Weekend thoughts follow up: how often do management teams quote Buffett?

Yesterday I did a post asking if there’s any signal (positive or negative) to read into a management team quoting Warren Buffett. After I posted it, a question occurred to me: I noted hair stands up on the back of my neck every time I hear a CEO quote Buffett….. but how common is it for a CEO to quote Buffett?

So I did some research and…. turns out that it’s actually pretty rare for management teams to publicly talk about Buffett!

Here was my method: I searched all corporate documents and transcripts on bamsec; if you exclude Boston Omaha (which is run by a relative of Buffett’s who has the last name “Buffett”), “Buffett” only pops up in transcripts or filings 28 times in the entire month of June, and the majority of those are either Buffett and Berkshire making a regulatory filing (Buffett giving away BRK shares, BRK buying more OXY, etc.) or Saba quoting a Bloomberg article as part of their activist campaign against some closed end funds. If we ignore all of those examples (or similar “not really spouting Buffett principles” filings), I can only count thirteen examples:

At their investor day, Evolution Mining talked about how they built up liquidity “to create what Warren Buffett aptly refers to building a moat of resilience around our business”.

Earlier in their investor day, they noted that they would have a buffet lunch after the presentation. I quote that only to note to people who were fooled by my April Fools’ post on Berkshire that, yes, I do know that Buffett has two Ts.

An analyst noted to Back of America that Warren Buffett likes competitive advantages and is a BOA shareholder, so the analyst asked what attracted Buffett to the company.

Apollo quoted Buffett (and Munger) in noting the current environment is likely to reveal who is swimming naked.

HP was asked by an analyst about Buffett having a big stake in them.

The Adirondack fund quoted Buffett’s “the way to become a millionaire was to start with a billion dollars and buy an airline” phrase in describing how the industry as changed and why they were cautiously adding to the airline industry.

Vela funds quoted Buffett “predicting rain doesn’t count, building arks does” when talking about doing bottom up work on companies.

Eagle Capital Growth quoted Buffett in noting the futility of predicting the stock market (Berkshire also doubles as their largest position).

Empiric Funds opened their semi-annual letter with Buffett’s “never bet against America” quote.

Scharf Fund discussed how Berkshire could benefit from the current environment by buying when there’s blood in the street and how they’re happy to be invested alongside Buffett by buying Berkshire (they have a position in Berkshire; they had similarly kind words for MKL and Gayner).

Sprott Focus Trust used Buffett’s “the stock market is a device for transferring money from the impatient to the patient” line.

NH Hotel’s annual meeting noted Buffett treats shareholder’s like partners and that they try to as well.

Kartoon Studios noted their merchandising agreement for the characters and logos related to “Warren Buffett’s Secret Millionaires Club” (they also have “Stan Lee’s Mighty 7”!).

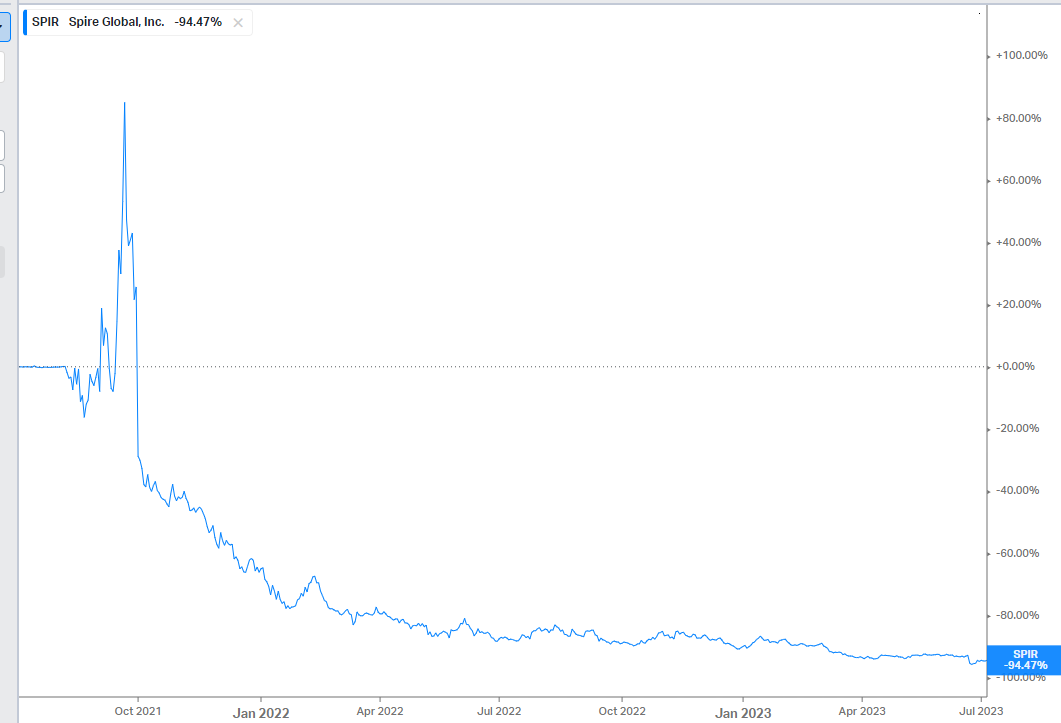

Spire Global (a microcap penny stock) said their stock presented “a great opportunity for those that heed the advice from Warren Buffett to invest at the sound of cannon balls.”

Of course, the sound of cannonballs connotes the image of something falling quickly, so you probably couldn’t blame SPIR’s shareholders for hearing the sound of cannonballs……

All in, that’s 13 Buffett quotes. Of them:

One (Kartoon’s) related to a legitimate business licensing agreement.

Two were analysts asking a company about having Berkshire as a shareholder.

Six were from funds (mutual or closed end) quoting Buffett in some way, shape, or form (and often those funds were investors in Berkshire!).

The remaining four were from companies using Buffett to relate to their company in some way shape or form:

NH Hotels talking about treating shareholders as partners (like Buffett does)

Evolution mining talking about using their liquidity as a “moat of resilience”

Apollo talking about swimming naked

Spire Global talking about their distressed share price as an opportunity.

Honestly, that’s kind of interesting! Take out the analysts asking about having Berkshire as a shareholder and Kartoon’s very unique example, and we’re down to ten mentions of Buffett. Of the ten, six are fund managers quoting Buffett, and I’d probably take that number up to seven given Apollo is a capital allocation firm that is at minimum “fund manager adjacent.” That leaves only three “operating” companies (if we take Apollo out) mentioning Buffett. That’s a really interesting ratio, and it makes sense: fund managers live and breath financial allocation and Buffett is the most successful of all time! Quoting Buffett is, at worst, a great form of marketing / PR to potential investors (invest with me! I follow the Buffett principles!), and hopefully a sign that they’re practicing and executing on sound fundamentals that will lead to long term outperformance.

Of the three operating companies mentioning Buffett, I’d say NH Hotels is the type of “Buffett name drop” I’d like to see my companies have; just noting that they’re treating shareholders like partners without getting too promotional. Of the other two companies that drop Buffett, one of them is an obvious example of the type of thing I was mentioning / thinking of yesterday that makes my “red flag” detectors go off, and the other mention is one that I find pretty misguided but ultimately probably harmless. I’ve done pretty much no work on either company, so it’s entirely possible I’m wrong in my gut takes there (though I doubt it!) and I won’t be more explicit than those descriptions; I’m sure you can figure out which I mean to be which if you’re really interested!

Anyway, I have no massive takeaways here. I was honestly a little surprised by how rarely Buffett’s name is invoked in public filings (though it was only one month, and a summer month at that, so it’s possible this was a lite outlier!). The fact that it is so rare for Buffett to get mentioned does suggest to me that there is likely some signal to when / how / if a company choses to mention him, but it’d probably need much further study to come up with anything scientific or a firm rule! For me, it just reinforces my initial instinct that an operating company mentioning Buffett is a rare thing, and when it does happen it’s worth giving extra thought to both as a positive sign and as a potential red flag.