$IONQ and the evolution of meme stock financing

Much like “normal” history, financial history rarely repeats but it sure does rhyme.

Back in the go-go days of 2021, you saw a slew of growth companies take advantage of their high volatility to issue low cost convertible bonds. Even at the time, people admitted that these bonds had “unbelievable terms” for the corporate issues; with their stocks at all time highs, the issuers were able to issue long term bonds with no coupons and insanely high strike prices. For example, Peloton issued almost $1B of five year convertible bonds with no coupon and a conversion price over $239/share (versus a closing stock price of ~$145…. and a price today below $10/share).

Those bonds seem pretty crazy… there’s no one in the world who would say “hey, borrow this money from me for five years… and the only way I’ll make money is if your stock goes up by more than ~70% over that time”? So why would any lender make that loan? The answer, of course, is arbitrage; the companies that made these loans had sky-high volatility, and hedge funds / quant shops could make money by making these convertible loans to the company and the selling lots of option premium around them. This is a huge simplification, but basically the convert upside allows an arb to start selling huge amounts of out of the money calls… if the stock goes up, your calls go in the money and you convert your bonds to cover the short; if the stock goes down, you keep all the juicy call premium and you still have the bond!

So those convert bonds were on great terms for the companies…. however, from the company’s point of view, the issue with convertible bonds is even if they pay no interest they still come due at some point. As the great 2021 growth hysteria wiped out and many of these companies discovered they were riding a one time COVID boom instead of a permanently sustainable growth model, many of these companies have struggled to refinance the “free money converts” they borrowed a few years ago. With their stock trading ~$21/share, Eventbrite, for example, raised >$200m in converts in 2021. Those converts paid a 0.75% annual interest rate and converted at >$27/share. Today, Eventbrite’s market cap is barely over $200m, and they had to take out a term loan (at SOFR + 250) to buy back those converts below par. Still not a bad trade for the company…. but benefit of hindsight I’d bet they wish they hadn’t raised that “free” money1.

As animal spirits have returned in 2025, we’ve started to see some companies re-run the 2021 playbook. MSTR would probably be the headliner here, as they’ve issued some of the largest converts we’ve ever seen. However, interest rates today are higher than 2021 (so converts can be issued with low coupons but free coupons are harder to come by), and I think issuers remember 2021 and know that even “free” convertible bonds eventually need to be returned2.

With all of that history in mind, I found the structure IONQ has been using for financing particularly interesting (they’ve actually done two of these now). For those who don’t know, IONQ is a quantum computing stock. It’s also a meme stock with a cult following. Roll all of that together, and you can probably guess how the company’s stock has performed over the last year….

As a retail favorite meme stock, IONQ’s volatility is off the charts; its implied vol has consistently been above 80%, and over the past month vol has drifted up to over 100%.

Quantum computing ain’t exactly cheap; in the first half of 2025, IONQ’s operating loss was around $250m! IONQ obviously needs to tap the market to fund themselves, and given the high volatility IONQ is an obvious candidate for some type of structured trade.

If we were in 2021, IONQ would probably have issued a convert bond. However, IONQ has learned from the mistakes of the past; on Friday, they announced a deal to issue $2B of equity (and prefunded warrants) priced at $93/share, a 20% premium to their closing stock price.

Now, you have to ask why anyone would write a $2B equity check at a premium to a company with a valuation as…. rich as IONQ. For a check that big, most investors would be looking for a substantial discount to the stock’s closing price, particularly if it was a stock (like INOQ) that had enjoyed a big run recently / might be trading a little ahead of itself on fundamentals (to put it politely).

And that’s where the structure of this transaction is so brilliant. The buyers of IONQ stock bought ~21.5m shares at $93/share (again, a 20% premium to the closing price)… however, they were also given ~43m seven year IONQ warrants with a strike price of $155/share.

Again, this is just brilliant. From the company standpoint, this money is a gift. It comes at a huge premium, and unlike convertible debt they never have to worry about repaying it. Quantum computing takes a lot of money, and we still might be decades away from a breakthrough. If IONQ had raised convertible debt and plowed it all into research, in three or four years they’d be worrying about how to repay the convertible debt.

Instead, IONQ gets a huge equity check and can go spend money on quantum R&D without ever needing to worry about repaying in. In exchange, their investors get double warrant coverage (remember, the investors bought 21.5m shares (and prefunded warrants, which are effectively shares) and got 43m warrants) on some insanely valuable warrants.

How valuable are the warrants?

I think you could argue that the warrants alone are worth more than $2B to the right buyer, meaning the investors here basically paid a cheap price for the warrants and got $2B of stock (probably more like $1.5B after removing the premium) for free as a cherry on top.

Why do I say that? Let’s do the math.

IONQ’s vol is ~90 for the farthest out options:

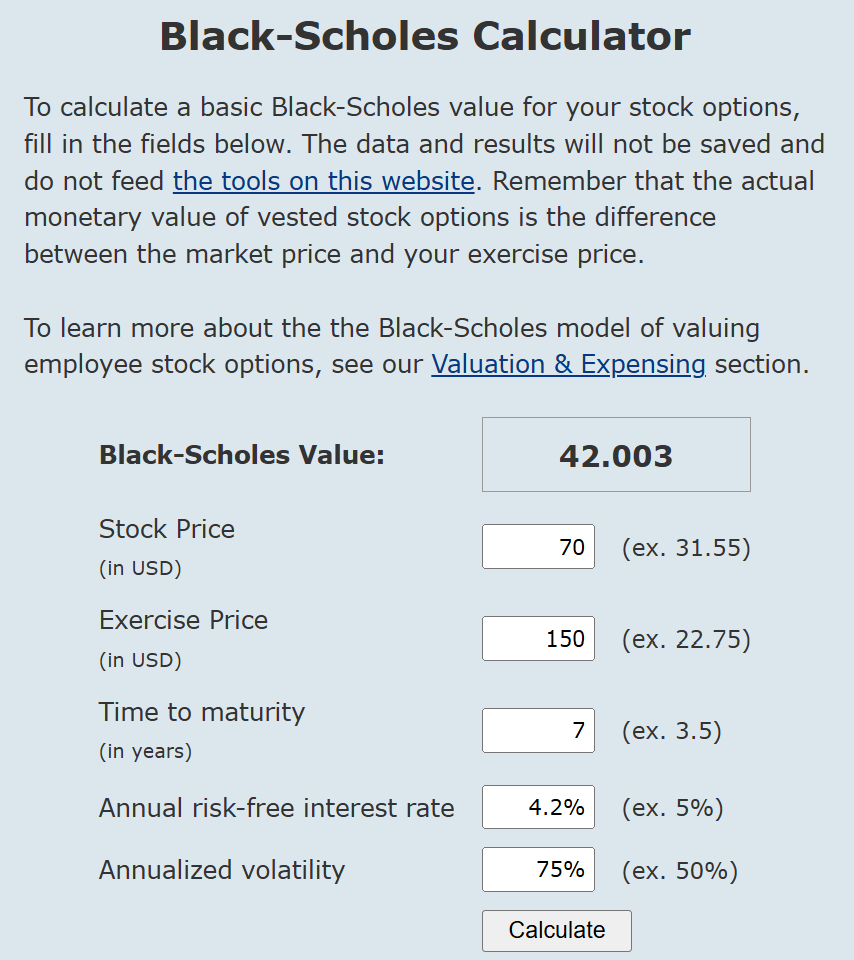

Volatility tends to lower over time (IONQ’s short term options have 110+ vol versus the ~2 year out options I’m looking at with 90 vol), and IONQ’s longest options are ~2.25 years out (January 2028) versus the 7 year warrants that IONQ just issued, so let’s tamp the vol down to 75.

After announcing the financing, IONQ’s stock ended the day at 70; it had actually closed the night before at $77.50 and opened at $77, so the drop seems much more to do with the stock market getting crushed on Friday than the big share issuance, but let’s use $70 as our stock price.

Combine that share price with the vol, toss in the interest rate, and we can see each warrant is worth ~$42 in a Black-Sholes model.

I think my math was reasonably conservative (I used the day end share price after the stock had been killed because of the market, and I slightly tamped down their vol) and it still results in enormous warrant value. And remember that the investors got two warrants for every one share of stock they bought; that’s ~$84/share of warrant value for every share they bought. The investors bought the stock for $93/share; it doesn’t take much tweaking to those numbers to come out at a place where the investors paid a fair price for the warrants and got all of that stock for free!

Now, skeptics might note two things.

The first question is that IONQ is very richly valued; what are the chances those warrants actually go in the money?

I’d answer that question with one historical data point and then some market knowledge.

The historical data point is that IONQ did a very similarly structured deal back in July when the stock was <$50/share that came with warrants that had a ~$99 strike price. A skeptic would have argued those warrants had no chance of being in the money then, but given IONQ started the week trading at ~$80/share and the warrants still had ~6 years and 9 months of life left, I think it’s fair to say the warrants had already proved their ability to accrue significant value before.

Building off that history dives into my second point: you don’t need to view a company as fundamentally undervalued for warrants to have huge value / warrants don’t need to go in the money to create value. Convert arbs and quant shops love these things because they can use them to put on other trades. The obvious one is selling calls: anyone who has these seven year warrants can instantly start selling calls against their position and clipping huge amounts of volatility. If the stock goes up, the warrant covers the losses. If the stock goes down, you keep the option premium. I’m obviously very much simplifying the situation, but just because a warrant is way out of the money doesn’t mean it is worthless (remember, a huge way that Milken made his fortune was getting “worthless” warrants attached to junk bond deals and keeping them for himself). The world is a weird place with a lot of thick tails, and all it takes is one weird warrant deal to pay off to make a fortune (and, again, even short of that, I suspect these things are getting hedged up and traded around so much that people are creating an enormous riskless profit on them).

That brings me to my second point: can you actually hedge these to create a profit? IONQ is huge: it has a ~$25B market cap and traded ~$2.5B in value on Friday. But this equity financing was an enormous deal: $2b of stock plus a ton of options. Could whoever buy them actually sell enough stock / enough volatility to lock in a profit without destroying the stock?

Here again I think the answer is clearly yes. First, the volume on IONQ is insane, so I suspect a sophisticated shop could get most of this position sold within a few trading days without much slippage. But, even without that volume, remember that this was a $2B investment. The world is large; I’m sure the firms that are making this investment have teams of data scientists that could instantly build some type of basket to offload most of the risk here. Remember, IONQ isn’t the only quantum compute stock; I’d guess you could figure out some basket of short NASDAQ plus a few of the other quantum compute stocks the day the deal closed that left the buyer largely covered on their investment, and then in the days and weeks to follow they could slowly cover that short as they worked down their IONQ position.

I will admit that I’m not an expert on complex warrant hedging or anything, so it’s entirely possible I’m missing something… but I’m pretty sure I’m directionally correct on all of this, and I’d guess that the buyers here made well over $500m in risk adjusted profit on this deal.

Just a heck of a deal and structuring. No position, and no interest in one, but it is really interesting to see how all markets, even the meme stocks, respond and evolve to the mistakes of yesteryear.

Remember that these would be great trades if the companies were raising a ton of zero cost converts, parking the cash on the balance sheet, clipping interest, and then paying the debt off at par when it came due…. but the businesses with high volatility often have questionable business prospects and/or are burning tons of cash, so in reality the cash that they raise absolutely gets spent and the fact they funded it with debt that needs to be repaid is a problem in the long run!

MSTR would be a clear example of the evolution as well; they’ve tried to shift from convertible debt to preferred equity, which obviously does not need to be repaid!

This is a really fascinatin look at how meme stock financing has evolved. The warrant structure IONQ used is way smarter than those 2021 converts that companies are still strugglin to refinance today. I love how you broke down the Black Scholes math showing the warrants are worth ~$42 each, which means investors basically got $84/share in warrant value for buying at $93. That's wild! The thing that strikes me most is how this solves the refinancing problem completly. Unlike Peloton or Eventbrite who have to figure out how to repay those "free" converts, IONQ just got permanent equity capital that never needs to be repaid. For a quantum computing company that might be decades away from profitability, that's absolutely critical. The double warrant coverage is genius too because it gives the arb shops enough ammunition to hedge properly without blowing up the stock. Question though: do you think the warrant issuance dilutes existing shareholders too much if IONQ actually hits the strike prices? Or is the alternative (debt that needs refinancing) worse?