What can you learn from how a SPAC handles redemptions?

I’ve said several times I feel “all SPAC, all the time” recently. That’s a little bit of an exaggeration; I’ve been managing to research things other than SPACs…. but it’s not much of an exaggeration. I wrote five different public articles on SPACs this month:

I got lots of questions on all of those articles, and today I wanted to follow up on a question that came up a few times in response to those articles. The question was actually a series of questions, but they centered on one thing: what happens to a SPAC that has a lot of redemptions?

To start, let’s talk about why redemptions happen. Simply put, redemptions happen when sponsors fail to convince the market that the company they are deSPAC’ing with is worth more than the all-in price they are paying (and remember, the all-in price includes hefty expense load from all of the banker fees and sponsor shares). When that happens, fundamental shareholders aren’t going to be interested in the company, and the stock will trade below trust and become a trading sardine for arbs. Why? Because buying SPACs trading below trust offers an incredible risk/reward. An example might show this best: AJAX has scheduled their deal vote for August 18. The stock is currently trading at ~$9.95. So an arbitrager could buy now and wait till the redemption deadline (August 16). If the shares trade above trust… great! The arb can sell them for a quick profit. If they don’t trade over trust… fine, the arb can redeem for ~$10. That would represent ~0.5% gross return inside of a month; not insane, but a pretty nice annualized return in a world of zero interest rates!

So why do we care about SPACs with big redemptions?

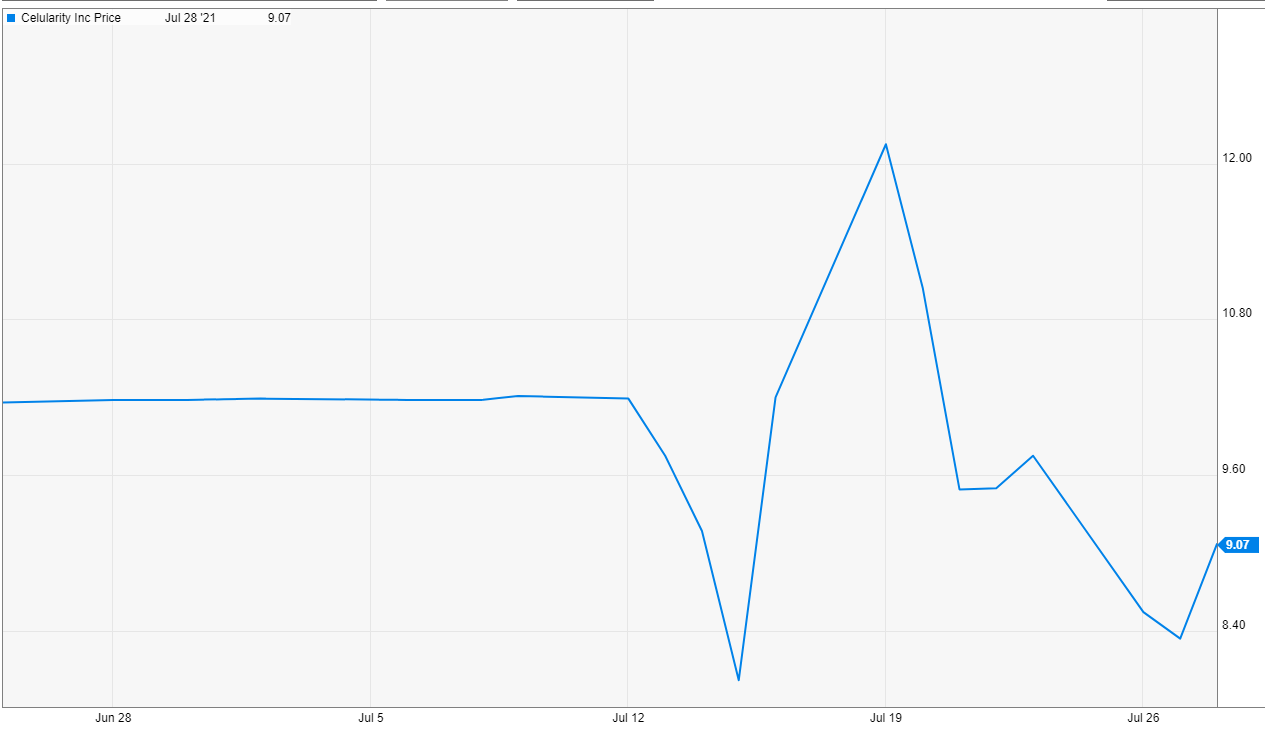

First, because it’s creating some really strange trading dynamics. Recently deSPAC’d companies are seeing volatility that rivals meme cryptos. Many of them are moving up or down 10% every day, often without any type of news flow. An example might show this best; below is the chart for CELU, which recently deSPAC’d from GXGX. I’ve put their stock chart below; there is some really volatile trading that happens right when the “redemption put” goes away as well as when the merger closes and the ticker officially changes from GXGX to CELU. Try to see if you can spot those days in the chart below….

I suspect what is happening here is some type of wild panic to get out from shareholders who forgot to redeem, followed by some weird short squeeze from people who got short the stock for some reason and couldn’t find borrow when the tickers changed…. but I really don’t understand that trading. I wish I did; the “drop and pop” has happened enough that if you could predict it with consistency (and trade around it), you could me some pretty outrageous returns.

The other thing that’s interesting with SPACs with big redemptions is that most SPAC deals have “minimum cash” conditions to close. To simplify, this is a condition in the merger doc that promises the SPAC will deliver a certain amount of cash to whatever company they are merging with. If they don’t deliver that much because redemptions run high, the target company would have the right to cancel the merger. So, for example, a SPAC with $200m in trust might have a closing condition that promises they’ll deliver $150m in cash to the company they’re merging with; if shareholders redeem more than $50m, the SPAC will have less than $150m in trust and the target will have the right to break the merger if they want to.

The reason I find that so interesting is a failure to deliver the minimum cash in a SPAC creates a negotiation between the SPAC sponsor and the target company. It’s a negotiation that the target company comes to with a lot of leverage; if the target doesn’t waive the condition and lets the deal fall through, then the SPAC is near guaranteed to fail and the sponsors will lose all their risk capital. Why? Well, say the first deal fails. Now the SPAC needs to find a new deal, except they are going around to every potential merger target and saying, “hey, merge with us and get some cash on your balance sheet…. except we can’t tell you how much cash, and our shareholders trust us so little that everyone tried to redeem in our first deal.” Only the most shady / desperate company is going to go for that pitch.

So target companies have real leverage when it comes to minimum cash condition negotiations, and I think the results of those negotiation can reveal a lot about how the company and sponsor view their valuation and deal. Some examples of how the negotiations play out might show this best; I’ve tried to list them below in order from most bearish to most bullish.

Have a third party provide debt to cover the minimum cash: If it looks like redemptions are going to cause the deal to come up short of cash, the company and sponsor can try to find someone to lend them debt to cover the shortfall. This is what CTAC / KORE did with their “innovative” redemption backstop convertible bond.

What could this signal? This is, by far, the most bearish thing I can imagine. It’s basically both the sponsor and target company looking at each other and saying, “This deal is awful. Any cash from shareholders silly enough to not redeem is literal gift from the heavens. Let’s try to jam this deal through and take whatever cash we can get.” It’s also an admission that they can’t find an external investor willing to buy equity at anything close to the price the deal is going through at.

Why is that the case? First, the sponsor is choosing not to inject more capital on their own. Maybe it’s because the sponsor doesn’t have that capital (though in CTAC’s case, their sponsor has pockets well deep enough to cover if they wanted to!). That’s a bearish signal on its own. Second, a company is choosing to deSPAC because they want equity capital. Choosing to raise a ton of expensive debt in order to cover any short falls screams that the company is just trying to get whatever capital they can. And the fact that debt is coming in at expensive rates despite the company getting tens or hundreds of millions in cash from the deSPAC’ing speaks volumes to how lenders view the company’s prospects.

Just waive the minimum cash condition: the target company can choose to just waive the condition and accept whatever cash the SPAC will deliver. That’s exactly what happened in the Wheels Up / ASPL deal (now trading as UP). The deal agreement called for the SPAC to deliver at least $120m, and redemptions caused them to fall $13.8m short of that number (see item 8.01).

What could this signal? My guess is it signals the company knows that the SPAC is overpaying for them. Remember, sponsors want to get a deal done; they’ll lose all of their founders shares if they don’t. The company should have the sponsor over a barrel; the sponsors have literally gotten to the one yard line and here’s a road block that could let the company tank the deal and ruin the sponsor’s SPAC. Instead of using that leverage, the company decided to meekly waive the condition. The only reason I can think the company would waive is they know their deal is hopelessly overpriced, and if it falls through they’re never seeing a valuation like that again.

A side note here: Just to be balanced, I’ll note I used UP as my example…. but it probably wasn’t the best example. ASPL was only $13m short of their minimum cash condition, and the deal came with a $550m PIPE on top of the >$100m the SPAC ended up delivering. In UP’s specific case, waiving the cash condition was probably more courtesy than a real negotiation. But it was the best example I could think of off the top of my head!

“Bribe” some redeemers not to redeem: If redemptions come in too high, the sponsors can go to some of the shareholders who are redeeming and try to convince them not to redeem. They could do that just by trying to explain the fundamental story better…. or they could do it by offering them some concessions. For example, a few years ago MIII was having trouble completing their merger with IEA. In order to get the deal over the finish line, the sponsor went to some redeeming shareholders and gave them a mix of founders shares and warrants in exchange for them pulling their redemption requests.

What could this signal? This is pretty bad. Not quite as bad as the company just flat waiving the minimum cash condition; at least here, the company was demanding the SPAC / sponsor do something to make up for too little cash getting delivered. But it’s real bad. If you’re not in the group that’s getting incentivized not to redeem, you should probably be redeeming your shares and running.

Have the sponsor make concessions to the company: The sponsor can try to entice the company to stick with the deal by giving up some of their founders shares. By forfeiting founders shares, the sponsors decrease the amount of shares outstanding the deSPAC’d company will have and thus increases the per share value of the remaining shares. This is exactly what happened with FGNA / OPFI earlier this month; it became clear they couldn’t deliver the $200m they had promised, so OPFI waived the minimum cash condition down to $83m in exchange for the sponsor forfeiting 2.5m shares of founders stock as well as several million warrants. That is a lot of forfeiture; OPFI would have had ~80m shares outstanding if no one had redeemed, so the forfeited sponsor sharse alone represents ~3% of the company. Another way to look at it? The sponsors had ~6.5m class B shares out, so they forfeited almost 40% of their shares to get this deal done.

What could this signal? I’d suggest this is a neutral to slightly bullish indicator. It shows the company isn’t simply desperate to merge (otherwise they’d just waive the cash condition). And it’s effectively a slight recut for minority shareholders; they now own more of the company since those shares were forfeited for nothing… but, as the next two examples will show, there are other options for covering excess redemptions that include large investors writing big checks to cover redemptions. I think new money being willing to come into a deal is more bullish than simply demanding some forfeiture.

The sponsor could find a third party to backstop the deal: The sponsor could go to a big institutional investor and try to get them to backstop the deal. This is what happened in the Origin / Artius deal last month; Apollo was already in the PIPE group but committed an additional $30m backstop to cover excess redemptions.

What could this signal? This is a pretty bullish signal. It shows the sponsor is worried the company will enforce the minimum cash condition (suggesting the target is not simply desperate for money), and it also shows that the sponsor and target were able to convince an institutional (and therefore hopefully somewhat knowledgeable) investor to write a pretty nice sized check to cover redemptions.

One more note here: I refer to this as a pretty bullish signal assuming that the third party is coming in on terms similar to what minority shareholders are getting (i.e. they’re just PIPE’ing in for common equity around trust value). Sometimes you’ll see backstops come for a mix of equity and debt; that’s a much less bullish signal as the debt normally comes on pretty pricey terms. It really depends on the mix of debt to equity, but I’d generally be pretty skeptical of this type of deal if it involved a lot of high priced debt.

Have the sponsor chip in money to cover the backstop: The sponsor could choose to put up cash and buy enough redeeming shares to cover the redemptions and keep the cash balance over the minimum condition. This is what I mentioned ALIT doing earlier this month, and it’s what Thoma Bravo did for the TBA / IS deal earlier this month.

What could this signal? This is, by far, the most bullish signal. On the sponsor side, it’s equivalent to an enormous insider buy. They’re literally putting their money where their mouth is, and saying that the deal is so good they will write a huge check to make sure it goes through. It’s impossible to say without knowing the exact negotiations between the company and the sponsor, but it probably speaks to some bullishness on the company’s side as well, as the sponsor chose to pony up because they were worried the target company thought the deal was too cheap and would try to enforce the minimum cash condition and get a better deal without the sponsor ponying up.

There might be more scenarios for covering too many redemptions, or there might be different views on what they’re signaling. But I think this is a pretty comprehensive list of what can happen if too many people redeem. I’m a big believer in the power of incentives, and I think I’ve got the incentives / signals sent by the different type of redemptions correct above.

Why does any of that matter? Two reasons:

First, for finding potential investments on both the long and short side. This one is pretty simple; if you’ve got a company where the SPAC sponsor injects hundreds of millions at trust value to ensure the deal goes through, and then the stock promptly trades well below trust…. well, it’s probably at least worth looking at. On the other side, if you’ve got a company where the only way they can get their deal through is from a very expensive third party debt offering, it might be worth revisiting as a short candidate as shares start to unlock and the borrow clears up (shorting is risky, and this is definitively not investing advice!)

Second, smart SPAC sponsors are absolutely going to be thinking about this when announcing deals going forward. TREB is a great example; they announced a redemption backstop alongside their deal announcement. I’d expect smart sponsor to do more of that or something similar going forward; it’s better to have a plan in place upfront than to be scrambling around trying to make the deal work at the last second.

Alright, that’s it for my thoughts on SPAC redemptions. I’m going to try to cut back on my SPAC focus next month, so hopefully I’ll be back to some “normal” articles soon!

You might be interested in looking into pipe terms. If you're not spac ed out. CAP, now Doma, did a $300 mm dollar pipe with good names - "accounts managed by BlackRock, Fidelity , The Gores Group, Hedosophia, SB Management, a subsidiary of SoftBank Group Corp., and Wells Capital. Existing Doma shareholder, Lennar, has also committed to the PIPE and Spencer Rascoff, co-founder and former CEO of Zillow Group,"

Have they all really lost 30%? Or were the terms not actually $10 per share. Were they given founders warrants? Shares? Was there some other undisclosed incentive? Owners of the target, like Lennar, have an incentive to get it public. If they raise their average a little it's worth it to get the deal done. But there's very little disclosure on pipe buyers, like dollar amounts per buyer. DOMA had 85% redemptions btw. In retrospect the whole thing smells to me. The sponsor, Capital, is a quality sponsor. And yes there are worse examples. Atip for instance.

Thanks for sharing your work.

Thanks a lot for your insights. Great article! Just two things which I am a little bit puzzled about:

Regarding the suspected sell-off before the voting date of Celularity and GX: Don´t all investor which hold the shares on the record date are able to vote for redemption until the voting date, so July 14th? So there would not be any pressure to sell before, but rather directly after that.

And secondly, regarding the incentives for the target company when redemptions are high: From my perspective among SPAC companies are a lot which are not able to get funding elsewhere. Although high redemptions may improve their negotiation power, I assume that most of them would even go with any funding instead of letting the deal slip away. At the same time, they gain access to the public market, where you can issue new shares afterwards. The question is of course if you are able to raise any more money afterwards when you are in a negative signal vicious circle being a Zombie SPAC from the beginning.