Weekend thoughts: death, quoting Buffett, and strategic alternatives $CSV

Last weekend, I had two posts on how I view management teams quoting Buffett (long story short: it’s quite rare for an operating CEO to quote Buffett, and it always raises some red flags for me / I have to check very carefully that they’re following Buffett’s actions and not just paying lip service to sucker me in!).

The company that inspired all of those posts is Carriage Services (CSV). It’s a fascinating company undergoing strategic review. so today I wanted to dive into them a little bit.

Let’s start with some background: while I’ve loosely followed Carriage for a long time (their share price fueled incentive plan from early 2020 put them squarely on my radar, and I’ve continued following them because every now and then the CEO will do or say something that cracks me up or makes me think), the reason I started revisiting them is because Park Lawn (a smaller competitor) made an offer to buy all of CSV in late June, and CSV responded by instantly announcing a strategic review.

Carriage operates in the death industry (funeral homes and cemeteries); it’s a highly fragmented industry that throws off tons of cash, has extremely limited economic / regulatory sensitivity, and even spins off a little float (~15% of CSV’s funeral sales and ~50% of cemetery sales are “preneed”, meaning someone buys and pays for them before they die, which creates trust funds that can be invested. CSV has >$200m in preneed trust funds/receivables; given the trend of PE funds buying insurance companies to invest their float, you could certainly imagine a PE fund drooling at taking control of CSV’s trust). Funeral and cemetery businesses are also sales heavy businesses, which always presents opportunities for optimization by tweaking sales force incentive structures.

Throw all of that together, and you’ve got a business / industry that is tailor made for private equity backing and strategic consolidation. So I was looking at Carriage with the thought that their strategic review could lead to a hot and heavy bidding war with multiple private equity firms and strategic parties looking to emerge victorious by paying a generous premium.

That’s certainly a possibility…. but it’s hard for me to see how someone could pay a big premium from here and really make money. At today’s share prices (~$34/share), CSV trades for just over 10x this year’s EV/EBITDA and >20x this year’s free cash flow to equity. CSV has built themselves up through acquisitions, and they seem to be generally good acquirers / operators who buy the best businesses in their markets. That’s a fantastic strategy…. but it also suggests to me that there’s not going to be a ton of synergies or low hanging operational fruit for whoever buys them to go and pluck. Put that together with a lofty multiple and a reasonably low growth business, and it’s tough for me to see a ton of upside that would let an acquirer come in and pay a real premium here.

I could be wrong though! Again, this is a business custom built for PE ownership, and the fact that Park Lawn has lobbed in a bid suggests they see some upside to a combination / are willing to make a deal somewhere around today’s share price (how much higher they’d go is an open question!).

But there’s another aspect to the CSV story that I wanted to dive into that spurred my Buffett quotes post from last weekend. The Chairman is obviously a big Buffett / Munger fan; every few years he’ll release a (lengthy) new letter where he’ll detail his vision for the company. To give you an idea of how thickly he lays on the Buffett / Munger fandom, the last plan letter he did was in May 2021, and in just the first paragraph he mentions Buffett, makes a reference to Ben Graham / The Intelligent Investor, and notes that his favorite book is Seeking Wisdom: From Darwin to Munger (he’ll later make references to Snowball as well, though if you want to be critical he refers to it as an autobiography, which would suggest Buffett himself wrote it, instead of being simply an authorized biography).

So, as a Buffett fan and value investor, it sounds sounds great (in theory) to have a CEO so versed in the lingo… but I pick on CSV because it’s a perfect example of the "preaching Buffett’s words while not following his actions” worry I have whenever I hear someone quoting Buffett. After talking about how much he loves these Buffett books and thinking long term, the Chairman then goes on to mention a bunch of very un-Buffett like actions: he describes how he got margin called in the late 90s when his firm’s stock price crashed, he praises his bankers for helping him sell a big bond deal with a well oversubscribed book, and does a few other things that are small in and of themselves but taken together just feel very un-Buffett like.

The CEO concludes the letter by talking about how cheap the stock is, and promising to buy back the stock aggressively as long as the market is giving them no respect (here he makes a Rodney Dangerfield reference that is very Buffett like in its “aw shucks” style).

So what happens? Over the next ~year and a half, CSV goes on an aggressive repurchase spree, buying back ~20% of their shares at ~$49/share.

You can probably guess what comes next… by the end of 2022 results are lagging as the company’s “COVID boom” wears off, and the CEO pledges to stop repurchasing shares in order to focus on debt paydown despite the stock lingering ~50% below the average repurchase price.

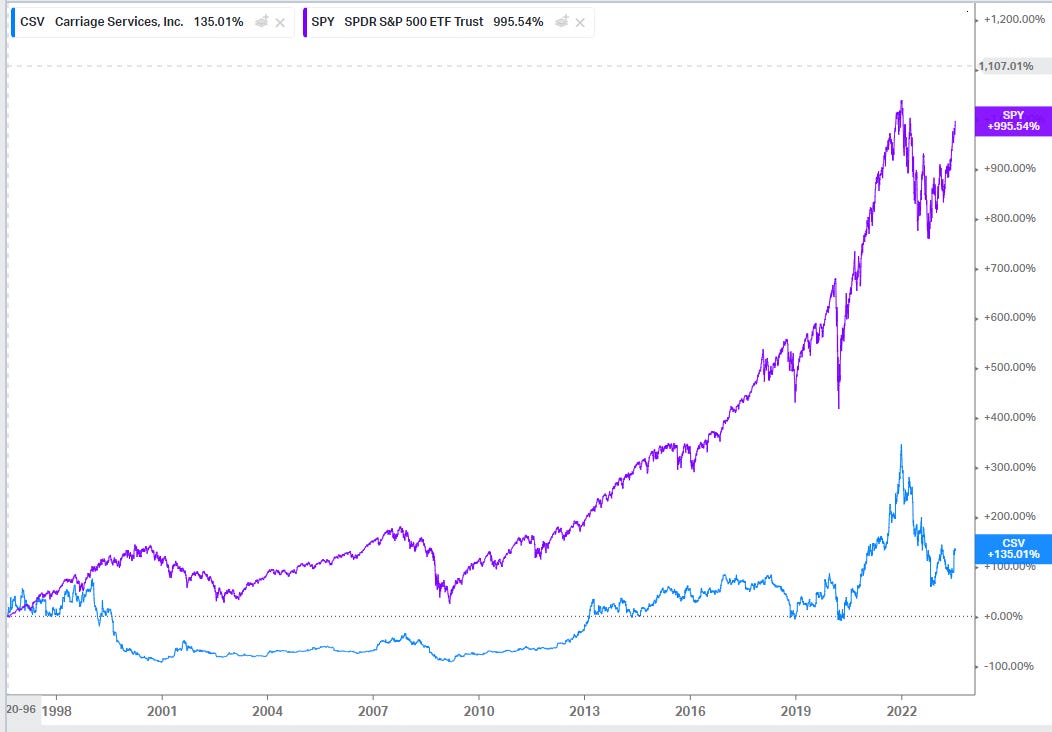

That type of “buy when things are good; retrench when things get rocky” mindset is probably partly responsible for the very un-Buffett-like returns CSV has generated over the long run. Pretty much no matter what time frame you track CSV for, it’s dramatically underperformed the index. That’s a pretty disappointing outcome (to say the least) given the stability of the business and what should have been some really large tailwinds.

Anyway, I don’t mean to pick on CSV. I’ve followed them for a while and, despite my critiques, I actually like their communication style and I’ve always been tempted to “take a ride” with them because I’ve found them to be generally good operators / acquirers (I think the trick is to just buy when they get over their skis and retrench and the stock gets hit, so perhaps now?).

But, to bring it back to earlier, I think if you’re buying CSV today you’re buying because you think they’ll announce a sale at a big premium (if not, why not just wait till the strategic process fails and then buy down 20-30%?).

And I’m skeptical you get a successful buyout here for four reasons.

Valuation to an acquirer: Mentioned above, but at current prices it’s hard for me to see an acquirer making juicy enough returns to justify the premium.

Acquisitions in this industry have tended to happen at 6-8x EBITDA (see, for example, StoneMor’s proxy from late last year, which lists the median deal getting done at 6.9x EBTIDA). CSV is a larger platform, which generally command stronger multiples, but it’s multiple is full enough that I don’t see much room for a bid. Park Lawn and SCI are both trading for ~10x EBITDA today, meaning even if they paid CSV’s current share price in a deal they’d only capture the synergy value for themselves, and as noted above I think CSV is a good operator that’s not likely to have tons of low-hanging synergy fruit to pick.

Internal valuation: If you go back to the May 2021 press release, they had a “roughly right” intrinsic value of $50-60/share. Yes, that was a few years ago, and interest rates are higher now…. but I wouldn’t be surprised if management thought their intrinsic value was in the same place or higher today (if you go back to their December 2022 call, they noted “With our stock trading below $25, the world thinks or thought we were the world's worst operator and consolidator of funeral homes and cemeteries.”). That valuation view could make a deal hard to strike; if, as a management team, you think your business is worth >$50/share and that a share price of ~$25 is literally a personal affront to your operating abilities, then it’s hard to sell for ~$35/share, even if that’s a big premium and kind of in line (or better than) recent transaction multiples / maybe above what a lot of outside observers think your intrinsic value is.

Incentives: CSV has a history of awarding their employees share price heavy options / PSUs. Here’s their most recent one; as the CEO proudly noted at the beginning of 2022, three of the tiers have already been hit / vested. I generally like share priced PSUs, but when half have been triggered and the other half are deep out of the money, I wonder if it creates a little incentive for a management team to turn down good acquisition offers in order to YOLO and try to hit their remaining targets (or just try to get new targets that vest)…. particularly when you combine this “out of the money options” situation with point #2 (management’s valuation), as you might have a team that has well out of the money options that they think they can hit without fully YOLO’ing it to get there.

(Note: I have no firm commitment to this theory; it’s just a worry I have / I’ve seen it be an issue in past potential acquisitions)

Reticence to deal with PE: the CEO (and he’s actually just the executive chair now) ended the 2021 letter by dissing private equity: “P.S. Confidential message to private equity firms: NO WAY because you would make us repeat all the ‘stupid stuff’ we did in the 90’s!” That’s completely fine, and maybe he’s right the a PE firm would overlever them and make them do “stupid stuff.” But, outside a strategic acquirer (of which there are only a handful), a PE firm is the natural buyer of this business…. and I’m a little skeptical that a CEO is going to hold a 20 year grudge against the PE firm way of doing business and then just suddenly turn around and change his mind now.

Even in a strategic deal, this hesitance to deal with PE might matter. Park Lawn (the strategic that submitted the first bid) is actually smaller than CSV, and their PR announcing the CSV offer highlighted they had partnered with a private equity firm on the bid. If CSV has a firm “no” rule to private equity, the partnership might prevent a deal from coming together (on top of all of the other issues above, though I suspect if Park was willing to pay a large enough premium to overcome everything else above CSV would drop their “no PE” concerns for this bid).

Again, all of this could be wrong or misguided. The executive chair is ~81 and owns >10% of the stock; I believe he’s talked about leaving it for the benefit of his estate, but given the recent challenges and his age maybe a strong bid today could get a deal done! But I spent ~2 days looking at CSV because I saw a stable business undergoing strategic alts that I thought could be the center of some pretty aggressive bidding, and the more I looked at it, the more skeptical I was that the strategic alts process would result in a premium bid and the more I kept coming back to my “be skeptical of CEOs who quote Buffett” instinct.

Why didn't you tell us you can see the future / are a Tesla insider?

I'm sure that Mel will do whatever is best for Mel :-)