Fairfax Loves Under Armour. I’m Not So Sure. $UA $FFH

Every person has some strange, quirky interest that they’re really into but most people don’t care about. I’ve got a few friends who love Harry Potter so much they got Deathly Hallows tattoos. Some of my friends are really into College Football. Or Star Wars! For my friends who are really into Harry Potter / Star Wars / College Football, they don’t just think about it much more than the average person does…. they think about it multiple times more than even a pretty active fan. For example, I’m a pretty reasonable Harry Potter fan; I’ve read all the books, seen all the movies a few times, been to the Wizarding World of Harry Potter, and even listened to a whole series of podcasts recapping the series. That puts me pretty far out there in terms of Harry Potter fandom…. but I’ve also been to a Harry Potter trivia night and gotten basically zero questions correct while teams of people with Ravenclaw shirts and Deathly Hallows forearm tattoos answer every question before the host has finished reading the question. That’s fandom!

When it comes to financial markets, there are a few things I’m a big “fan” of. One of those interests is huge insider purchases. Now, I’m probably not going to get a tattoo of the largest insider purchases in history (though getting a back tattoo of a form 4 would be hilarious), but in the same way that the people who got Deathly Hallows tattoos are way more into Harry Potter than I’ll ever be I’m pretty sure I’m way more into big insider purchases than even the casual financial fan. I just don’t think most people understand how rare truly large insider buys are (as I discussed in this article1).

Speaking of fandom (but completely unrelated to finance), there are two other things I’m a pretty big fan of.

First, I’m a really big basketball fan (specifically the NBA)! I try to watch a game a week, and I actively listen to several basketball podcasts every week.

Second, I’m a closet narcissist, so I’m a big fan of my own podcast.

Why do I mention fandom so much?

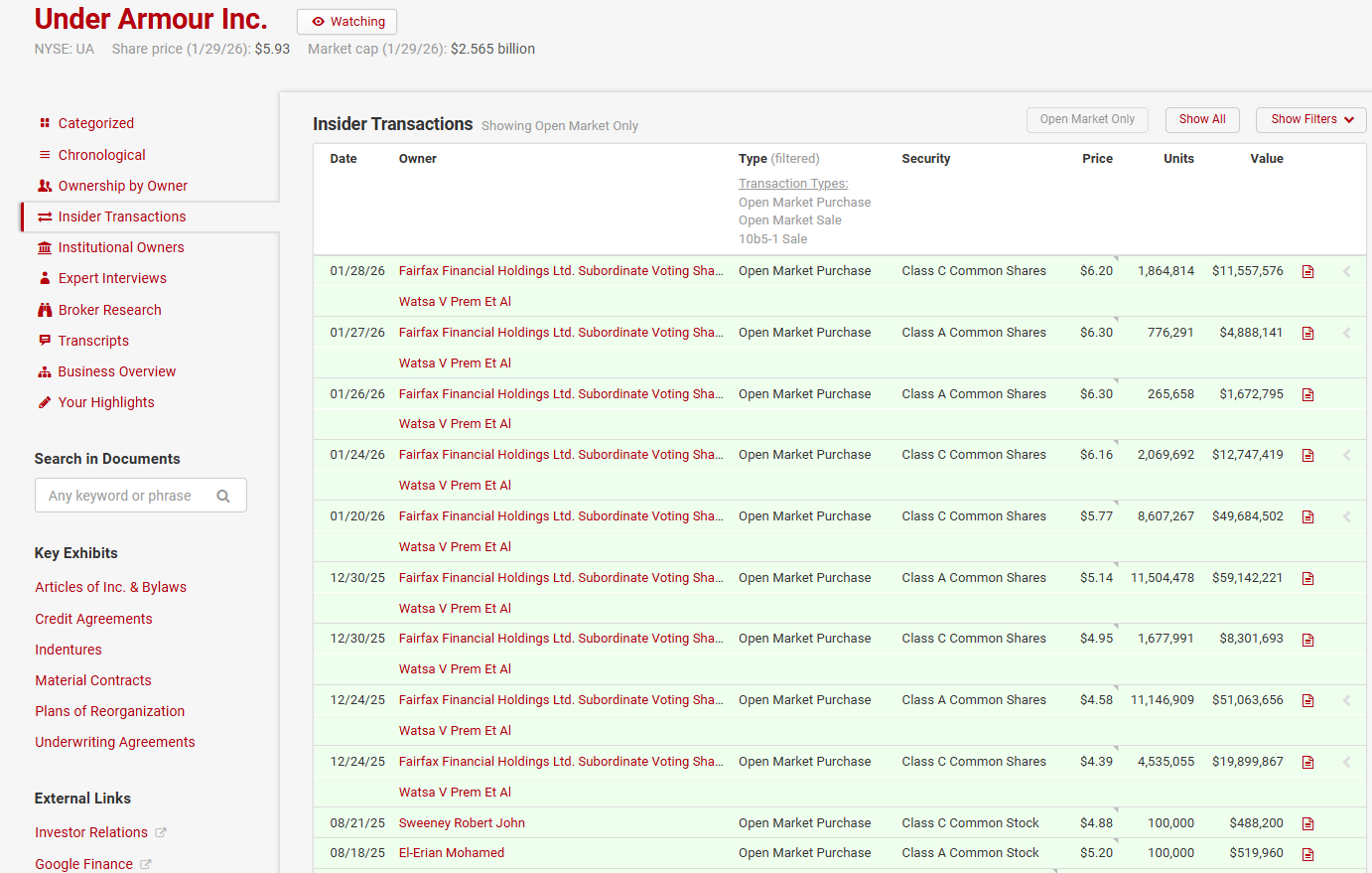

Because Fairfax has been on one of the biggest insider buying sprees I’ve ever seen over at Under Armour. In the past ~month, they’ve bought ~$220m of Under Armour stock on the open market:

So, in that one set of transactions, you’ve got something that combines three of my interests: basketball (Under Armour was the long time sponsor of Steph Curry), insider purchases, and my podcast (episode #353 was an interview with the author of the Fairfax Way). Roll those three together (and a current interest in anything Fairfax invests in), and how could I not do a post on the big buys?

Let me start this post with a confession: I don’t have a position in Under Armour (or any of the stocks mentioned), it’s really hard for me to see myself taking one, and I do not consider myself an expert in the space at all. So I’m writing this post because I’m a passionate observer / interested follower here, not because I’m saying I’m a complete expert on any of this (to be fair, I don’t think I ever position myself as a complete expert on anything!).

That caveat out of the way, let’s dive in.

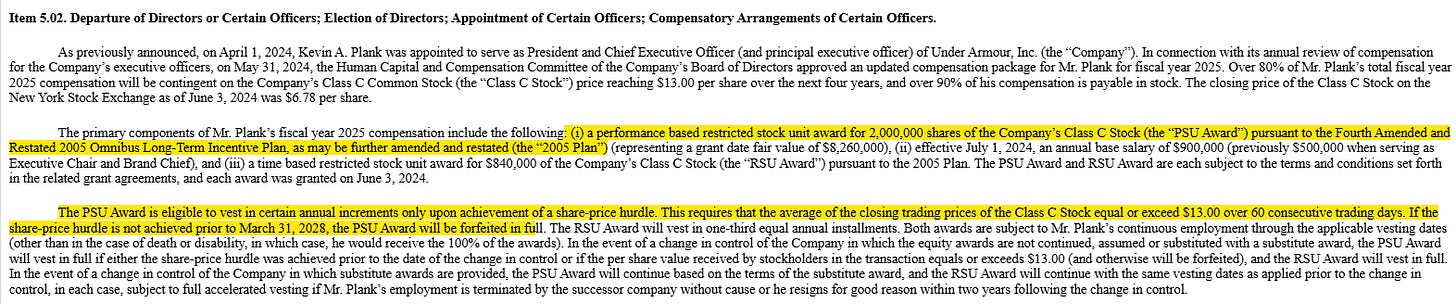

The first thing I want to note is that Fairfax is probably not alone in their bullishness on UA. Kevin Plank came back as CEO in early 2024 and, with the stock trading for <$7/share, he took a pay package that really only got him paid if he could get the stock up to $13/share within four years.

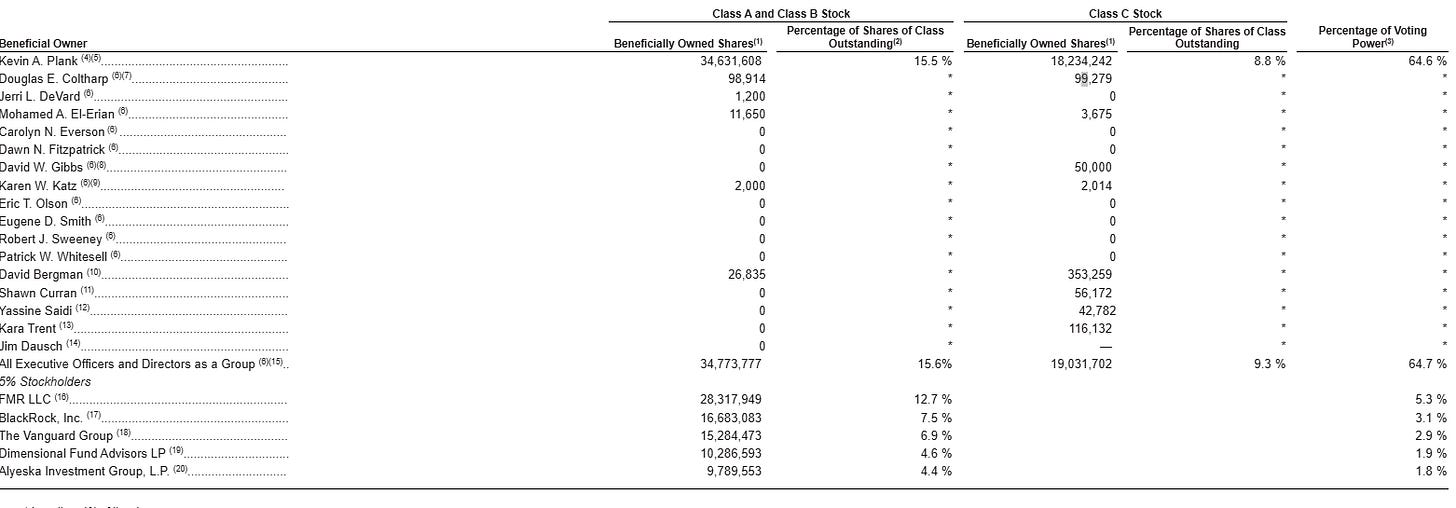

That pay package is really interesting; I love to see CEOs taking a “get the stock up or don’t get paid much” bet on themselves and really aligning themselves with shareholders, but Kevin is UA’s founder and already owned >50m shares. Given he already owned so many shares, is tossing another 2m shares into the pile really making him that much more incentivized?

On to my second point: certain investors have stocks that are in their “sweet spot”; nothing in life is certain, but sometimes when a really talented investor buys a stock that’s in an industry they really know you just know it’s going to work. Buffett was like this with banks for the longest time; there’s a story (that I’m having trouble tracking down) about a firm that was looking at Wells Fargo in the early 90s and thinking about assigning an analyst to cover it…. but when they saw Buffett had bought it they just figured “good enough” and bought the stock hand over fist.

Now, I personally never want to outsource my diligence to that extent but there are a few people who are so knowledgeable in certain sectors that if they tell me something’s interesting I’m going to spend a lot of time on it.

The counterpoint to that corollary is that there are some sectors where investors (particularly value investors) just get slaughtered every time they dip their toe into them. Department stores are probably the most famous of these killers; almost every value investor of note has bought one of the department stores over the past twenty years on a “look at all this real estate + the business can be stabilized” thesis, and every one of them has had their heads ripped off (Lampert + Sears and Ackman + JCP are the headliners, but there were plenty of others).

I’d argue that consumer retail brands are almost as bad for value investors as department stores. Perhaps it’s lack of imagination or too shallow a search on my end, but it’s hard for me to think of a value investor who has made a value focused bet on a consumer retail brand in the past ~10 years and come out of the other side with a big winner.

I think the reason these bets turn out poorly is simple: consumer retail is really eff’ing hard, and it’s getting harder. Between drop shipping, Shopify, and Instagram, the barriers to entry for starting your own consumer brand have never been lower. Value investors tend to buy stocks on a “this company looks cheap on a historical financial metrics” basis, and in a consumer retail world this competitive companies look cheap on a historical basis only because their brand is irrelevant and their future earnings are going to be a disaster.

Could an investor make a winning bet on a consumer retail brand turnaround or catching lightning in a bottle? Absolutely! But buying turnarounds or brands that are about to catch fire is a very different skill set than the one most value investors have / focus on.

Consider this: if you’re just going by stock price, Under Armour peaks in the ~2015 time frame. Obviously brands needed to have an internet strategy then, but the competitive landscape is very different in 2015 than it is today. Instagram was a much less dominant force back then, legacy retailers are waning but still really important distribution / retail partners, and the cable bundle is at the height of its powers and still an incredibly important advertising vector.

On basically every vector I just mentioned, the competitive landscape has gotten worse / the barriers to entry have gotten lower for a new brand. In 2015, it would have been borderline crazy for an NBA player to turn down a major shoe deal and launch their own line or work with a much smaller brand; today, you’re seeing a lot of players consider going that route. And the “online first” high end brands (things like NoBull, TYR, Vuori, Fabletics, and dozens of others) didn’t really exist; today, there’s dozens of them attacking basically every sport and lifestyle from multiple angles.

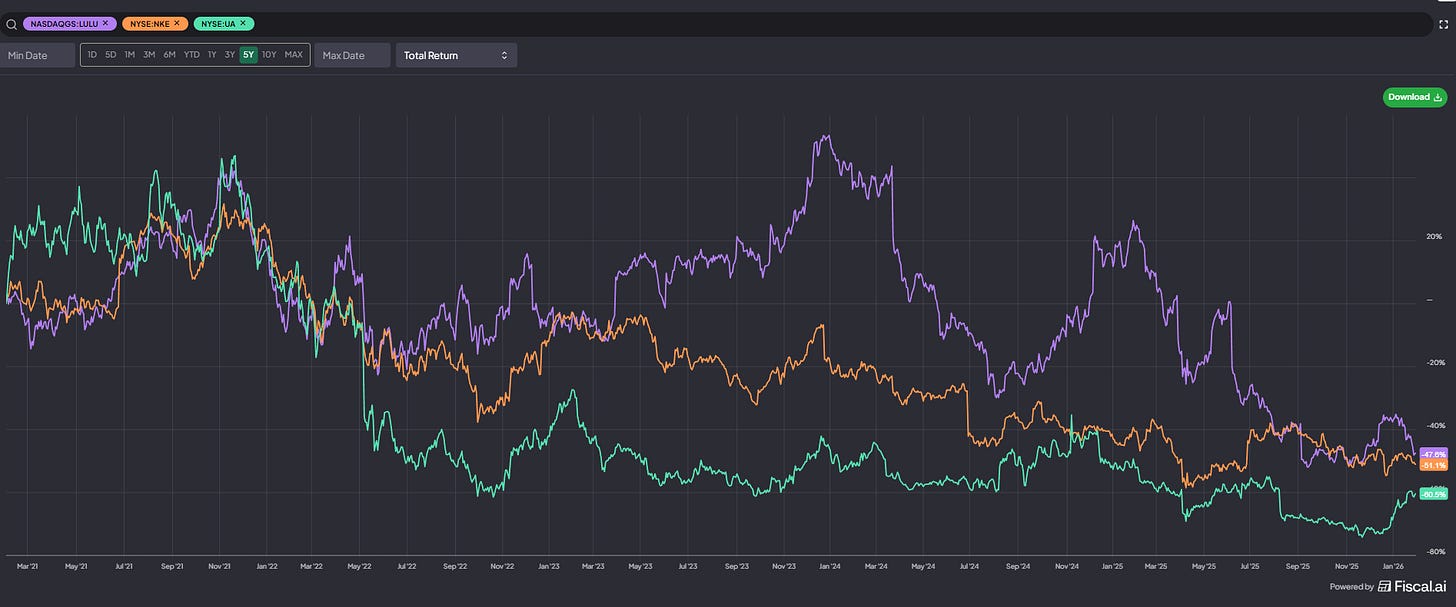

By the way, I think you can see that competitive landscape shifting not just in UA’s stock. Nike and Lululemon’s stock haven’t exactly been rocket ships over the past five years. Is some of that stock underperformance driven by company specific issues and inflated valuations at the start of the time frame? Yes, absolutely…. but I think the fact all of them are down substantially kind of shows how quickly the moats / barriers in the field have come down.

So I’ll be honest: you can color me skeptical here. UA’s turnaround seems to be focused on a (as this Trata call put it2) "shrink to grow strategy”: cutting discounting and eventually reducing wholesale in order to focus more on the D2C side3. That sounds great…. but D2C has just gotten way, way more competitive over the past ten years given everything I’ve talked about in the last paragraph (dozens of instagram focused brands competing heavily for online ads, much more fractured media landscape, etc.).

Which brings me to my last point: let’s say I’m wrong and a turn around has a decent shot of working at UA. Even if that’s the case…. I’m kind of unsure if the juice is worth the squeeze here. There just doesn’t seem to be that much upside even in a pretty bullish turnaround scenario.

UA’s got ~$200m of net debt right now. Their market cap is >$2.5B, so we can round their EV to around $3B. At its peak, this is a business that was doing $600m+ in EBITDA (in the 2021 COVID checks crazy, and roughly there in the mid-2010s).

Maybe the business can get back to that level of earnings again. If they do, the stock will obviously be a home run; I don’t think it’s crazy to think this is a 10-12x EBITDA business at steady state45; if they get back to ~$600m in EBITDA, you’re talking about a $6B EV and the stock is more than a double from here.

But that’s a really big assumption…. Buffett has been telling investors for literally five decades that “turnarounds seldom turn.” Obviously there are more considerations than pure upside6, but in general if I’m going to bet on a turnaround I’d want to have much, much higher upside than “more than a double.”

For minority shareholders, there is one other interesting angle worth considering. This was mentioned towards the end of the Trata call, but there could be some logic to a take private at UA. Plank owns a big stake in the company, most companies don’t like to do turnarounds in public, and there’s a lot of private equity money out there. Could a take private happen here? Absolutely possible. In particular, I’d note Fairfax has a lot of financial resources and a history of taking businesses private, particularly when they like the management team (they’re in the middle of a take private right now7!). IDK how Fairfax feels about Kevin Plank, but he does kind of seem like the type of executive Prem likes / would back. Could Fairfax look to support a UA take private? Or could UA just run a process and have a private equity firm back a take private? Either seems absolutely possible, and would likely result in a windfall for minority shareholders (a windfall that I think the take private sponsors would ultimately rue!).

Odds and ends

One interesting thing: Kevin noted that when he joined the product lead times were ~18 months, which meant that fall / winter 2025 is when the turnaround would start to show. It’s entirely possible I’m too skeptical of the turn around here and it’s already in full force / someone has holiday 2025 credit card data that shows the UA brand is back. The entire Q2’25 call certainly seemed to suggest that the internal metrics had started to turn already, and the company has said before that the brand will inflect before the business does8…. so maybe I’m just completely off and Fairfax is actually buying after the turnaround has already turned and it just hasn’t hit the numbers yet!

I’ve detailed previously how Fairfax loves to back founders / executives they trust and have relationships with. I have no clue if they have a relationship with Kevin Plank, nor do I have evidence if Plank is actually very good or just caught lightning in a bottle with UA’s original launch. I know a lot of consumer focused investors who have followed UA for a long time and are pretty skeptical of him TBH…. but I will say that I read a lot of company investor day transcripts and conference calls, and I’d put Plank on the far, far right tail in terms of his ability to communicate and excite around a vision.

Under Armour announced a “separation” with Steph Curry in November 2025; I find that separation really interesting. On the one hand, cutting expensive endorsement deals is the backbone of a shrink to grow strategy, and Steph is approaching the twilight of his NBA career so a “cut the old guy and invest the money in stuff with more upside” strategy makes sense. On the other hand, Steph was an incredibly successful endorser for them, and if you go read UA’s investor day from late 2024 (when Plank had already taken over and was laying out the turnaround strategy), the Curry brand is one of the company’s cornerstones and mentioned constantly throughout the investor day. It’s interesting to think about: was this UA breaking an endorsement deal with an aging superstar who could no longer pull his weight? Or was this Steph looking at his individual brand appeal and thinking that he could make more on his own with full control than he could partnered with UA?

Consider the anecdote below (from the investor day). It’s really powerful. Does the anecdote work without Steph at the center of it? Probably not! So maybe cutting Steph makes sense from a pure dollar figure standpoint, but you have to worry about a lot of that brand halo going away… does a school that hears this pitch and choses UA a few years ago ignore this pitch when Steph isn’t involved?

One more Steph focused story from the investor day just to highlight how much losing him changes the global story; again, it probably works out well and the valuation doesn’t demand a global powerhouse, but it is kind of concerning to have the Curry brand go from center piece of the investor day to getting separated within a year.

This anecdote is also from their 2024 investor day, but I think it nicely illustrates the tough thing about investing in anything consumer. Even if you’re super innovative, anything you invent will be copied by a slew of competitors within a year or two. So the only way to make money on an enduring basis in the space is to have a brand consumers will pay a premium for / have a connection to, but man is that hard to build and maintain.

Below is just one example of this quote, but I’ll frequently hear UA say something along the lines of “our right to win is that we’re more nimble than the big guys but have more resources than the small guys.” It’s a strange argument to be making; most people generally don’t love being in the middle.

I also mentioned in this follow up that the early returns from Elon’s big buys are pretty solid!

Obviously Trata is a sponsor of the podcast, but I quite like the product and that that interview in particular was pretty solid for thinking about the ups and downs of UA, so I’d encourage you to check it out.

Their Q2’25 call notes they cut 25% of SKUs since Kevin took back over

This is a big assumption; UA is attacking a big market so if the turnaround is successful people could start viewing them as NKE 2.0 and putting a big multiple with a lot of growth expectations attached. Absolutely possible…. but there are so many competitors now and so much of the shine has come off UA / they have given up so many of their old world domination plans as part of the turn around I have trouble believing even a successful turn would command too high a multiple.

Remember that there are real capex requirements to this business; 10-12x EBITDA is probably high teens unlevered free cash flow on normalized margin.

Many turnarounds come in highly levered stocks where there’s a good chance of a zero if the turn doesn’t happen; Under Armour only has ~$200m of net debt so it would take years of failed turn around attempts to even think about UA being a zero.

disclosure: long KW

Investor day, “You said that the brand will inflect before the business does. So maybe actually the whole group could answer it. What type of leading indicators are you looking for of this brand inflection before perhaps we see it in the fundamentals of the business?”

Fairfax is also an investor in BDT Capital which owns 15% of UA. Their founder, Brian Trot, seems to be tight with Plank.

I would love to chat with you about Fairfax. I really like David Thomas’s book on Fairfax but you were asking him investor questions and he’s a journalist. I think it can compound 15-30% over the next 5 years.

Are they betting on a turnaround or that Kevin is about to take it private?