Elon's big $TSLA purchase and insider signaling

Elon Musk bought $1b of Tesla last week.

I’m not exactly breaking news here; CNBC covered the purchase extensively, as did plenty of other news outlets. Most of the news coverage covered similar bullet points: Musk’s largest purchase ever, sign of confidence in the business, etc. Other analysts (including Matt Lavine and Byrne Hobart) noted the curious timing (right after Oracle’s stock rise had Larry Ellison pass Musk as the world’s richest man) and Musk’s ability to move his own stock.

And all of those angles are absolutely correct…. but, as someone who follows insider purchases almost obsessively1, I thought they missed something. In particular, I’d note that Musk’s purchase isn’t just the largest purchase he’s ever made; I believe it’s the largest single insider purchase ever made, and it’s not particularly close.

The closest insider transaction in terms of pure size I can find would be Dustin Muskovitz buying ~$350m of Asana back in 2022, and Elon’s buy is almost 3x the size of that purchase…. however, despite the enormous size disparity, I don’t even think that comparison does Elon’s buy justice. The Asana purchase was a private placement between Asana and Muskovitz; obviously it’s still a huge buy, but it’s a buy through a stock issuance, while Elon’s buy was a flat out purchase on the open market!

If we’re talking pure “go out on the open market and buy stock,” the largest form 4 purchases I can find are2:

Berkshire’s >$3B (yes, more than $3B!) purchase of OXY in early 2022

Berkshire is a financial investor and only filing because they own so much of OXY, so I don’t think this is a fair comp…. But it’s such a large purchase I had to highlight it!

Muskovitz’s just shy of $100m ASAN purchase in December 2021.

Harold Hamm bought almost $200m of CLR around $17/share across a few ~$50m slugs back in 2020…. this worked very well for him, as he took the company out at ~$74/share a few years later!

Tilman Fertitta’s ~$27m purchase of WYNN in early April

Fertitta is not an insider of WYNN; however, he is a gaming veteran and a huge owner of Wynn, so I thought I’d call this out because it’s the largest non-Elon purchase I’m aware of so far this year and thus it nicely frames just how insanely large Elon’s purchase is.

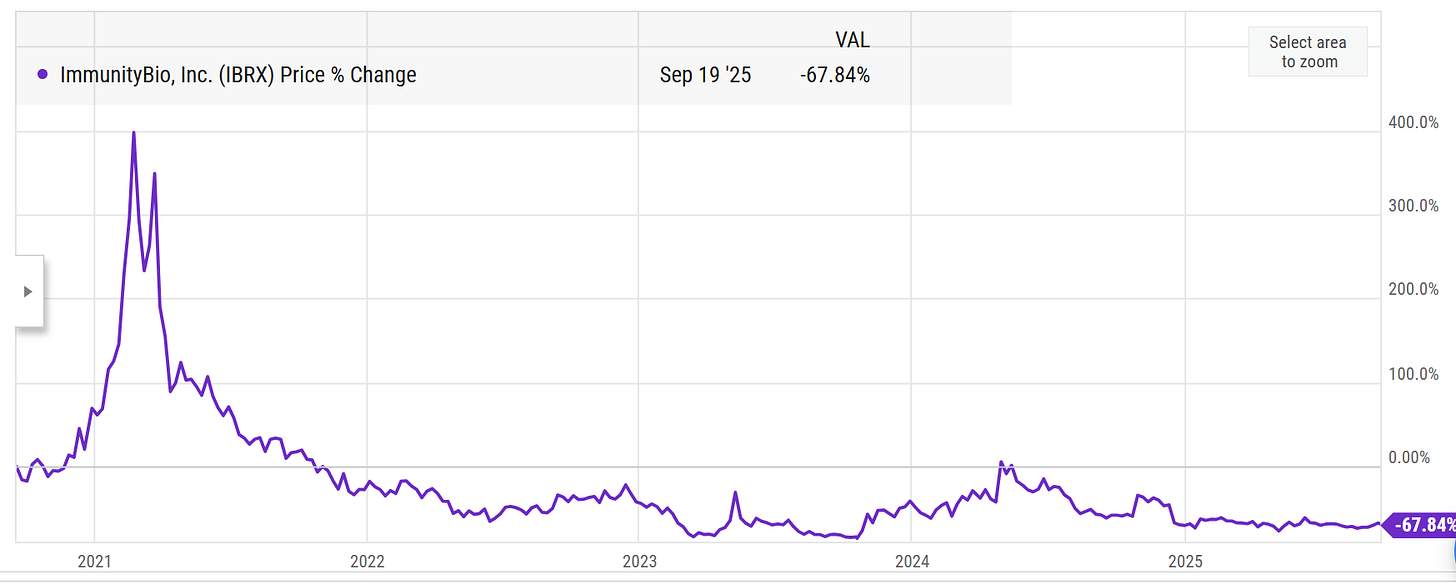

Patrick Soon-Shiong’s ~$45m investment into NK in 2020.

Again, not a perfect fit because this was a placement, not an open market purchase. But I included it because Patrick bought the shares concurrently with the company doing a public equity offering, and Patrick bought the shares at ~$12/share while the public offering priced at ~$9/share. Paying a >30% premium on a ~$45m investment is a big bullish sign!

I think when you look at the infrequency of big insider buys like this and the sheer size of the Elon buy (it’s 10-20x the size of the best comparisons I can find!), it shows you just how unique the Elon buy is. Of course, it makes sense that it’s unique! There are few companies that have the combination of the public float to support an insider buy of that size plus an insider who is financially capable of buying $1B! It’s not crazy surprising that the Tesla buy is unique when you think of those circumstances!

So I wanted to start by pointing out how insane the sheer size of this purchase was…. but I also wanted to look / highlight two other things.

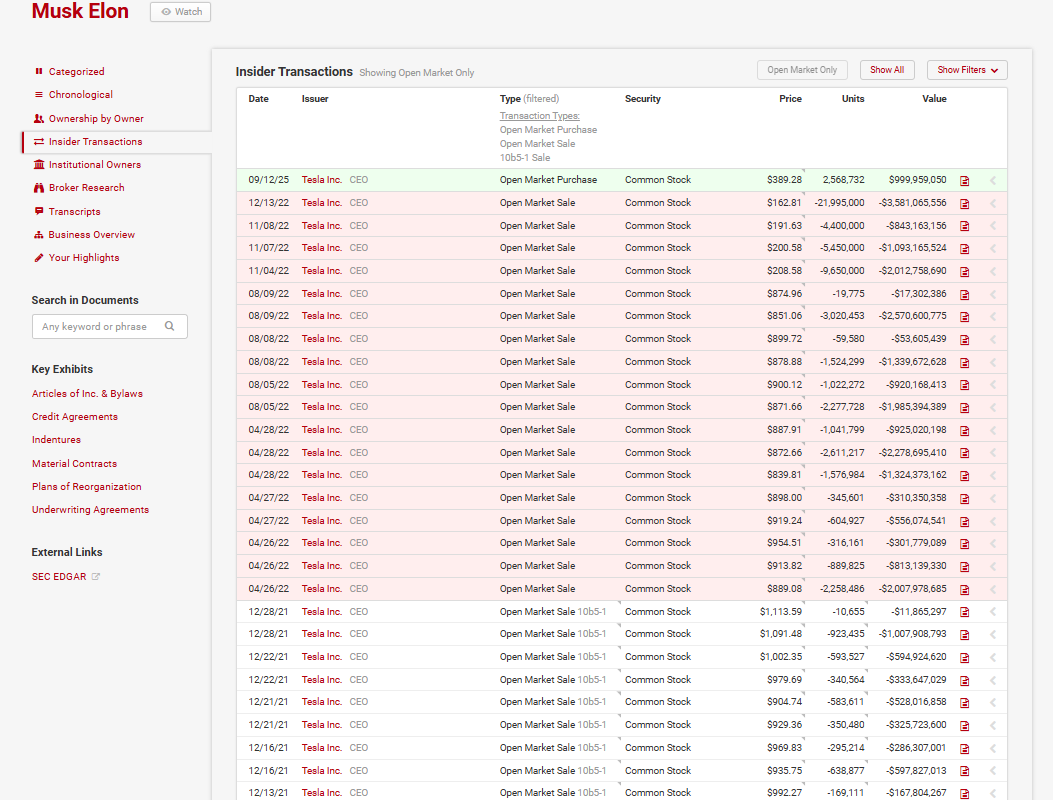

First, I think the “why now” question is interesting. For all the discussions (and lawsuits!) about Elon’s compensation and stock ownership, Elon actually doesn’t trade in his stocks very much. In late 2021 and all through 2022, he was a major seller of Tesla stock (the 2022 sales were were largely to fund his Twitter purchase)…

but, before that, he almost never traded in the stocks of his underlying, and when he did it was often small buys to support a stock offering by the company.

As far as I can tell, this is Elon’s first ever open market purchase of Tesla (he did buy some Solarcity on the open market back in 2016).

So not only is Elon’s open market purchase the largest ever by orders of magnitude, but it’s his first open market purchase of a stock in ~10 years and the first time he’s ever bought Tesla on the open market?

That is a really interesting signal, and given it comes along Tesla’s robotaxi launch and the rollout of the humanoid robots Elon says could be worth the majority of Tesla’s value, you have to wonder what internal metrics Elon is looking at that made him feel the need to plunk down $1B right now.

The stock was up ~10% on the heels of Elon’s purchase, so bulls were obviously asking the same questions and concluding that the answer was “things must be going awesome.” And that makes total sense!!!!

But I think there’s something in those purchases that’s really interesting for bears as well: the history of enormous insider purchases is actually really, really poor!

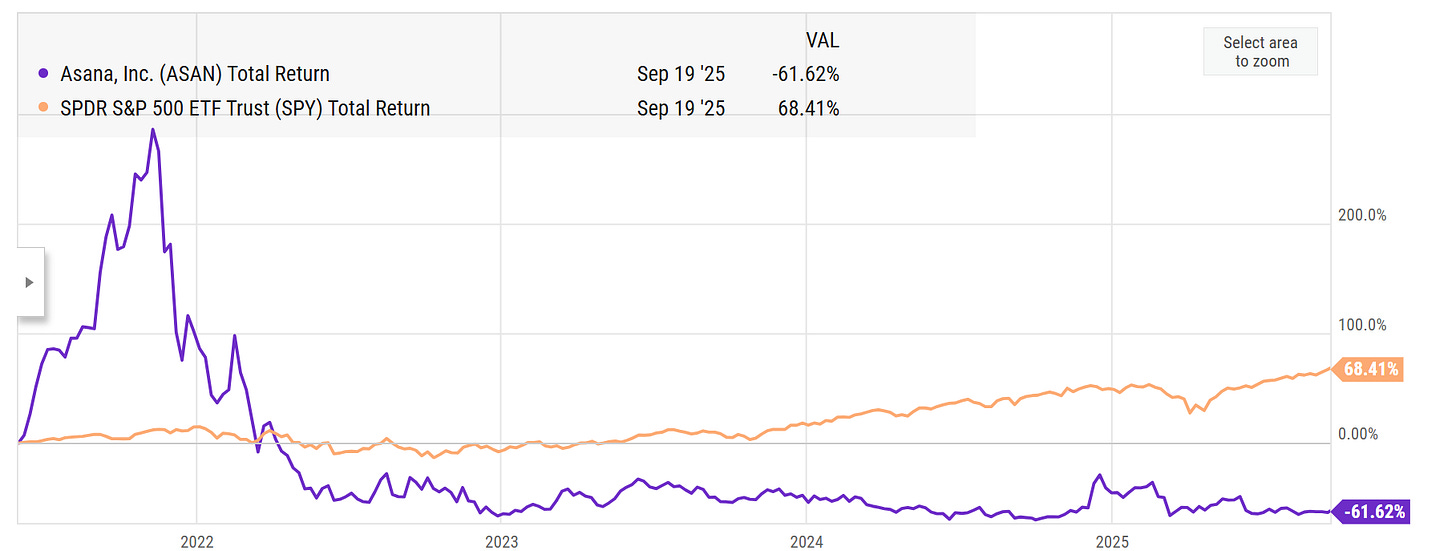

The most famous example would have to be Asana. Dustin Muskovitz made his first open market purchase of Asana at ~$37/share in the middle of 2021. From that point on, he became a consistent buyer of Asan, buying shares as high as $100/share in late 2021, and the buying spree continues to this day. In total, Dustin’s bought well over $1b in stock in Asana over the past five years… and the stock has been a complete disaster. It’s down >60% from his first buys, and almost 90% from his highest buys.

You can find similar disappointing results from other big plays. OXY is ~flat since Buffett’s wild purchases in 2022, well underperforming the S&P as well as peers.

And NantkWest merged into ImmnityBio (IBRX) and has been in almost perpetual distress since that merger and Patrick’s big insider buy (despite significant financial support from Patrick!):

That’s not to say all big buys are bad!

Some are mixed; Richard Kinder bought tens of millions of KMI stock all through 2019 and 2020…

and the stock has done well though it’s probably been a slight laggard versus the overall market.

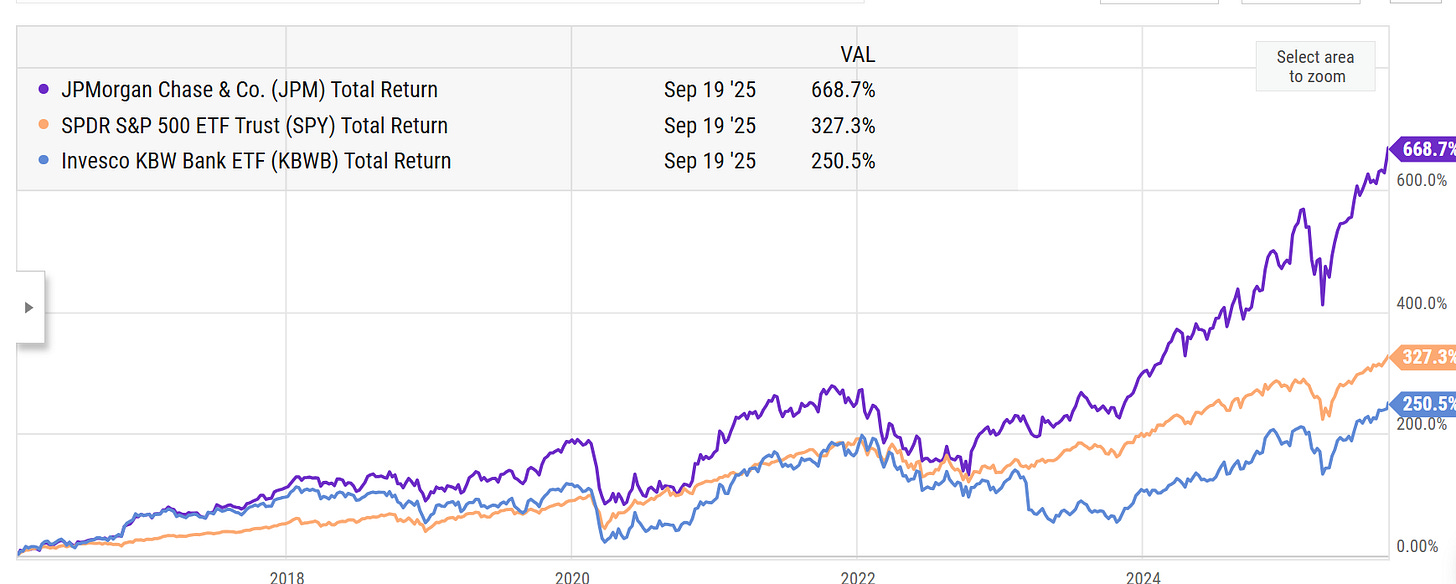

On the positive side, JPM has done really well since Dimon’s big buy in 2016…

And Harold Hamm made a fortune on the ~$200m he bought in mid-2020 at $17/share given he took the company private at ~$74/share a few years later.

Who knows how Elon’s insider purchase will turn out? History suggests that betting against Elon is a fools’ errand…. but history also suggests that when rich insiders get really bullish on their stock and start swinging around fortunes to increase their exposure, the results are mixed at best!

Why follow insider purchases obsessively? Everyone knows the old “insiders sell for lots of reasons, but only buy for one reason (they think the stock’s going up)” adage, and I think insiders have started gaming that adage quite a bit (you’ll often see token purchases from management teams and boards under fire)…. but there’s still a ton of signaling power in insider purchases IMO. In particular, I’d note that sector wide insider purchases often have enormous signaling power (it was a large reason I was so bullish on banks after the SIVB failure in 2023 as well as busted bios earlier this year, and with the benefit of hindsight I should have been even more bullish / long).

The SEC system ain’t exactly easy to navigate when you’re filtering for form 4s by size. Is it possible there’s a larger purchase that slipped through the cracks? Absolutely! Please feel free to shoot me a note / leave a comment if you’re aware of one, but I’m pretty sure I’ve got the largest.

Wish we had the ability to filter on insider buys as a percentage of net worth!

Some investors suggested that Elon bought before the vote on his massive comp package to improve the optics of the whole situation but none of us really know the real motivation.

CVNA father and son bought over $500m of shares in early 22.