An open letter to the $ARVN board

Tl;dr: We own ~1% of Arvinas (ARVN; disclosure: long); given myriad concerns with the company’s valuation and strategy, I have been privately communicating with the board and management team for months. However, I’ve been disappointed by the complete lack of urgency I’ve seen from the whole company on a variety of issues. Given the recent Logos 13-D filing, I figured I’d practice good shareholder engagement and communicate my concerns more broadly. As I’ve mentioned in public letters to the SAGE and Keros boards, I’m not looking to form a group with anyone (in fact, I don’t think I’ve ever spoken to Logos)… but it seems clear to me Arvinas is undervalued and the best chance to realize that value is shareholders practicing good shareholder engagement and letting the board and company know what they believe the best path forward is. If you’re a shareholder and have views on the company, I’d encourage you to reach out to their IR team (ir@arvinas.com) and express them (whether you agree with me or not!); IMO, shareholder engagement is the only path to a risk-adjusted positive outcome here.

Full letter to the company below

Arvinas team,

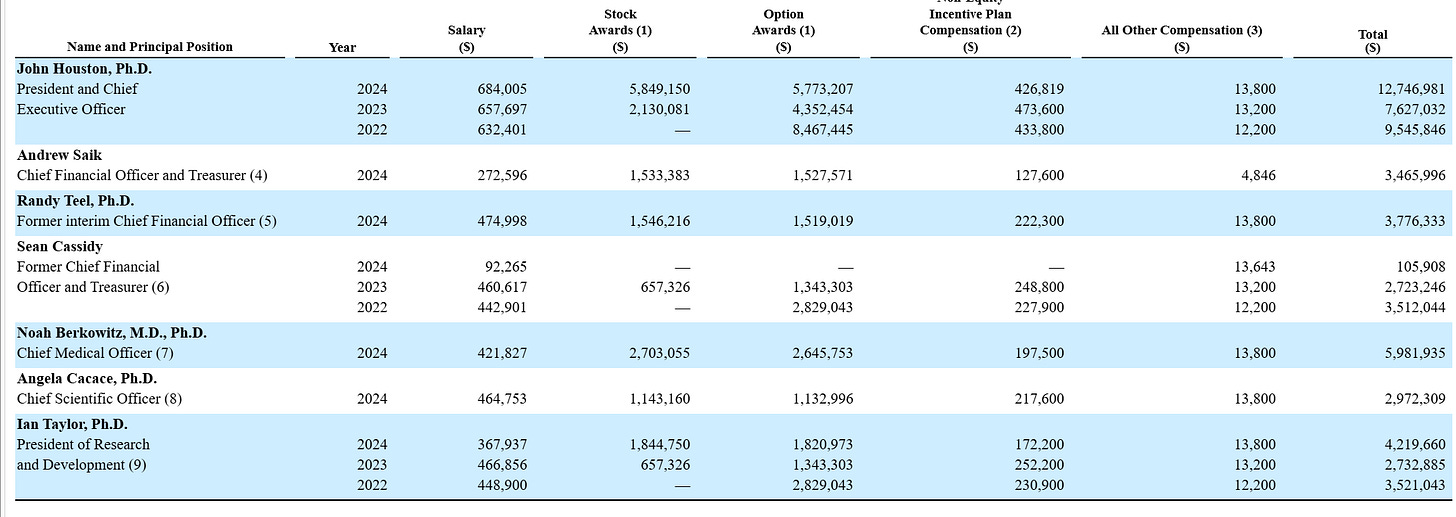

They say a picture is worth a thousand words. While I can (and will!) spend much more than a thousand words detailing the issues at Arvinas, I thought it appropriate to start this letter off with a picture because, in this case, the picture is not worth merely a thousand words…. It’s worth literally hundreds of millions of dollars.

That is a screenshot from Arvinas’s most recent proxy. It shows the pathetic amount of insider ownership at Arvinas; in fact, the ownership is even worse than that table suggests because the majority of the shares owned represent stock options that are deep out of the money. I hate to call any one particular person out because this lack of ownership is not an indictment on one person but rather the whole board…. still, an example would be useful, so rather than call out one specific director I will just point (without naming names) to the two directors who joined in 2019. The table above suggests each of these directors owns over 87k shares; however, if you read the footnotes, you’ll see that ownership consists merely of 4,121 shares actually owned in addition to another 5,899 RSUs that will vest in the near term. That’s about 10k shares in total if we assume all RSUs vest and aren’t sold for taxes; at Arvinas’s current stock price, that’s <$75k of stock ownership. The other ~77k shares the proxy says each director owns consists of stock options that are deep, deep out of the money. Arvinas pays their board members a staggering amount of money (almost $500k/year in cash and stock); how can a board member serve for over 6 years making that much money and own less than $75k of stock? And how can a board member who owns that little stock versus their annual compensation claim to be working to maximize shareholder value when they are clearly much more incentivized by their annual board compensation?

Turning back to the ownership table, why do I say that specific picture is worth hundreds of millions of dollars? Because Arvinas is trading for a market cap just over $500m despite having well over $800m in cash on its balance sheet. The market clearly believes that management and the board have no desire to create any shareholder value here and would instead prefer to pursue R&D at hugely negative risk-adjusted rates in order to justify their bloated salaries and bonuses. Given the lack of urgency I’ve seen from the company and the disappointing responses to our private communication and concerns, it’s hard for me to fault the market with being concerned!

I will be blunt here: I’m not sure I’ve ever seen a company that is a more clear cut case for a strategic process and/or large capital return than Arvinas in its current form. We’re calling on the company to immediately review strategic alternatives, including (but not limited to) a sale of the entire company or a large capital return.

Why do we believe Arvinas needs a strategic process? Arvinas’s legacy cost structure (particularly its management compensation) is simply much too high for its current reality, and, given John’s looming retirement, there is simply no world where shareholders would be better served paying a new CEO millions in compensation (particular stock compensation given the stock is trading below cash!) and having the new CEO looking to deploy Arvinas’s cash balance on his own / inside the Arvinas cost structure versus returning the majority of that cash to shareholders.

We have detailed our concerns and issues with Arvinas in numerous letters and calls with the management and board; we are happy to go through all of them in depth at the board’s convenience (and may publish follow up letters detailing all of our concerns). However, our overarching concern is that management and the board’s lack of stock ownership create enormous alignment issues with shareholders. For the sake of brevity, let me highlight the single most pressing area in our opinion: management compensation and alignment.

Let’s start with compensation: ~18 months ago, Arvinas was a multi-billion market cap company with a promising phase 2 asset (ARV-766) and a phase 3 asset (vepdeg) that Arvinas planned on leading commercialization and turning into a multi-billion dollar drug. Today, ARV-766 has been partnered out, and Arvinas has admitted that it no longer makes sense for Arvinas to commercialize vepdeg on its own. That means the “core” Arvinas going forward largely consists of three Phase 1 assets. This is not to say ARV-766 and vepdeg do not have value; we are simply highlighting that given these assets are partnered / will not be commercialized by Arvinas going forward, there’s not much path for Arvinas to direct or create value in them.

I will admit: I’m not a scientist. I can’t tell you if these drugs are guaranteed blockbusters or absolutely failures (though I doubt anyone could tell you that with certainty). However, I do know corporate governance and compensation reasonably well, and given that knowledge (plus a sprinkling of common sense) I know that a company pursuing three phase 1 assets should have a dramatically different cost structure than a multi-billion dollar market cap company that has line of sight to commercializing a multi-billion dollar blockbuster (as Arvinas was with vepdeg ~two years ago). Arvinas is set up as the later despite clearly being the former. Top management combined make >$25m/year…

While each board member is pulling in almost $500k/year.

That cost burden is simply too high for Arvinas’s current reality, and it’s why we believe a strategic review is urgently needed here. John Houston (Arvinas’s CEO) has announced he is retiring (though he will remain on as chairman). It is impossible for us to see a world where shareholders would be better off not just maintaining the current cost structure but adding to it by hiring a new CEO versus simply running a strategic process and returning capital to shareholders.

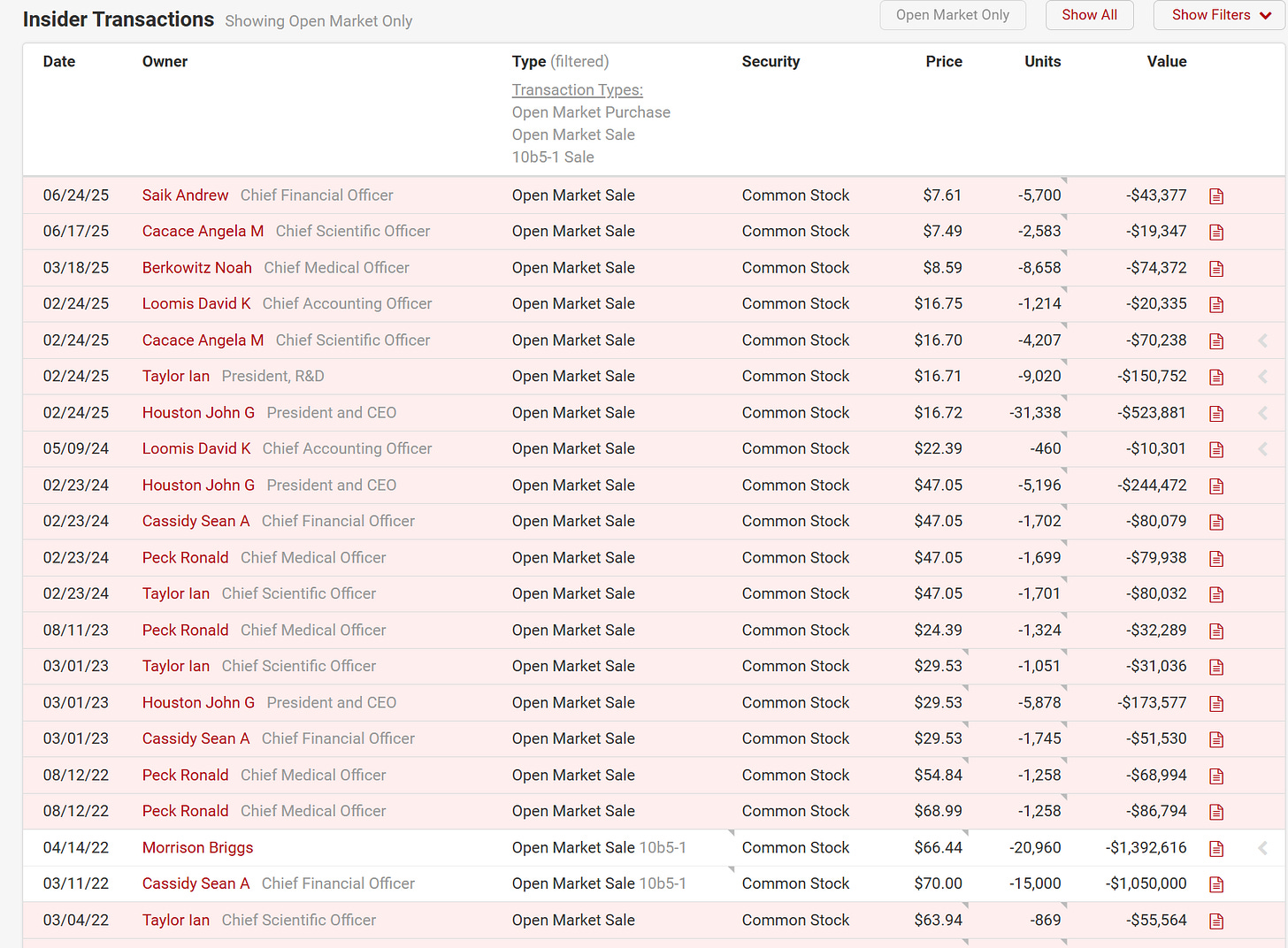

We think the superiority of the strategic review / capital return path is pretty clear. However, we are increasingly concerned that the board and management are incentivized not to realize the superior path. Why are we concerned? Well, on top of the dismal insider ownership and the board and management’s history of aggressive insider selling (note the chart below is only the direct sales that fit insider of a screenshot; the full list of insiders selling runs much longer)….

…we’d point to some incredibly questionable compensation decisions, in particular the off-cycle RSUs handed out earlier this year. In May the board decided to grant tens of thousands of off cycle RSUs to most of the C-suite of despite the stock trading for a fraction of cash value. This is abysmal corporate governance at its finest, as it creates a true “heads I win; tails I don’t lose” culture at the company. Why should management be rewarded with new grants simply because the stock is down?

I’m sure the board would say, “With the stock down so much, we needed to give them new equity to align their incentives / retain them.” That’s a literal textbook example of a statement a misaligned board without a shareholder focus would make. Management should win and lose with shareholders; if vepdeg had been a home run, would the board have gone to management and said, “hey, you’re way overpaid because the stock has done so well; we need to take some of those shares back!” I doubt it (and of course management wouldn’t have agreed to it!). If the company wouldn’t have taken shares back on the way up, I see no reason why shareholders should subsidize management on the way down. The board has effectively encouraged the management team to invest in lottery tickets going forward; yes, shareholders will be much worse off, but management knows they can keep reloading on options until one of the lottery tickets pays off.

And I will again emphasize one more point: Arvinas’s cost structure was designed for a much larger company with more (immediate) commercialization prospects. Management compensation needs to be coming down to match the company’s current asset base, not going up. Awarding a bunch of off-cycle RSUs is a step very far in the wrong direction.

Our concerns are not limited to the off-cycle RSUs and bloated compensation; however, for the sake of brevity we will save our other concerns for a later day, particularly given many of the other concerns are rooted in the incentive issues we’ve discussed. Let’s wrap up by discussing what steps we’d like the board to take.

To begin, we think Arvinas (like all companies) should pursue the path that creates the most risk-adjusted shareholder value. We believe that path is clearly running a process and selling the company, whether that’s in whole or in parts.

However, if Arvinas board explores a strategic process and decides to remain a standalone, we’d suggest the following steps should be taken with haste:

Every top insider (including the board) needs to take a significant pay cut to align with the company’s new financial reality. To the extent any board or management member says, “hey, it’s not worth my time to work here if I take a pay cut,” we’d suggest that’s a problem that’s easily solvable: wind the company up, or resign and let the company be managed by someone willing to take compensation more in line with what Arvinas can afford in its current reality.

A significant shareholder should be appointed to the board. To improve alignment, the board should immediately add a significant shareholder who has actually spent money buying the stock on the open market.

Arvinas needs to return a significant amount of capital to shareholders. Most of Arvinas’s current cash balance can be traced to either the Novartis partnership or vepdeg (in particular, to the $650m in upfront payment plus $350m in equity from the Pfizer partnership); there is no reason to hold on to all of that cash now. Arvinas should retain enough cash to see their current pipeline through phase 1 trials; if the assets are promising, Arvinas can use those promising results to raise money or partner those assets out. If the results are disappointing, then the money will have been of better use in shareholders’ hands anyway!

In advance of hiring a CEO, Arvinas should set up a CVR structure for the Novartis partnership and vepdeg. Executive teams should only be paid and rewarded for things they can control and influence. We see no reason that a new CEO should step into Arvinas and potentially be rewarded by the success (or punished by the failure!) of assets that they had nothing to do with. To use one example: if ARV-766 is successful, Novartis will pay Arvinas over $1B in milestones plus royalties. Arvinas’s market cap is barely over $500m right now. A new CEO could take over Arvinas and light its current cash balance on fire…. and still make quite a bit of money if ARV-766 works! How would that be fair to anyone? With Arvinas looking to hire a new CEO and the company trading below cash, handing these assets directly to shareholders would create greater alignment and prove the board is working to maximize shareholder value.

Let me be clear here: we’re not saying that anyone at Arvinas is a bad actor or a bad person; in fact, we’ve generally found our interactions with board members and management to be cordial and professional. But we are big believers in incentives, and the incentives for Arvinas’s management team and board are diametrically opposed to shareholder value creation right now, and the actions and words of the company over the past few months suggest that, left to their own devices, management and the board will pursue a path that results in dramatically inferior risk-adjusted returns for shareholders.

We would be happy to discuss anything in this letter (or anything broadly Arvinas related) with any member of the board or management team.

Andrew

Thanks for your thoughts, Andrew. The C.E.O will make sure to read this letter multiple times consequently in a linear level, transparent kind-of-thinking overview of the situation then send a 3-minute short response with an automated email template.

You are not being entirely truthful when you say that the board are all good people. They have been corrupted by easy money and are showing contempt and a total disregard for shareholders.

There is nothing good about this.