Correlations, Leverage, Caution, and $TSLA

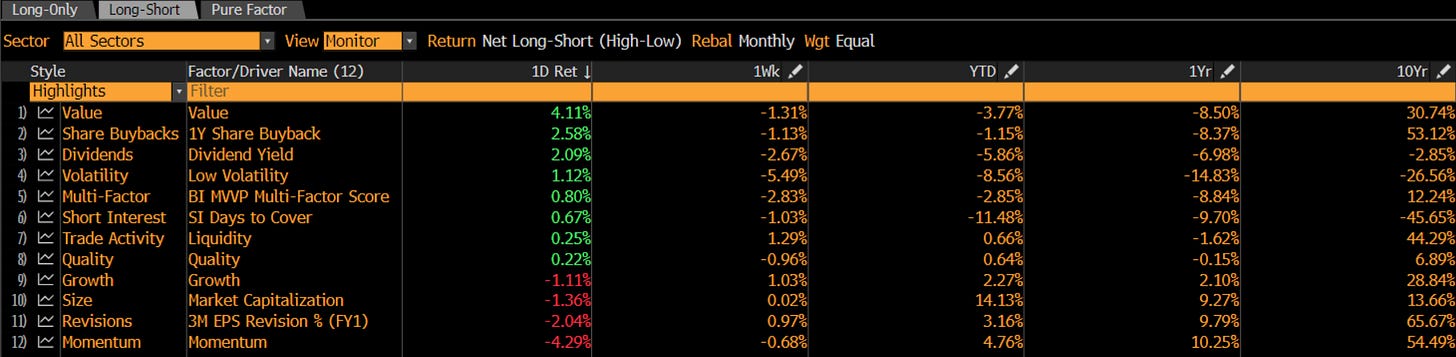

I’m far from the first one to point this out, but yesterday (July 1) was a really good day for the value factor and a really bad day for the momentum factor:

Most of my friends (including me) tend to invest more on value factors than momentum factors. Perhaps it’s because we’re dummies, perhaps we’d have been better off never reading The Intelligent Investor, or perhaps we’re just unwilling to evolve with the times… whatever the reason, most people I spend most of the time talking to tend to explicitly or implicitly be long value and short momentum. So when value has a day in the sun, I can sometimes kind of feel the energy among my friends / there is just a bit more pep in their step when I’m chatting with them.

I say all this to give some background: I tend to be more factor agnostic in my investing; I’m generally looking for quirky situations or one-offs that don’t fit neatly into a factor bucket…. but even trying to be relatively factor agnostic it’s hard not to have at least some awareness of what’s going on in factor land. So, again, when days like yesterday happen, I feel it.

And days like yesterday have been relatively rare; momentum has just been smashing value for most of the past few years, and it’s hard for me to remember a ton of clean days where value has decisively outperformed (though I’m sure I’m forgetting a few; it’s hard for me to pull individual historical day by day factor performance!).

Why do I mention all this?

Because it’s interesting to me that the two days that jump out to me where I can remember value factors just smashing momentum factors relate to feuds between Elon Musk and Donald Trump that saw Tesla’s share price tank. The first was yesterday’s move, when Tesla shares tumbled after Musk threatened the Republican tax package and Trump hit back saying DOGE should look at taking away Elon’s subsidies. The other was early June, when Tesla’s stock tumbled after Elon accused Trump of being on the Epstein list. That was a really weird day; the market was relatively flat (IWM up slightly, QQQ + SPY down slightly), but you saw a lot of meme related stocks making huge moves on no news. To just throw a couple out there, bitcoin was randomly down 3%, PLTR was down ~8%, COIN was down ~5%, TSLA was down ~15%, and CRWV was down ~17%.

Those are really big moves in a flat-ish market, particularly given there was no fundamental news (at least, none I can remember / am aware of) for any of those companies except for Tesla!!!!

I realize nothing I’ve written so far is particularly groundbreaking, nor does it have any scientific rigor or anything. So feel free to take all of this with an enormous grain of salt…. but I’ve had some friends (or people I follow on twitter!) call the current stock market the “casino” market because it feels like investors are continuously betting on (and getting rewarded for betting on) the riskiest YOLOs. I’ve adopted that framing of the market, and for the past few months in my “state of the markets” I’ve noted I continue to find a weird dichotomy in the valuation of the growthier / sexier stories in the market and the hairier / more value stories.

It’s been well reported that the post-Liberation day market rally has been largely “retail” and FOMO driven…. but I can’t help but wonder when I see the huge correlations between seemingly unrelated businesses / asset classes (it’s a little weird for bitcoin to be down 2%+ on flat market days both times Tesla takes a dive, and it’s hard to see how Musk accusing Trump of being on the Epstein list would have any impact on Coreweave’s business… but Coreweave dropped almost 20% that day with a ~flat QQQ so apparently it has quite the impact!) if there’s a lot more leverage driving the system than the headline stats would have us believe (and that could be explicit leverage like margin debt, or simply other forms of leverage like retail yolo’ing zero day options and 2x levered ETFs to get leverage / drive the rally).

I do not know…. but you could certainly find precedent for such leverage / correlation driven gains in prior markets (I’m thinking specifically of the late 90s / dotcom bubble and the early 70s / Nifty 50). And while those parties can last for a long time, the hangovers can be pretty brutal.

Anyway, I realize I sound1 like an old man yelling at the clouds (and, increasingly, I’m becoming one!). Perhaps my fears and worries here are for nothing. But past experience has taught me a lesson: however trite it may sound, when markets are getting euphoric, it pays to be cautious. And when you have a bunch of stocks whose businesses should be reasonably uncorrelated that are seemingly marching to infinity together but all tumble when one stalls out…. well, that seems as good a time as any to be cautious.

I actually recorded a “random ramblings” over the weekend where I dove into some of these points (though obviously it was before yesterday’s Tesla led tumble!)…. but i had a microphone issue on the recording and no audio got produced so it was just 30 minutes of me waving my hands like a wild man. Perhaps I’ll try to do another next weekend!

You should give access to the video file to your followers, and invite them to dub their own 30 minutes (or less) of dialogue, and provide a really good prize to the one(s) you judge best in one or more categories. A few creative people might take the challenge.