Weekend thoughts: Checking account bonuses and interest rate driven opportunity cost

I will be honest: today’s post is a little anecdata-ish, and it’s a silly little example… but it was quite thought provoking and interesting to me, and it’s my blog so I’m writing about it, silliness be damned!

Anyway, like everyone else, my mail is always filled with a host of banks offering “switch your bank account to us and we’ll give you $100”. These always end up where they belong (in the trash / recycling), but a few weeks ago one caught my eye: Chase offered $750 to switch an account to them. That caught my eye for two reasons

My main bank account (for both my personal stuff and for the Yet Another Value Empire!) are already at Chase, and it always cracks me up when I get a mass mail offer from someone who already has my business.

It was, by far, the largest promo offer I’d ever seen for switching a checking account.

The specifics of the offer were as follows (I’ll note that I’m doing this from memory; fortunately for you, I have a pretty good memory when it comes to numbers and finance despite having a pretty poor memory for just about everything else (as my wife would attest)):

Bring >$100k in new money into a chase checking account

Leave it there for >3 months

Chase would give you $750

Those terms are pretty standard when it comes to the “bring money over and we’ll give you a little bit of extra cash” bank account offers (most of them will give you X dollars for bringing in Y dollars (which is a large multiple of X) and keeping it for 3-6 months; some also require you to set up a direct deposit or bill pay to increase the stickiness).

But here’s what tickled me: if you took that offer, you were a fool. Even if we completely ignore the time and headache and hassle of switching your bank account over (and trust me, bank accounts are not easy to move around; wiring money in is easy, but if you want to change your direct deposit and bill pays and such you’re talking about a near full day endeavor!), the offer is significantly worse than the risk free rate!

Let’s do some math: a Chase checking account yields effectively nothing. I know this because my wife and I are Chase customers; here’s last month’s interest payment.

I didn’t include our account balance for obvious reasons, but I don’t think it’s crazy to assume my wife and I’s combined account has more that $1k in it. If it had just $1k, that interest payment would come out to ~0.3% annualized. Not 3%; 0.3%. And, again, it’s not crazy to think my wife and I’s combined account has more than $1k in it, so the interest rate is substantially lower.

So it’s saFe to say that a Chase checking account pays a roughly 0% interest rate; given that rate, if you took the Chase bonus offer, wired $100k into Chase, parked it in that account for 3 months, got the $750 bonus, and then walked away, you’d walk away with ~$100,750.

That math works out to a return of 0.8%, or an annualized return of ~3.1%.

As I write this, 3 month treasuries yield 5.25% (annualized).

So, to take that offer and get the bonus, you would have taken all of the hassle of opening a bank account and moving money in to earn less than the risk free rate…. and the returns would get even worse if you weren’t all over the redemption dates. Withdraw a day too early and you lose the bonus; withdraw a day too late and your IRR decreases a bit. And, either way, you’ll have the headache of needing to shut down a bank account on the back end.

Not great for you…. though it’s great for JPM, who gets your money at below the risk free rate and creates a new customer relationship. If you take that offer up, their cost to acquire you as a customer is effectively negative; they’ll have made a few hundred dollars in interest income off your money (net of the bonus they gave you) with the opportunity to build that relationship into an even more profitable one.

Anyway, you might be asking “isn’t this a blog about investing (and maybe a little about spreading the gospel of the Wandering Inn and other fantasy books I love), not personal finance? Why is Andrew writing so much about a terrible bank match bonus offer?”

Two reasons:

First, again: the math on this “bonus” offer just really tickled me.

Second, and more important: it’s a silly example, but one that I think nicely shows how rising interest rates can change opportunity costs and the attractiveness of different options

The first point is pretty obvious, so I want to just drill down on the second one.

Let’s rewind to late 2020. The fed funds rate was effectively 0. In that world, these bank match offers were actually quite profitable (if you ignored the hidden cost of your time and the headache of setting them up!).If JPM had made the same offer then, it would have been a bonanza in terms of a bonus versus other alternatives. You couldn’t get that type of yield anywhere; buy $100k of 3 month t-bills in late 2020 and you basically got $100k back when they matured. To take this offer and get $750 at the end would have been way better than your other alternatives.

So three years ago, this offer actually cost the bank something; they were giving you extra yield in return for establishing a relationship with you. Today, the offer doesn’t really cost them anything; they’ll actually make money parking your cash in treasuries over the life of the deal, and any additional business they do with you (or if you keep your money with them) is gravy.

It’s a small example, but it just shows how rising interest rates really can change the math around all sorts of investments and offers. And I see tons of people who fail to take the “new” math of a positive interest rate world into account.

For example, some people have emailed me “juicy” bank deposit offers like the one I listed above recently without doing the math that, even ignoring the headaches of setting up new accounts, you’d do better parking your money in t-bills. These are people who’ve been taking advantage of arbitrages like this for years; if you’d “successfully” clipped thousands of dollars of bonus offers like the JPM for a over a decade (as you could have from ~2009-2021), you might be slow to recognize that the bonus offers are not the same deal they were in years past now that there’s an alternative with yield.

Or, to bring it back to investing, I’ll have lots of other investors email me about two particular categories that I think they haven’t fully updated on: fixed income instruments (both debt and preferred equity) and merger arb.

Let’s start with merger arb: a frequent merger arb question I’ll get is, “Hey, I think this deal looks really safe, and it’s trading at a 5% spread! Isn’t this worth a huge position given there’s no regulatory risk and you’ve got a top flight buyer?”

A lot of times, the answer is simply, “Hey, this deal will take nine months to close. In 2020 when interest rates were zero, a ‘no risk’ 5% spread over 9 months was awesome! In 2023, a ‘no risk’ 5% spread over 9 months is barely better than treasuries, and you’re exposed to all sorts of tail risk (an unexpected block, the business going up in smoke, Elon getting cold feet, or simply the deal taking longer to close than you expect so your return ends up being less than treasuries)! Not exactly alpha!”

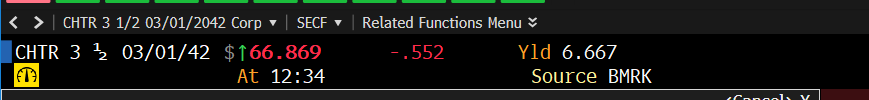

I see the same with fixed income instruments. Long time readers will know I love the cable companies and cable business; every now and then I’ll get an email from a reader or peer that says, “Jesus, CHTR has some bonds that are trading for 67% of face; is CHTR in some crazy distress or are those a screaming buy?”

The answer, of course, is that those are super long dated bonds issued in a different interest rate environment (they pay 3.5% interest and mature in 2042!). The 20 year treasury currently yields ~4.5%; those CHTR bonds are roughly the same duration and yield ~6.667% to maturity. Now, a >2% yield over treasuries is nothing to sneeze at…. but unless you’re running a fixed income mandate, I’d guess that spread isn’t really worth the illiquidity, risk, trading costs, need to monitor the credit, etc.

Something similar happens with preferred equity. I’ll have a lot of people email me about generic XYZ prefs, which have a face value of $25 with a 5% payout. The prefs will trade for ~$18, so they’ll have a ~7% current yield, and I’ll get a lot of emails along the lines of “I get an almost 7% yield plus the opportunity for capital appreciation if these go back towards par, and I think this is a great company so I’m really comfy the preferred is extremely well covered / won’t stop paying the dividend.”

It’s a nice thesis…. but preferreds are perpetual! So you’re talking about locking yourself into a permanent 7% yield. That’s not the end of the world…. but, again, 20 year treasuries are yielding 4.5%. You’ve just locked yourself into a permanent 7% yield. Is it possible that interest rates touch 8% sometime in the next 10 years? It’s unlikely, but certainly possible! Where do you think these prefs are going to trade in that world? What if we have another huge bout of inflation; you’ve locked yourself into a fixed yield here and these prefs aren’t going to look pretty. And none of that accounts for the illiquidity, company risk, etc.

Again, I’m not saying the generic pref I described above is the worst idea in the world….. but I think a lot of the people who suggest them to me are still living in a zero interest rate world and thinking that ~7% dividend yield is really attractive. I don’t think they understand that they’re making an interest rate bet much more than a company bet, nor do I think they understand how much interest rate risk they’re taking (on top of company risk and all the rest).

This failure to update for interest rates doesn’t just apply to investors. I’ll see tons of companies that will proudly discuss their opportunity to invest in projects at 10% rates of return. Again, in a zero interest rate world, that return was attractive; with rates where they are, I’d guess a project with a 10% IRR doesn’t justify the execution risk.

To bring this discussion back to cable (given the Charter mention earlier), one particular area I’ll see this is with fiber overbuilders. Back in 2021, fiber overbuilds (where you either build out fiber into a new town currently only served by cable, or upgrade a legacy DSL asset to fiber) were all the rage, and most overbuilders were targeting mid-teens IRRs. That return was great when interest rates were zero and the overbuilders could raise long term debt at 6%, but today interest rates are up a ton and the market has cooled quite a bit. But it took a while for overbuilders to realize that the rising cost of debt was really going to impact the returns of these projects, and it wasn’t really until earlier this year that we really started to see some of the companies slow down their build outs.

Or I was talking to a company the other day, and they mentioned being excited to buy competitors for ~8x EBITDA (pre-synergies), which they thought would be ~6x after synergies. Two years ago, their stock traded for 10-12x EBITDA, so that math made a ton of sense (particularly if they were issuing equity to do it). Today, their stock trades right around 6x EBITDA and their debt yields high single digits; given the integration and execution risks around mergers, I’d argue buying competitors is far dominated by the opportunity cost of buying back their own stock or paying down debt.

Alright, this post started with discussing multi-hundred dollar bank account bonuses and ended with discussion multi-hundred million dollar M&A (be honest: how many authors can ramble from one to the other? Not many!), so I’m going to wrap it up here with one last point.

If I had to sum this whole post up, it’d be with one thing: opportunity costs matters, and it’s changed massively as interest rates have risen. Whether you’re looking to park some cash somewhere or make a big acquisition, make sure you’re updating your priors for your opportunity cost.

Odds and ends

Obviously, this story focused on bank checking account matches. Those are separate from credit card sign up bonuses; as a former consultant, I fully endorse taking advantage of credit card sign up bonuses (within reason! obviously nothing on here is financial or investing advice, but be sure to live within your means!). You might as well get a bonus on your spending!

True story: when my wife moved in with me, she found a drawer of like 15 credit cards I didn’t use anymore and was worried she was moving in with some credit card scam artist (I just had done a bunch of matching bonuses and never cancelled the cards for fear of credit score retaliation!).

I’m not as active in the credit card sign up bonus game anymore (again, these can be lucrative, but as you get older your time gets more valuable and the incremental time to chase every last dollar of credit card rewards is no longer worth it versus the incremental time I could spend investing / writing / cleaning up after the new analyst)…. if you’re interested, I basically only use the Chase Sapphire and Amex Blue; both have pretty generous sign up offers through those links (worth ~$300-500) which are very easy to hit.

Another funny JPM Chase story: again, I bank with them. Over the summer, one of their bankers called and said, “Great news! We’re offering a special on CDs. You can get a 3.5% interest rate on a six month CD!” I asked him, “well, fed funds are 5.25% and I could get more just parking in treasuries with less risk and have liquidity any time I want; is there something I’m missing that makes the CD better?” The line was really quiet for a second and then he said, “honestly, no one’s asked us that. The banking markets are just rocky and some of our clients like the safety of being in JPM CDs.”

I’m not giving that anecdote to dunk on anyone! The bankers were clearly moving CDs at that rate to be calling around and making the pitch (he was very enthusiastic about the CD; it sounded like the pitch had been selling itself!). I’m more just in awe of the JPM cost of funds!

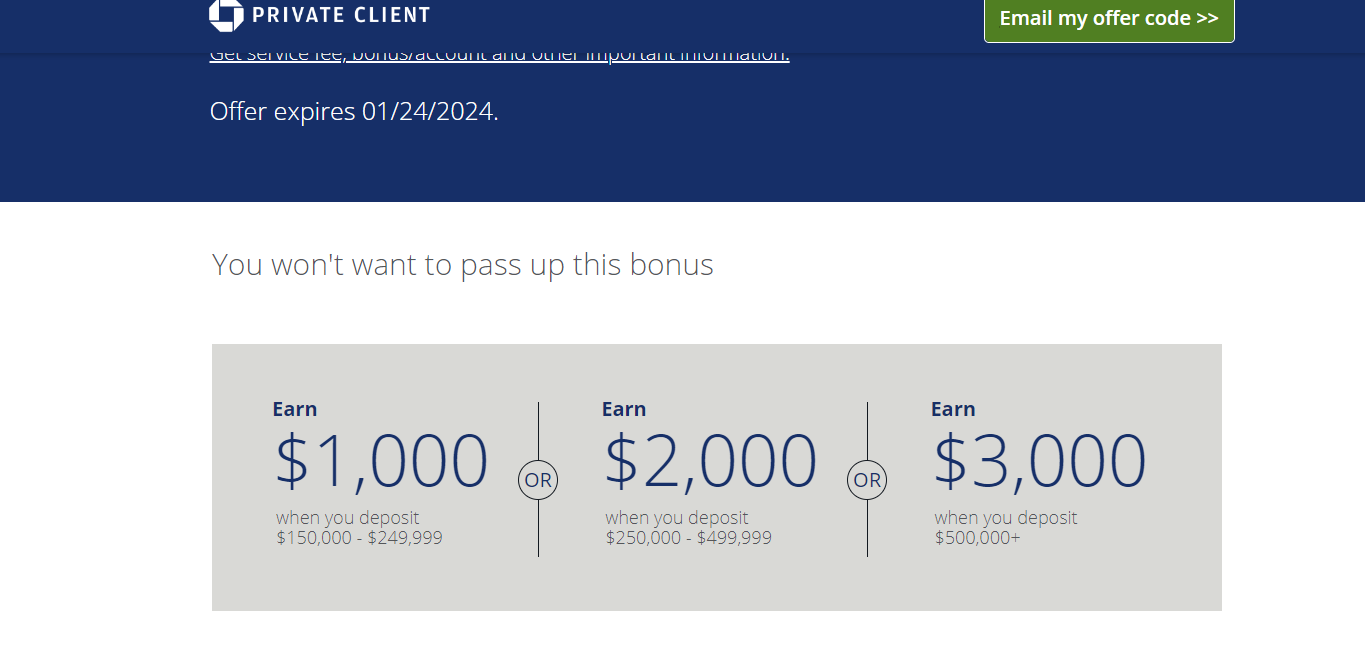

I mentioned the $750 deal, but I did some googling and JPM has an even bigger one currently; they’ll give you $3k…. if you bring $500k over. Again, you’re getting paid less than the fed funds rate on a huge chunk of money for that bonus. I didn’t mention it in the main article because I believe you can also toss that $500k into a brokerage account of some form with this offer, which might give some backdoor ways to earn an actual market return and collect the bonus, though I think it also creates a pretty attractive fee stream for JPM….

This post mentioned collecting bonuses on $100k and $500k deposits, so I do want to assure you…. running the YAVB empire is great, but it’s not so lucrative that I’m just tossing around $500k willy nilly to collect sign up bonuses!

Long ago, I believe AMBC was one of your picks. These recovering/restructuring bond insurers have given many value investors fatigue.

Thursday, however, MBI common was up 80%+ on news that it was paying an $8 special dividend with the blessings of its regulator. It would seem this would highlight similar opportunities in AMBC which was up 9% in sympathy.

Any thoughts here? Do you plan to revisit the idea?