most frequent push back I get to energy companies being too cheap versus their cash flow / what the energy strip implies is some form of “but what if energy prices go down?”. This risk is mostly associated with a recession sapping demand, but not that’s not the only way prices could go down (demand could get sapped through conservation, through new technology, or we could have an enormous amount of new supply coming on).

Obviously that’s a risk… but it doesn’t change that these companies are currently trading below the cash flow that they will print at the current energy strip. So it’s a risk, but it’s a hedge-able one.

Here’s a simplification: Apple stock is currently trading for $154/share. An option to buy Apple at $150 should be worth $4 plus some adjustments for time value and volatility. Say for some reason that option was trading for $1. You could say “but there’s a risk we have a recession and the stock price goes down and the option is worthless!” Sure, but that’s a very hedge-able risk (you could buy the option and short the stock), and the risk prices go down in the future doesn’t change the fact the option is mispriced today.

At the current energy strip, many of these companies have stock prices / market caps below the free cash flow levels they will print of the next five years, giving you all of their terminal value for free. Yes, energy prices could come down, but energy companies can hedge those prices out to remove the risk of energy crashing. I mentioned this hedging option a few months ago: it seems an obvious trade right now is for private equity firms to buy these companies up, hedge out all of the near to medium to energy price risk, and just use the free cash flow from these companies to mint money (in fact, if prices crashed, this strategy would likely prove super beneficial as your hedges would not only be in the money but your price of production would scream downwards as equipment and labor prices would likely come down significantly). I’d also note that cash flow for energy companies are very front loaded given backwardation (energy prices today are higher than energy prices tomorrow), so a crash would need to happen pretty quickly to change the cash flow math I’m discussing.

Speaking of hedging, I’ve talked to a lot of small cap energy companies recently. The sentiment I’m hearing nearly across the board usually involves two related things:

The physical market for energy is really tight. Inventory is lower than normal, and for a variety of reason (lack of labor, underinvestment in PP&E / rigs shortages, etc.), there’s limited near term capacity that can come online. Basically, these companies think that if demand continues to rebound or we have any supply disruption (i.e. a pipeline goes offline for a little bit), we could see energy prices go way higher

Here’s a quote from OXY that I thought nicely encapsulated why supply was going to be difficult to bring online in all timeframes (near, medium, and long term).

Given that tightness, there’s a hesitation to hedge out energy prices right now. Execs just think prices are biased to the upside.

I’ll be honest: that type of thinking makes me real nervous.

I generally don’t care if companies hedge or not. If they’re going to run a hedging program, great! I love certainty…. but it needs to be a systematic program that is executed consistently in good times and bad. And almost every company I’m talking to that’s not hedging today was hedging like crazy in 2020 and 2021. To be fair to them, many of them had significant debt loads that required them to hedge when prices were low…. but honestly, that’s even worse to me! Commodity prices are obviously cyclical; by layering debt on top of that cyclicality, these companies added financial leverage to operating leverage, and by refusing to hedge when they put the debt on, they were forced to hedge at the least opportune moments.

I’ll give you a fantastic example. Consider the quote below from EQT’s Q1’22 earnings call

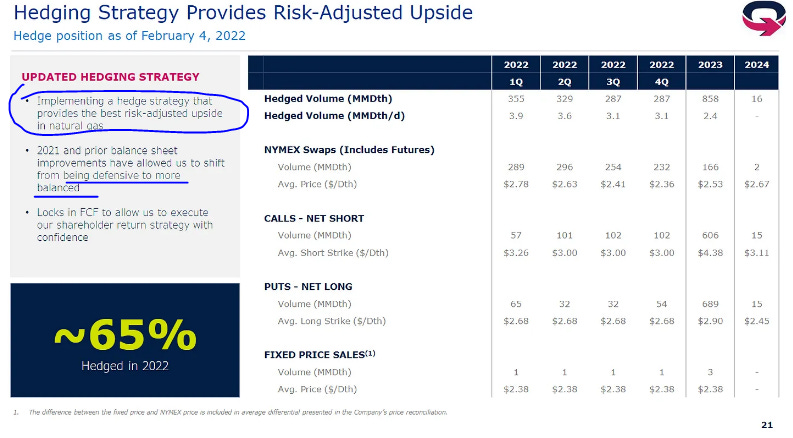

I mean, those are some bonkers pro-cyclical quotes. And you can see this in the company’s actions too. Here’s EQT’s hedging slide from their Q4’20 earnings call in early 2021 (note the part I circled).

And here’s the same slide from their Q4’21 earnings deck in early 2022 (again not my circles / underlines)

I will give them credit for one thing: the formatting is way nicer this year. But everything else about this screams cyclicity. Prices have risen to levels that they would have been thrilled with two years ago, and EQT has responded by shifting their hedging strategy from a defensive strategy focused on “de-risking cash flows” to a “more balanced” one that gets them upside.

Wouldn’t it be better if they had done the opposite? Why wasn’t the focus in 2021, when prices were lower, getting the best risk adjusted upside? And with prices way higher today, why wouldn’t you want to de-risk cash flows at these new, materially higher levels?

EQT is far from the only one letting hedges lapse now after being largely hedged when prices were low. For example, consider OXY (which was the genesis for yesterday’s post). I think the quote from their Q4’21 earnings call sums it up nicely:

The oil and gas hedges we had in place rolled off at the end of the fourth quarter, and we are now positioned to take full advantage of the current commodity price environment. We recognize the possibility of a swift change in commodity prices always exists.

Again we have a company that largely hedged when pricces were low, and now that prices are high they’re letting it roll.

OXY broke down their hedging strategy a little more in their Q1’22 earnings call:

I get that sounds reasonable… but, again, you have a company that took on a bunch of leverage and was forced to hedge like crazy at the bottom. Two years later, prices are at levels that I would near guarantee you the execs never thought they’d see again, and they’re just letting it ride.

Maybe this strategy will work out for them (and by them, I mean the industry in general and not just OXY in particular)! In fact, I think on the balance it’s likely that it will. The gusher of cash flow they’ve realized over the past year has materially improved all of their balance sheets, and (again) supply is tight and bringing new projects online is difficult.

But energy is a commodity, and history suggests when commodity prices are high the world finds way to bring new supply online (or bring demand down in some form).

Maybe this time is different, but history also suggests when oil and gas people are calling for continued high prices across the board, we’re generally due for the tide to go out.

The most frequent pushback I get on energy companies is prices collapsing so the cash flow doesn’t come through. And I agree- that’s a material risk. But, to me, the bigger risk is that management team’s continue to engage in pro-cyclical behavior: letting hedges roll off now that prices are higher, increasing exposure with prices high, engaging in big M&A that needs the current energy prices to justify it, going for big speculative exploration programs that incinerate cash, etc.

In other words, the bigger risk isn’t that energy prices collapse.

It’s that energy management teams continue to be themselves.

Well argued, thanks

I'd add that for smaller companies the possible collateral requirements could be a barrier to large hedging programs

Interesting post Andrew. Thanks. I do wonder why some of these smaller Oil E&P don't get taken private, hedge at current prices and just let the cash flow pay off debt and provide a nice return on a future debt free Co.?