Weekend thoughts follow up: $NYCB insider buying and mea culpa

Last week, I posted on NYCB’s on-going disaster (Weekend thoughts: $NYCB and regretting sweetheart deals). I got tons of inbounds on it, and there was a decent bit of news on NYCB during the week. Given that combo, I figured a follow up was in order. There are four things I want to touch on in this update:

I was wrong; the loan book is in way worse shape than I thought

Quick thoughts on the NYCB update call this week

Insider buying at NYCB

Is NYCB interesting here?

Let’s start with an admission upfront: I was likely wrong on the rent-regulated portfolio. Given the DSCR, low LTV’s at issuance, and low default / criticized rate, I thought calls for billions of losses in this portfolio were much too draconian.

I had several friends reach out to me when they read that and walk me through the math of the portfolio, and I was flat out wrong. We don’t know the specifics of the underlying portfolio, so it’s hard to make too broad a generalization, and it’s possible this portfolio gets bailed out by some combination of interest rate cuts and changes in rent regulation, but the losses on that portfolio as we sit here today are probably huge.

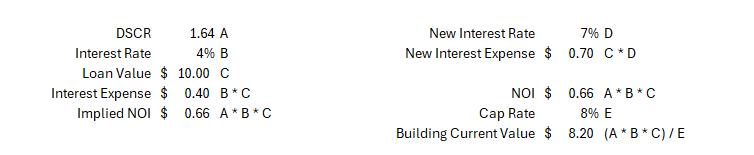

Here’s some quick math. Just assume that you have a building with a $10m loan outstanding that was done at a fixed 4% interest rate a few years ago. That implied ~$400k in annual interest expense and ~$660k in annual NOI (using the DSCR numbers from that chart). If we assume interest rates on mortgages today are 7%, then the building would be cash flow negative on current interest rates / once the rate resets ($700k in interest expense versus $660k in NOI).

Even worse, due to the rent regulations, a lot of these buildings are going backwards in terms of NOI (expenses are growing faster than revenue). What’s a building where NOI is shrinking and you can’t do anything to fix that without a legislative intervention worth? An 8% cap rate? That feels kind of generous to be honest (publicly trade multifamily in good markets are currently going for 6-7% cap rates, and i think private markets are just inside of that…. would you rather pay 5-6% for good, new assets in good markets without rent regulation and that’s growing NOI, or 8% for a rate regulated building that’s shrinking NOI?), but that cap rate would imply the building is worth ~$8.2m… or 18% less than the loan, and that’s before including all of the messiness of a foreclosure and sale. You can see all of that math below.

Again, we do not know the specifics of the NYCB loan portfolio, so maybe there’s some internal metrics that are better than expected. And the future is unknowable: the portfolio could easily get bailed out by some combination of interest rate cuts, rent regulation changes, and inflation coming down. One particular area of hope: a lot of NYCB’s loans were originated from 2020-2022, after the rent regulation changes really took hold. You’d hope those loans had started to adjust for the issues and that losses in the more recent stuff would be much lower than the pre-change loans.

(PS- look at the bottom of that slide. For years they’ve had zero net charge-offs on this portfolio! One of the things I got hung up on last week is the fact a portfolio that’s performing this well, with this low of current delinquencies / criticized loans, could have losses as large as it seems like they ultimately will. It kind of reminds me of the GFC on a much smaller scale: rent-regulated loans were a great product with no default for decades, but the environment underneath them shifted and hid a lot of rot / will eventually lead to enormous losses when the underlying starts to shift).

So, yes, it wouldn’t take too much to imagine a scenario where these loans get bailed out…. but, as we sit, I’d guess there are a heck of a lot of hidden losses sitting in that portfolio (though to be honest they’re not that hidden!). I was wrong; the people wringing their hands were right (there was a nice odd lot podcast this week that went a bit further into the history of rent regulation if you’re interested).

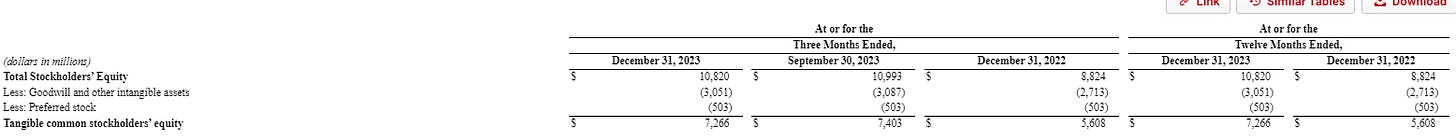

There is some good news for NYCB: they’ve got >$7B of tangible equity.

Even if you assume they’ve got $4B of losses hiding in that book, they have enough equity to muddle along….. particularly when you see the the options/interest rate resets on the portfolio are well staggered over the next few years.

As the new executive chairman said on their special update call this week, “The bank has earnings power. Consensus estimates are that we can generate over $840 million of pre-provision pretax income this year.” So if NYCB takes ~$700m in losses/year on this book, but it’s well staggered over the next 5-6 years, then they should be able to muddle along / handle it with their current equity and earnings power.

That brings us nicely to the second thing I wanted to talk about: NYCB’s special update call this week. You can read the whole thing here. Overall, I think it went about as well as could be expected. The simple fact is NYCB is in a tough spot; after last year, bank investors and regulators are shooting first and asking questions later. As noted above, NYCB’s got some real asset issues, and the whole situation results in a bunch of questions that aren’t easily answered (for example, look at the part when the new exec chair responds “I don't know why that matters. When that decision was made.” when asked about when the move to exec chair got planned).

So, yeah, tough hand. But I thought they did a nice job of painting a positive picture that could stem the bleeding and that the bank wasn’t going anywhere. They gave every key stakeholder (regulators, investors, depositors) something to hang their hat on:

Investors: the new exec chair noted he’d taken over Flagstar under an OCC consent order, and under his leadership the bank turnaround and did the best TSR of any midsized bank. With NYCB trading for ~0.4x book, that’s the type of thing investors are going to want to hear. NYCB is clearly a turnaround currently, but the upside is huge and the exec chair painted himself as someone who knows what it takes to do that successfully.

Depositors: NYCB noted the strong liquidity position that well exceeds uninsured deposits, and that deposits have remained stable. They’re basically screaming “we can cover withdrawals if there’s a run…. but there is no run here, so no need to withdraw!”

Regulators: NYCB promised to reduce CRE concentration quickly and that all earnings are going forward are going to build capital. Again, they’re telling regulators “we know we have a problem, but there’s no need to step in and shut us down. It’s not a terminal problem, and treating it like one is likely to cause way more issues than letting us just keep on chugging along and building capital. We promise we’ll be prudent.”

Remember- regulators got burnt by SIVB and FRC. They seized Signature and the bank may have still been solvent. They’re not going to let a bank spiral out of control; they will seize fast and ask questions later. NYCB is reassuring the regulators that they can make it through this, that regulators won’t have egg on their face if they let NYCB muddle along, and that by doing letting NYCB continue regulators will avoid huge costs and headaches.

There were plenty of other things on the call (promising the bank had earnings power, noting the strength of the deposit franchise, talking about building the organization, etc.). They also noted openness to selling assets and possibly shrinking below the $100B mark.

Again, not a perfect call, but they’re in a tough space and the most important thing for a bank in a crisis is to stop the bleeding and prevent a possible run, and I think NYCB easily cleared that bar.

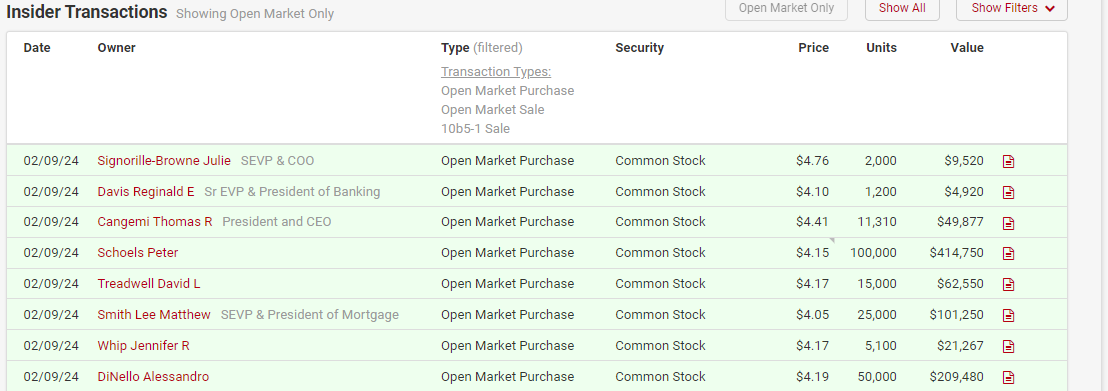

Speaking of preventing a run, there was a wave of insider buying on Friday. That’s standard for any bank crisis; even if it’s just a token amount, insiders buying shows faith in the underlying institution and that it won’t just evaporate / that there aren’t discussions going on for an FDIC takeover*. What I thought was really interesting was how tuned into the “buy shares on the open market to build confidence” playbook NYCB was; given the update call was on Wednesday (Feb. 7th), I’m guessing the whole company was blacked out from trading on Thursday (February 8th), meaning the window for insider buying opened up Friday (February 9th). Insiders did not waste a second of that window being open; they instantly bought the stock and started filing form 4s intra-day.

And I do mean instantly; I was live tweeting this, but look at the executive chairman’s form 4. He filed it at 9:51 AM on Friday; that means he literally instantly bought the stock on the open and had the legal team push the SEC filing as fast as they possibly could.

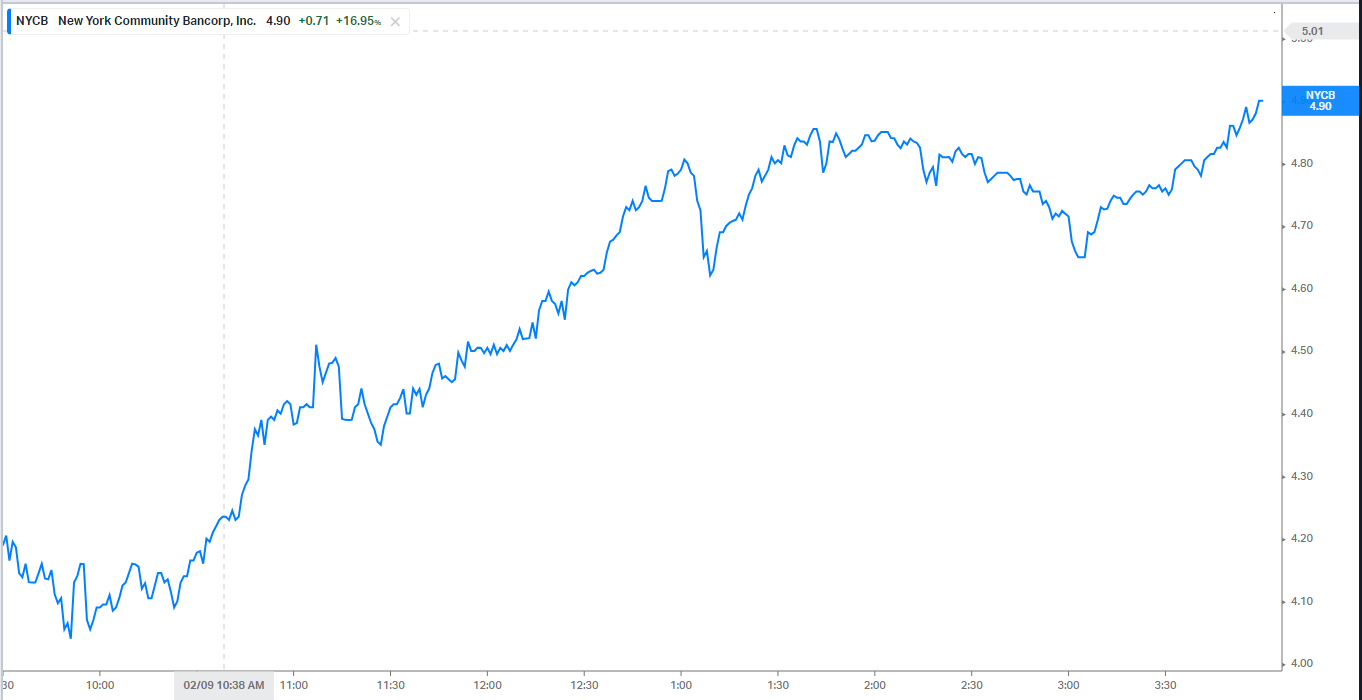

Nothing wrong with that strategy: a panic is a funny thing, and it’s better to pull out all the stops to prevent the bleeding upfront versus let things spiral out of control. I guess NYCB knew that getting their form 4s filed instantly on Friday versus later in the day (or, heaven forbid, after the weekend) would go a long ways towards stabilizing the stock price (which can be self reflective on the company and depositors; financial companies are the one breed of company where a low stock price can actually tank the business if unaddressed). And the strategy seems to have worked: NYCB closed the day up ~17% and seemed to go up a bit every time a new form 4 hit.

Let me close up with a question I ended my first write up with: is NYCB interesting here? Honestly, I’d reiterate the answer I gave in my first write up. NYCB is probably interesting; given the deposit base and this week’s call, I’d put high odds on them making it through the current storm. Tangible book value here is ~$10/share; even if they earn nothing for the next four years (all of their earnings go to building reserves and covering losses), eventually they’ll work through the current asset base and you’d be back to a normal bank with a good deposit franchise that is probably worth around tangible book. I could easily paint a >20% IRR over a multi-year hold period with that set of facts….

But the question is simply opportunity cost. With the whole sector getting hammered, there are plenty of banks that don’t have any of this issues / concerns that are trading for under book value. You could easily model any of those banks for high teens annualized returns from today’s prices, and you wouldn’t be facing any of the seizure / zero risks that come with NYCB. Or you could just avoid banks all together and go find any other number of companies that are growing and trade for reasonable cash flow multiples; banks are black boxes, and (as NYCB has shown) often times you can buy a cheap black box and discover that it’s filled with something completely different than you thought!

Anyway, NYCB is a fascinating story. The bank could get seized over the weekend and all of this could look really silly…. but my guess is there’s enough equity here and the management team has done enough to get through the current crisis and let them earn their way out of it. I probably won’t do anymore updates on NYCB unless something really fascinating happens, but I wanted to provide some updating thinking on last week’s post as well as note some of the more interesting things going on here!

Hi Andrew, as a fellow investor and Substack writer, wanted to tell you I really admire you for being honest with your readers and admitting you were wrong.

My publication does not make market calls; rather, I analyze situations and let readers make their own conclusions, but you are a big inspiration to me!

> I had several friends reach out to me when they read that and walk me through the math of the portfolio, and I was flat out wrong.

Being able to say “I was wrong” shows a lot of maturity. Kudos to you.

Citrini on Forward Guidance also emphasized the need for generalist investors to talk to many experts. Thank you for sharing their insights.