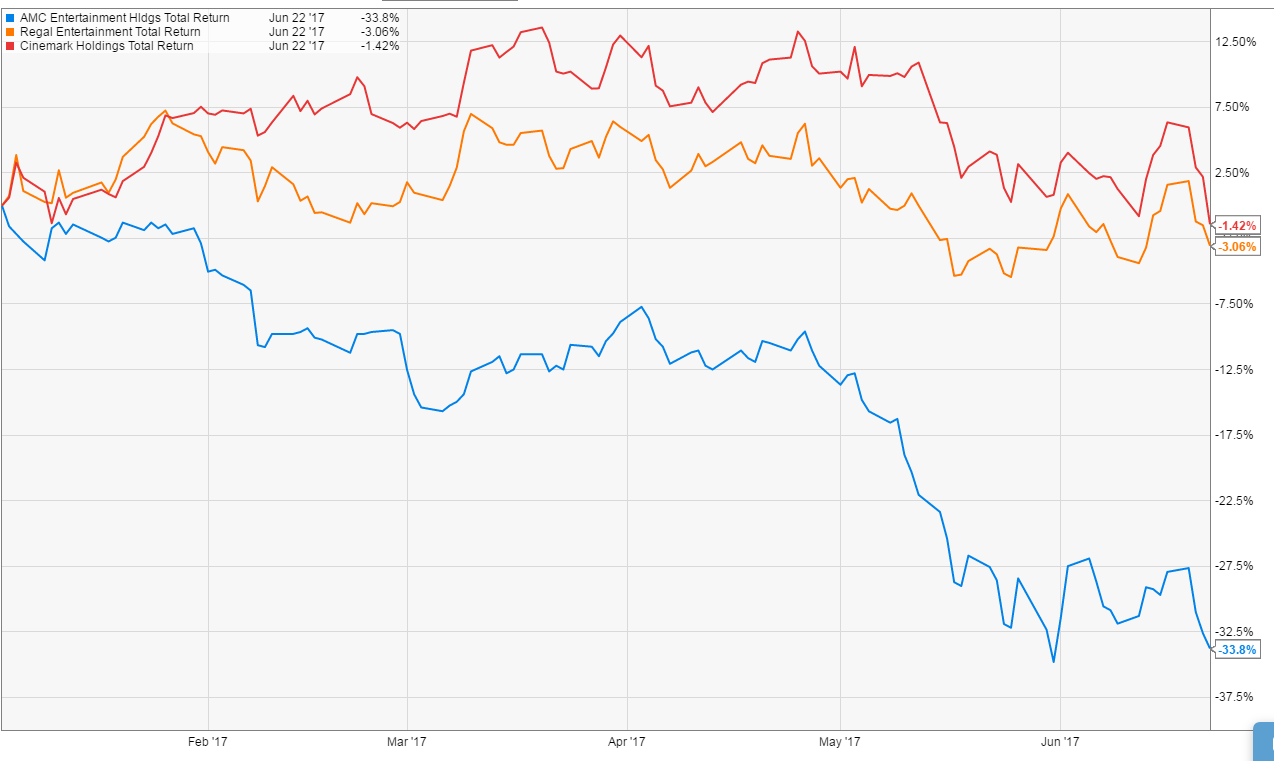

Why the big decline, AMC? $AMC

Key investment thesis: AMC (disclosure: long) shares have recently dramatically under performed peers RGC and CNK (disclosure: short a non-life altering amount of both as a hedge), providing investors with an opportunity to invest in the company at a below peer valuation despite better growth prospects.

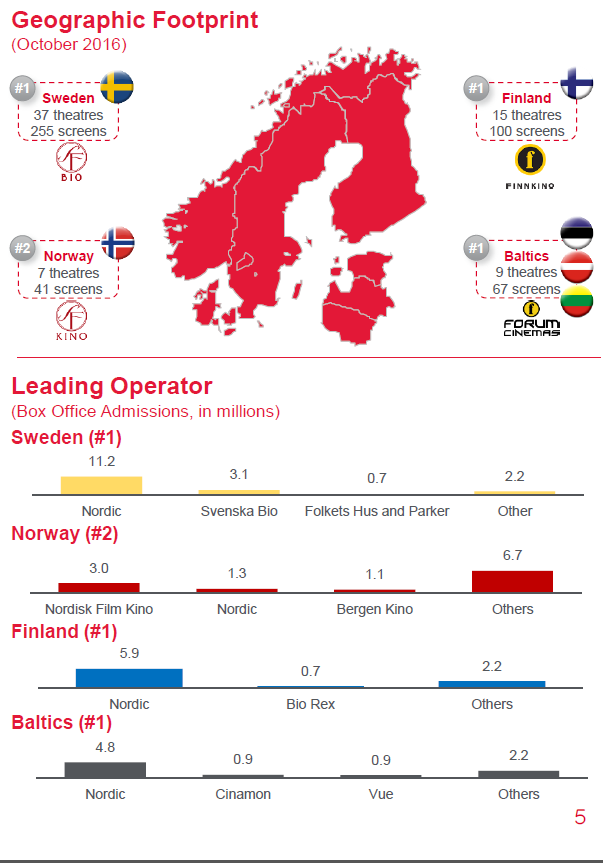

AMC is the largest movie theater exhibitor in the world. Their merger with Carmike in late 2016 made them the largest operator in the U.S., while their Odeon and Nordic mergers in late 2016 / early 2017 left them as the #1 player in Europe as well.

The core thesis here is that, at today’s share prices (~$23), AMC is trading at a discount to its U.S. peers (CNK and RGC) but it likely deserves a premium. I believe AMC deserves a premium for three reasons.

Earnings tailwind: AMC is now the largest player in both the U.S. and the world. There are some scale benefits to being the largest player in a given market. The largest scale benefit is your ability to negotiate film costs with the major studios. As a general rule of thumbs, box office admissions are split roughly evenly between the studio and the movie theater, but generally larger theaters can negotiate a slightly better box office split than their smaller peers. For example, in FY15, Carmike paid studios 56.5% of admissions revenue, while legacy AMC paid studios just 54%. The table below shows AMC, Regal, Carmike, and Cinemark’s Film Costs, Admissions revenue, and attendance for fiscal year 2015. As you can see, more attendance and larger admissions generally resulted in better film cost %.

AMC is now the largest US player in admission by far, with Q1’17 attendance ~25% higher than RGC and 44% higher than CNK. Despite this, AMC’s film cost as a % of admissions revenue in Q1 was closer to CNK than it was to RGC. As AMC fully integrates CKEC and renegotiates its film studio contracts, I’d expect film costs to come down over time, resulting in an earnings tailwind over time. Given that earnings tailwind (and assuming all), you’d think AMC should trade at a higher LTM multiple because they’ll have higher built in earnings growth. Despite this, AMC trades in line with peers currently.

Euro multiples: ~25% of AMC’s value comes from its European theaters (its current EV is ~$7.7B, and they spent about $2.1B on Odeon and Nordic). European theaters trade for higher multiples for a combination of reasons (lower tax rate, more diverse revenue streams given local movies + American movies, lower penetration allows for higher growth, lower interest rates, etc). Given a quarter of AMC’s value comes from a group that probably deserves a higher multiple, the implied EV multiple for AMC’s U.S. theaters is well below peers. The slide below is a bit stale (I pulled it from an AMC investor deck), but it does a good job of highlighting this.

NOLs- AMC has significant NOLs that shield them from taxes. From their 10-Ks, AMC has $257m of state NOLs, $562m of federal NOLs, and $460m of foreign NOLs. Regal has $84m in federal NOLs; CNK doesn’t appear to have any. This results in a significantly lower amount of cash taxes for AMC; for example, in 2016 AMC paid $4.7m in cash taxes on ~$150m in EBT; in contrast, RGC paid $102m on $282m in EBT and CNK paid $93m on $361m in EBT. Eventually, AMC will use all of those NOLs up (or they’ll expire), but for the next few years AMC will likely pay a lower tax rate than its peers. This means its EBITDA should convert to after tax cash flow at a higher rate than peers, which deserves a premium EV / EBITDA multiple vs. peers.

The question I keep coming back to is why has AMC’s stock sold off so hard? In other words, why has this opportunity presented itself?

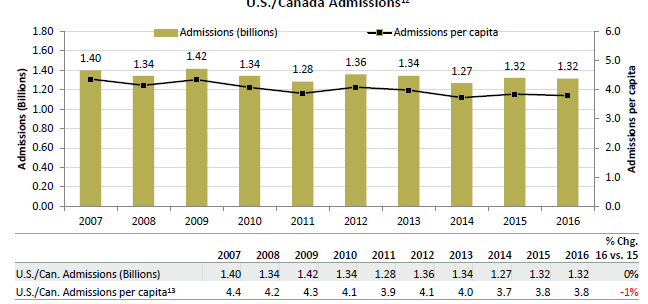

Everyone’s first stab at the reason for the decline is “o, the movie theater window is going to close, and the market is discounting the lost profits.” Currently, movie theaters have the exclusive rights to movies for ~100 days before they go into pay per view, streaming, DVDs, etc. Movie studios are always pressing to shorten this window because doing so allows them to spend less on marketing (currently, a studio needs to advertise a movie when it comes out and again when it goes on to DVD. If you could release the DVD while movies were still in theaters, you could consolidate that marketing and save a bunch of money). Window shortening is certainly a risk and I’ll discuss it later, but I can’t see it being the reason for AMC’s sell off because only AMC has sold off, not any of its peers.

So is there something AMC specific?

Technical reason / lock up. Odeon’s former owner had half of their shares coming off lockup (meaning they can sell them) at the end of May. Fears that the market would be flooded with shares could have driven AMC’s share price lower.

I don’t think this holds up under scrutiny. The lock up only releases ~2.5m shares, which is roughly AMC’s average trading volume. If the selloff is really driven 100% by lock up fears, this is an incredible opportunity. Plus, it’s been ~a month, so you think this would’ve passed by now.

AMC specific fundamentals: Since peers haven’t sold off, the market could be selling off in response to something AMC specific. I can think of a variety of reasons.

Integration issues: AMC has made 3 pretty major purchases in one year (Carmike, Odeon, Nordic). The total of all these purchases approaches $3.5B; given a current EV of ~$7.5B, AMC has basically doubled their size. The selloff could be related to some form of integration issue that people are picking up on.

While certainly possible, I’m just not seeing any evidence of integration issues. To start, the integration is not much more complex then turning every sign that says “carmike” into an “AMC” sign. Yes, there is some back office stuff, but even if they were completely botched the downside seems much lower than in say a consulting firm merger, where all of you employees leave or something. Also, on the Q1 call, management indicated the integration was going incredibly smoothly and would basically be finished by the end of May. They could be lying, but it just seems really unlikely that from late April to today the integration took a turn so bad that shares should have dropped almost 30%.

The above only referred to AMC / Carmike. It’s possible the Odeon / Nordic transactions had rougher integrations, but those are mainly being run standalone so it seems even less likely that there are integration issues there.

China ownership: AMC is controlled by the Wanda group, a Chinese super conglomerate who own ~57% of AMC’s shares and control the company through super voting shares (their shares get 3 votes for every 1 normal shares get). Perhaps investors are worried about something Wanda might do.

There could be some merit to this; Wanda tried to buy Dick Clark productions for $1B late last year and had to call the deal off early this year, and the company is pretty leveraged, so Wanda could look to dispose of their shares at some point to bring leverage down. Again, I have trouble reconciling the huge move down with this news: it’s not like Wanda suddenly sprung up as majority owner, and the bulk of the selloff occurred in May, more than a month and a half after the Wanda / Dick Clark deal fell through.

There was also recent news of China scrutinizing Wanda. Again, this could serve as a risk (does Wanda need to dump all their shares?), but it could also be an opportunity- perhaps it results in a big tender over or Wanda looking to sell the whole thing?

Nordic deal- AMC announced their Nordic deal in January and closed it in late March. Perhaps the market is concerned by the Nordic deal.

This is a valid concern as AMC provided substantially less detail into the Nordic transaction than they normally do. In particular, AMC did not provide an EBITDA or earnings number for Nordic, saying they couldn’t do so while Nordic’s audit was underway and because they still hadn’t figured out the transition from IFRS (which Nordic reported in) to GAAP.

Still, the selloff happened well after the Nordic deal closed.

In addition, I find it hard to believe that the Nordic deal could have destroyed enough value to justify AMC’s stock drop. AMC’s stock has dropped by ~$1B in total market cap. AMC bought Nordic for ~$930m. I estimate this was between a 12-14x EBITDA multiple. If we assume Nordic deserves a 9x EBITDA multiple, AMC would have burned ~$350m on this deal, much less than the value destruction in their stock. You basically need to assume Nordic is worthless to justify this big of a drop.

I think the acquisition is likely to do well over time. Perhaps it doesn’t justify the lofty multiple, but Nordic is, by far, the #1 player in 3 of their four markets. Given the scale benefits of being #1 discussed above, Nordic probably has pretty attractive economics.

European issues: AMC is the only of the big 3 players (RGC, CNK, AMC) with significant euro / UK exposure. RGC is a pure play U.S., while CNK is US + Latam. Perhaps the market is discounting a deteriorating European business.

Unlikely. AMC bought Odeon after Brexit, so it’s not like they paid an above market multiple thinking Brexit wasn’t going to happen. And European peer trading multiples have remained strong, suggesting there’s nothing wrong with the industry over there.

Why are European multiples higher? It’s a question I asked myself a view times. After some digging, it seems movie penetration there is a bit lower and they’re farther behind on the upgrade cycles, so the market is pricing them more expensively to account for more growth / positive ROIC remodels in their future. I believe they also have slightly lower taxes, and they’re a bit more diversified since their revenues are a bit more evenly split between American films and local films.

Serious leverage: AMC is, by far, the most levered of all of the chains. After the Nordic deal, I’d put AMC’s gross leverage around 5.5x compared to RGC at ~3.5x and CNK under 3x. Perhaps the market is concerned by their leverage.

Possible, but (similar to Wanda ownership questions) it’s not like their leverage sprung up on the market out of nowhere.

If peers were down 15-20% and AMC was down 30%, I think the leverage argument would carry much more weight. But I see no reason why AMC should be down 30% / trading below peers just because it has a bit more leverage.

NCMI share decline: As part of their deal with the DOJ, AMC needs to sell the bulk of their NCMI shares over the next few years. NCMI’s share price has been hammered over the past few months, so perhaps the market is adjusting to that.

While it obviously would have been nice for AMC to sell their NCMI stock at the ~$15/share level they opened the year at instead of today’s ~$7.50, I don’t think this can explain the decline. CNK and RGC both own NCMI stock as well, so the NCMI share decline hits them as much as it hits AMC.

It is true that AMC is the only person of the group that has to sell NCMI, and given AMC’s leverage (discussed above) and growth capex, NCMI’s decline probably has the biggest effect on AMC.

NCMI dropping from $15 to $7.50 reduces the value of AMC’s stake by $250-300m. AMC’s share price dropping from ~$30 to ~$23 reduces AMC’s equity value by just under $1B. NCMI’s drop alone can’t explain that.

Industry Risks- I discussed a lot of the AMC specific risks above. The two industry specific risks that keep me up at night are window shortening, streaming services, and VR.

Window shortening: theaters and studios have a contract that dictates the length of time between a movie coming out and it getting released on DVD, streaming services, etc. As discussed above, studios generally want this window to be shorter in order to minimize marketing costs, while theaters like longer windows to encourage people to get into the theater. The big worry here is studios shorten this window and it causes attendance to drop. Theaters have generally pushed back on this and said that if they agree to a shorter window, they’ll want a piece of the early streaming economics. This makes sense, but it could really weaken their hands going forwards (while a studio might agree to give theaters a cut of streaming at first, at some point you have to think they’ll lock them out of anything that’s not happening in the studios).

I tend to think this concern is overblown. It’s worth noting we hear waves about this every few years (here’s an article discussing the same issue back in 2009). I tend to think this is overblown for two reasons

There is something about the experience of getting out the house that matters. I think back to a comment from a sports exec I once heard (I think it was the Braves CEO but I’m not positive). He basically said that, throughout history, people have predicted things would kill live sports attendance. First it was the radio, then it was television, then it was high def, etc. But there’s nothing that can replace the experience of seeing something in person. Now, movies are a bit different than sports, but the whole process of dressing up and getting out has value that offering a live stream doesn’t.

I think studios will need to have a long thought about doing anything that threatens movie theaters. It’s doubtful streaming or shorter windows can replace the economics of showing things in theaters; of note is that Disney (the most successful studio) is also the only studio not calling for a change to the model today (the CEO explicitly said so on recent earnings calls and conferences).

The Carmike CEO had an interesting way of framing it at a recent conference: it used to be that 1/3 of a movies economics came at the box office while 2/3 came from other windows; now it’s more like half and half. Are studios really going to do something that risks half of that revenue, particularly given that a lot of the ancillary value is driven by how the box office performs?

Another risk people love to talk about is young people not going to the movies as much as they used to. Younger people still over index as a % of the population attending movies. Yes, young people have always overindexed, but overall box office admissions have been relatively flat over the past few years despite the rise of streaming; so I tend to think that + young people still overindexing indicates there’s still interest in going to movies.

Streaming: separate from the shortening of windows is the rise of streaming. Consider Netflix’s (which the industry association once suggested was trying to kill movie theaters) deal with Adam Sandler. Netflix gets Sandler’s movies directly and never puts them in theaters. Now, everyone loves to trash on Sandler, but those are movies that traditionally would have gone into theaters and done $50-100m in box office and people are obviously watching them. Could streaming services continue to take incremental supply away from theaters? Could they look to produce their own Marvel type tentpole movie (they already moved into a $60m Brad Pitt war movie)?

I think the incremental argument is more pressing than Netflix taking away tentpole like movies.

Tentpole movies are a massive investments- at least $60m, and many of them push the $200m+ market once marketing and everything is included. These films can gross $300m+ in theaters and do something similar to that in DVD / PPV / streaming revenue after they’ve been in theaters. Netflix’s revenue in FY16 was ~$8.8B. A giant sum, sure, but it just doesn’t feel like tentpole movies huge cost fit well with Netflix.

Also worth keeping in mind- tentpole movies are often meant to launch other things (toys with Disney, other tentpole movies, movie star brand awareness, etc). Limiting them on Netflix kills those ancillaries. All in it just doesn’t seem like the right fit.

Tentpole movies are also just more fun to see on a big screen with surround sound versus on a smaller screen, while rom coms and more character driven dramas can actually feel a bit more intimate on a smaller screen. This article predicted crouching tiger 2 (which Netflix released) would be hurt since it wasn’t on theater; indeed, the flim was a disaster, though it was probably more the film than the experience in this case. Between Crouching Tiger 2 and the War Machine reviews, I wouldn’t be surprised if Netflix continued to pull back on action movies and focus on character films.

Of course, I could be wrong- Netflix is spending $100m+ for the next Scorcese movie.

In contrast, incremental movies, particularly smaller indie type films, seem like a perfect fit for Netflix, and I would not be surprised if Netflix / amazon etc. continued to take this incremental movies. While that could hurt attendance LT, I think we’ve got it more than priced in at today’s prices.

I thought this think piece covered a lot of these points interestingly.

Prestige TV- Somewhat related to Netflix incremental worries above, but it seems increasingly like the line between TV and Movies are blurring. Consider something like True Detective: that was basically movie level quality with A list actors. As prestige TV economics ramp up and fight for A list talent, does that sap away incremental movie business? Again, it doesn’t kill movies, but on the margin it shrinks the pot.

VR- My biggest worry is what happens as VR gets more widespread / adopted. My argument against streaming and window shortening to some extent was the experience. If you’re putting on a headseat for VR, you don’t need the experience. In fact, going in person to the theater is antithecial to the whole point of VR.

This is an industry wide problem, not an AMC problem, so it’s unlikely AMC YTD performance is solely driven by VR fears

The rate of adoption is likely to be incredibly slow. Movies take a long time and a lot of money to make, and studios aren’t going to shift their tentpole movie spend (which really drives the industry) to VR until they see evidence of adoption and it’s a bit better understood. I would bet this takes much longer to play out than most people expect, and even once VR is more widespread I wouldn’t be surprised if there’s still an active theater going business for years after.

Also, it’s possible I’m wrong that VR is antithetical to movie thaters; IMAX and AMC are experimenting with a VR experience in one of AMC’s NYC theaters. Perhaps my worry here is akin to thinking video games would kill movies once their graphics got better.

Bundle falling apart- a quirky risk that nags at me: what if it turns out that most movies are actually sold (i.e. the massive advertising campaigns are really what puts butts in seats). As the TV bundle falls apart and people watch less TV with advertisements, does that drive a decline in movie attendance? I don’t think so but again it’s a quirky risk that nags at me.

Catalysts

Resolution of lockup overhangs

More details on Nordic acquisition

Earnings growth as acquisitions fully integrate and remodeled theaters ramp up

Excitement over box office in H2

Probably already baked in since it’s so visible, but STAR WARS!

Odds and ends

I haven’t discussed AMC’s valuation in absolute a ton; instead, I've mainly focused on the comparison to CNK and RGC. That’s mainly because AMC haven’t given us specifics from the Nordic deal so it’s tough to come up w/ a specific earnings number. If we exclude Nordic (i.e. just assume Nordic is worth what AMC paid for it), AMC’s EV is ~$6.5B. EBITDA for 2017 should come in around $900m and they’ll spend around $600m in capex. A lot of that is growth capex- the company argues maintaince capex is closer to ~$150-200m/year (~15k/screen given current screen count of ~11.5k). That feels a bit on the lowside- the company is saying everything needed to take a seat to a recliner is growth capex, but a lot of the things they do (reflooring, improving screens, etc.) probably needs to be done to the theaters once every ten years or so anyway. So maintaince capex is probably closer to ~$300m (no firm rationale there, just ~$25k/screen which feels roughly right to my gut), meaning unlevered FCF is ~$600m ($900m EBITDA less $300m capex) and the whole company is selling for an unlevered FCF yield of over 9%. With a highly levered capital structure focused and their debt costing them 5-6%, FCFE easily exceeds 10%, which is obviously attractive, particularly since I think that should grow as the remodels fully take hold.

Overall, I just can’t help but look at AMC (and theaters in general) and see multiple areas for upside.

For years, theaters have been cramped, sticky messes that were slow to change / upgrade. That started to change with the megaplexes and now we’re seeing lots of change to improve the movie going experience; I think that’s bound to lead to better economics. Theaters have started to introduce common sense upgrades (selling alcohol, better food and snacks, etc.) and rolled out improved seating. There’s still plenty of wood to chop here- the major chains just started focusing on their loyalty programs in the past year, and markets like China have dynamic ticket pricing (saw this from an IMAX investor presentation) but the U.S. doesn’t. As they upgrade all of these, we should see a nice boost.

And AMC specifically seems to lag a lot of these areas. For example, Regal’s loyalty program had 11.8m members at YE16. Stubs (AMC’s program) was only 5.3m. AMC’s attendance is ~25% higher than Regal’s, so I don’t see why they shouldn’t easily surpass them over time.

In July 2016, AMC created a pricing department for the first time. I think there’s an easy argument to be made that movie theater pricing in general is insane- why do tickets to Star Wars opening night cost the same as tickets to Pirates of the Caribbean on a Weds after its been in theaters for a month?

In 2014, AMC started their “tax on top” strategy (adding tax to ticket sale instead of including it) and saw some success; I think flexible pricing is another move that could add a little but to the bottom line. Nothing earth shattering, but every bit counts when you’re buying a levered company at 8x EBITDA.

The CEO has mentioned trying a monthly subscription pass several times (pay $30/month, go see as many movies as you want) and they have something like that in Europe. I don’t know if that makes a ton of sense (seems like you’ll pick off people who go 3 or 4 times a month and won’t get the infrequent movie goers, so you’re cutting your revenue down plus questionable how you split that with film studios), but if successful a subscription product could take a ton of market share (I doubt any chain other than the big 3 could do it, and it’d have pretty nice first mover advantages plus give them insane incremental data on movie goers).

AMC owns just under 17% of Screenvision, which is currently up for sale. If Screenvision were sold for the levels that article discusses, it could result in a nice windfall for AMC (I haven’t given AMC any value for Screenvision in my cap structure). Not a huge swing but an incremental positive.

All of the theater chains are in the process of upgrading the bulk of their theaters to have reclining seats, serve alcohol, improve food, etc. While the easiest money from this has been made (converting the first theater in a market to recline seats showed incredible returns; at this point they’re mostly converting the second, third, and fourth theaters in markets so the returns are lower), it should serve as a nice tailwind for earnings growth over the next few years.

I suppose a bear case is that the returns from the new renovations will be awful. Certainly possible, but if that happens the spigot for these remodels can be shut down quickly. Tough to see that as an existential threat.

Alcohol is an easy target here. From their legacy AMC locations, AMC had 178 theaters serving alcohol at YE16. In June, the company opened their 250th bar and they plan on getting to 275 by YE17. Some of that growth is driven by including Carmike, but a lot of it just comes from opening the bar. This should result in nice incremental profits, and AMC still has a significant runway (250 locations is less than half of AMC’s US total).

AMC’s CEO: I’m really mixed on the AMC CEO. On the negative side, he has really stretched the balance sheet to roll up three companies in a year. And I find him really promotional and saying a lot of things I hate to hear CEOs say (for example, on the Q1 call, he discussed being “absolutely perplexed” by a dramatic increase in short sales, he’s mentioned beating analyst estimates, and he’s focused on his stocks daily average volume. I hate it when CEOs focus on what analysts / shorts / traders are doing). But on the positive side, I think the logic underlying all of his acquisitions are pretty strong, he’s doing some very interesting / innovative things that have the potential to drive a lot of value, and he at least puts his money where his mouth is and buys the stock on the open market (he put $1m into AMC’s recent share issuance and he’s bought stock four times in the past ~18 months, including 10k shares at $24.72 earlier this month).

Here’s a quicker overview of the opportunity in Barron’s from May.