With this much smoke, is ComScore actually on fire? $SCOR

ComScore’s (SCOR) shares were rocked yesterday on continued accounting issues

I thought this might be a case of a bit of smoke and no fire, but man there is a lot of smoke here. It’s tough to imagine that smoke is coming from anything other than a raging inferno.

All of these thoughts are preliminary; if you have a different (and well researched) angle, I’d love to hear it.

Yesterday (Feb. 6) was not a good day to be a ComScore (SCOR) holder. In the morning, the company announced that they would be unable to file their long delayed 2015 10-K plus their 2016 financials, so the Nasdaq would probably kick them off and force their shares to trade OTC. Shareholders did not like this announcement, sending shares down ~28% on the day.

The company came out with more bad news last night. The Nasdaq had rejected their appeal and will kick them off at the open tomorrow (Feb. 8). I am guessing shares are in line for some more pressure tomorrow.

Companies getting kicked off exchanges are like crack to me. There are plenty of investors who won’t or can’t hold stocks that are not traded on a major exchange, so an unexpected kick-off can create major selling pressure (plus, a lot of analysts will pull their ratings, which can create panicky PMs and more opportunity). While the stock price might drop like a stone, the company’s underlying value should be the same whether they trade on the NYSE, OTC, or on Mars, so as a value investor having forced counter parties selling for uneconomic reasons is exactly what I get up in the morning looking for.

ComScore had already been on my radar a bit due to their lingering accounting issues, but with the massive sell-off and increasingly bad news, I spent all last night checking the company out. And while I can see the potential value case here… holy crap is there a lot of smoke indicating something is really, really off here.

We’ll start with an overview of the company, but before we get there an upfront note. I’ve spent all night frantically trying to research SCOR in anticipation of a big sell off over the next few days, but that means my work might have been a bit more rushed / sloppy / off than normal (some might argue it is always rushed / sloppy / off and that this is just a particularly bad case). My hope in posting this quickly is to use the “power” of the blog and solicit input from anyone who is more familiar with the company / industry; please hit me up on twitter or email me if you fall into that camp and want to swap notes.

Anyway, overview. ComScore offers companies (mainly advertisers) a way to accurately measure who is viewing content. The most basic of way to think of this is the most famous example: the Nielsen rating that TV shows live and die by (Nielsen is a major ComScore competitor). Having a third party measure ratings is actually pretty important: advertisers would be foolish to trust viewing numbers provided by TV stations and vice versa, and having one third party provide a consistent metric across different stations and buyers can make deal making easier (i.e. if everyone uses Nielsen ratings, a buyer has a very good idea of what they're getting if they write into their contract people need to give them X number of viewers aged Y-Z as measured by Nielsen).

ComScore started off measuring internet metrics and became a go-to internet viewing metric. Last year, they bought Rentrak in order to scale up their video measurement metrics; the deal was clearly targeted at creating a company that could measure across all screens (TV, tablet, phone, etc.) and was seen as a way to beef up and take on Nielsen. Wall Street loved the deal and sent SCOR shares up 7% on the deal news.

In late 2015, investors started questioning SCOR’s accounting. In particular, they wondered if SCOR’s “nonmonetary” revenue bookings were too aggressive. Sure enough, in March 2016, SCOR had to delay filing their 10-k after their Audit Committee received “a message regarding certain potential accounting matters” (if I had to read between the lines, it wouldn't take to large of a magnifying glass to guess a whistleblower called a hotline).

That delay was announced March 2016. The issue with being unable to file your financials is that they scale- if you can’t file your 2015 10-K, then you can’t file your 10-Q for Q1’16, which means you can’t file your Q2’s 10-q, etc. It’s now Feb. 2016 and SCOR still hasn’t been able to get their 2015 10-K filed; according to the press release yesterday, they don’t think they can get them filed till summer 2017 at the earliest, which is why NASDAQ is kicking them off.

And that long timing is really the first red flag. Honestly, I don’t mind a company taking a while or being kicked off the exchanges, but the timing seems out of sync with what the company has announced so far. In September 2016, SCOR revealed a prelim estimate of the revenue adjustments to their historical financials, which were material but not earth shattering (and caused shares to jump as investors started to hope this was behind them), and then in November 2016 the audit committee completed their investigation. If the investigation has been complete, why do they need until the summer to file financials? That seems way out of sync with the amount of time to do an audit or a reaudit with no lingering investigation- they easily should’ve been done by late Feb (the deadline Nasdaq had given them) or maybe early March.

The more I dive, the more red flags I see. I’m just going to list them in bullet form below: (note: the company has hosted two calls since the restatement; an executive change call in August 2016 when they brought on their new CEO and a business update call in September 2016; I refer to them as “August Executive Call” and “September Business Update” below).

Financials- The company’s been extremely sketchy with providing any financial data for 2016, but the sparse details they’ve provided make me think business might have fallen off a cliff (and the fact they’ve only provided sparse details seems to confirm that). As far as I can tell, they’ve only provided two pieces of financial data so far:

In the August executive call, management noted that they had done $214-218m in revenue in H1’16, which was below budget by ~$20m and included $10m of non-monetary revenue. When they were asked for more info on their September Business Update call, they really hedged and seemed to even back off the H1’16 revenue numbers

Cash balance- This is where things start getting scary for me. Based on both my numbers and what they disclosed when they announced the acquisition (see the September 29, 2015 merger presentation p. 13; it's also pasted in towards the bottom of this post), Rentrak + ComScore should have had significantly in excess of $200m in cash on their balance sheet at the start of 2016. On their August Executive Update call, management noted they had $150m in cash and marketable on their balance sheet at June 30, 2016. In yesterday’s Nasdaq listing update, they said they had $116m in cash currently. Why is the company burning so much cash? ComScore, on its own, generated nearly $60m in OCF in 2015 w/ minimal capex. After adding in Rentrak, the company should’ve been gushing cash flow. Extra accounting costs and severance costs for merger synergies don’t even begin to explain how they burnt so much money; the only explanation I can come to is that the business has imploded.

Leadership change- Most companies that have an accounting scandal fire their CFO at some point. If the scandal drags on, the CEO gets the ax as well. ComScore axed both the CFO + CEO pretty early in the process (August 2016). So those guys leaving don't worry me.... buut it is concerning how fast everyone else seems to jumping off the ComScore ship.

Audit committee / investigation committee resignations- perhaps the biggest red flags here.

Joan Lewis: She joined the board as Non-Executive Chair in August 2016 as part of the management shakeup. She resigned in November 2016 when the audit committee investigation concluded.

Patricia Gottesman: Patrica resigned the same day Joan did (it’s in the same 8-k filing. Patricia was Chair of the Board’s Nominating and Governance Committee.

What did Joan and Patricia have in common? Both Joan and Patricia served on the Audit Committee. That meant they also were involved with the investigation into SCOR’s accounting; however, they wreen’t just involved in the investigation, the two of them were the co-chairs of the investigation.

To sum this up: the co-chairs of SCOR's audit investigation committee, including the chair of SCOR's board who had just joined ~3 months ago, resigned immediately upon the conclusion of the investigation. What the heck did that investigation turn up?

Other resignations

The company’s co-founder / exec chairman resigned in July 2016 and then completely left the board in December 2016 even though he was supposed to stay on until 2018.

The former CEO resigned in August 2016 but stayed on the board until December 2016; how he managed to stay on so long and why the company let him is beyond me.

Perhaps staying on this long is a positive? If something really, really awful had been done (like I assume from the co-chairs immediately resigning and the fact the company still can’t file financials), there’s no way they would’ve let the CEO who head up all the awful stuff stay on the board, right?

Share repurchase- When the company announced their Q4’15 earnings (before they knew they couldn’t file their financials), they also announced a $125m share repurchase. When the company announced they couldn’t file their financials, they cancelled the share repurchase “out of an abundance of caution”.

It’s a small point today, but it does leave a feeling in your gut that the company realized this was really bad very early.

Ok, so ComScore can’t file their financials, seems to be burning an amount of money completely out of line with what their prior history suggests they would be burning unless their business had imploded, and is having anyone who touches their audit investigation resign as soon as they possibly can. This is awful; case closed, right?

I’m not so sure. I can’t get over the potential valuation here. ComScore has ~56m shares outstanding and, importantly, no debt. At today’s share price of $23 (and probably lower when the stock opens), the company has a market cap of ~$1.3B and an EV of <$1.2B.

Here’s what the two companies were pitching their financials as when they announced their merger; in addition, they thought they could realize $20m of synergies in 2016 and $35m in 2017.

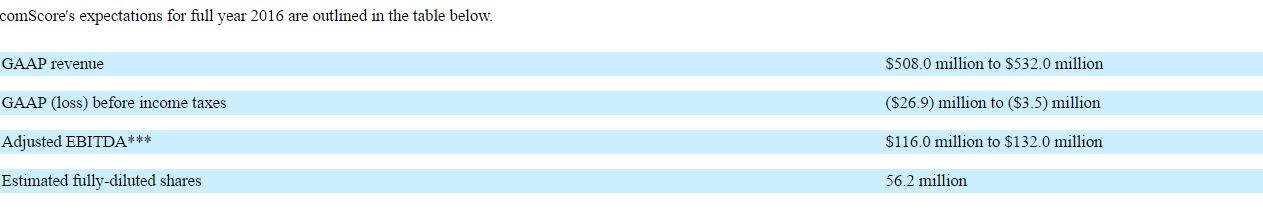

And here’s what they were projecting for FY16 before all of the accounting issues started up:

Capex for the business should be minimal ($10m-ish per year) and the company should have plenty of tax assets to offset tax payments in the near term. So, if you thought the business could recover from all of these shenanigans, there’s no reason the company couldn’t be generating $100m+ per year in cash flow while growing in the double digits. To buy that level of cash flow and growth for just a shade over $1B could represent a fantastic value.

Maybe to just throw out $100m in cash flow is too bullish given the accounting issues and that the business seems to have fallen off a cliff. But it seems all of the accounting issues were related to ComScore, not Rentrak, and Rentrak was valued at $650-700m before the SCOR deal was announced. If you think Rentrak’s business hasn’t been harmed, then it represents ~half of today’s EV. To get SCOR’s business + the potential synergies between Rentrak and SCOR for just $600m (assuming a $23 share price and that Rentrak is worth $700m) seems like a steal given the upside potential.

I don’t know. It’s tough. There seems to be a ton of smoke here. I’m staying away currently, though if shares were just slaughtered tomorrow or someone could point out some upsides I’m missing I’d be interested.

Odds and ends

Rentrak’s attractiveness- Part of my made up bull case involves Rentrak being worth something near what it was worth before the deal, but that might be a bold assumption on my part. As mentioned several times, the whole company’s business seems to have fallen off a cliff, so Rentrak probably isn't performing well. Also, I’m not sure how attractive Rentrak really is. You can read the proxy between Rentrak and ComScor here. It doesn’t read like Rentrak was a super attractive asset. Four companies were approached by Rentrak and all declined to bid. ComScore and Rentrak shared a major stockholder (WPP) who kept bugging both management teams to look into a merger. It seems like ComScore kept trying to get out of looking at a merger but getting pressured by WPP. That setup plus that the merger was stock for stock deal with no/low premium makes me think Rentrak wasn’t viewed as an attractive or strategic asset and ComScore bought them due to a lot of pressure from WPP.

WPP- Advertising giant WPP is a major shareholder, owning just shy of 20% of the company. They bought a ton of shares back in late August in the mid to high 20s. Did they have more info than we did at the time (unlikely as that’s insider trading, but they could’ve gotten in front of management and at least read their body language) that still suggests this is better than it appears from the outside? Do they still believe in SCOR? Would they look to take advantage of the company’s depressed share price and buy them out while the accounting overhead lingers?

Business is real- The one thing that lends me some hope is that there is no doubt this is a real business that creates real value. If you pay attention to the footnotes of charts and data type things when you browse the internet, I guarantee you’ll start to see a lot of “data from comScore” type footnotes. Or just check out CBS’s 10-K; they brag about ranking among the top internet properties in ComScore Media Metrix.