Three things on my mind $AMRZ $DASH $MIDD $MSTR $TSLA $SFM $GO

With a new baby, I’ve had a lot of late nights just staring up at the ceiling waiting for it to go to sleep. Here are a few things that have been running through my sleep-addled brain.

Insider buying: Returns from Elon’s big buy and large buys at AMRZ, DASH, and MIDD

Grocery store operating margins: What’s up with SFM and GO

The Mona Lisa of Investor decks: A true work of art at MSTR

Let’s dive in:

Insider buying: Returns from Elon’s big buy and large buys at AMRZ, DASH, and MIDD

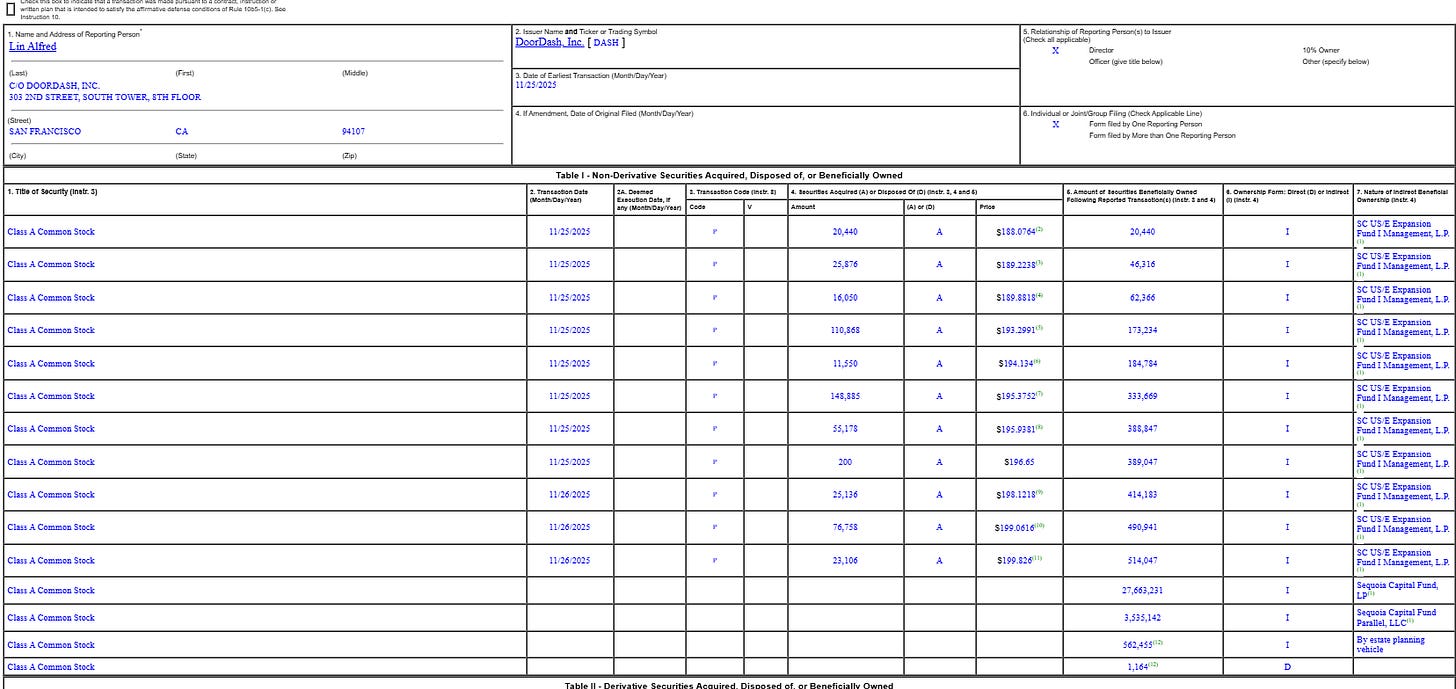

Inspired by Elon’s enormous $1b open market purchase of Tesla, over the summer I did a post on the largest insider buys of all time. I was reminded of that post because DASH recently had a director buy $100m on the open market.

Now, haters will say “it wasn’t the director who bought the stock; it was his fund.” And while that is true…. I’d suggest that a fund with a director on the board buying $100m of stock on the open market is still a pretty powerful signal! Heck, it’s one I wish I had followed on; yes, it’s only been a few weeks, but the buys happened under $200/share and as I write this the stock is ~$233. Not bad!

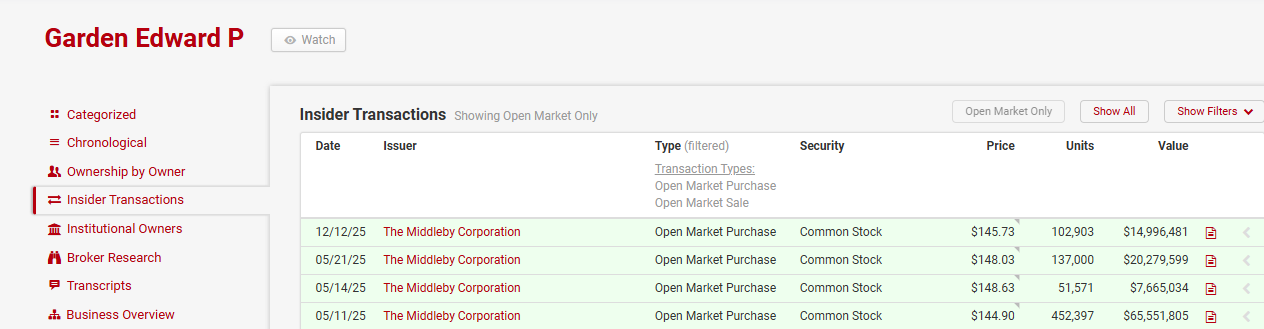

I’d also note a pretty big buy over at MIDD, where Edward Garden (a director / >5% owner) bought ~$15m of stock on the open market (alongside another director buying ~$100k). That $15m buy is a big buy in itself…. but it brings Mr. Garden’s purchases on the year to ~$100m. Garden has an impressive financial background; he also serves on several boards and does not resort to open market purchases much. Combined, I’d suggest there’s likely to be some signal in those buys.

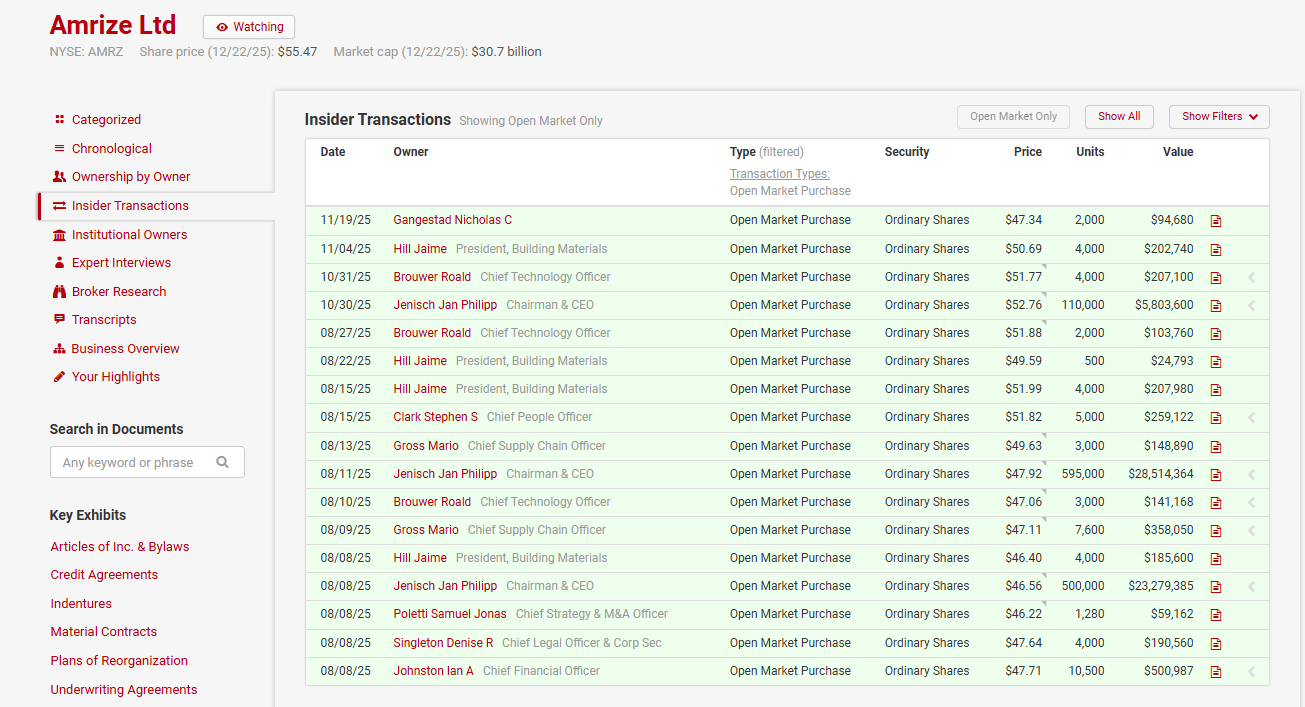

But perhaps the most interesting buy is at Amrize (AMRZ). AMRZ is a cement and aggregates company that spun off over the summer. Insiders have been massive buyers since the spin, with across the board buying headlined by ~$60m in purchases from the CEO.

AMRZ is not cheap on a headline number…. but they have a very good, future proof business (cement and ags), and the combination of spin-off + massive insider buying suggests there’s probably upside here.

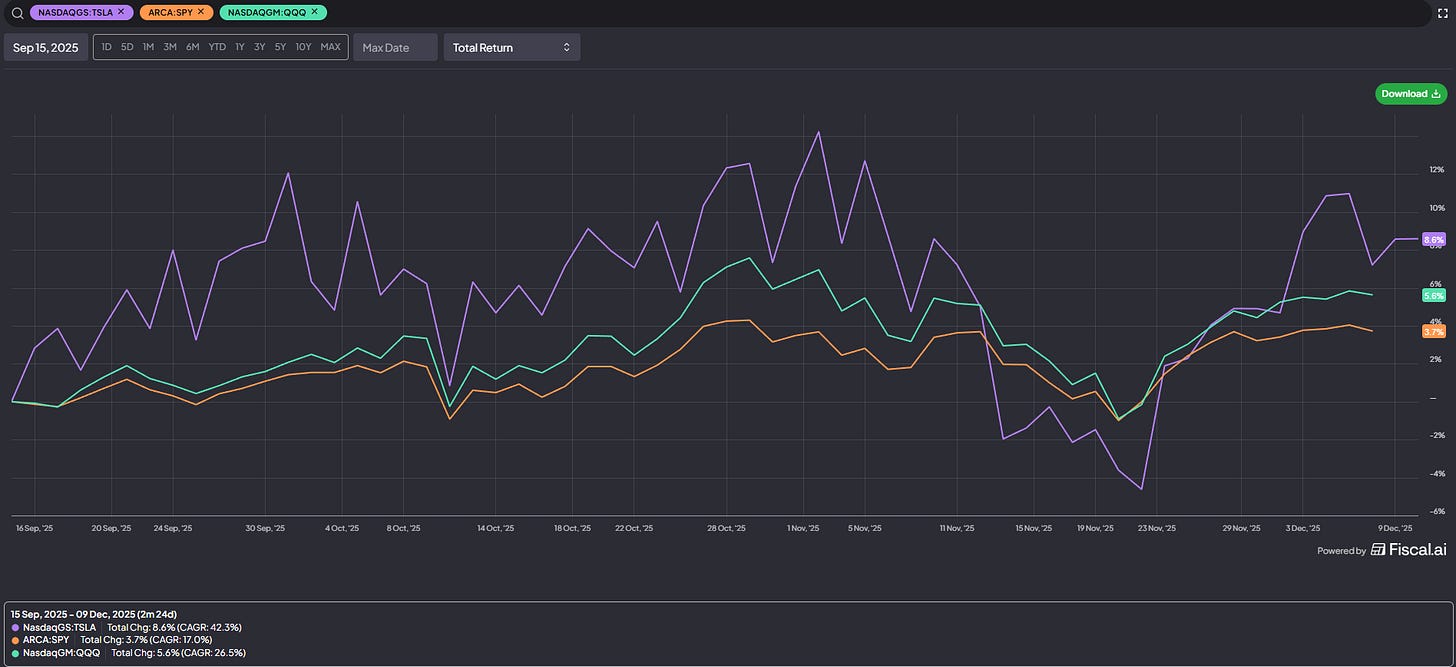

While I’m updating on insider signals, I’d be remiss if I didn’t point out that the early returns on Elon’s insider buys over the summer have been pretty solid; again, it’s early, but how does everything he does end up working out?

Grocery store operating margins: What’s up with SFM and GO

I’ve spent a decent amount of time on two specific grocers over the past few years: SFM and GO. Why? Grocery is a brutally competitive game, but I think you could argue each SGM and GO have somewhat unique models that could lead to a sustainable advantage against the behemoths competing in the space.

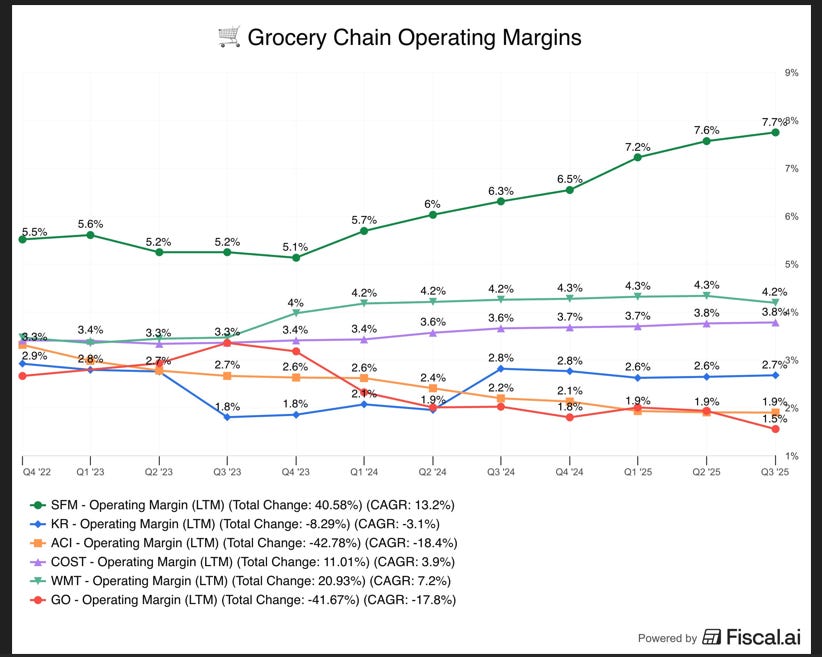

Grocers famously operate on razor thin operating margins; ~3% is kind of the rule of thumb in my head, but that’s just a guideline / not a firm rule. Still, as this chart shows, it holds pretty well across grocers:

Over the past two years, SFM’s operating margins have exploded (from ~5% to approaching 8%). GO’s have been decimated (from ~3% to 1.5% in the most recent quarter). I understand saying “from 3% to 1.5%” doesn’t sound like much… but think about it! On a flat revenue number, that movement in margins would call for GO’s earnings to have been cut in half! That’s wild.

Obviously execution at SFM has been outstanding, and GO has had a bunch of issues. But you have to wonder how long margins can sustain at these levels on both ends…..

The Mona Lisa of Investor decks: A true work of art at MSTR

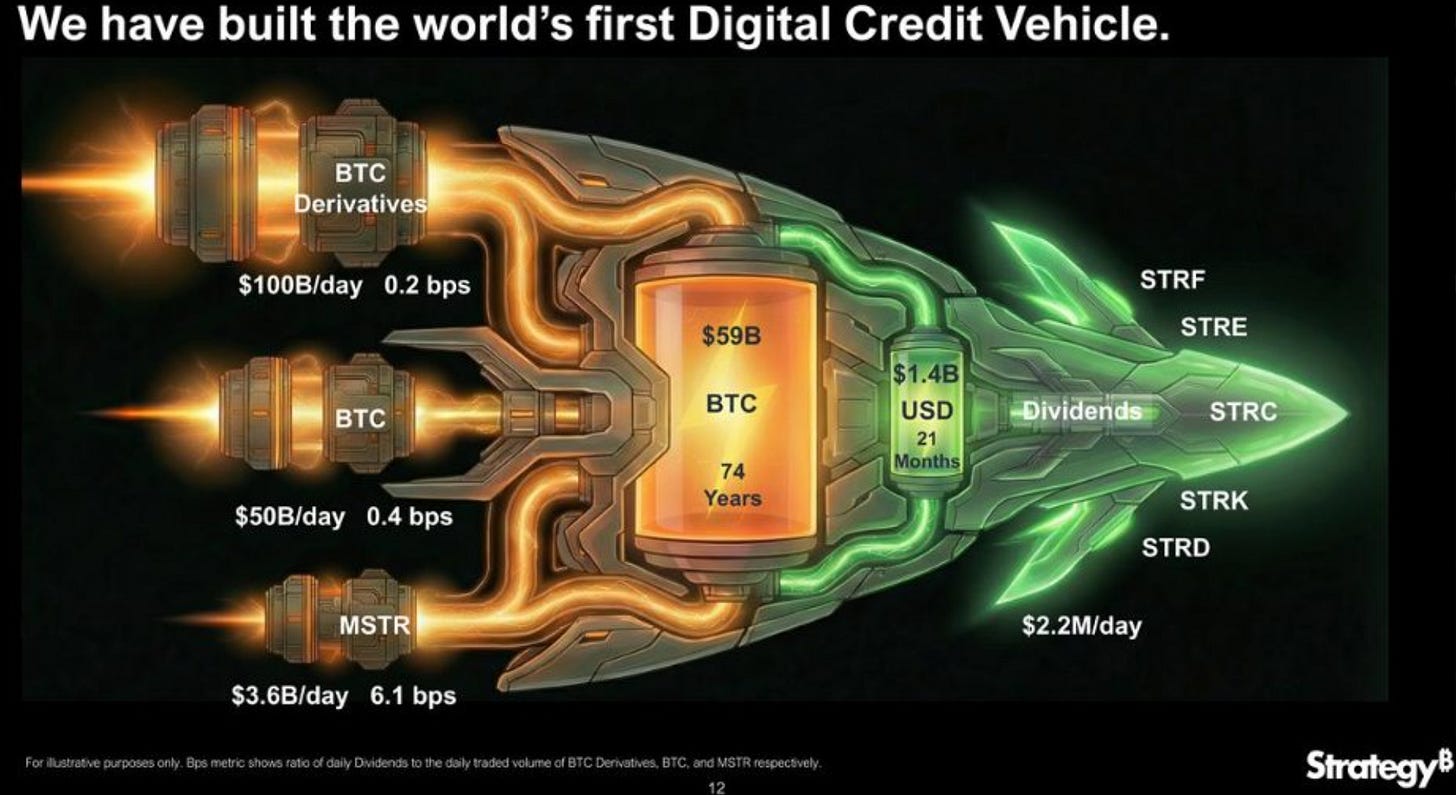

I’m not kidding when I say this is the greatest piece of corporate artwork / investor relations I’ve ever seen, and it’s not particularly close.

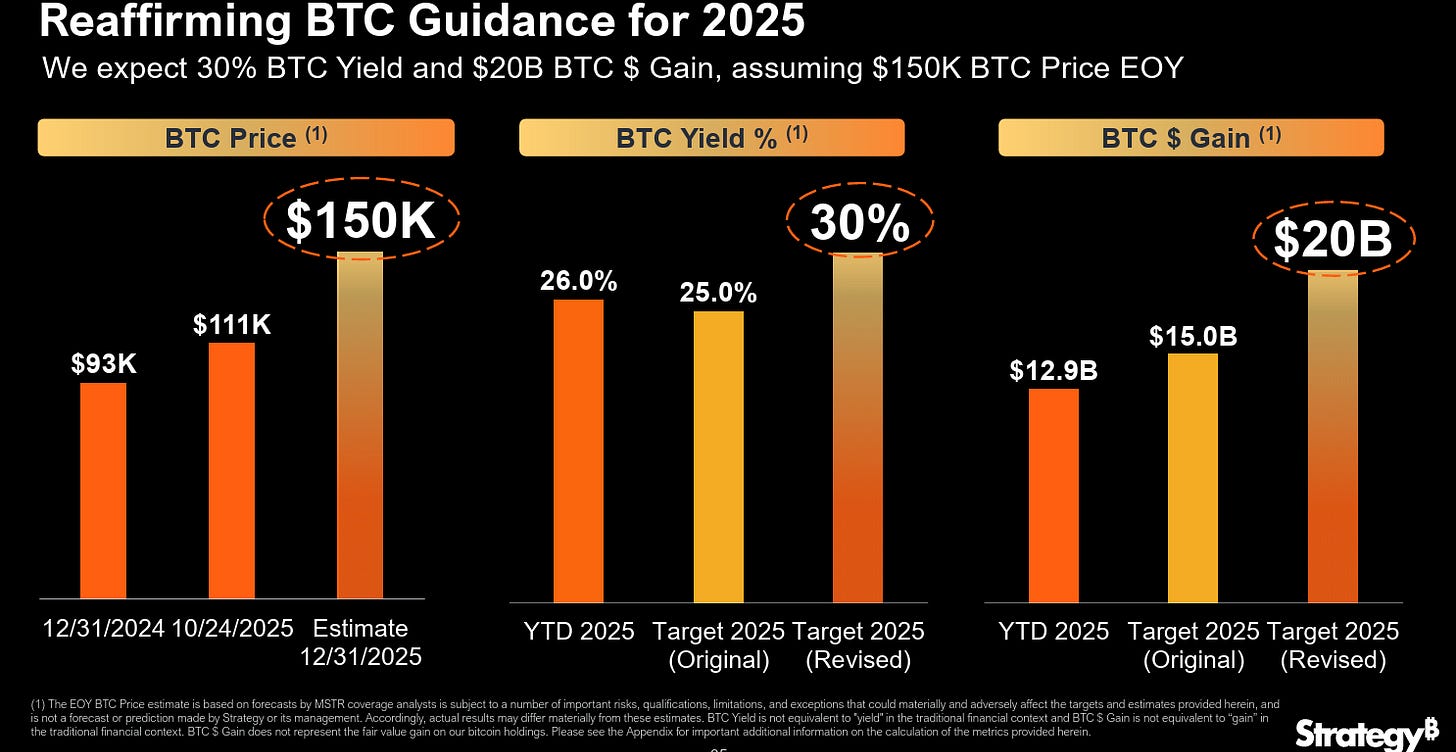

In late October (when MSTR published their Q3 earnings deck), BTC was ~$110k. MSTR published a year end “estimate” of $150k. A casual ~36% move in two months on one of the largest assets in the world; no big deal. As I write this on December 23th, BTC is trading for <$90k…. just a bit off, but I guess there’s still time to hit the MSTR price target!

Anyway, I don’t think I’ve ever written anything about the MSTR earnings decks on the blog before. That’s a mistake; they are incredible, and honestly whoever is running their IR / deck creation function should get snatched up by Netflix and put into the Stranger Things writing room. Incredible stuff.

I propose to change MSTR name to MOON

What software are you using for the AMRZ chart?