REITS, Private Market Discounts, and Déjà vu at $FSP

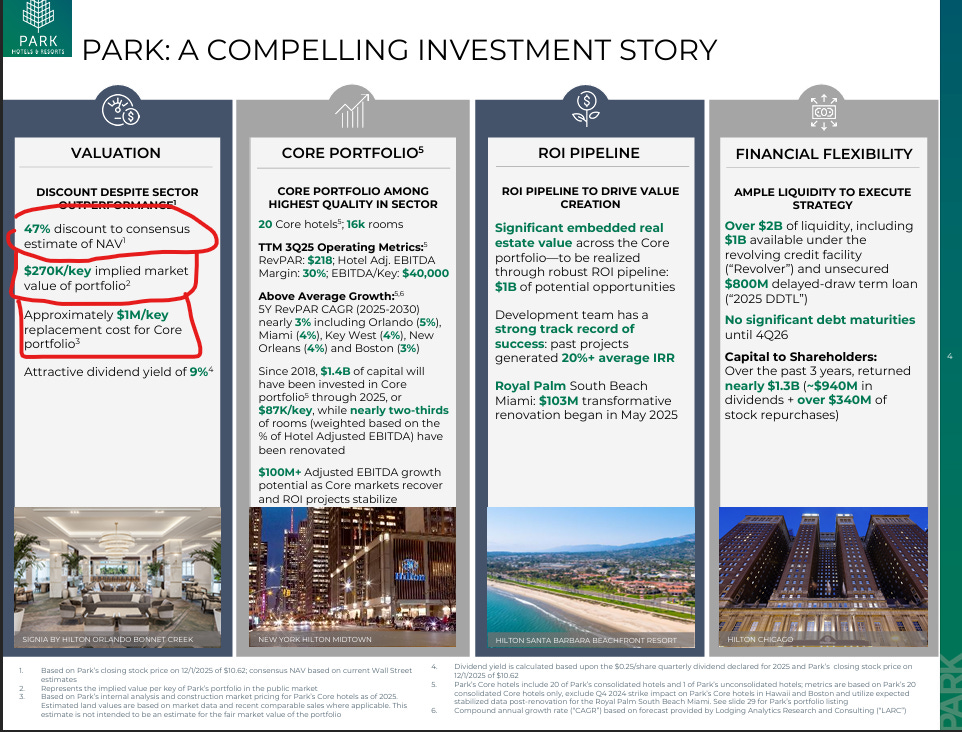

One corner of the market I find fascinating right now is real estate. There are a lot of REITs (and REIT-adjacent) companies that are trading for a large discount to their private market values1. Just to choose one example2: PK has consistently argued that they trade for a huge discount to their NAV and a fraction of their replacement cost.

But you don’t just have to take REIT management teams at their word; we’ve seen a string of publicly traded REITs get taken out at juicy premiums. I’m sure I’m forgetting a few, but off the top of my head in the past few months we’ve seen:

ALEX get taken out by Blackstone for a 40% premium

Peakstone get taken out by Brookfield for a ~45% premium

Plymouth get taken out by Makarora for a ~50% premium

Obviously every company (and REIT) is different / unique…. but when you see three companies in the same industry get taken out for a massive premium by financial buyers and the premium matches the discount public market players are saying they trade at versus private markets…. well, that’s very confirmatory!

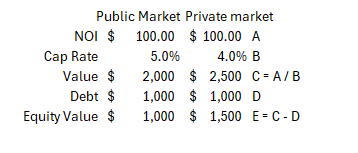

Now, REITs3 are generally valued on a cap rate (NOI divided by value). Cap rates vary by building location, quality, type, etc. (a thirty year office building on the outskirts of Detroit is probably going to have a higher cap rate than a brand new apartment complex in Miami), so you can’t paint too broad a brush, but in general real estate cap rates track interest rates and are in the mid to high single digits right now. For example, MAA owns apartment buildings and they’ve talked about core assets having “cap rates in the, call it, 4.6% range”.

REITs also tend to employ a decent bit of debt; just sticking with MAA, they finance ~30% of their assets with debt.

The combination of pretty low cap rates with “employs a lot of debt” creates a very interesting setup: you can find REITs that are massively undervalued on a private market basis but where the long term returns from holding them might not look that interesting to a person who compares themselves to equity benchmarks.

A hypothetical might show this best. Pretend that a publicly traded company owns a bunch of apartments. The stock is trading for a 5% cap rate and is 50% debt / 50% equity; however, similar apartments are trading in the private markets for a 4% cap rate. With those metrics, the stock would be trading for a 50% discount to private market value…. which is completely consistent with the takeout premiums we’ve been seeing in the recent PKST / ALEX / PLYM deals I just listed!

Why do I find that math so interesting?

Because consider what happens if you don’t get taken out; then you own the REIT and will earn its underlying economics. If you’re buying at a 5% cap rate for the whole company and they’re using ~50% leverage, then the return to equity holders will be somewhere between 6-8% (depending on what you assume4 about cost of debt, SG&A burden, rent inflation, etc.). That’s on the lower end of what people generally expect5 from equity investments.

So REITs present this really interesting dynamic: in a sale, you can realize this really big pop by instantly closing the gap to private market value…. but, if you have to buy and hold them, your returns will probably be middling / well below what most active managers are looking for in an equity investment6.

The trick would be to identify REITs that are about to sell themselves and close that gap to private market value. Unfortunately, identifying REITs right before they sell themselves is much easier said than done. I am of course always open to hearing great ways to identify companies right before they sell themselves for huge premiums (my DMs are always open), but outside of engaging in some very extralegal tactics (hacking into corporate emails, spying on executives, etc.), the best way I know of to find REITs that are about to close the gap between private and public market value is to listen to the companies themselves: if a REIT (or real estate company) announces they are for sale, I try to pay attention / see if there’s a big private market value gap.

All of which is a very long winded way to bring me to Franklin Street Properties (FSP). FSP is a REIT that owns ~14 office buildings in ~four markets (Dallas, Denver, Houston, Minneapolis). To put it kindly, these are not exactly pristine assets. Office buildings in general aren’t exactly en vogue, and older office buildings with <70% occupancy (FSP’s occupancy at their last quarter was ~69%; nice for the memes, not so nice for the owner!) are basically toxic right now. Of course, you probably didn’t need me to tell you that low occupancy office properties aren’t in high demand; anyone who has followed public (or private!) markets for the last ~5 years knows office is not great, and a quick glance at FSP’s stock chart would have reaffirmed everyone’s priors:

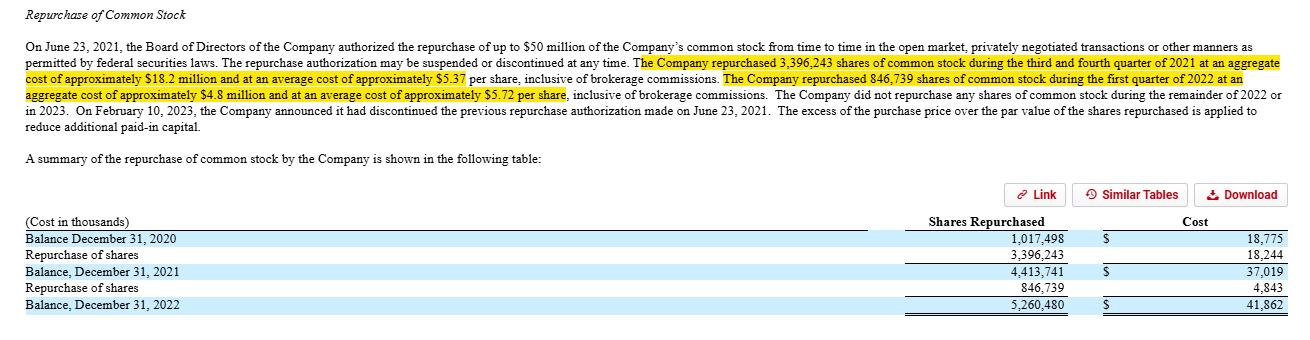

FSP doesn’t have their head in the sand about where their assets stand in the public markets; over the past few years, they’ve been selling down properties to pay down debt and even buy back shares (they had been buying back shares until their lender forced them to stop as part of a refi in early Feb 2023; let’s just say the >$40m of stock they bought back at >$5/share isn’t going to win them any “Capital Allocator of the Year” awards).

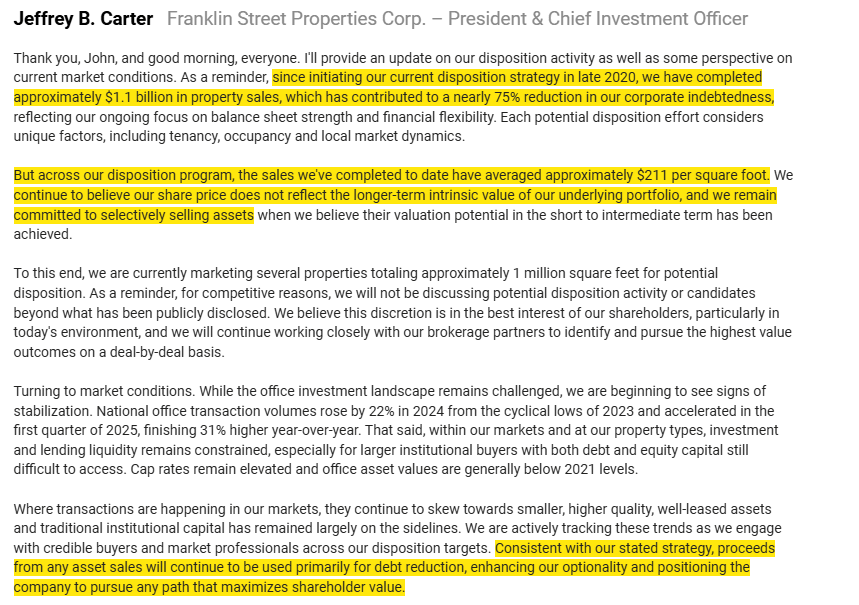

Anyway, I’ve had FSP on my radar because (again) I try to follow any REIT that announces strategic alternatives or anything just given the huge premium take outs I’ve seen / the public to private discounts we’ve seen. I’ve been following FSP for a long time7, but my interest has been piqued up since their Q1’25 earnings call when they said they were “actively considering all options from operational adjustments to strategic transactions and are consulting with several third-party professionals in that regard.” That earnings call is the last one they’ve done; in Q2’25, they formally announced a strategic review with BofA and they haven’t hosted an earnings call since.

For years, FSP has been pounding the table that their stock price does not reflect their intrinsic value. Over the past ~5 years, they’ve sold $1.1B of properties at >$200/SQF. Their current stock price (~$0.80/share8) values the whole company (including debt) at well under $100/SQF, so if you believe the current portfolio is worth anywhere close to what they’ve sold prior buildings at the stock is a multi-multi-bagger9.

So the combination of “highly levered company trading for a discount to where they’ve sold properties” and “running a strategic review that will accelerate / unlock that value” is what got me interested in FSP/ why I’m following.

But, humorously, none of that extraordinarily long winded intro is why I’m writing this article. The reason for me writing this article is one of my favorite things to look at in the public markets is situations that have never happened before. And last week FSP did something I’ve never seen before: they issued a press release.

Ok, that’s being coy. Obviously companies issue press releases all the time, and, as far as press releases go, there’s nothing particularly unique about FSP’s. FSP’s press release is actually pretty typical for a company with a long running strategic review and a stock price that has been hammered (the stock is down ~15% on the year and ~33% over the past three months on no news that I can see), and it can actually make sense for companies undergoing a strategic review to put out a press release noting there’s been no news to drive the stock down if the stock gets randomly hammered; imagine being a bidder in the final round of bidding for a company and seeing their stock price suddenly dive. Would you have second guesses about your bid? I know I would! I’d be wondering what the market was seeing, why the stock was diving, etc. I’d obviously still be wondering that after the company put out the PR, but you can see why trying to stabilize the market certainly makes some sense when you have a process ongoing10!

So FSP’s press release simply says “the review remains ongoing, and we’re negotiating with our lenders.” Again, pretty standard fare for a company undergoing a strategic review that’s seeing their stock price dive. What is atypical about the press release is it’s basically a carbon copy of a press release FSP put out at the end of November. That press release noted that, despite the stock price decline, the strategic review was ongoing and the company was negotiating with their lenders.

Now that is strange! I can think of a lot of companies that have put out releases on strategic reviews as the stock drops / markets get volatile. I can’t think of a single company that has put out two separate press releases saying “all is fine” during the same review!

So what is going on here?

It’s obviously impossible to say for sure from the outside, but given the timeline and event path here I think we can make a very educated guess.

FSP has been engaging in a slow moving liquidation for the past ~5 years. At the end of 2021 they had 24 properties, and they had gotten down to 14 properties by the end of 2024. Today, they still have 14 properties. So with a long term slow moving liquidation in the background and a strategic review ongoing for almost a year, FSP has made no progress on getting rid of more buildings…. and their term loan comes due in April of this year (2026).

Given all of that, my guess is that FSP has gotten deep down the path of a big deal a few times over the past few months only to have their counterparty drop out. Today, the company finds themselves between a rock and a hard place: they expected a deal to be in place by now, but after several fits and starts they’ve got no deal and their loans are coming due.

Will FSP be able to roll their loans? Probably. There is asset value here, and lenders are loath to foreclose on properties (why not extend and pretend and let the operator continue to try to figure it out?). I’d guess FSP extends their loans, limps along, and eventually finds a deal that probably has upside from today’s share price.

But I will be honest; I love to buy distressed / beaten down assets that make people want to vomit when they look at them…. and FSP is too nasty even for me.

What a messy (and fascinating) situation.

Odds and ends

Gun to my head, I’d guess that two things are true:

The most likely outcome for FSP is the equity is seriously impaired

Despite impairment being the most likely outcome, FSP is a very positive risk/reward from today’s price just given the pure asset discount / huge leverage.

If I believe FSP is a positive risk/reward (as I posited in the bullet above), why don’t I have a position here? I will be honest: I would take one if I got a check on the value of a few of their buildings. To date, I haven’t, and my history with real estate companies in semi-liquidations is that the better assets are sold first and the last assets to be sold always disappoint, so I’m worried what is left here is really problematic / going to require a huge haircut. It’s also not super promising that the company has twice had to put out PR that included something along the lines of “don’t worry guys; we’re in active negotiations to extend our debt that is due imminently.”

FSP is also burning cash / FFO negative. Asset values really shouldn’t be impacted by near term FFO, but mentally I find it much easier to think about buying REITs that are generating cash versus ones that are burning cash.

Alignment should be pretty solid here. Erez Management (which has gone activist on several REITS, including a new campaign at Veris) sits on the board and owns >3% of the company. The CEO’s sons serve in the C-Suite, so you could worry about nepotism…. but the CEO also owns >1m shares, executive compensation isn’t outrageous for a REIT, and the situation looks dire enough that I’d think everyone would like to save face and hit the bid (if there is one).

Clark Street Value had a nice, brief summary of the set up over the summer.

I chose this example just because it’s laid out so easily in this slide; trust me that there are plenty of others!

I’m using “REITs” as a quick, casual way to describe real estate overall; please forgive my casual-ness!

These are all big assumptions! I’m just trying to illustrate a hypothetical; obviously every REIT and individual asset will look a lot different!

Again, these are big assumptions! On the bull side: I’m probably light on the rent growth, and I give no credit for the relevering possibility as NOI grows. On the bear side: I haven’t really adjusted for corp SG&A, and management teams have a nasty habit of continuing to reinvest by buying private market assets at 5% caps while their stock trades at a 6% cap (thus diluting and squandering the discount over time).

I think you could very coherently make the argument that earning 8% in a generic REIT is much lower risk than the generic market. That’s probably true / probably why the private market values a lot of real estate at such low cap rates! But if you’re an active manager getting paid for putting up good returns, saying “hey, we delivered below market returns for years but we didn’t take a ton of risk” doesn’t exactly by the bills!

I think this VIC write up first put them on my radar

This is a very small company! I have no position, am highlighting this because it’s interesting, not investing advice, etc. etc.

That said, office is a disaster, the portfolio is low quality, and there is a ton of debt here. I have no position; you can probably read between the lines on how I think about the risk/reward here.

I’d be fascinated to see a court case on this, but it might also encourage buyers to bid because it gives them an MAE out if the business actually is imploding. If the business is imploding and the company puts out an “all fine” PR and announces a deal the next day, then the buyer could make a coherent argument to the judge that the company had breached their reps and warranties as part of the deal? Again, I’m not positive, and I’m not a lawyer, but it’d be an interesting case!