What the heck is happening at $CUTR

In Saturday’s post on CANO, I noted that there were two strange proxy situations in the market currently. CANO was obviously one of them; the other is Cutera (CUTR).

While CUTR might not have quite the same explosive headlines and drama that CANO does, I think the CUTR situation might actually be the strangest proxy situation I’ve ever seen just in terms of the board dynamics and the seemingly game of thrones style shifting alliances. I believe I’ll be doing a podcast on CUTR with Vince Martin from Overlooked Alpha (who wrote CUTR up here) this afternoon, so I wanted to put this post up just as prep for the podcast / to provide some background.

Some (very) quick business background as that’s not really the most interesting thing here: Cutera makes laser/energy-based aesthetic systems. That sounds cool, but they’re generally just selling lasers than make cosmetic / non-surgical improvements. You’ve probably heard of some of their products (for example, truSculpt for “muscle sculpting” or enlighten for laser tattoo removal).

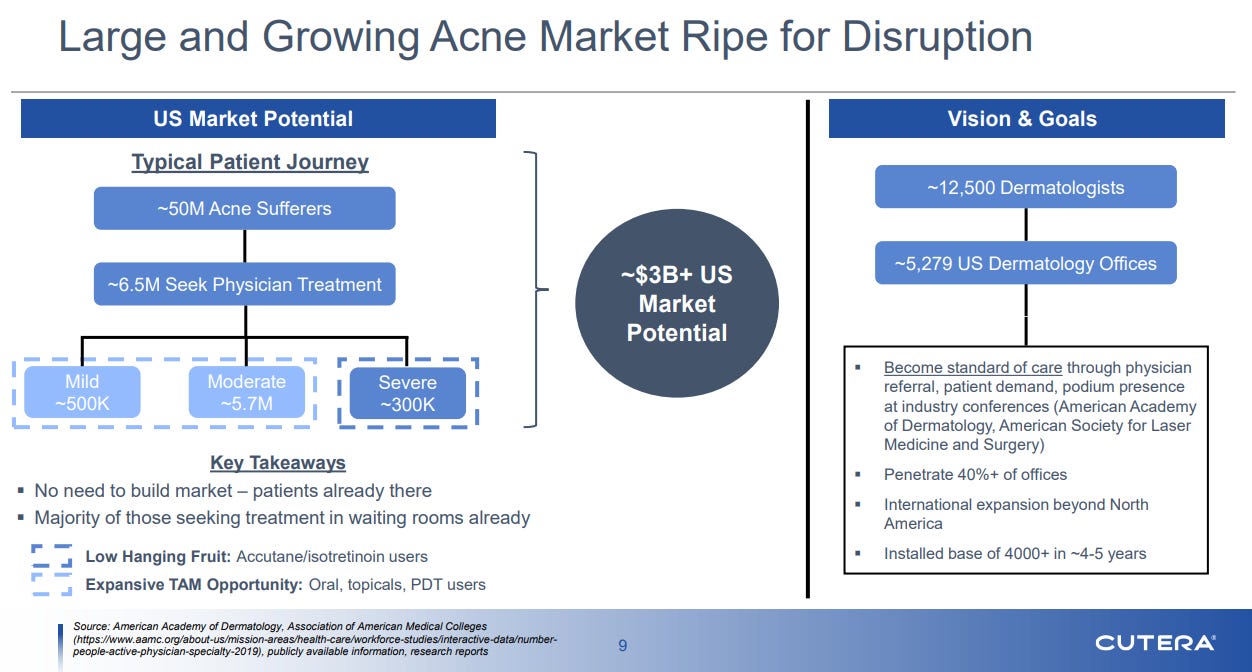

Recently, the company has had a breakthrough with AviClear, the first FDA-cleared “energy-based” device for treating all forms of acne.

Cutera has been investing aggressively into AviClear. It got approved by the FDA in March 2022, and the company managed to place 600 units by the end of 2022 with a goal for placing 200-300 units/quarter in 2023.

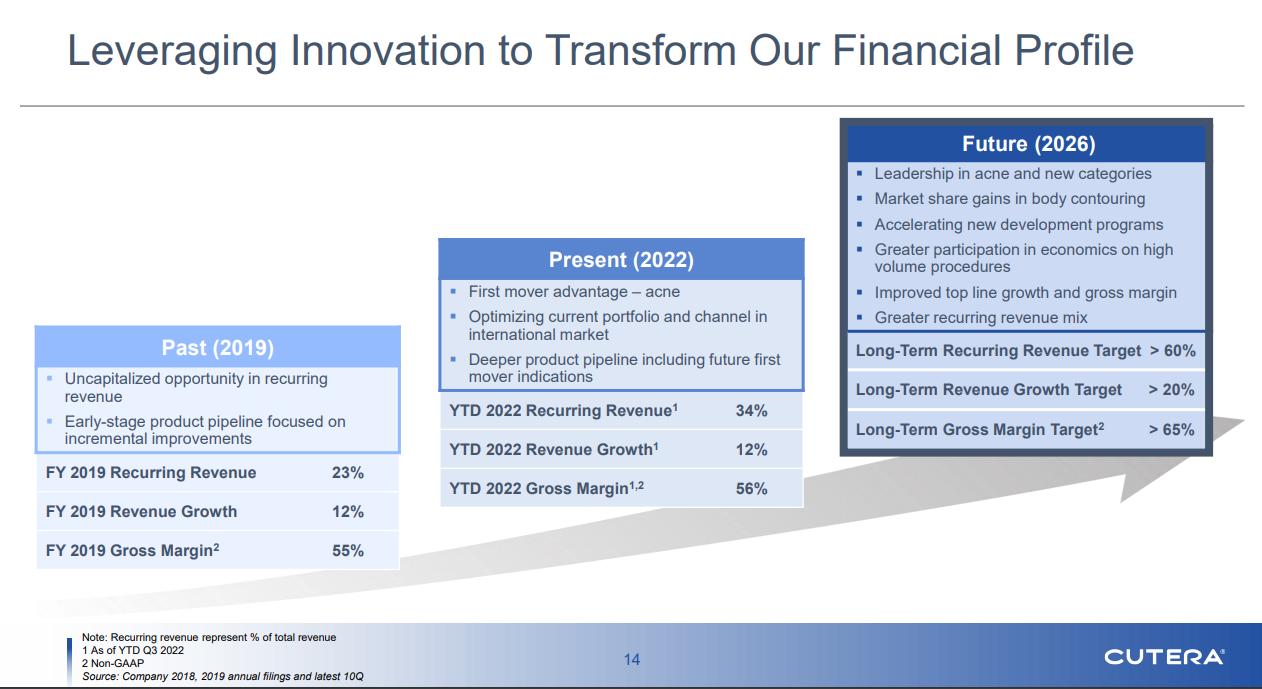

Those familiar with medtech know that these launches work as something of a razor/razor blade model, except with a whole bunch of selling expenses upfront to get the razor sold. CUTR described the AviClear structure on their Q1’22 call; basically, a practice that gets an AviClear unit enters a partnership with CUTR, and the practice then pays CUTR an annual licensing fee plus a fee for each patient treated by the device. In order to get that partnership entered, CUTR hires an expensive sales force that basically goes knocking door to door on a bunch of dermatological (and I think aesthetic) partnerships each year. So CUTR takes a whole bunch of expenses upfront, but each product placement should give them a steady (and growing) stream of royalty revenues from procedures (here’s how they put it on their Q3’22 call: “our innovative AviClear business model trades a much lower capital revenue inflow for significantly higher procedure fees over the life of the device. This is a compelling financial arrangement, but one which requires a heavier upfront financial commitment on our part accordingly.”). You can see the results of the investment in their income statement below; the core business was profitable (before a decent bit of overhead!), but the AviClear segment blew $28m (against less than $4m in revenue!) as they looked to get that razor/razor blade model sold.

I have not done crazy amounts of work around AviClear, but let’s just say we believe CUTR’s slides below that show the potential for >4k offices to have an AviClear. Launching in ~Q2’22 and had ~200m units installed heading in Q4’22, where it did >$3M in revenue. If you just averaged that per unit number across 4k units, you’d expect AviClear to do ~$250m of annual revenue. That’s almost certainly way too low; once an AviClear (or any medtech tool) is at a practice, it takes time for the practice to get used to it / fully utilize it in their process, so you’d have to imagine the per practice revenue number is going to rapidly expand as the installed base seasons.

Ignoring those seasoning issues, AviClear is a medtech product that is largely recurring with what should be very high revenues (CUTR guides to >65% long term gross margins). What would that be worth to a variety of strategic players? 5x revenues doesn’t seem crazy; that’d imply AviClear alone would be worth more than $1.25B (assuming the economics I presented are correct; a big assumption!). At $22.50/share, CUTR’s EV is ~$550m, so AviClear alone would be worth double CUTR’s EV… and that’s without valuing the rest of CUTR’s core business (which, as shown above, did $250m in revenue and ~$21m in EBIT before corporate allocations in 2022).

Anyway, all of that was very high level and very simplified. And, to be clear, I’m not saying that any of those EV or revenue numbers were the base or even bull case for CUTR. But I wanted to do a quick overview of CUTR and show you the potential pot of gold at the end of this rainbow (of course, that assumes the path to the end of the rainbow is smooth, which is always a bold assumption!), because I think it helps frame the set up and the crazy battle going on at CUTR.

So let’s dive into the battle.

It starts innocuously enough. On April 7, CUTR quietly files an 8-K noting that their executive chair (J. Daniel Plants) has sent a demand for a special meeting to remove most of the directors from CUTR’s board. Only Mr. Plants, CUTR’s CEO (David Mowry), and one other director would survive the purge.

That alone is wild. The exec chair was appointed by Voce, one of CUTR’s largest shareholders at ~6.4% ownership. It’s sort of insane that the board would just quietly file an 8-k noting he was trying to remove basically the whole board!

We got some more background on April 10. The exec chair and CEO jointly file a press release noting they’re calling for a special meeting to replace the board and detailing why. I’d encourage you to read the whole thing, but some keywords that I think will give you an idea of the tone of the letter include “a level of dysfunction that critical decisions are not being made and vital initiatives are unable to move forward”, “the Board’s lack of transparency, attempted micromanagement and political behavior have become a major distraction for the Company and its leadership team,” and accusing the board of “Misappropriation of corporate assets and machinery” in a “personal battle against other Directors.”

Again, the exec chair and CEO both serve on the board, and the exec chair is a major shareholder. It’s incredibly rare for people inside the board like that to feel the level of dysfunction at a board has reached the point where they need to go public with their concerns.

The exec chair and CEO then get the majority of CUTR’s senior leadership to sign a public letter supporting them against the board.

So, at this point, CUTR’s board is up against their executive chair and their CEO, with the executive chair doubling as a major shareholder. They also know senior leadership seems to be behind the exec chair / CEO. Generally, you’d think a board facing those odds would quickly settle unless something really crazy was going on…

As you might have guessed, it seems something really crazy is going on, because CUTR’s board response is where things go next level. They immediately terminate the executive chair and CEO for cause and withdraw the company’s 2023 outlook/guidance with no color. The board names one of their own to serve as interim CEO while searching for a permanent CEO and another of their own to serve as independent chair.

This would be an aggressive response on its own. But what makes it so crazy is that the board notes they began exploring a CEO transition in November 2022, and as part of that exploration the executive chairman “strongly recommended the immediate termination of” the CEO so that the executive chair could “succeed him as the Company’s next CEO.” The board also notes this wasn’t the first time the executive chair had tried to remove and succeed the CEO (he tried to do so in February 2021 as well).

That is wild! The chair tried to fire and replace the CEO not once but twice…. and then a few months later is partnering with that same CEO to fight the entire rest of the board!

That’s some Game of Thrones level board politics!

The exec chair and CEO immediately respond by filing a lawsuit against the board, calling the firing “unlawful and unjustified.”

Now, the board here is fighting an aggressive game. Again, the exec chair is a major shareholder, and the board has just tried to take him and the CEO out over the opposition of CUTR’s senior leadership. You’d expect the board would at least be united in their decision making and have the support of some other major shareholders that these actions need to be taken.

Nope!

One of the board members (Joseph Whitters) puts out a public PR noting that he doesn’t support the boards maneuvers, and CUTR’s two other major shareholders (Pura Vida and RTW) each put out public statements against the removal of the exec chair/CEO and calling for a special meeting to replace the board.

At this point, it seems the board might have gone a little rogue… but just this morning CUTR’s board filed a PR trying to justify the actions they had taken to “protect stockholder interests.” They note that, under the current CEO, the company was having trouble building and retaining a “world-class" executive team,” and that the limited commercial roll out of AviClear in 2022 had not gone to plan (this was true; go look at the Q4’22 call and look how much discussion there is about missing sales targets due to poor sales force incentives / alignment). They note that the exec chair was generally in favor of replacing the CEO, and that when the exec chair was told he would not replace the CEO that he generally stopped working for the company and “did everything he could to try to frustrate and delay the Board’s search process” for a new CEO.

So that brings us up to today (as I write this the morning of April 17).

Two things jump out to me here that make this story so crazy

It just seems so wild the exec chair / CEO would end up aligned so firmly after the executive chair had made multiple moves to remove and personally replace the CEO.

The current board has waged a “burn all the bridges, no turning back” war against the executive chair and CEO despite, as far as I can tell, no support from any other relevant constituency. It seems all of the other major shareholders (RTW and Pura Vida) and the rest of the management team support the exec chair / CEO. Generally, a board would only chose to wage a battle like this if they had some line of sight to victory. That could be support from a major shareholder who had sent an inbound along the line of “this performance is awful; we need fresh blood in the CEO role”, or it could be a real smoking gun that they published after the fight started that brought everyone over to their side (corporate malfeasance, initial 2023 results that were so bad that everyone agreed the CEO needed to be replaced and the corporate strategy shifted, though that would have some blowback on the board for letting things get that bad!). As far as I can tell, the board waged this war without either (though it’s early; maybe they haven’t shown all their cards yet!).

Anyway, this battle might not be quite as explosive as the CANO battle, but I actually think the shifting alliances make this one even more interesting. I’m really curious to see where the board goes from here; at this point, it seems clear that they’ll lose at the special meeting in June, and I don’t know how they could hire a full time CEO into the roll when the CEO knows the board is likely to change right after he’s hired and multiple board members might want his job. At this point, I only see one out for the CUTR board: try to sell the company before the special meeting.

But that’s just me speculating. I’m looking forward to talking about the situation this afternoon and following it over the next few months as we get closer to the special meeting.

Big short interest in CUTR - Bloomberg has it at 28.71%

Andrew,

Unless they get a crazy high price, the Board cannot sell the company. That would require shareholder approval, no? And why would anyone bid knowing that shareholder approval is unlikely? Anyone bidding would need to also negotiate with the large shareholders to secure approval. The whole mess makes it very unlikely even an interested bidder would engage at this point.

It seems to me that based on the support from mgmt and other shareholders, Plants is likely to win the boardroom battle. The mgmt support may be coerced, but the support from other shareholders is not coerced. So what does that mean? Does he want this as a pet project to aggrandize himself? Or does he simply want to bring sanity to the operations and capital allocation? I often (not so humbly) think I could add a lot of value to companies simply by bringing sanity to capital allocation even though I know nothing about the business. So I'll grant that Plants can probably do this. But if he aspires to do more, this sounds like bad news, and while a great jockey cannot improve a bad horse, a bad jockey can certainly destroy a good horse.

Do you have any info on Plants other than his standard Wall Street resume? Is he a blowhard, etc.? It seems important to determine if Plants is legitimately frustrated by poor corp governance or whether he is a part of the problem seeking to become a bigger problem.

And we still have the huge about-face of Mowry to explain!?!? Was he promised a big "consulting" contract? Weird.