Icahn versus Paulson: the $BHC "challenge" trade

Whether it’s fantasy or real, trades and transactions are huge part of what makes sports fun.

Structured well, most trades should have some type of win/win component. Consider fantasy football: if I have four great wide receivers and no running backs, and you have four great running backs and no receivers, there’s the makings of a trade that works for both of us.

But not all trades need to have a win/win component. One of the most interesting trades is what has come to be known (at least in my circles) as a “challenge” trade. An example will make this really easy to understand: I think your running back is better than mine, you think my running back is better than yours, so we do a “challenge” trade and swap them. Each of us is betting that we’re a better analyst than our counterparty, and we make that trade betting that we’re right. In contrast to the win/win nature of swapping receivers for running backs when we each have a deficit in one and a surplus in the other, a “challenge” trade is zero sum as one person will be proven correct and have improved their team by upgrading their running back, while the other person will have made a mistake and hurt their team / have a worse running back.

Turning from fantasy football back to the stock market… markets are a zero-sum game, so basically every time you buy or sell a stock you are making a challenge trade: if you buy a stock, you are betting that stock will create generate positive risk-adjusted returns, while the seller is betting that the risk-adjusted returns of the stock will be below wherever they are redeploying that cash. Are there some exceptions to that rule? Sure, perhaps you’re buying from a forced seller on the wrong end of a margin call, or the maybe seller is selling to lock in a tax loss…. but those exceptions are pretty rare and, even then, you’ve made the decision to buy before other people have, and thus you’re betting that the price dislocation now is big enough to justify all of the other potential unknowns / risks even though other buyers by definition don’t think the discount is large enough yet (or else they’d have stepped in and bought)!

Unlike fantasy football, investing is a largely anonymized game; you rarely know who is on the other side of the trade, and you certainly don’t know if they have information different that you do. Almost all trades happen because you press the buy or sell button in your brokerage account and buy/sell anonymously from someone else on the internet. It’s pretty rare that you can point to the other side of a trade, and when you can point to the other side of a trade it’s often scary because you don’t know what they know. For example, say a private equity firm owns 20% of a stock and is selling it all in a block…. are they selling because their fund is end of life, so buying their sale is an opportunity to buy a block at a discount? Or are they selling because they’ve interacted with the management team for years and think they’re losers and have checks through their portfolio company that the industry is falling apart, so buying this block is buying into a business right before it implodes?

Why do I mention all of this?

Last week we saw maybe the most interesting “challenge” trade I’ve seen in the stock market: John Paulson bought ~35m shares of BHC (>$300m of stock) at $9/share from Carl Icahn1.

(Clip from Icahn’s 13-D showing the sale)

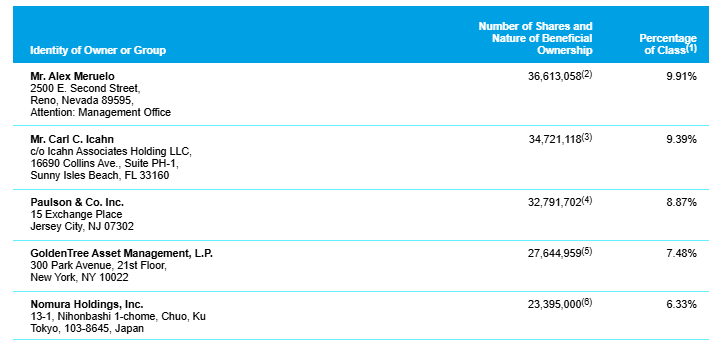

What’s so fascinating about this trade is that both Icahn and Paulson should have near perfect information on BHC. Not only are they BHC’s ~largest shareholders (per the proxy)…..

…. but they each have board seats, so they should be very well informed on the company’s outlook and strategy (Icahn’s son is on the board plus Steven Miller also works at Icahn and serves as a board member. Paulson himself is on the board).

Now, reasonable people can be on the board of a company and differ about valuation and the attractiveness of a stock / company. But BHC is a very unique case; BHC is the husked-out remains of Valeant (of Ackman / Pershing fame). For the most part, the value creation potential at BHC is very clear: BHC is massively overlevered thanks to the old Valeant days; however, BHC owns just shy of 90% of BLCO. The core question for value creation is if BHC can spin off (or sell) their huge stake in BLCO and get the majority of proceeds to shareholders, not debt holders2.

Which is why the challenge trade is even more interesting: both Icahn and Paulson are part of BHC’s board room discussions on liability management and financial engineering. Paulson apparently is sitting in those meetings thinking “I’d love to own a ton more of this thing; we’re going to shift so much value to equity” while Icahn’s team was thinking “O man, this seems a long shot…. wish we could get our money back!” and the two found a trade to express that.

There’s one more really interesting twist to this story: the share price of the block trade. BHC’s stock was trading in the low $6s to ~$7/share before the Paulson / Icahn block trade. That price was a little influenced by Paulson; in the days leading up to the Icahn trade you can see he bought >3m of stock, with the first buys in the low $6s and then over $7 as the market ran up:

But the Icahn / Paulson trade happened at $9/share, a massive premium to the market price! Which begs the question: why the premium? What were the two seeing that lead them to settle on $9/share?

Icahn sold ~10% of the company to Paulson. In general, if you’re looking to sell a block that big, you need to offer a discount to the market price to account for liquidity / how big the block is. For example, if Icahn had gone to an investment bank and said “I’d like to unload ~10% of BHC,” I’d guess the bank would have told him he’d be looking at a 15-25% discount (i.e. if the last trade was $7/share, Icahn could probably move the block for ~$5.50/share), and perhaps largely given investors would (rightly) panic if they heard a sophisticated board member was looking to sell out of their entire stake. Paulson and Icahn both know a large block generally trades for a discount, and that had to have some influence on the negotiations here. Personally, if I was in Paulson’s shoes and Icahn wanted out of a big block, I’d be asking for a big discount…. yes somehow the two negotiated a big premium to trade this block! I wonder what drove those negotiations! What was each side looking at that made them settle on a premium to market prices, but also made Icahn want out of the stock while Paulson wanted more?

There are lots of possibilities here, but I think the most likely is that Icahn and Paulson both agree there’s a clear path to large value realization at BHC (even if the market is skeptical!). Remember, BHC shopped their BLCO stake earlier this year but eventually pulled the sale; today, BLCO trades for ~$14/share. Maybe Paulson and Icahn both know there was feverish demand for BLCO at >$20/share from buyers, and that the company is planning on running another sale process later this year. So, with line of sight to that value creation, Icahn could go to Paulson and say something like, “BHC is going to work well. You know it, I know it, our board knows it….. but I need liquidity elsewhere in the portfolio, so pay up to take me out and we both know that this will work well for you.”

If that is correct, it suggests $9 is a pretty opportunistic buy from a buyer (Paulson) who knows a heck of a lot about the company, and with the stock languishing around $8.35/share on the heels of the deal, the stock is probably a pretty good opportunity.

Which begs the question: is that the correct read of what happened? Honestly, no idea! I think that line of thinking makes sense / is probably correct, but I will admit that BHC is about the sharkiest name I can imagine (distressed funds are all over every angle of their docs), and I’m a little scared to take a position without a full time distressed analyst dedicated to covering the company! So no position for me, but it was such an interesting challenge trade I figured I’d right something (and kick myself if and when $9 proved to be a steal!)

I wrote most of this Friday morning; the company published a PR detailing the trade and that the Icahn representatives are resigning from the board Friday afternoon. Don’t think that changes anything I’ve written, but just noting in case there’s anything I write in this that sounds a little different with the clarity of that PR!

The BLCO stake used to be largely unrestricted, so it used to be a simple question. However, BHC pledged just over half the stake in their most recent bond refi, so the question has gotten a bit murkier as now you’re kind of betting on getting half the stake out to equity holders plus whatever value is left at the stub…. but for simplicity this is still an easy way to think about it!

There's a lot more going on than you wrote in the article. Icahn also had something like 24% economic (but not voting) interest in cash-settled swaps, so if he still holds them, he had a selfish reason to not tank the share price. It's also possible he wanted to get his people off the board and unload the shares so that he can be free of the insider label do whatever he wants with the swaps whenever he wants.

Or, maybe it was Paulson that wanted to add to his share holdings (he also bought more than 6 million shares in June; before that, he held around 25 million shares compared to 70 million now) more than Icahn wanted to unload his shares, and so the negotiated price was higher than the market price. Or, maybe Icahn unloaded the shares to raise some cash but entered in more swaps. So it's not clear to me that this is a challenge situation; they might be on the same side, even if not working together, (e.g., Paulson buys up Icahn's shares to give Icahn more flexibility to enter into more swaps, and the swap counterparties have to buy more shares to hedge the swaps, pushing up the shares even higher, benefiting them both). Or they might be trying to buy the company outright.

Also, Paulson is the chair of the board, not just any old board member. Additionally, a few months ago, a shareholder rights plan was proposed (and to be voted on in a special shareholder meeting in October).

As far as I understand, the main thing preventing the distribution of the BLCO to stakeholders has not been the objections of debtholders, but instead the opt-out litigation; but the speed of settlements for that litigation has been accelerating, with a trial date for a number of the cases in September.

In addition to distributing the BLCO stake to shareholders, distributing Solta to shareholders would be another victory; you can look at Solta's profitability, revenue, and growth rate and a value of a few billion dollars (more than BHC's market cap) would not be unreasonable.

Re. the thing about discounts on large sales - it would seem to me that's a symmetrical thing, in that if you want to quickly buy another 10% of a company, you'd probably expect to pay a 15-25% premium. It's just that we more often see large holders try to sell their 10% than buy an extra 10%.

So I'd suggest the premium is no great mystery, it just says that this trade happened because Paulson wanted to buy, rather than because Icahn wanted to sell.

But yeah, the fact a $9/sh transaction happened between two incredibly sophisticated insiders probably suggests that's about as good a valuation as you're going to get - less, of course, a small discount for the possibility that Paulson is able to maneuver such that he gains in a way the unwashed masses don't.