TMT earnings $TWTR space tmr night

Tomorrow night (August 3) at 8 PM EST, I’m doing a twitter space on cable / telecom / media (TMT) earnings with some fellow cable junkies / investors. I’ve really enjoyed every space I’ve participated in, and I’m hoping to do one or two a month going forward (I am hopeful we’ve got a great crew for a Disney / Marvel themed space next week!).

So I’m really looking forward to the space tomorrow, and I wanted to put down some of my thoughts / notes in prep for the space. I put several out on Twitter here, but I wanted to add a few / build on them some more.

If I had to give an overall takeaway from TMT earnings season, it would probably be:

Broadband demand remains strong; despite weakness since I fully jinxed ATUS with this article, I’d stand by everything I said in it (about both ATUS and the space in general).

With Comcast restarting share buybacks, the big 3 cable companies are all going to be returning capital / reducing their share counts pretty aggressively. The big 3 are also trading at multiples in line to below where worse assets are trading in the private markets. What are the big 3 seeing that the market isn’t (or, conversely, what risk is the market picking up on that the big 3 are missing?)?

The scale gap of Netflix versus all other media peers is bonkers; Warner / Discovery is just the start of dealmaking for the legacy media players. It’s “get eaten or disappear” for the minnows; Netflix’s scale just consumes too much attention and allows them to pay prices for content no one else could justify.

Reese Weatherspoon’s “Hello Sunshine” just sold for almost $1B. How do you put that valuation into context versus Amazon paying ~$9B for MGM or Lions Gate trading for ~$6.5B in the public market?

Wireless metrics for the wireless players (T, TMUS, VZ) were good…. but Charter / Comcast wireless initiatives are gaining stream quickly. Between them taking share and T striking a deal to take DISH’s MVNO from TMUS, is competition in wireless about to heat up?

Anyway, those are my three big takeaways / things I’m still noodling on. But I’ve got plenty of other things I’m thinking about; I’ve included those questions (plus clips from earnings calls backing them up) below; I’ve dived them into two buckets (cable / telecom is the first set of questions; media is the second); I’m hoping we’ll address them all on the space, but there will also be plenty of room for other questions if you want join / ask questions! See you tonight!

Cable / telecom

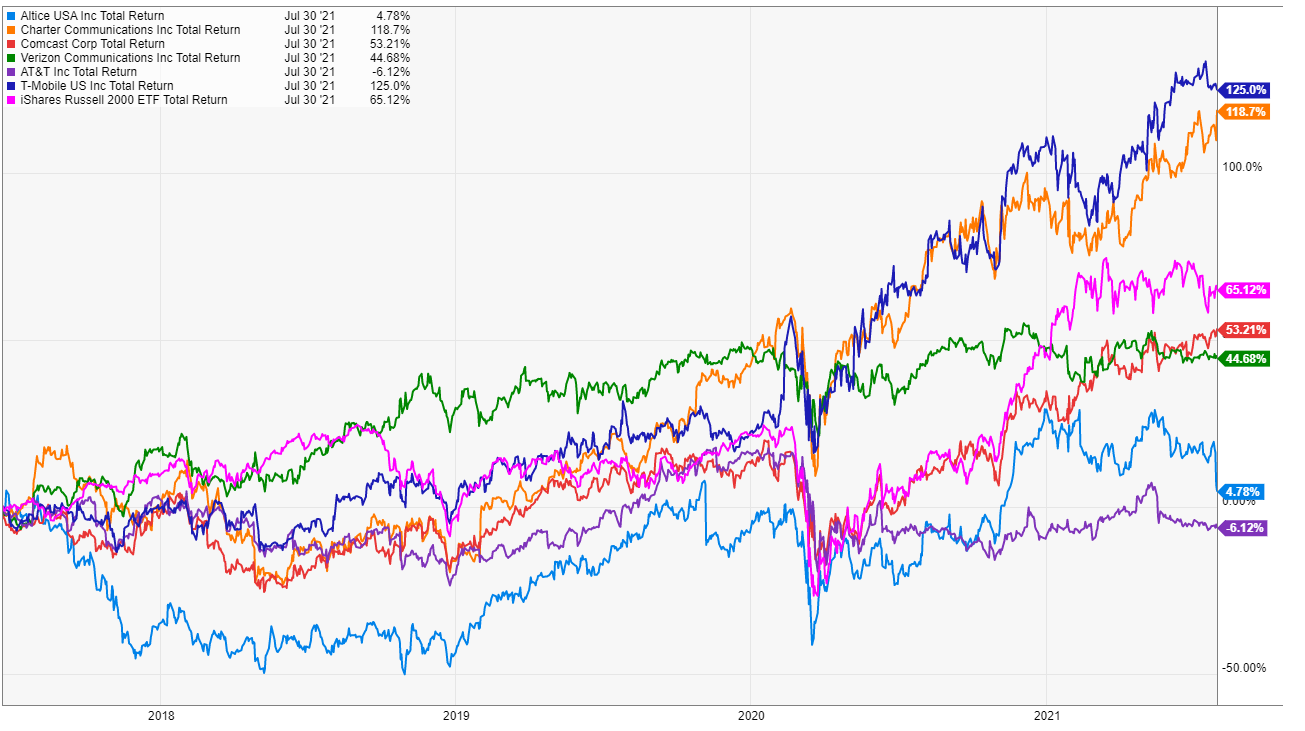

Zoom out: you could bucket telecom / cable since Altice’s IPO in 2017 into three buckets

Outperformers: TMUS and CHTR; ~2x the index return

Inline: VZ and CMCSA, roughly around index return

Underperformer: T and ATUS, both flat

Is it a coincidence that the two best performers had the largest / most synergistic M&A? Probably not…. but why does ATUS underperform Comcast, which way overpaid for Sky and has a significant chunk of their value coming from NBCU (which, comped to media peers, is probably a big value drag)?

Why is Altice underperforming CHTR and CMCSA (both YTD and since IPO)? Is it because of the quotes below, is it because I jinxed them, or some combination of the two? And, if it’s the quotes below, why is ATUS seeing such different trends?

ATUS: “We've now finally been able to resume our normal disconnect policies across the whole company, and so our trend should normalize by the fourth quarter. However, if elevated move churn persists as we in fact continue to see it recently, it may be difficult to match historical 2018 and 2019 organic broadband customer growth for this year.”

CMCSA: “Our broadband connect activity is healthy, and churn improved for the 14th quarter in a row. In fact, we hit the lowest second quarter churn rate in our company's history. Based on our first half results, combined with the strength we're seeing in current trends, we now expect total broadband net additions for 2021 to increase mid-teens relative to 2019.”

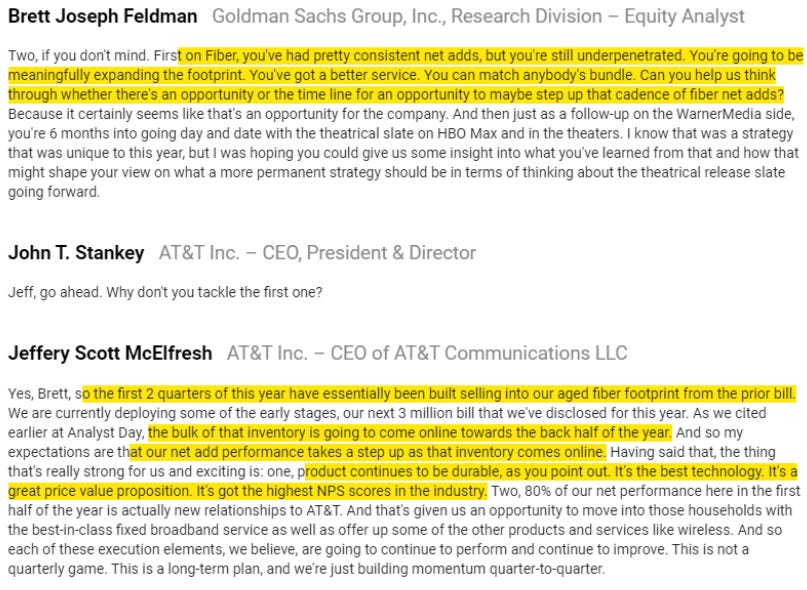

T’s fiber building plans; competitive threat to cable? Good IRR for T?

Speaking of fiber, ATUS is moving ahead with their plans for FTTH, while CMCSA / CHTR and other peers are taking a more measured pace, basically sticking with DOCSIS while acknowledging that eventually they will inevitably get to FTTH. Why is ATUS alone in their “skip DOCSIS” strategy?

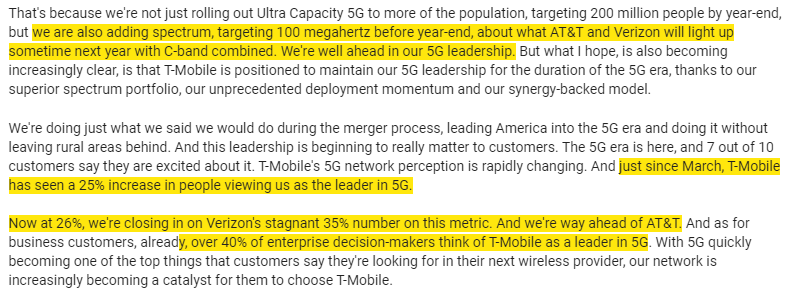

On top of fiber, TMUS is making big proclamations about their fixed wireless offering. Any threat to cable there?

Mobile: CMCSA growth is accelerating and just hit “standalone profitable”. T just won a big MVNO deal with DISH, taking “$500m out of a competitor’s profit”. What do you think of the wireless landscape, both overall and for the cable companies going forward?

TMUS appears to be lapping VZ and T; their network is in way better position, and their growth is much stronger. Between TMUS’s network and competition from CHTR / CMCSA, what do VZ and T do?

Media

CMCSA + Olympics; as a shareholder, how do you feel about “the importance is not financial” quote?

Compare the CMCSA / Olympics quote above to Netflix’s continued avoidance of sports rights

WWE gives an overview of current rights market (it’s hot!). (Here’s a bonus WWE note showing how big the reopening demand for live is).

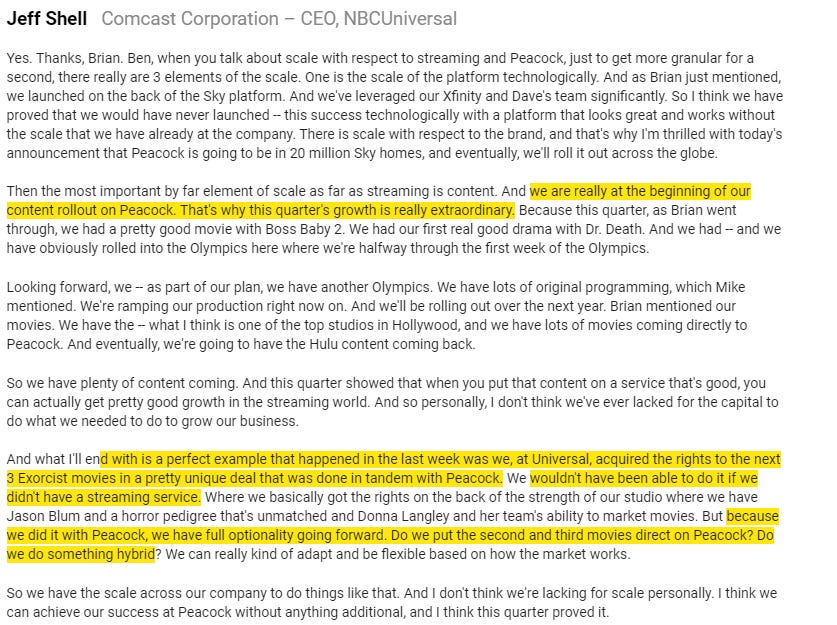

Peacock strategy / Exorcist uniqueness?

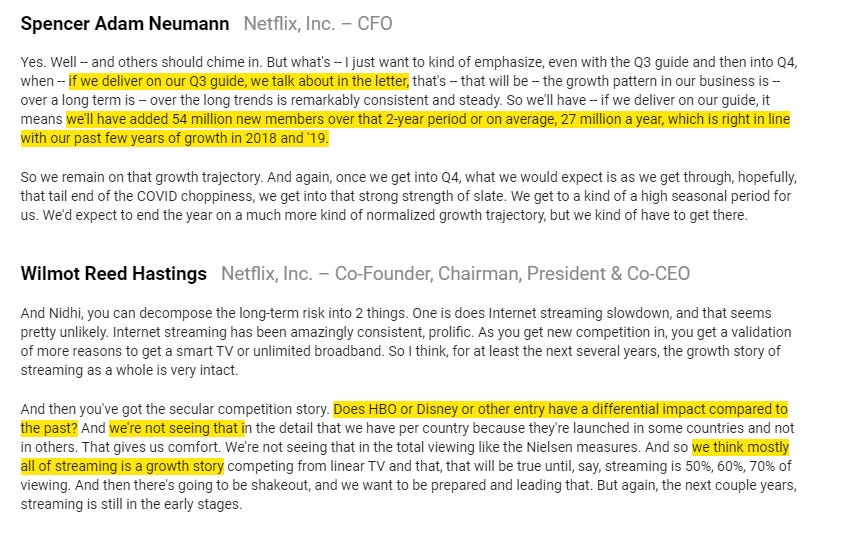

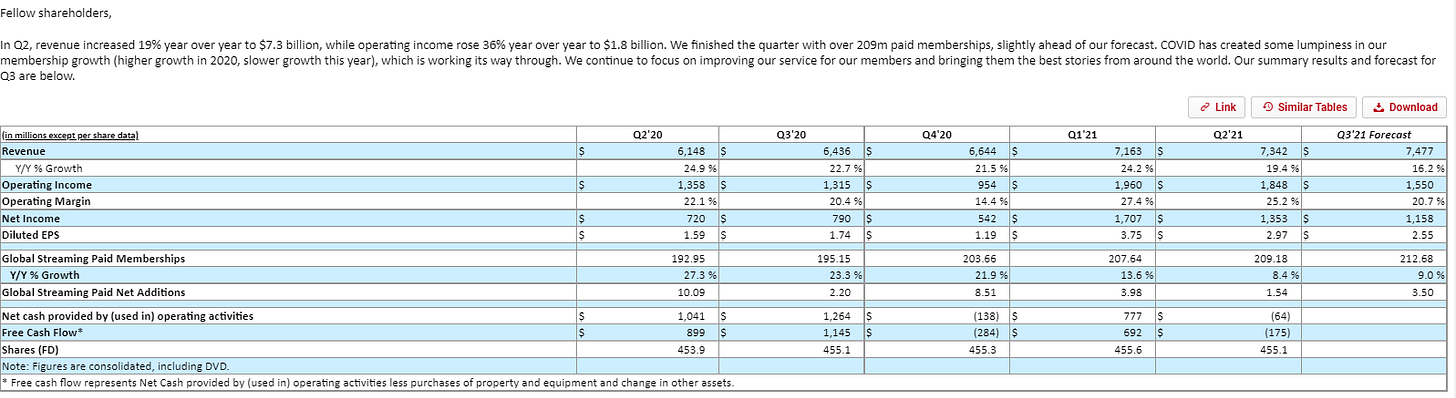

Comparing HBO to Netflix; HBO is up to almost 70m worldwide subs…. but that’s nothing compared to Netflix (it’s barely more than Netflix has added over the past two years!). Post Archegos blow up, the shine has come off a lot of the “legacy media” streaming plays (VIAC, DISCA, etc.), even though all of them are talking up great early trends and how excited they are to lean into their plays. What’s the disconnect?

T / HBO

NFLX

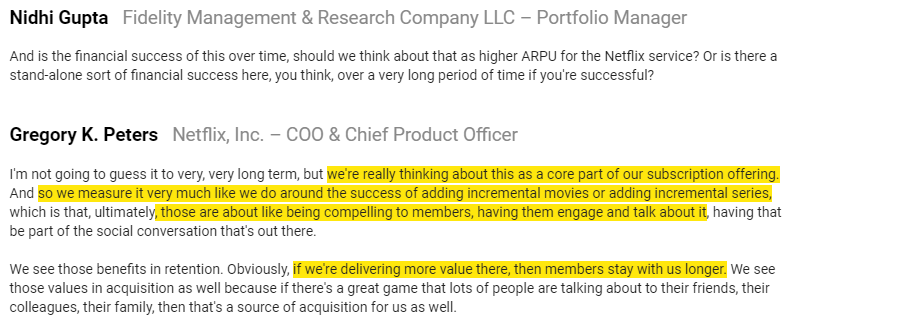

Netflix’s gaming foray

My case against NFLX is that the library isn't worth anywhere near what they've valued it at on the balance sheet, because most of it has little rewatch value. So when the new release pipeline for a region (as we've seen in NA) is weak, they have net churn. Thus the shoveling of money into new releases can't stop, at least not until the valuation of streaming services decreases, which isn't exactly bullish.

I've seen a crackdown on password sharing put forth as a way to drive growth, but the better way IMO to view the sharing is as a churn reducer, creating a social stigma for canceling. A friend or relative who lives far away whom you don't talk to that much isn't going to get regularly asked "how much of the NFLX are you watching?" (barring a real rate increase).