"Suspicion of Gross Fraud": some notes from passing on Intellego Technologies $INT.ST

Let me tell you a story. It’s a pretty wild one.

The story starts with a multi-day research effort that leads to me passing on a stock, morphs into the stock driving me crazy as it turns into a quick triple and me asking myself “do you like accounting or do you like making money?”, and ends with the CEO getting arrested on “suspicion of gross fraud” and the company having some of their cash seized by Swedish authorities.

The company at the center of this story is a tiny little Swedish company named Intellego Technologies; when I was researching them over the summer, they had a ~$200m market cap (note: I used USD there, but Intellego reports in SEK; for ease going forward, I will use SEK through the rest of this article. 10 SEK roughly equals $1, so just divide by ten to get to a rough USD number)1. Given the small size and obscure market listing, I would guess that 99.99% of the investing world has never heard of the company…. but for the 0.01% who had heard of them, Intellego was one of the biggest bull / bear debates of the past few years.

Bulls claimed Intellego was the next great growth company. The company was attacking an enormous TAM and growing insanely quickly; their Q3’25 results showed revenue up ~300% YoY and EBIT up ~700%. Combine that insane growth with a CEO who owned ~12% of the company (plus would buy stock on the open market!), and you had all the makings of the next great multi-bagger…. and the stock price might have demanded dropping the “next” from that sentence, as the stock had already ~five bagged from the start of the year to early September:

Bears claimed the company was…. let’s say incredibly sketchy. The financials didn’t really make sense. Despite seemingly massive profits, operating cash flow was basically non-existent. Bulls said the bears were missing the forest for the trees and misconstruing normal small company growth pains with something more nefarious; incredibly, I saw one bull who pushed back on the bear case with this quote referring to the CEO a few months ago: “Could this guy be a financial manipulator that fooled Deloitte (as of YE ‘24), the EKN, countless investors, distro partners and now a new credit partner? Ok, sure. Probability? Very low, imo.”

Obviously, that bull / bear debate seems to have been settled now; the stock getting halted because the company’s cash was frozen / the CEO getting arrested for “suspicion of gross fraud” has a way of settling debates (though I suppose there is some “very low, imo” probability that this was all a misunderstanding and the company rises like a Phoenix)!

Anyway, I wanted to put some thoughts to paper because, again, Intellego drove me crazy over the summer. I passed because I pretty quickly identified the shenanigans risk in the stock, and I was basically tearing my hair out as the stock proceeded to double and then almost double again almost immediately after I passed and it felt like I had passed on a rocket ship2.

A bit more on my history with Intellego: in September, I had a bull reach out to do a podcast on Intellego. I agreed…. but ultimately ended up cancelling that podcast a few days before taping because I thought the chances of shenanigans at Intellego were so high that the majority of questions would need to be accounting related3, and my prep for the podcast and continued frustration with missing the rising stock actually inspired me to write my “Risking a zero: Fraud, Ponzis, and $BRK” post in late September (the premise of the article was how much zero risk could you take if there was a chance of multi-bagger upside; you can see how that thought process would come on when thinking about passing on a multibagger with potential shenanigans risk!).

With the Intellego story seemingly in its final chapters4, I wanted to share some notes and takeaways from the whole experience. I’m not trying to spike the football here for passing on what, with only a little hindsight benefit, was a pretty obvious candidate for some shenanigans; I never had any position in Intellego. In fact, I paid for some expert calls on the company, so I technically lost money on Intellego, and if I charged myself a “time budget” for the research time I devoted here and particularly the mental headspace Intellego clearly took up for me over the summer (and perhaps it continues to live rent free in my head)... well, Intellego was a big “psychological” loser for me.

So I wanted to share these notes for three reasons:

I think the story is fascinating, and I think some readers will find it fascinating as well.

Despite realizing how dicey Intellego was, I clearly had some temptation to buy Intellego given how crazy it drove me. Putting some thoughts and notes down on paper might help me (or some reader!) more easily avoid the “next Intellego.”

I had a long call with Intellego’s (I’m guessing soon to be former) CEO5 in early August that was interesting at the time and absolutely wild in hindsight. While I won’t rehash the whole call, there’s one or two tidbits that are worth sharing with the same “how do I avoid the next Intellego” though in mind.

Let me start with my big takeaway from Intellego: there were a lot of reasons to pass on Intellego. As I’ll detail, to say Intellego had a ton of red flags around it is an understatement.

But, even if you put those red flags to the side, there was a pretty easy reason not to invest: it was literally too good to be true.

Intellego’s core business is UVC dosimeters. This video is short and shows what they do nicely, but basically a dosimeter is basically a color changing sticker. You put it in a room or on a surface that you’re about to disinfect with UV radiation (basically ultraviolet light), and it changes colors when exposed to the light. That’s a valuable signal; light is a great disinfectant when properly administered but it’s all too easy to accidentally have something too far away from the light source or not expose it to light for long enough and wind up in a situation where you think something has been disinfected but it’s actually still dirty / you’re risking potential contagion.

Intellego’s pitch was pretty simple, “hospitals would rather spend a dollar for dosimeters than be exposed to the enormous downside of using a product that wasn’t properly disinfected.” That’s a really attractive pitch; disinfection is an enormous market, and you could see how the pitch would get bulls dreaming of multi-billion TAM. Management wasn’t exactly pouring cold water on those dreams as they would publish enormous long term targets; for example, from the Q1’25 report “The company has previously said that its 3–5-year financial goal is to reach above 2 billion SEK in revenue. However, the group now see that with the right investment, the group can reach over 10 billion in sales in the next 5 years”.

Here’s where the too-good-to-be-true part comes in: UVC dosimeters aren’t exactly an unknown technology; a quick amazon search reveals a heck of a lot of options for dosimeters. Sure, maybe a hospital grade disinfecting system needs something better than a color changing chameleon sticker, but this technology isn’t some wild revolutionary breakthrough. Intellego was guiding to more than 700m SEK in revenue and 400m SEK in EBIT for 2025. In USD, that’s ~$70m in revenue and $40m in profits, making Intellego a very large and profitable business…. and an extraordinarily fast growing one; revenue was ~260m SEK in 2024, and the company was suggesting >10B SEK (~$1B in USD) in sales in five years.

I could never find a single person who could explain to me why Intellego had a right to make such enormous margins and insane growth on a technology that seemed so simple / commoditized. I’d hear bulls wave their hands and say “probably some type of patent?”, but I’d never really hear a good answer why this was a defensible market that should yield such high profits / growth. And it’s not like Intellego was spending insane amounts on R&D; Intellego appears to have capitalized their R&D (their financials don’t break it out clearly). At the end of Q3’25, they mention SEK 10.285m in capitalized R&D costs…. about $1m USD. That is not much research to support a business generating 50%+ operating margins growing over 100% year over year!

There were other issues too. Intellego was running an enormous accounts receivable balance (we will discuss this much more in the “red flags” section, but for now I’m only discussing this from a business perspective). They tried to explain the receivable balance away by saying that they initially had to offer customers really crazy payment terms to try their dosimeters, and then customers got used to the payment terms and refused to switch to more normal payment terms. For example, from the Q3’25 earnings release, “Since 2023, Intellego has offered extended payment terms as part of a deliberate strategy to increase market share. Over the past year, we have gradually begun shortening these terms to improve cash flow and strengthen the company’s financial position. The transition is taking longer than expected, as customers have become accustomed to longer payment periods and the associated liquidity benefits.”

Again, ignore the red flags with the accounting and everything for a second… have you ever heard of a business that needed to offer year long payment terms to sell a product? I have not6! Remember that Intellego was claiming to be growing ~300% year over year and selling a product with 50% margins; how could the product be this in demand from customers yet customers were refusing normal commercial payment terms? And, in particularly, who’s heard of a financing needing huge financing terms on a core product that would cost like a buck per use?

One thing I’ve been trying to train myself on recently: the investment universe is large. If you’re researching something and there’s some type of behavior or action that doesn’t make any sense, it’s generally better to just step away. Intellego had that in spades: it made no sense that they should be growing this quickly given my understanding of their products and technology, and it made no sense that they’d have this much trouble collecting from customers if their product was really selling this quickly. Combine the two and it was clear something was wrong.

But while that “I don’t get it” combination is what ultimately made me pass on Intellego, there was a lot more under the hood here. There were so many red flags at Intellego that it’s kind of comical with hindsight. It’s honestly hard to detail them all (though this post does a great job), and some of the claims get really into the technical weeds…. but I think these three would be pretty easy red flags that even casual due diligence would reveal:

“Beat and raise” on steroids: At the end of August, Intellego guided to over 700m in revenue and 400m in EBIT for all of 2025. Two weeks later, they announced they’d already hit that target. I know managers like to set the guidance bar low and so they can beat and raise…. but I’d suggest smashing through full year targets set two weeks earlier and PR’ing that out falls closer to “trying to pump the market” than “setting the bar low.”

The August 2025 beat and raise was the most extreme…. but the company had been issuing weird guidance beats for years.

Incremental margins made no sense: As mentioned, in August Intellego guided to over 700m in revenue and 400m in EBIT for all of 2025. Intellego’s initial full year guidance came in February 2025 had been for over 500m in revenue and 160m in EBIT for all of 2025 (which in itself represented insane growth from 2024’s ~260m in revenue). If you believed those numbers, the business was going parabolic. But look at those numbers: from February to August Intellego increased their sales guidance by ~200m and their EBIT guidance by over 240m, which implies that the business was experiencing negative incremental costs. How?

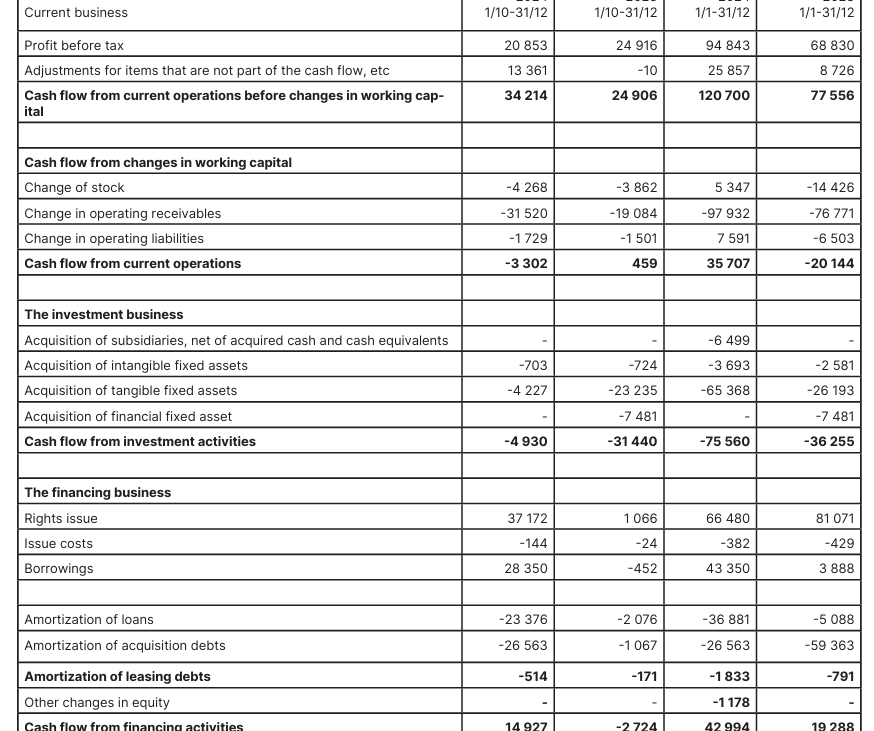

Cash flow badly trailed net income: below is a screenshot from Intellego’s 2024 AR. If you look at the “cash flow from current operations line”, you can see they generated basically no cash flow over the two years despite reporting hugely positive profit before taxes because working capital and particularly operating receivables were exploding.

Again, those are just a few of the red flags at Intellego7, and just writing them seems crazy in retrospect.

But there was a reason people were long this stock despite the red flag. Heck, just to throw myself under the bus, I admitted earlier that I was very tempted by the company despite all of the red flags! Bulls would say, “The upside here is enormous, and while there’s smoke around Intellego, it’s slowly clearing up… as the smoke clears, the stock will reflect the explosive growth / upside.”

I think the main thing bulls would point to as a reason to ignore the noise and think the upside was real came from customer checks. It wasn’t hard to get someone on the phone from an Intellego partner8 to talk about their partnership with Intellego, and the feedback there was universally good (at least from the calls / checks I did). So bulls would say that you’ve got major customers / partners validating the technology, and all of the other smoke around the company was slowly clearing up9. That combination would create explosive upside as the growth continued.

As mentioned earlier, another big red flag was Intellego’s accounts receivable balance, and I think a lot of bulls dismissed that concern by saying, “who really cares if the payment terms are 90 days or 900 days? Revenue is tripling and profits are exploding!” And bulls took comfort in Intellego upgrading their auditor to Deloitte10 and the Swedish Export Agency had entered a deal to factor their receivables. If two knowledgeable parties were willing to sign off on / bless / lend against the accounts, how could there be any issues with the accounts recievable11?

Anyway, I’m going to largely wrap the story up there…. but I did want to share one last tidbit from my Intellego research: my call with their (again, I assume soon to be former) CEO. I had a call with him in early August to talk about the company. It was a really weird call (my first notes from the call were “weird call”) for a bunch of reasons, including that he showed up ~ten minutes late. I won’t get into all of the details of the call, but there is one specific thing that I’ve been thinking about a lot with the benefit of hindsight that might be interesting.

I spent most of the call pressing on my key question: how could a product that seemed so simple / commoditized generate such high margins / insane growth? The CEO was pretty dismissive of those concerns (at least in my opinion), and on the heels of the call I would have a lot of mental debate with myself: was he dismissive because he was crazy, or was he dismissive because there was something so good about the product that he knew he had the right to be dismissive (was Steve Jobs crazy to be dismissive of the Zune?). The interesting thing is that he was quite cavalier on all of my questions about competition…. but he was completely honed in when I asked him questions about the company’s accounts receivable. Multiple times he told me “our one weakness is accounts receivable” or “we know that the receivables are our big weakness.”

I’ve heard CEOs mention receivable as an opportunity to improve (i.e. bring receivables from 60 days to 50 days and ROIC improves markedly!), but I’ve never heard a CEO say they were a weakness, let alone the company’s sole weakness! It just seemed like a really weird focus / Achilles heel for a company whose products were so in demand that revenue was set to ~triple, and it seemed like a strange thing for a CEO to be so singularly focused on.

Let me hard transition back to the CEO’s dismissal of competitive threats. At one point, I asked the CEO about the R&D that went into creating Intellego’s products, and he suggested it wasn’t much. From memory12, he said that Intellego had spent a couple million in R&D to create them. Later, we talked about competition, and he explained how large potential competitors (like 3M) would face a “buy versus build” decision and, while the price would be high, ultimately find the potential competitors would find it cheaper to buy Intellego for a big premium than develop the products themselves. I paused him and asked how that could be possible; earlier in the call he had told me Intellego had spent maybe a few million developing the products. He told me that the way big companies worked is the R&D function would be incredibly slow and burdened by excessive costs. I found that to be a strange answer at the time; how could someone believe that a big company is so cumbersome / bloated that it would cost them hundreds of millions and years to recreate a product that was developed on a shoestring budget? So I found that answer strange at the time, and I’ve been thinking about it more and more in light of the recent scandal.

I don’t have any major takeaways or anything from the experience. But (again) I wanted to put my thoughts to paper because I thought readers might enjoy the story and the whole experience is definitely something I want to carry forward to future research / diligence (for example, in the future when someone pitches me a hyper growth story with some red flags, I might forward them this article and ask them why this new hyper growth story isn’t Intellego 2.0!).

PS- one last note. I mentioned earlier that the customer feedback at Intellego was quite good; this good feedback largely came from Intellego’s major partners. One interesting tidbit is Intellego’s stock went down massively just a few days before the CEO was arrested because investors were shocked by the Q3’25 earnings. Why? Among several other things, the part of the business everyone thought was most valuable and growing quickly was the curing business, and Intellego’s Q3 earnings revealed that business was much, much smaller than most investors thought; it’s not a stretch to call the biz “nascent”. I actually think that disclosure helps square the “how do customers say they love this business in calls” with the “what the eff happened here” paradox; Intellego’s partnerships were largely on the curing side, and that’s where the good customer checks were coming from. The Q3 call revealed that all the good checks / proof points the business was real were coming from a tiny faction of the overall business (though I don’t think it solves it entirely by any means!).

As always, nothing on this blog is investing advice. See our legal disclaimer

To make this super explicit, one reason I wanted to post this is because when you research something and pass for any reason, and then the stock rips up, it can be very difficult to sit there and watch everyone make money. You feel really dumb. The more I do this, the more I understand the Soros story of selling into the dotcom bubble…. only to buyback in aggressively at the top. If you pass on something at $50 and it goes to $100, it’s so easy to think “why don’t I just chase it” and lose money on both sides!

This is a really polite way of saying “there’s a decent chance this company collapses; it’s not worth having that smoke on the podcast”

Perhaps this isn’t fair… maybe Intellego can rise from the ashes! Maybe the arrest was a big misunderstanding. We’ve seen crazy things happen before!!!…. but I suspect the end is nigh.

As I was getting ready to publish this article, Intellego announced the CEO had stepped down / been replaced by a board member as interim CEO.

Businesses selling very expensive products, like cars or airplanes, might offer financing options, but that’s financing, not generic accounts receivable

There were many more red flags: constant executive and board turnover, customers who denied ever knowing the company, weird financing schemes, weird buyback schemes, and I believe there were multiple grammatical and mathematical errors in their financial statements….. and those are just off the top of my head! There were more!

In particular, I’d note Intellego had a partnership with Henkel; Henkel’s a mammoth company with a lot of employees, so it wasn’t hard to find someone who’d worked at Henkel and had some exposure to Intellego’s products.

For example, Intellego used to have a part-time CFO, and they’d upgraded to full time, though they had to change CFO’s pretty quickly

I’ll refer you again to that incredible quote I started the article with, “Could this guy be a financial manipulator that fooled Deloitte (as of YE ‘24), the EKN, countless investors, distro partners and now a new credit partner? Ok, sure. Probability? Very low, imo.”

Yes, benefit of hindsight I realize that seems crazy, but this VIC post serves as one of the many examples I saw of this defense. I thought about that VIC post and the back and forth quite a bit over the summer; message 28 included the (legendary, IMO) line “Are we day trading frauds now based on vibes?“ that inspired this tweet from me.

I didn’t write the specific number down in my notes, and I’m too lazy to go back through the mess that is Intellego’s financials and recreate it.

I passed at 25 SEK.. could've been an 8-bagger. But the story also didn't make sense to me at the time.

In today's market you don't need to be right to make lots of money. And while this mostly goes for stuff like quantum stocks etc. it proves true here too.

Definintely one of the most interesting stocks to have watched over the past year!

I held my nose, bought and sold in time to make it 3-bagger. What concerned me was their patent expiry. The price then became too high to earn its price.