Weekend thoughts: an embarrassing confession and buying tattoo worth brands

Here’s a confession for you (though, admittedly, one I gave up on my May ramblings): I only have one vice in the traditional sense1 at this point. I’ve never smoked, I gave up drinking to focus more on fitness / being more focused on work a few years ago, and (as appealing as haypp makes it sound) I’ve never done anything with nicotine.

My one vice?

Energy drinks (well, and maybe sweets, though I’m always trying to cut back on those). I just eff’ing love energy drinks. If you watch the podcast on YouTube, you’ll catch me sneaking one on most episodes. For example, here’s me drinking a C42 during the PAR pod with Scott Miller:

So I drink an embarrassing amount of energy drinks (sugar free, obviously); I’m not really caffeine sensitive and I just love the taste / taking a minute break to enjoy one a few times a day. And I do mean an embarrassing amount: I’m a little embarrassed admitting I love energy drinks publicly, and I’d probably be even more embarrassed if I disclosed just how many I drank.

Anyway, why do I subject myself to the shame / embarrassment of admitting all this?

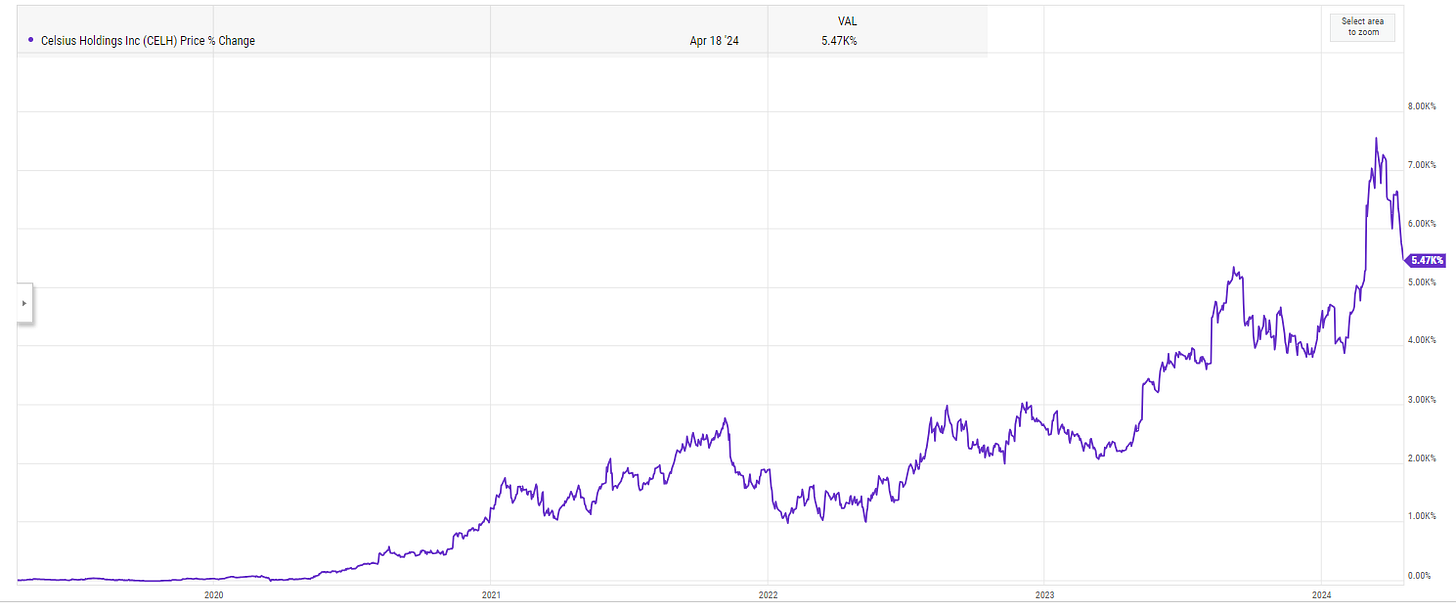

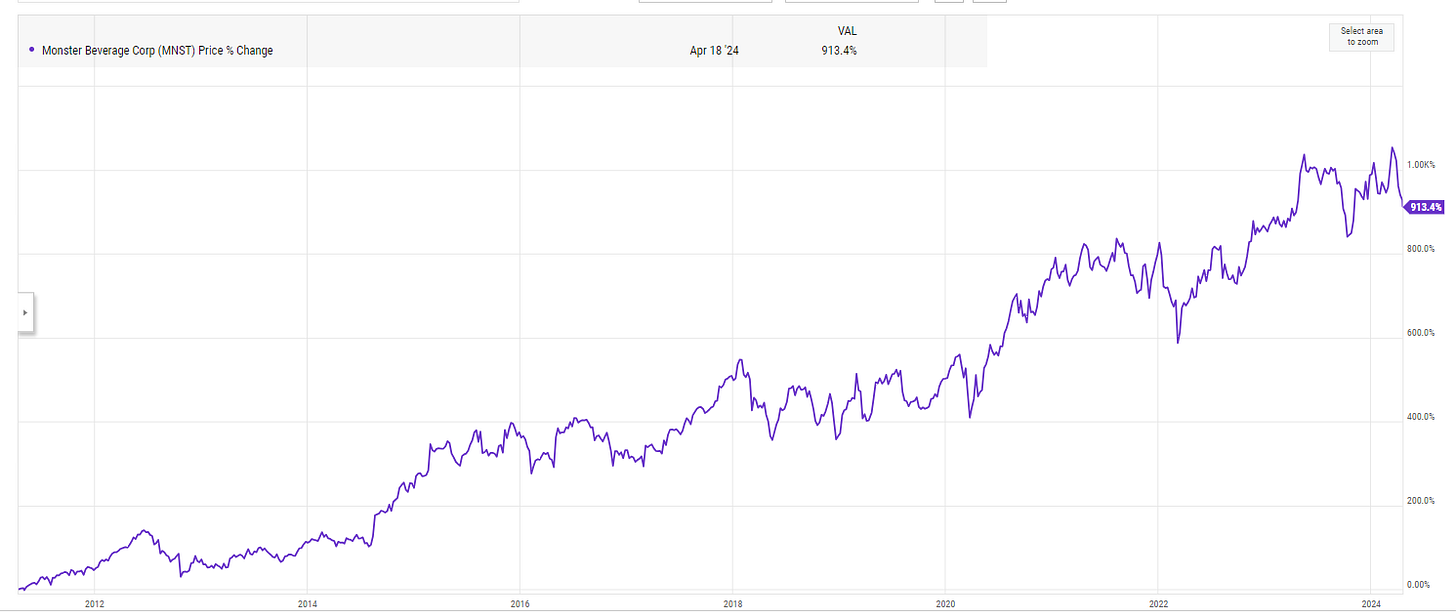

Because two of the greatest compounders of the past ~20 years have been Monster (MNST) and Celsius (CELH), and I missed both of them. It’s a sin that’s borderline unforgivable as, given my love of energy drinks, both were literally right in my wheelhouse.

Let me give some background: in ~2011, I was at an event with a friend, and someone very high up from Monster was there (either the CEO or CFO, but I was young and impressionable so maybe it was just a board member. I can’t remember now). I drank a Monster basically every morning before the gym; my friend knew this and went up to the CEO and said I was a huge fan of the product. We talked a bit and I mentioned I was in finance / interested in stocks, and I vividly remember him saying something along the lines of “our stock’s the best performing stock of the best 10 years, and we’re going to do it again over the next 10”. He wasn’t quite right as there are a handful of companies that have outperformed MNST over the past 10+ years, but he was directionally spot on and the stock has been an absolute screamer since:

I mention that quick anecdote because it makes my “pass” on Celsius even more unforgivable. I’ve mentioned before but I’m pretty active in weight lifting / fitness (or at least I was pre-pec tear!), and I vividly remember a CrossFit style class I went to pre-pandemic (let’s call it 2019, but it may have been earlier) where I saw two girls, one guy, and the instructor all drinking a Celsius before / during class. Split adjusted, the stock was ~$1.50 then. Given I’d missed the massive run up in Monster, you’d think I’d learn my lesson and just buy the stock. But, nope, I sat on my hands, and the stock is a casual >50 bagger since.

Now, if I’m being fair to myself, a big reason I sat on my hands is CELH used to have some really weird related party deals (look at the related party deals in their 2018 10-K or some of the stuff they disclosed from their Func Food acquisition in their 2019 10-k…. and that’s just the tip of the iceberg! Overlooked alpha had a nice piece on CELH that covered a ton more of their historical red flags). But I’d seen what Monster did, and I saw the insane brand / demand CELH was generating… I think I probably should have looked hard in the mirror and asked myself “do you like accounting or do you like making money” when it came to those red flags versus the wave CELH was pretty clearly on the verge of riding. Sure, there were red flags…. but they just weren’t that big compared to the opportunity / upside for a rapidly growing energy drink, and I could see the demand and shelf space share pretty clearly!

Why do I mention / confess to all this?

Two reasons:

There are two small energy drink companies that I know of that are publicly traded (Guru and Yerbae). And I do mean small; both are Canadian traded low dollar price microcaps (which obviously comes with an insane amount of risk; please do your own diligence). I have looked at both and can’t get comfortable with any of the risks or confidence that the brands are CELH / MNST 2.0…. but if I’m wrong and I miss out on a third rocket ship in the energy drink space, I may have to swear off energy drinks for good.

There is something really interesting about buying the stock in a product you love. A lot of investing is about developing conviction: conviction to hold a stock through volatility, or conviction to hold on to a winner as it continues to grow. A great way to get conviction is to love a product and be convinced everyone else will love it and it’s going to take over the world; if you loved energy drinks in 2002 and thought they were going to replace coffee and Monster would be the biggest brand, then holding MNST stock through all sorts of volatility would be pretty easy because you could imagine just an enormous prize at the end of the day. You could say something similar for a lot of products with passionate fan bases: how many people bought a Tesla car and loved it, so they bought the stock and held on for the full ride? How many Apple fan boys bought Apple and have held it as it multi-multi bagged? How many libertarians bought BTC and have rode it to generational wealth?

Anyway, I started writing this article, and then I went on a run and sat back down to finish it…. and I found I’d been mulling #2 over for the whole run. When I wrote that bullet, I was initially thinking, “you need to be careful buying brands you love, because that can give you false confidence and you can ride something down while screaming ‘this is going to be huge’ the whole way down” and there is certainly a kernel of truth to that. If, for some reason, you loved Beyond Meat and were convinced it would replace all animal meat consumption over the next ten years, it would be pretty easy to have bought the stock and rode it all the way down will convincing yourself you were at the front of a growth wave.

So caution is of course warranted…. but here’s the thing: it’s really hard to think of counter examples / warning signs of companies were consumers love the product and stock didn’t work in the long run. I mean, I had to reach for the Beyond Meat example (where I’m not sure anyone really loves that company) above because I spent fifteen minutes trying to think of a beloved main stream-ish brand that had a disastrous stock and I couldn’t come up with one. I’m sure there are some (maybe Under Armour, though I’m not sure consumers loved UA) but I just couldn’t think of any and I did spend some time thinking (the best I could come up with was some failed retail brands, but I’m not sure retailers really inspire the same passion I’m talking about here outside of maybe some regional grocery / C-store brands like HEB or Wawa).

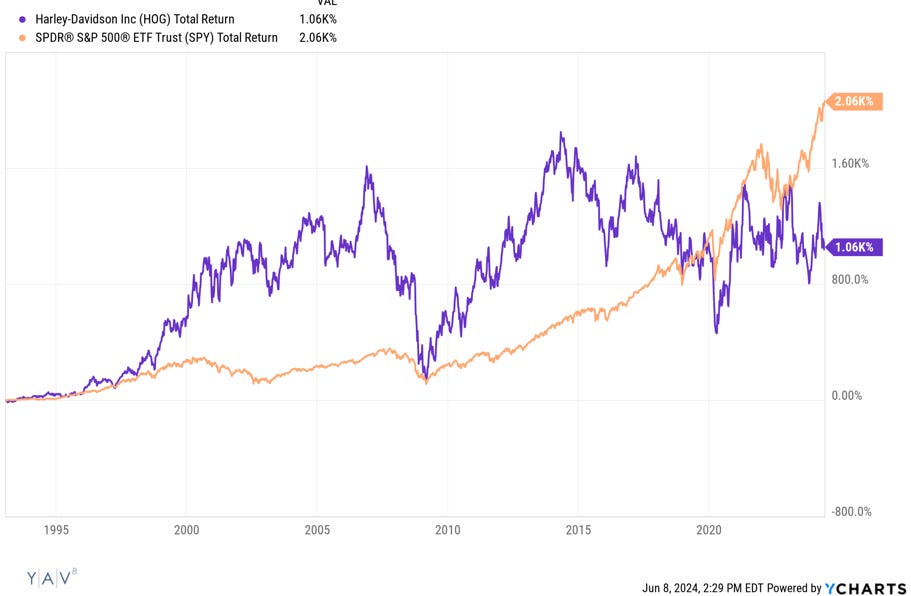

A few years back, there was a popular adage that was something like “buy companies where the brand is so good people turn it into a tattoo.” If we use “people get it as a tattoo” as a benchmark for brand love, it’s hard for me to think of a single example of widespread tattoo usage that has failed on the long run as a stock investment (widespread is important; I wouldn’t qualify Galaxy Digital’s Luna tattoo for this exercise!). The worst I can think of is Harley Davidson (HOG), which crushed the market for years but lost their mojo during the financial crisis and have been huge underperformers since they mid-2010s:

Some of the 2021-era SPACs probably pushed this “tattoo worthy companies outperform” adage to the limit by taking public (at huge valuations) companies that were very small / niche but had a wildly passionate audience (things like Black Rifle Coffee). There are probably a few lessons in that SPAC failure (namely valuation matters, though I do think you need a brand that can expand beyond its niche for the strategy to really work), but even those have not been abject disasters for the most part (particularly when you compare them to the rest of the 2021 SPAC class!).

Alright, this post has veered way, way off (which tends to happen when I take a break to go on a run halfway through an article). Let me wrap this up with two thoughts:

Again, people are always looking for brands with a lot of passion, but I’m going to spend the next week trying to think of smaller brands with a hugely passionate base that have the chance to go mainstream (by think of them, I mean look for companies as a long candidate) as well as historical stock market examples of brands with that type of passion that failed as stocks.

The first companies that jump to mind here are the publicly traded sports teams (the Knicks / Rangers through MSGS; Manchester United through MANU, the Braves through BATRA, WWE and UFC through TKO, and maybe Formula 1 through FWONA). That’s probably a good idea, though the drawback for all of those is they either trade at a very full valuation and/or have some serious corporate governance concerns.

If you have any companies that you think qualify for either (but particularly on the long side), feel free to throw it into the comment or slide into my DMs. I may do a follow up post looking at some of my favorites.

To bring this article full circle, just on Guru / Yerbae as energy drink plays: if you were looking at Guru / Yerbae as miniature Celsius / Monster plays, you’d have to look at them and think “this can take huge share in the energy drink market / this has real brand passion behind it.” I’m absolutely not there with either; I just don’t really see what separates either from the dozens of energy drink contenders out there nor do I see why someone would chose to pick Guru / Yerbae over Celsius or something. But if you could gain confidence / clarity on either brand really gaining steam, that would be the opportunity / the thing that causes me to miss a third rocket ship energy drink stock.

How could you gain that confidence? One way would be to become a super fan of the product yourself, but the risk is that lends false confidence (as discussed above). A better way might be to interview a few product super fans and learn more about them; with Celsius and Monster both, I suspect both brands were bringing in a lot of new to the space energy drink drinkers. If either Guru or Yerbae were doing that, it could show they were playing in a less penetrated / competitive niche. On the other hand, if you interviewed a ton of people and found most of them were switching from other energy drinks for some reason, it could show they’re big share winners, so……

PS- one of the tough things with energy drinks is getting distribution, and it seems like both brands are at least having some success there. Yerbae appears to have deals with Target and Costco (at least based on their instagram; I can’t find them in Manhattan, but they are in several regional groceries in the tri-state area), and Guru appears to have some distribution with CVS and Whole Foods (not a nationwide deal, but their store locator showed them at ~3 Whole Foods and 1 CVS in Manhattan, so some).

I say vice in the traditional sense. I love fantasy books (even “bad” ones; a reader recommended Grand Game earlier a few months back, and I read the first book inside of two days), I would like nothing more to spend a full weekend playing board games, and my work schedule can look pretty manic. I think someone could easily look at any of those and suggest I use them as a vice, but I’ll leave that up to a therapist I suppose.

My C4 review? Meh. I generally prefer NOCCOs or Reign, though admittedly I’ve increasingly been switching to Celsius (in part because their “we’re healthier / not quite as packed with fake flavors at the other guys” pitch is working on me, and in part because CELH has an active following on Fintwit and if I can’t make money on CELH I figure I might as well help them with it).

Counterexample: Peloton

Maybe the investment rule should be, find products that are legally addictive and buy them?