What $IS $U going to do?

What’s the widest merger spread out in the market currently?

Believe it or not, it’s no longer the TWTR / Elon Musk deal I’ve been obsessed with. I believe (and I say this because it’s possible I’m missing one) the widest spread currently belongs to the IronSource (IS) / Unity (U) deal.

That deal was announced in mid-July. It’s an all stock deal, with each share of IS scheduled to get 0.1089 shares of U. At current prices, each share of IS would get ~$6.23 of U stock if the deal goes through. IS is currently trading for <$4/share, giving the deal an absolutely bonkers gross spread of >50%. The IRR is even more impressive; the deal is scheduled to close before the end of this year, so even assuming it closes on the last possible day of the year, we’re talking annualized returns in excess of 200%.

Now, all of that might sound too good to be true…. and of course it is too good to be true. This week, IS’s rival APP made an unsolicited offer for U that is conditioned on U dropping the IS deal. U’s offer for IS came in at a whopping 74% premium to IS’s 30 day VWAP, so IS’s downside if the U offer breaks is substantial.

Anyway, as you might expect in a three-way merger triangle with huge upsides and downsides, IS / U / APP has been a focus of most of the event driven investors I’ve talked to the past few days. Personally, I’ll admit that I have no clue what’s going to happen here; it’s a crazy complex situation. There’s enormous potential for upside, but there’s so many different angles to the situation that it’s really tough to get enormous (or any!) conviction one way or another. In fact, the more time I spend on it, the more difficult it is for me to see how this plays out as every single event path seems possible.

So I wanted to throw a post up with some thoughts on the situation and why it’s so complex / fascinating. I’ll disclose I currently have a very small IS long position offset by an even smaller U short position as I think the market is a little too negative on the chance IS / U goes through and a little too negative on the IS downside, but I have very little conviction in that and I could be convinced to change my mind either way.

One more note: this is a fast evolving situation, and again it’s pretty complex. That makes writing an article about it both difficult and likely to be out of date by the time you read this. No need to cry for me, but I wanted to highlight that in case we get a bumped offer from APP on Monday or something.

Anyway, let’s start by disputing one frequent claim I’ve heard: that the APP offer for U is dead on arrival.

I’ll hear people point to lots of reasons, but the three major ones I’ve heard are

U chose to merge with IS; if they had wanted to merge with APP, they would have reached out before the IS merger

APP’s stock dropped ~11% on the merger announcement, so they have no room to bump their bid (remember that all of these mergers are all stock deals, so the equity price going down makes it much more difficult to make the merger numbers work).

APP’s stock dropped another 10% after announcing earnings, again making a deal more difficult.

I’ll admit that was my initial read of the situation as well…. but at this point I think all of three of those points are wrong.

The key starting point here is on #1: U “choosing IS over APP”. Yes, it’s true they “chose” IS in that U signed a merger contract. But I know when I saw the APP offer earlier this week my first thought was “O, U definitely did a bake off with APP and IS earlier this year and ultimately chose IS.” That is not what happened; here’s what APP’s CEO said on their earnings call when asked if they had been approached before the U / IS deal:

No. I mean, look, I can answer that without answering it too directly because we've known Unity for a long time. I've known JR for years, have a lot of respect for what he and the team have built over at Unity with Create and Operate. And I hope they have mutual respect for what we've built over here.

So in a way, like I can't answer that too clearly because over the past many years, we've had discussions well in the past. But what we're looking at today was a bid that we made really unsolicited. It was -- it can't -- we were really busy in Q1 with MoPub, right? And then we've seen a lot of growth in our own business. We're putting the pieces together.

And of course, over the years, we assessed the Unity business and been very -- really impressed with what they put together. And over the last couple of years, as we put our technology stack together, we saw a lot of complementary pieces, but we didn't stop to think about the synergy math until they announced that ironSource deal, and we started doing the analysis. And then we just saw a need to put this bid out there because the math was so compelling to us that we felt putting a very thoughtful offer out there would be appropriate for both parties, companies, teams and shareholders.

That response bleeds into my second point: just because APP’s stock has dropped on the (proposed) deal announcement and earnings does not mean that the APP offer is dead.

I’ll talk why in a second, but just high level think about this offer. APP’s biggest competitor is getting acquired in a massively synergistic deal. APP thinks there would be $700m in synergies if U chose to merge with them (an absolutely enormous number; the EV of an APP / U combination is ~$30B). In fact, APP’s co-founder / CEO thinks the merger is so synergistic that APP’s offer notes that U’s CEO will be CEO of the combined company (with APP’s CEO / co-founder serving as COO).

Put that all together, and I think you can see how critical APP thinks this merger is. I’m not sure they’re going to let a small share price drop keep them from their long term vision. This is their one shot to get a hugely synergistic merger done with U; if they miss their shot, U merges with their largest competitor and APP never gets this chance again. APP has super voting shares; the controlling shareholders (including the CEO) can push through a merger that minority shareholders might not love if the control shareholders think it creates long term value.

Stratechery wrote a piece on the APP offer that stuck with me. Ben was initially bullish on the IS / U combo, and on the heels of the APP bid he noted “AppLovin is an even better match” for U. He also noted that U “is the prize in this love triangle.”

Bottom line: I don’t think APP is walking away just because their stock was down a little bit on the offer announcement. They might not end up with U, but I think they will be willing to bump their bid substantially in order to get U. They view a U merger as both offensive and defensive: offensive in that it’s hugely synergistic (read the earnings call and see how excited they are by how U’s data will accelerate their growth), and defensive in that it keeps U from a competitor.

And I think U needs to seriously consider APP’s bid. Again, as Stratechery said, APP might be an even better match for U, and the combined company’s financials look very attractive versus a U / IS combo.

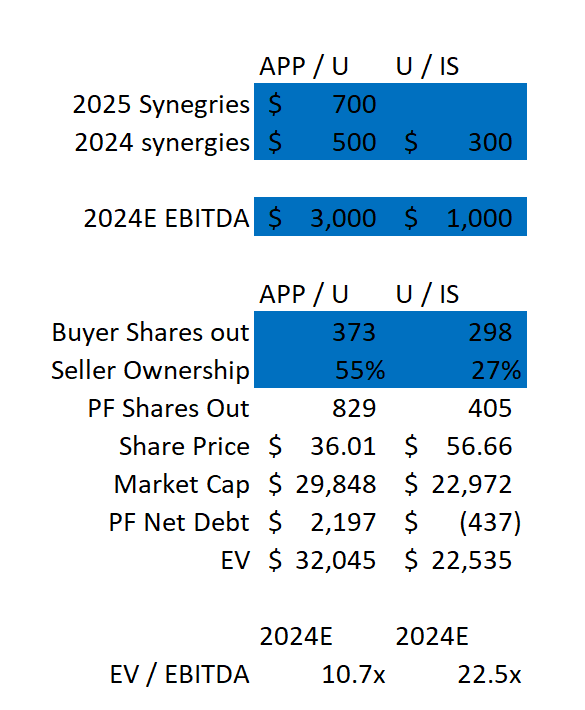

The math gets a little funky, but U would own ~73% of a combined IS / U. At U’s share price (~$57/share), that combo would have an EV of $23B. U disclosed 2024E EBITDA for the combined company of $1B, so they’d be trading at ~23x EBITDA.

A combined APP / U would have an EV of ~$32B at APP’s current share price (~$36/share). APP thinks the combination would do $3B in EBITDA in 2024, so the combination would be trading at <11x 2024E EBITDA.

A hastily thrown together chart might show this best:

But there’s more! IS / U are targeting ~$1B in 2024E EBITDA… but that’s after ~$300m in synergies, meaning synergies make up ~30% of EBITDA. APP is targeting $3B in EBITDA for a combined APP / U…. but that’s after $500m in EBITDA in 2024 (growing to $700m in 2025). So synergies make up ~17% of the APP / U combined EBITDA.

It’s not perfect to compare synergies as a % of EBITDA across deals for a whole host of reasons. But I think APP is going to have a very credible pitch to U’s board. “Hey, our combination makes more sense. It’s more synergistic, you’re getting the combined company at a cheaper multiple, and that’s despite building in a much lower piece of the earnings come from synergies. This offer is far superior to your current deal; drop the IS deal and take this one).” APP also suggested on their merger call that their synergy estimate is done from the outside in given they didn’t have data room access; again, these numbers aren’t perfect but it could be a suggestion that APP has room to bump their synergy targets in a final deal.

Another way to hammer this home: at current prices, APP trades for ~13x 2022E EBITDA. IS trades for ~16x 2022E EBITDA, and that’s with their share price inflated by the U deal premium. Again, APP can hammer home to U that, by merging with APP, U gets a smaller piece of a much more profitable company and doesn’t have to pay that enormous premium IS is getting.

Bottom line: I don’t think the APP deal is dead. In fact, I think APP has a lot of arguments for why their deal is actually better for U. Yes, U controls less of the company… but there are more synergies and U buys in at a much cheaper valuation.

But that does not mean that the APP deal is a cake walk to go through either. I think they’re going to run into a few issues.

First, APP’s offer to U is structured to give U both voting and non-voting shares, and values the non-voting shares at no discount to the non-voting shares. That’s obviously not going to fly. I assume APP will eventually drop that requirement and just give everyone one vote (all of my spread models just assume APP will convert the class C shares they are offering to class A shares in the final bid)…. but maybe not? Maybe APP really doesn’t want to give up full voting control to U, and that becomes a sticking point in the merger talks. Or maybe APP just walks because further offer bumps just give up too much of the company. Also, U’s deal with IS precludes U from searching for a superior offer…. if U enters a deal to buy APP that results in U having voting control of the company, could IS argue that U was in breach of the merger contract? I think that’s a very long shot, but I have been wondering if there are some games to be played with the contract from IS’s side here.

Second, you have to wonder if U really wants to sell this much of themselves. Maybe giving away 27% of the company to IS in a less synergistic deal versus giving ~half to APP in a more synergistic deal is a feature, not a bug. What do I mean by that?

U’s stock was ~$180/share as recently as November. What if U’s insiders really believe that this market down turn is just a blip on the radar, and the company is a world beating $500B juggernaut in the long term?

If they believe that, keeping more of the combined company in an IS deal is going to be better in the long run than getting less of the company in an APP deal, even if the APP deal’s economics are better.

With that in mind, it’s worth noting that U’s two biggest shareholder (Silver Lake and Sequoia) are investing $1B into U convertible debt as part of the IS merger (that debt converts at ~$49, so it’s in the money currently). The proceeds from that debt will go to buying back some of the U shares issued in the IS deal, which will let them get even more ownership of the company.

So if you’re U and its largest shareholders: the IS deal not only let’s them keep more of the company versus an APP deal…. but it also let’s them invest more into U at advantaged pricing versus the APP deal. Yes, APP can overcome those drawbacks by blowing U away with an offer…. but all else equal I think U and the insiders would prefer the IS deal that gets them more of the company and more upside.

And remember: while APP is the interloper here, U “is the prize in this love triangle.” IS does not need to sit on its hands while APP steals U; they could always offer to recut their current deal. The current IS / U deal gives IS ~26.5% of the company. What if IS looks at the APP deal and says “we can’t get left out by ourselves” and recuts themselves down to, say, 22.5% of the company? Such a cut could make sense for both sides: each share of IS would get ~0.081 shares of U, worth ~$4.60/share at current prices, while U would own even more of the combined company (levering themselves to future upside if they’re really bullish).

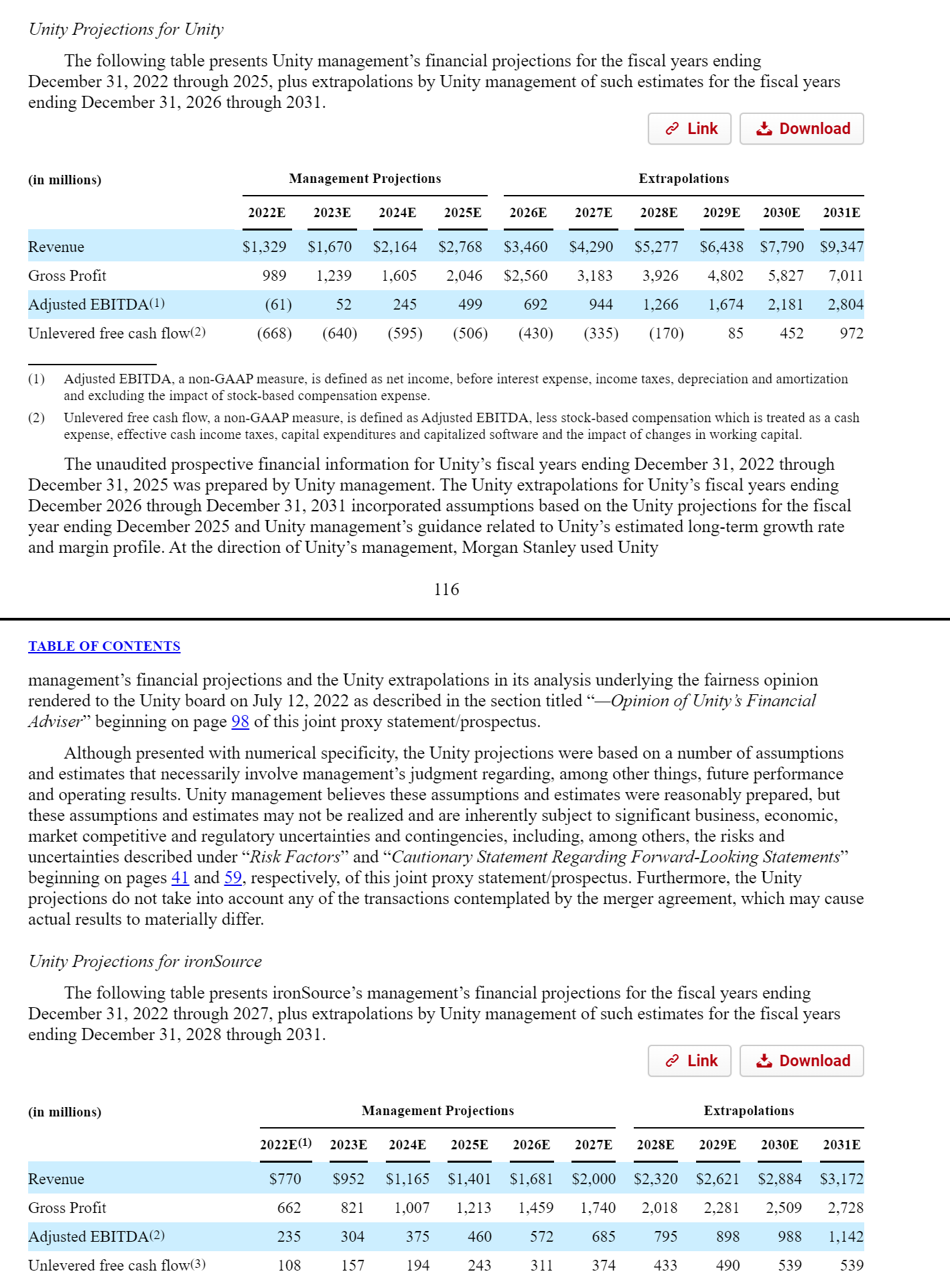

One other point on the “U and insiders are bullish U” argument while I’m here. Below are the company’s projection from the IS / U proxy.

I’m not saying this is the case, but I think you could paint a picture where U is really bullish on their future…. but looked at the current market and their internal projections and said “we’re going to need some cash at some point.” Could they get the cash from dilution / issuing equity? Sure! But an IS merger let them issue equity for something that generated cash (solving their funding needs) and had huge synergies with their business.

Does an APP deal do that too? Of course… but it also results in much larger dilution, so the U shareholders (and particularly insiders) get less of that upside for themselves.

Anyway, I am absolutely rambling here. That’s what happens when I stumble on a fascinating situation that pulls me in a thousand different directions. I think anything can happen here…. but my gut says that an IS / U recut deal is a little more likely than the market is pricing currently.

I’m still trying to think this through. I might do a more organized / thoughtful piece on this in the near future. But IS / U / APP is one of the more interesting public market love triangles I’ve seen, so I wanted to get some thoughts out now / plant a flag if anyone has done work here and wants to discuss it.

Odds and ends

I’ll fully admit I rambled a little in this article / I probably could have tightened it up a little more. But I’m writing this all Friday, August 12. Given how quickly this will likely move, I figured better to get a sloppy article out in the near term than have more news come out and make the whole thing stale.

A common risk I’ve heard is that the APP bid opens the door for another U bidder. Possible, but I’m not sure who that would be. APP / U or U / IS are massively synergistic mergers; I’m not an expert in the space, but I’d think only the tech majors would have bigger synergies, and I’m not sure who could buy them. Facebook wanted to buy U a few years ago, but given they can’t do tiny VR mergers right now I’d guess U is an absolute no go. MSFT is buying ATVI, which almost certainly precludes them, and Google would be a slam dunk anti-trust no.

A question I’m still pondering: what’s IS downside if the U deal breaks? The break fee here is very small (~$150m, 3% of equity value), so you don’t get a ton of benefit there. On the one hand, the offer was a massive premium to IS’s standalone stock price, and if IS loses this deal it’s to a competitor who will get huge synergies. That combo suggests big downside. On the other hand, all tech stocks have ripped since the IS / U deal was announced (the Nasdaq is up almost 20%), which suggests IS’s stock would be much higher than the unaffected downside without the deal, and IS’s board has shown an openness to strategic mergers / selling, so I’d guess the market prices in some deal odds in a break.

I know U is a super strategic asset…. but after looking through their proxy I’m surprised by how expensive it is! At current prices, it’s a >$15B company. They’re not even forecasting $1b in revenue in 2023, so we’re talking >15x next year revenue, and EBITDA doesn’t cross $1B until 2027/28. Again, I know it’s a big growth company with lots of potential… but those are big multiples, and that’s after the stock has been cut more than in half this year!

Not saying that to knock anyone. I remember when IS went public I thought it was a best of breed SPAC: a super growth-y company backed by a high quality sponsor who was pumping a big check into them at $10/share. Here we are ~a year later, and the sponsor is willing to sell at less than half the implied price and we’re talking about how massive the downside is if the deal doesn’t go through! All of us (well, most of us) got a little sloppy on the valuation multiples for good growth companies last year!

Good analysis. The other wild card is what APP does if U combines with IS. APP has more and better developer relationships than either U or IS. If a U competitor (Epic?) picked up APP then all of a sudden U is on the defensive with some real threats. U's rt 3d tech is fantastic but the vast majority of their revenue is driven by much more basic mobile development tools, where Unreal has closed the gap and perhaps even pulled ahead of them. It's interesting to imagine a world where access to dev tools is subsidized by the ad and analytics platforms.

I’m not sure the ebitda numbers make sense. You have the app/u combo doing 3 billion in ‘24. Let’s back out the synergies of 500 so that’s 2.5. For simplicity, let’s say half from u and half from app. So 1.2 each. Yet U/IS ebitda pre synergies for same year is 700. Implying iS detracts $500 million ebitda from the combo. Looks like there are a lot of apples and oranges.