A quirky little CVR / M&A case study: $ALIM

A very small corner of the market went on life support for a brief second this month.

The small corner is the “CVR arb” market, and it went on life support because, for roughly half a day, it looked like the ALIM / ANIP merger would be heading to court (disclosure: the merger closed Monday, and I was long ALIM into the close so I’m now long some CVRs1). I had a few different thoughts on the merger and some takeaways from everything that happened, so I wanted to write a quick note detailing everything.

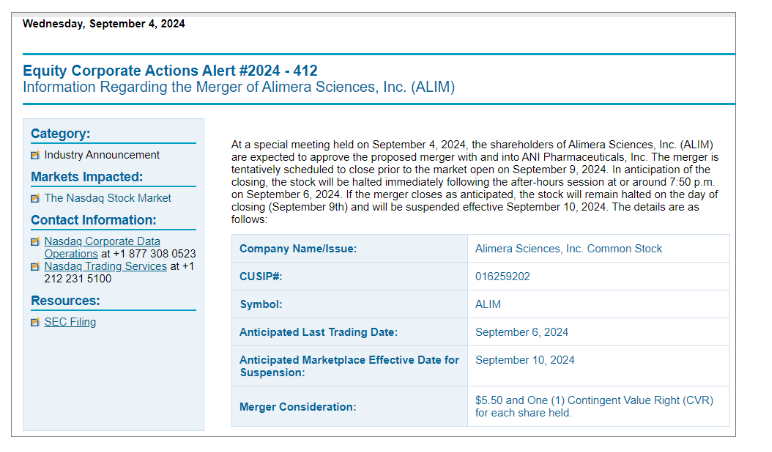

Let’s start with a little overview of the merger and what happened last week (Matt Levine had a nice blurb on it as well, but for my purposes it missed a few key items so I’m going to detail it for posterity’s sake). In late June, ANIP announced a deal to buy ALIM for $5.50/share plus a CVR. ALIM had their (successful) shareholder vote on September 4, so by the terms of the merger the deal2 should have closed on September 9. NASDAQ even issued a trading halt notice that said the stock’s last day of trading would be Friday, September 6.

Sure enough, the stock was halted for trading September 6….. but, strangely, the halt was removed and the stock reopened September 9.

On September 10, we found out why…. ANIP was dragging their feet closing the merger, resulting in ALIM filing a court case to force them to close. ALIM’s stock crashed on the news, opening up in the low $4s before recovering to the low $5s when ANIP put out a mid-day press release saying they were working towards closing. The next day, ALIM and ANIP put out a joint press release saying the merger was scheduled to close Sept 16, and the stock ~recovered to its prior close.

Why did the merger not close on September 9? ALIM’s suit against ANIP remains under seal, so we may never know what actually happened here. Matt Levine’s article suggested the deal didn’t close as scheduled, and rather than pick up the phone to see what was up ALIM went nuclear and responded with an instant lawsuit. That’s certainly possible; however, the manufacturer of ALIM’s key drug received a warning letter from the FDA in early July, and that letter was made public in late August….. I wonder if ANIP was trying to use that warning letter to pressure ALIM into recutting the deal lower, or was thinking about trying to claim an MAE of some form…. but then thought better of it once ALIM sent them a suit and ANIP realized that they weren’t getting a cut / they’d lose a case (and that ALIM had the stones to take a case all the way through!). Again, I don’t know given the suit is under seal and the merger has now closed, but for ALIM to feel the need to sue to get ALIM to commit to closing suggests to me that there was some weird cold feet on the buyer’s end, and I’d guess that letter is the cause….

So that’s the history…. but the reason I’m writing this article is I wanted to use that history to point out a few different takeaways / learnings.

Let’s start with the obvious: weird things happen in the market sometimes, and if you’re mentally flexible enough you may be able to find alpha in those weird things. Remember, the ALIM merger was supposed to close before the market opened September 9.…. but on September 9, the stock was unhalted and kept trading…. and the stock price barely moved on the reopening!!!! If a trader had been thinking with just a trading risk/reward hat on, they could have probably thought something like “well, the merger agreement says it should have closed today, yet the deal didn’t close and the stock is still trading basically flat. In the best case, this is an innocuous delay and the deal closes in the near future. In the worst case, something wild is going on and the deal is about to break / be contested.” If they were thinking with that pure trader / risk-reward hat mentality, that would be a really interesting set up for a short (note: shorting is risky, and the attachment of a CVR carries extra complexity here. I’m just talking about a hypothetical trade, not recommending anything!). Even for someone who wasn’t an “active short” trader, if they had a long position in ALIM for the CVR, that Monday trade was a pretty interesting opportunity to cut their exposure! Again, heads, the merger closes and they create a CVR pretty cheap…. tails, the merger doesn’t close and ALIM’s in some type of weird lawsuit / legal situation to force a deal.

So here’s my first takeaway from this deal: when weird things happen in corporate actions, it’s worth stepping back, thinking about what could be going on, and reassessing the risk/reward, because the market might be treating something as no big deal when the risk/reward on it could be really skewed!

Let’s go to the second takeaway: the risk of CVRs. I’ve written about CVRs previously (see: A quick guide to CVRs through the recent $ABMD deal), so I’d encourage you to read that article for full background, but here’s a quick rehash: I suspect that there’s some alpha in non-traded CVRs because they are very funky securities with no natural buyer base that take a lot of capital to get a little exposure to. Just consider ALIM: if you read their proxy, the CVR was fair valued at $0.32/share (see p. 44). ALIM closed for trading at $5.54/share and the deal called for $5.50/share in cash for ALIM, so a buyer of ALIM right before the close was creating a CVR the bank had valued at $0.32/share for ~$0.04.

Why would that opportunity exist? There’s a few reasons.

First, the market might not believe the assumptions that go into the CVR! The bank fair valued the ALIM CVR and seems to have assumed ~100% chance of the CVR paying out3; just increasing the odds of a miss there for whatever reason would take a bit of the value away from the CVR (and this is a sales milestone CVR, which can be very gameable by a buyer…. why come not delay $1m of sales from one year to the next if doing so saves you $2m in CVR costs? I’ve seen stuff like that happen all the time in CVRs!)4.

The second reason the opportunity might exist is lack of a natural buyers. The first tranche of this CVR won’t pay out for >2 years. The average tenure of an analyst at a fund is probably <2 years; what’s the upside for recommending a CVR that won’t pay out until that far in the future? As an analyst, you have to do a ton of work, convince people to buy it…. and if and when the CVR pays out, you’re probably at a different shop so you don’t get any reward!

The third reason the opportunity might exist is what I call a capital / positioning issue. Let’s say you thought the ALIM CVR was a really good idea, and you wanted to get a 1% position in it. ALIM’s stock closed for $5.54/share, and of that the CVR was $0.04. If you wanted to get a 1% position into close, you’d need to take a 100% position in ALIM into closing. Nothing on this blog (or the podcast) is ever investing advice…. but you probably don’t need me to say “not investing advice” to think through how insane it would be to take a 100% position to get a 1% position in the CVR.

So, combine all three, and I think you have the making of an inefficient market when it comes to non-traded CVRs. You’ve got no natural buyers in a quirky, long dated asset that requires huge position sizing just to get a small position in the endgame.

But I started the article off saying the “‘CVR arb’ market went on life support for a second last week”, and I think you can see why when you think about the math on point #3 (the capital / positioning issue). Getting access to these “cheap” CVRs assumes a 100% hit rate on the merger closing; if any fell through for whatever reasons, the loss on that one would overwhelm the profits roughly a hundred of these “free / cheap” CVRs. Let’s just use ALIM as an example: it was trading for ~$3/share before the merger was announced. It probably goes well below that if the deal fully breaks (the only real way the deal breaks is in an MAE, and in an MAE the stock is almost certainly going lower than the pre-deal price!), but let’s just use $3/share for simplicity. ALIM’s stock was trading for ~$5.54/share into the close, so it’d be roughly cut in half on a deal break. I laid out the math on getting a 1% position in the CVR above and showed it’d require ~100% position in ALIM’s stock pre-close…. imagine someone who tried to do that and woke up to find the merger had broken instead of closed! They’d be waking up to a down 50% day on their entire portfolio to something they thought was going to be a 1% position!

So that’s why I think the “CVR arb” market went on life support for a second when the ALIM deal almost broke. I know there are a lot of people who like to play the CVR arb market (I’m one of them at times! Heck, every now and then I’ll do a premium write up of CVRs I think are particularly attractive)… none of them are insane enough to play it with 100% positions (well, I can think of one friend who might come close, but even he will say he is an insane person and I’d certainly suggest no one follow his example!), but even if you were playing with a smaller position if ALIM had broken the losses here would have destroyed the profitability of CVRs for 100 years. I’d guess every single CVR arb player who took that hypothetical loss would probably never play in the CVR arb market again!

Anyway, the takeaway on this last point…. There’s a lot of things in the market that look / feel risk free. But literally nothing in the market is completely risk free; a meteor can always strike, and a deal that’s mere minutes away from closing can always be called off. So sizing, risk management, etc. etc. all remain insanely important.

Finally, let me wrap up with the third takeaway. It’s actually not a takeaway; it’s just a little confession from me: I’m honestly a little bummed we didn’t have a court case here! Long time readers will recall that one of the investments I talked about / focused on the most was the TWTR / Elon MAE case. I would have loved to have another MAE case to analyze / bet on… particularly one that I suspect would have been extremely strong on the ALIM side!56

Given the level of shenanigans here, I obviously waited for the merger to close and the cash consideration to hit before posting this article! But, again, that does mean I’m still long the CVR for complete disclosure!

The merger agreement called for the deal to close three days after the vote: “ The consummation of the Merger shall take place at a closing (the “Closing”) to be held remotely via electronic transmission of related documentation or similar means, on a date and at a time to be agreed upon by Parent and the Company, which date shall be no later than the third (3rd) Business Day after the satisfaction or waiver (to the extent permitted by applicable Law) of the conditions set forth in Article VI..”

I didn’t find the disclosures around the value of the CVR clear, but the CVR consists of 2 $0.25/share payments that will be made 2-3 years from now. The discount rate is disclosed at 12.75%; just discounting the payments back to today basically takes the headline number of $0.50/share down to the $0.32

One interesting wrinkle to the CVR story: again, I have no idea why the merger didn’t close as seemingly scheduled September 9. But, if you think it’s because ANIP had cold feet for any reason or that they were trying to play a game to strong arm ALIM for a price cut…. well, either scenario suggests the CVR is a bit less likely to achieve its milestone! If it’s the former, ANIP has cold feet because they think future growth is threatened, and if it’s the later than ALIM is the type of company who might play games to get an edge (and thus might try to shift sales around just a tad to miss milestone payments!).

I say extremely strong for two reasons. The first reason: of course the moment this lawsuit announcement hit I started doing work on how a warning letter to a supplier would be looked at in a court case for a MAE, and my first blush was quite strong for ALIM. The second reason I think ALIM’s side would have been strong is because ANIP closed the merger, suggesting they knew they had no shot!

Somewhat humorously, ANIP put out a press release the morning of the close (September 16) that said they were “initiating the closing… pending satisfaction or waiver of any remaining customary closing conditions”…. which started another mini-arb panic as it’s a very strange press release and I’ve never seen someone “initiate” a close pending closing conditions rather than just close. Fortunately, a few hours later ANIP officially closed the deal.

Thanks for the write up! You added a lot of value above the Matt Levine mention which is pretty rare / hard to do!

@Andrew, random question on CVRs - how are they taxed? So as a hypothetical if I bought the ALIM immediately before closing would the base 5.50 would be taxed as short term gains? and the CVR that sits in an account for a year or longer as long term gains? Just curious. Thanks!