Yet Another Value Blog calls for immediate change at Berkshire $BRK

It’s time for a change.

That’s all I could think about when reading Berkshire’s most recent annual letter.

It’s rare to see a corporate CEO admit to a single mistake in public. That’s why I was so surprised to see Berkshire’s Chairman / CEO (Warren Buffet) admit to the “many mistakes” he’s made over the years. If he’s willing to admit to “many mistakes” when most CEOs would not admit to a single one, imagine how many more mistakes Mr. Buffet must be hiding from us.

Perhaps making “many mistakes” would be acceptable if Mr. Buffet had founded Berkshire. We expect founder led companies like WeWork or Theranos to experience a stumble or two along the way…. but those stumbles are part of the gig when it comes to founder led companies and their inevitable rise to greatness as they attack and inevitably dominant multi-trillion dollar TAMs.

In contrast, Mr. Buffet is not Berkshire’s founder. He’s just some pencil pusher who used his large bank account to take over the company years after it had been founded. Surely this corporate raider cannot take over a company and expect to lead it through stumbles and missteps that way a visionary founder could. We as shareholders expect…. nay, demand, better from our managers, and when they continually stumble it’s time for them to be replaced.

With that in mind, Yet Another Value Blog is not so humbly leading an activist campaign to replace Mr. Buffet.

We (and by we, as a one man blogging shop I do of course mean I) do not take this move lightly. However, given the litany of mistakes listed in the annual report and Mr. Buffet’s refusal to engage with us, we have no choice but to make our demands public. Let’s dive into the many mistakes Mr. Buffet has made, including both the ones he listed and the ones he omitted.

We’ll start with perhaps the most important reason for change: performance. Mr. Buffet admitted that Berkshire had “a very minor gain in per-share intrinsic value took place in 2022” (emphasis his). A minor gain might sound nice…. but we need to put that minor gain into context. The price of Newcastle coal went from ~$157 at the start of 2022 to >$400 by the end. A literal lump of coal more than doubled in value, and Berkshire can’t do better than a “very minor” gain in value? Abysmal.

A “very minor” gain in value continues a years-long trend of mistakes at Berkshire. By Buffet’s own admission, his capital allocation has been, at best, average. Per the annual report, “in 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. In some cases, also, bad moves by me have been rescued by very large doses of luck.” Shareholders now have 58 years worth of results to look at, and their CEO has, by his own admission, mainly made “so-so” capital allocation decisions. With most decisions being “so-so,” how can shareholders expect anything more than “so-so” results? How long until Mr. Buffet makes one of these bad moves and is not rescued by “very large doses of luck”?

Truthfully, this average performance could have been avoided from the beginning. Berkshire used to be a textile company. That business was “on a death march”, and the company needed to pivot. Mr. Buffet himself admits “Looking back, I was slow to recognize the severity of its problems.” Again, this speaks to the problem with having a pencil pushing money manager in charge of the business instead of a founder with an owner/operator mindset. When Sam Bankman-Fried (aka SBF) realized his firm could make more money as a crypto exchange than a crypto hedge fund, he instantly pivoted and created one of the world’s largest crypto exchanges. That exchange was so profitable that within a few years they could sponsor multiple sports leagues and teams. In fact, their time was so valuable and they were so profitable that they needed to hire private planes to get Amazon packages flown from Miami to Bermuda in order to optimize employees’ time. Talk about a valuable and profitable business! Now Michael Lewis is writing a book about FTX and SBF. No one’s written a book about Mr. Buffet in years, and based on that book’s title I’m pretty sure it’s only about Mr. Buffet having an ice cold hand in investing and maybe getting run over by the proverbial avalanche of his own mistakes?

If shareholders had recognized the problem and removed Mr. Buffet when he was slow to recognize that initial issue at Berkshire, shareholders could have saved themselves 58 years of “so-so” decision making. Imagine how much richer they would be today!

However, Berkshire’s problems do not just stem from recent small gains in value and a decades long track record of so-so decision making. Berkshire’s financial statements and the company’s culture are also littered with red flags.

Let’s start with perhaps the biggest red flag. Mr. Buffet notes that Berkshire’s 10-K is “not… required reading” (emphasis his). There are few ironclad rules in investing, but one of them is this: when a company is telling you not to read their filings, you need to read their filings even closer because it’s probably a scam. On these grounds alone, Mr. Buffet should be dismissed and an accounting investigation immediately opened.

Why does Mr. Buffet believe his shareholders do not need to read his annual reports? I believe the answer can be found elsewhere in the shareholder letter. Mr. Buffet admits “even the operating earnings figure that we favor can easily be manipulated by managers who wish to do so. Such tampering is often thought of as sophisticated by CEOs, directors and their advisors.”

Honestly, Mr. Buffet is just telling on himself here. Encouraging readers not to read the reports, and then admitting that his operating earnings can be easily manipulated by sophisticated managers? Absolutely damning. Either Berkshire’s managers are sophisticated and manipulating their numbers, or they simply aren’t sophisticated enough to engage in manipulation and accounting fraud. There is simply no other answer.

Now, shareholders who have really drunk the Kool-Aid might say “sure there’s another answer; the managers could just be honest!”

O you poor, poor fools. Clearly you’re not reading the same letter I am.

In this very same letter, Mr. Buffet pleads “ignorance” on near-term economic and market forecasts, notes that he hopes and expects “to pay much more in taxes during the next decade,” and admits to being “shameless” in going “straight for” his shareholders’ wallets.

Is anyone else seeing this? An ignorant CEO who wants to pay more in taxes? How has no one filed a 13-D on this company yet!?!?!

Of course, it’s one thing to be ignorant and willingly pay more in taxes. It’s another thing to take money from your shareholders. Few CEOs would ever admit to even considering such a thing, but to not just admit it but be “shameless” about it? Just what I’d expect from a man who encourages his shareholders not to read the filings.

And it's not just the annual letter that is littered with red flags. Let’s turn to Berkshire’s most recent proxy.

There are multiple items worth calling out, but for the sake of brevity we will limit it to just one. The proxy notes “Mr. Buffett will on occasion utilize Berkshire personnel and/or have Berkshire pay for minor items such as postage or phone calls that are personal.” Taking personal calls on the job? Using company postage for personal uses? I read dozens of proxies every month, and it’s safe to say that Berkshire is the only one I have seen mention an executive’s use of postage and phone calls for personal use.

What’s next? I have heard Mr. Buffet drinks multiple Cokes every day; is the company going to start paying for their Chairman’s personal soft drink consumption as well? On top of Mr. Buffet’s Coke consumption, we’d note Mr. Buffet has a well known sweet tooth. Given this, we believe an immediate investigation needs to be made in Berkshire’s historical investment into both See’s Candy and Coke stock. We believe there is a strong chance Mr. Buffet made these investments only because he liked the products and wanted to consume them on shareholder’s dime. What are the chances shareholders actually profited from such boring investments?

We would also note that, unlike most corporate executives who serve on multiple boards, Mr. Buffet currently serves only on Berkshire’s board, as the proxy notes he left Kraft’s board in 2018. It is telling that no other board believes Mr. Buffet could add value as a director, though given the years of “so-so” decision making and corporate resource waste we’ve mentioned earlier it is perhaps no surprise other boards would quickly pass on Mr. Buffet.

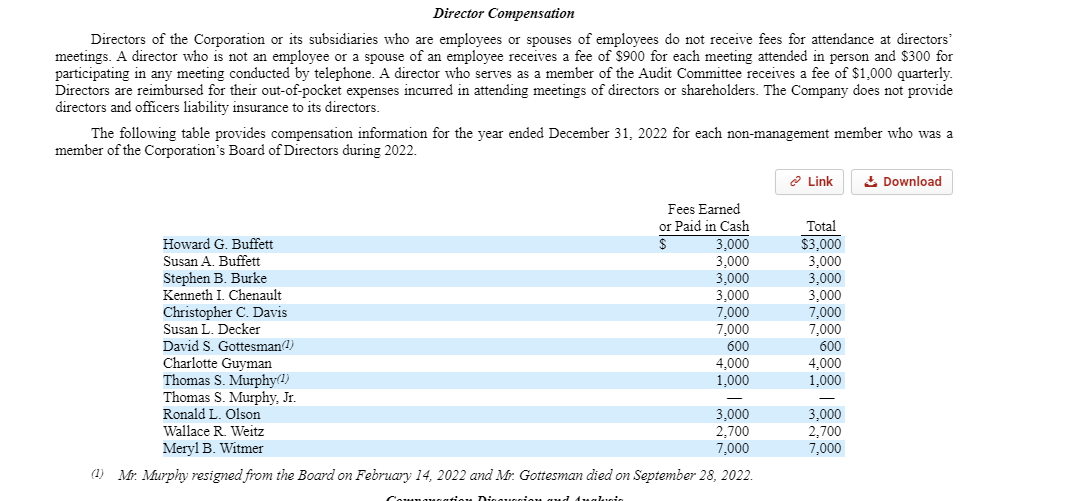

The proxy contains numerous other red flags. Chief among them is the stunning degree of board overpay. I have pasted the director compensation chart directly from the proxy below.

Astute readers will instantly notice two issues with this chart. First, it is obvious this director compensation chart forgot to note that it is in thousands. After all, the going rate for large corporate board directors is in the hundreds of thousands per year for service; to suggest Berkshire is finding board members willing to serve for less than minimum wage is laughable. Once we adjust the pay for that obvious oversight, we can see Berkshire is paying their directors millions of dollars per year. A truly damning double whammy here: this table shows sloppiness from leaving off the “in thousands” footnote that clearly belongs here and shows absolute greed, as paying directors $3m+/year has to make this by far the highest paid board in corporate America.

No wonder the board is letting the Mr. Buffet run around mailing untold amounts of notes and making hundreds of personal phone calls on the company’s dime. They are getting paid an outlandish amount to look the other way.

Before we wrap this letter up, we would be remiss if we did not mention one other glaring area for improvement at Berkshire. Over the years, Mr. Buffet has frequently noted that Berkshire holds on to cash and treasuries far in excess of what they need. For example, this year’s letter included the line “As for the future, Berkshire will always hold a boatload of cash and U.S. Treasury bills along with a wide array of businesses.”

This is a simple and quick area for improvement: Berkshire should immediately improve the yield of their excess cash by investing all of it into longer dated securities. Doing so would instantly improve the Berkshire’s earnings.

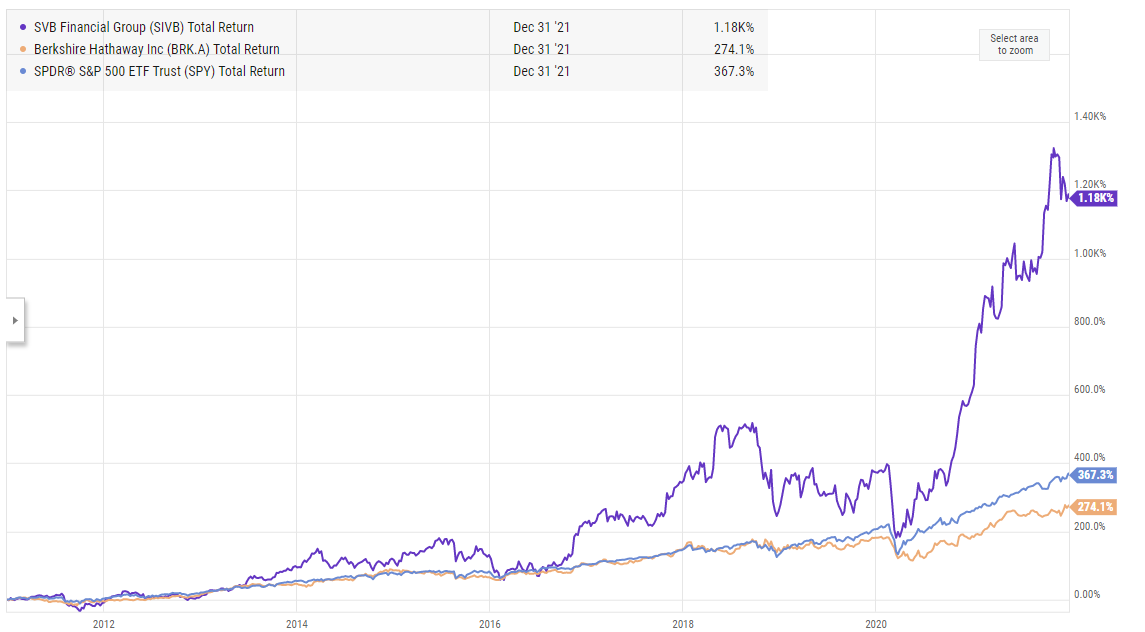

While this is somewhat apples to oranges as Berkshire is mainly an insurance company, we would note that Silicon Valley Bank (SIVB) has pursued a similar strategy of investing in longer dated securities to improve yield, and their stock returns have absolutely trounced Berkshire. From 2011-2021, SIVB stock increased almost 1200%, more than 3x better than the index. Berkshire, in contrast, lagged the index over a similar time frame.

And I would note that increasing yield by investing in longer dated securities carries almost no risk! As an insurance company, Berkshire can mark longer dated securities as “held-to maturity” and hold them on their books at cost, so if interest rates go up and the bonds lose value, Berkshire’s earnings will not take a hit. We have seen multiple banks pursue this strategy recently while noting ignoring the market-to-market losses on securities better reflects the true economic value of their business, and we can see absolutely no downside to such a decision. I would be remiss if I did not note that, on top of decrying how GAAP accounting for available-for-sale securities obfuscates his bank’s true earnings, ZION’s CEO also quotes Berkshire’s annual letter, noting that “Warren Buffet” had endorsed share repurchases (note: we are happy ZION’s CEO spelled Mr. Buffet’s name correctly in his letter; we were extremely concerned that Berkshire’s letter constantly misspelled their own Chairman’s last name, though not surprised given the footnote issues related to the board we mentioned earlier). Given his admiration for Mr. Buffet, perhaps ZION’s CEO would be happy to school Berkshire on how buying longer dated securities and holding them at cost can create shareholder value with no risk in good times and bad!

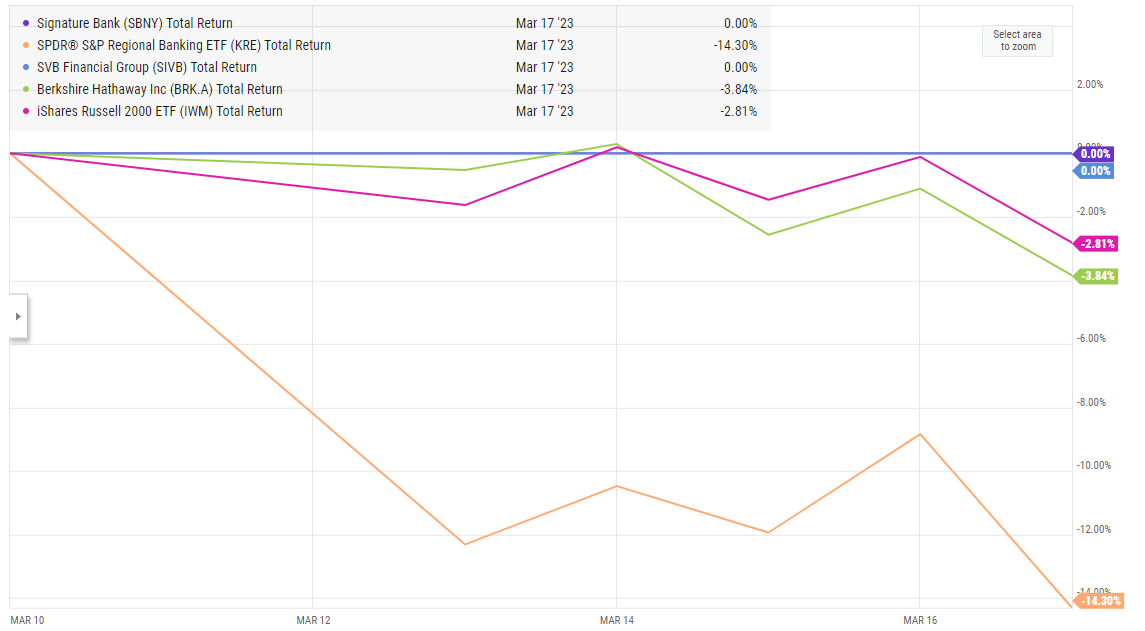

We would also suggest that this “buy and hold while ignoring fair value losses” model can reduce Berkshire’s volatility. Consider the week of March 10th. It was an awful week for markets; Berkshire’s stock dropped ~4%, the Russell 2000 dropped ~3%, and the regional banking index (KRE), which SIVB belongs to, dropped a shocking 14%! Under this dire back drop, SIVB and a similar peer, Signature Bank (SBNY), delivered stunning outperformance, with their stock trading complete flat for the entire week as peers and markets melted down.

A wise man once said “there’s never just one cockroach in the kitchen.” Given the number of errors and issues we’ve pointed out above, we would suggest that the issues we have noted will prove just the tip of the iceberg if someone comes in and really starts digging through Berkshire’s books. In addition, while the idea of taking Berkshire’s cash and immediately investing it into longer dated securities to increase yield is an obviously good idea that should be implemented immediately, we note that Berkshire has historically been averse to hiring business consultants and bankers, and we are sure that a team of consultants and bankers could instantly come up with several ideas just as simple and value accretive as our “invest in longer dated securities” idea if they were brought inside of Berkshire.

Again, it gives us no pleasure to write this letter or air these grievances in public. But the issues at Berkshire are clear, and I would not be doing my job as a blogger if I did not bring them to light.

Berkshire Hathaway has always been a Ponzi company, since there are no dividends and no effective voting rights. Sold the company ages ago. Warren Buffett is so old fashioned. Bet there are lots of near worthless bonds hidden in the insurance floats.

Satire is the best form of flattery.

Solid April fool's! Thank you.