Celebrating Buffett's Longevity (weekend thoughts)

Earlier this month, Buffett announced he was handing over the CEO role at Berkshire.

I published a bit longer reflection on Buffett retiring (and how it hit me personally) here. but that’s not actually the article I set out to write!

The article I set out to write relates to Buffett’s longevity. Spurred by Buffett’s retirement, I’m rereading The Snowball for my fintwit bookclub with Byrne Hobart (you should check it out if you haven’t; I think our last episode on tariffs was by far the most interesting we’ve done now that we’re starting to get the hang of it). I haven’t read Snowball since it came out in 2008. I was in college at the time, and now I’m….. very much not in college.

It’s funny how the things you pick up on when reading a book change depending on where you are in life. When I read the book in college, I was much more focused on the legendary investments (buying Amex in the oil scandal or whatever) and his work habits (leaving parties early to read Moody’s manuals). Today, married with a kid, I pick up on a lot of other stuff. Namely the inter-personal and family dynamics; for example, I didn’t even remember how poor his relationship with his mom was, and today I read a lot of the stuff about his relationships with his kids and think “o man, can’t let that happen to me.”

But my new takeaways from the book are also not what I wanted to talk about. Instead, I wanted to praise Buffett for something that I don’t think he gets enough praise for: how he’s not getting yanked off the stage to end his career.

Now, Buffett doesn’t exactly need my praise. He already gets tons of praise from tons of people for everything. And rightly so; he’s the best to ever do it.

And you can find plenty of articles celebrating Buffett’s late career investments, particularly his Apple investments in the mid-2010s (which would become his “most profitable” investment):

Certainly that’s an insane investment; it’s crazy that an 80 year old managing hundreds of billions can casually buy and hold a concentrated-ish position in a mega-cap tech company as a multi-bagger. And he’s rightly celebrated for that.

But I don’t think that’s the most impressive thing about Buffett’s late stage career. What’s most impressive to me is that Buffett managed to avoid the late stage blow up.

As I’ve gotten older, almost every “titan” of any sport or industry has embarrassed themselves (or blown themselves up) with a late career move. Sports is probably the easiest place to find parallels1; just to list a few:

Bill Bellicheck’s post-Brady Patriot years were an abject disaster…. and the saga with his (much younger) girlfriend now isn’t covering anyone in glory.

MJ’s Wizard years aren’t remembered fondly, and while he wasn’t the worst owner in the NBA in the 2010s (not an easy task in a league with Donald Sterling), he would have certainly been receiving some honorable mention votes in the “worst owner” category..

Boxing is probably the king of finding aging fighters who hang on for too long… but the Tyson / Paul fight would be an easy / over the top one to point to.

But it’s easy to miss / forget how many investors suffer really poor final years. Just look at Charlie Munger; his “swan song” investment in the last years of his life was buying Alibaba on margin, and he’d regard that as one of the worst mistakes of his career after basically getting margin called on it.

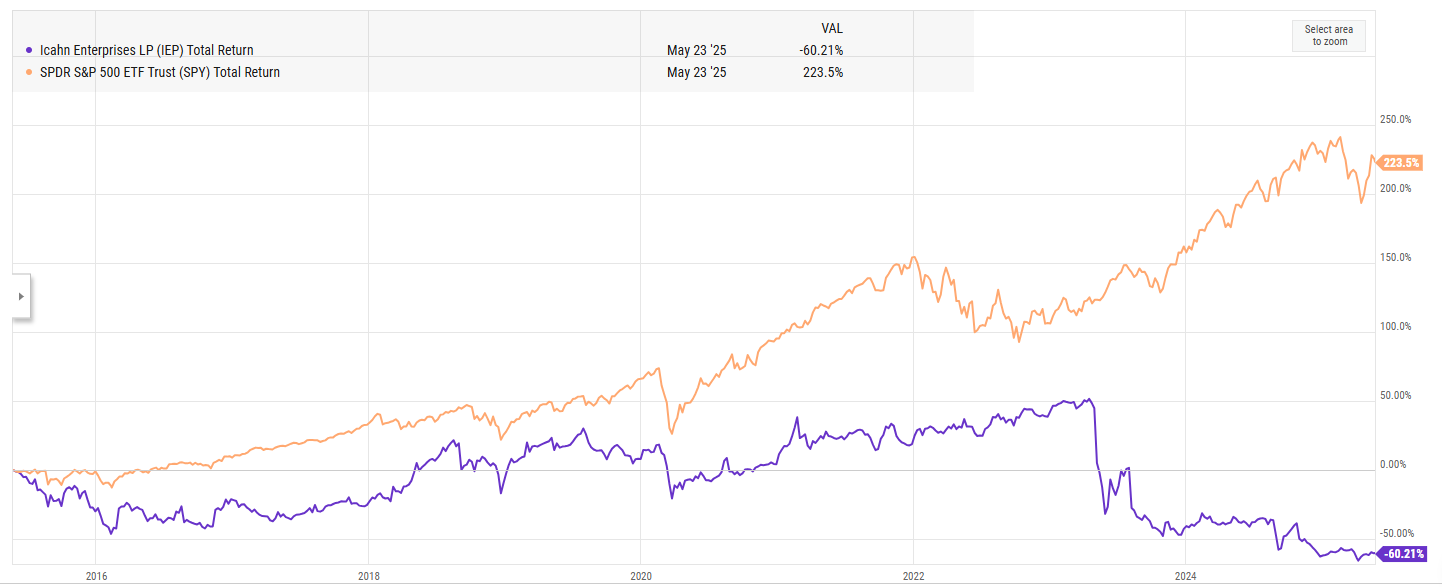

Or consider Icahn; he’s markedly underperformed the market over the past 10 years:

There are a lot of factors behind that underperformance (including some good old fashioned bad stock picks!), but I think a major one is that Icahn has just been consistently extremely bearish. If you go back through IEP’s 10-Ks, you can see Icahn is consistently running massively net short, peaking with his 2016 10-K when IEP is 128% net short2.

Those are just two examples of investors who really stumbled at the end of their careers; I’m sure you could find dozens of others if you were looking.

But I’m not trying to dunk on them or anything. I think the fact that most of the greats struggle at the end / don’t know when to hang it up makes what Buffett is doing all the more impressive. His last big investment (Apple) was an absolute grand slam, and he passed the torch before there was any material mental impairment that could lead to him dragging down Berkshire’s performance.

Yes, it’s probably easier to hand the reigns over in investing (when you can keep investing at a high level until basically the end of your life) versus sports (when your career will end at ~35 and you’re staring down another ~50 years of living without the thing that has dominated your life so far), but plenty of business legends (particularly media tycoons) have held on till the bitter end and seen their empire deteriorate in their last years (heck, forget business; we’ve seen a very public recent example with Biden’s deterioration!). Buffett seems to have dodged that problem too.

And Buffett even dodged the “young woman” issues. This is dangerous ground so I’ll try to step carefully, but we’ve seen plenty of older men get into trouble with young women (see: Bill Belichick). Rereading Snowball makes it very clear that Warren is very interested in the fairer sex3, and Buffett clearly has a type when it comes to the journalists who get the most facetime with him…. but, unlike a lot of his peers in powerful positions (including Bill Gates!), Buffett never did anything untoward (at least to my knowledge!).

So, yes, Buffett is rightly celebrated for a ton of stuff in his career. But rereading Snowball and just looking at how so many titans of anything (sports, investing, business) end their careers with some type of disaster, one of the most impressive things to me is how Buffett is managing to walk-off on a relatively high note / without some type of major blow up.

Sports is easy…. but media is not exactly lacking for aging directors / actors throwing up some Ls with their last projects!

I understand this exposure is a little funky; it includes some options, and if you own $100m of businesses and are short $1m of stocks you will show as hugely net short even though you’re very long…. but I don’t think you can have a >100% net short position without having some bearishness!

His relationship with woman is a constant through line in the book; a throwaway line about his dinner with Dolly Parton is both innocent and easily illustrates the risks that a…. less principled man might have fallen into: “he dined with Dolly Parton. But Buffett, who found Parton likable as well as hugely attractive, failed to make the lasting impression on her that he managed with most other women.”

One of the things that struck me about Buffett's lifestyle is that he just doesn't seem to care about anything other than investing.

Family time? He'd rather read investment reports.

On a cruise? Investment reports.

At a party?...

He's been doing it "for the love of the game" in a way that no one else could ever do. He doesn't get distracted because he has very little desire to even recognize the rest of the world. In a paradoxical way, it's actually more of a pathology than an exercise in willpower. No willpower is needed when there is no desire!

Andrew, the sports analogy was appropriate, and it can be added to. Consider yourself. You engage in lifting and running, and you are still at the stage where you can get better at both. You won't know when you reach peak performance except in retrospect, and you will have a long plateau, followed by a slow and then accelerated decline. This will be comparatively easy to measure. (It is harder for the athletes to see it in themselves.) What is harder to see is that mentally you will do the same. And you could have found analogies in scientists, and no doubt in other mental pursuits.

So for investing, while the process can be continued for decades, it makes sense to both establish processes that will rely less on peak intellectual power, and to quantify some performance metrics (not returns) so that you can recognize when the plateau and subsequent declines are operative. Perhaps a "hitting percentage?" And recognizing that the odds are against you being near peak performance as you approach your mortal terminus, perhaps to scale back your active share. i.e., if you love the process, you can enjoy it with 10% of your vast fortune in your dotage and let the other 90% run on passive.