Weekend thoughts: $TMC / $SOAC and some more SPAC insanity

I’ve written extensively on all of the shenanigans going on with SPACs (most recently commenting on the MUDS / TOPPS deal falling apart and how SPAC sponsor don’t give a fudge about their reputation), but just when I think I’ve seen it all a SPAC will come out with some weird, new angle that leaves me with more questions than answers. And this month, I saw perhaps the weirdest announcement and SPAC stock response yet.

The company / SPAC is TMC, which deSPAC’d with SOAC (disclosure: I own some puts on them; though we’re talking in size so small that if this went to zero tomorrow I would be able to pick up a modest bar tab. Volatility is insane so I probably way overpaid for the puts, puts are super risky, and this is now a super thinly traded semi-meme stock that can truly trade at any level on any given day, so please remember to do your own work and that nothing on this blog is investing advice). The stock was formed when SOAC announced a deal to merge with DeepGreen Metals in early March, and shareholders approved the deal earlier this month.

To put it bluntly, the SOAC / DeepGreen deal is emblematic of a lot of the problems and history of the SPAC market. Rumors that the two would merge broke in late February, right around the peak of the SPAC / growth stock crazy. When the rumors broke, SOAC was trading well above trust (>$11 versus a $10/share trust). When the deal was announced, SOAC was still trading with some premium to trust (~$10.20). However, as both the SPAC and hyper growth stock mania cooled, SOAC traded consistently below trust over the next few months. Like most SPACs trading below trust, SOAC saw huge redemptions when shareholders approved their deal this week: of the $300m SOAC had in trust, >$270m (more than 90%) elected to redeem their shares. That left SOAC with a tiny free float and created a mini-short squeeze that has seen shares trade with wild volatility before kind of settling around today’s price of ~$10.50/share (see charts below; first is the one year price of SOAC / TMC; second is the one month so you can really zoom in on the vol since deSPACing).

Honestly, all of that (the high redemptions and the mini-squeeze / large vol on a small float) are pretty typical for SPAC deals recently. I very much enjoyed this meme that perfectly sums up the state of the SPAC market currently:

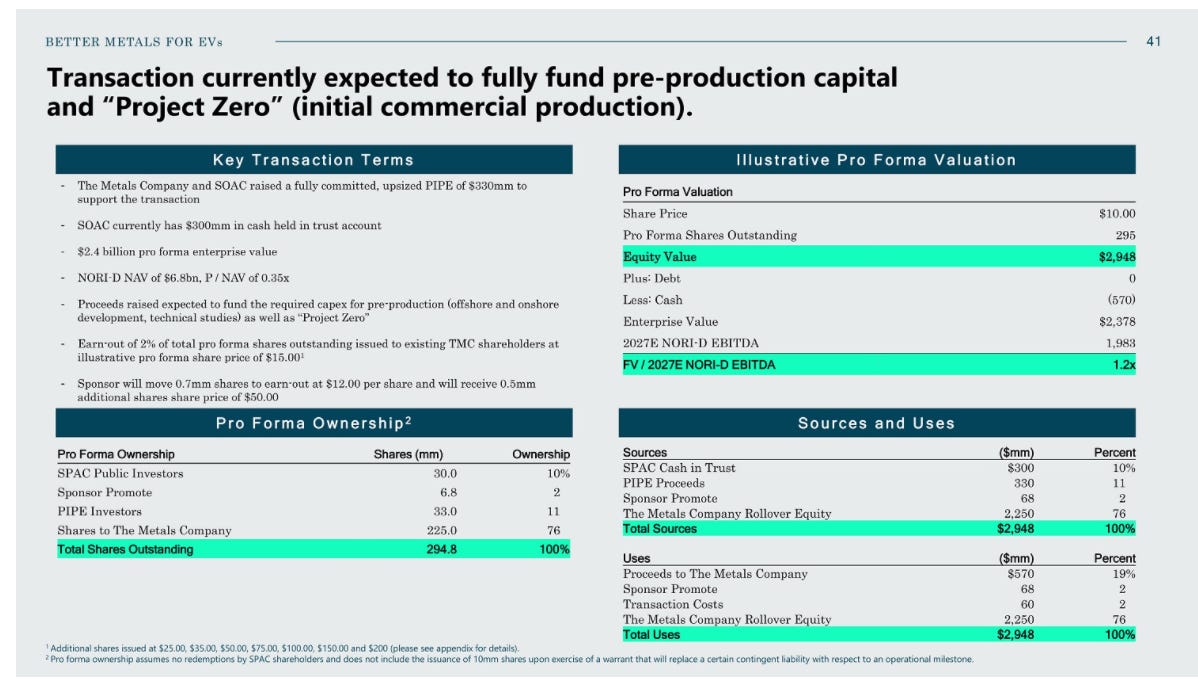

What’s so interesting about SOAC / TMC versus the normal SPAC shenanigans is what happened to their PIPE. When SOAC announced their deal, they planned on delivering ~$570m to DeepGreen: $300m from the SPAC trust and $330m from their PIPE less $60m from transaction costs.

However, DeepGreen and SOAC have had trouble getting the PIPE investors to deliver their cash. Per the PR (emphasis is mine),

SOAC entered into subscription agreements with a number of strategic and institutional investors for a $330.3 million private placement of SOAC Class A ordinary shares; however, only approximately $110.1 million of proceeds from the private placement were received as of the date hereof. SOAC intends to continue to seek to enforce the funding obligations of the non-performing investors under the subscription agreements, but there can be no assurances that it will be successful in those efforts. DeepGreen intends to waive the BCA’s condition to closing that the Aggregate Transaction Proceeds (as defined in the BCA) shall be equal to or greater than $250 million.

As far as I know, this is the first time a PIPE buyer has not delivered to a SPAC deal they committed to. Which is what made SOAC so interesting to me. My initial thought was the PIPE buyers simply had cold feet. Again, SOAC / DeepGreen was a more speculative deal announced at the height of the SPAC boom, so I thought the investors were just saying “Jeez, we overpaid and we’re gonna be way underwater. Let’s try to cut this valuation by not funding the PIPE.”

But the more I thought about it, the more I thought something more interesting could be going on here. Even outside of SPACs, it is very rare for someone to commit to an investment and then not deliver when it’s time to close. It’ll happen every now and then when an investor commits to a deal and then blows up before closing so they simply don’t have the cash to deliver, and you’ll generally see groups of investors default on their commitments in times of real stress (i.e. at the height of COVID, you saw plenty of deals where buyers were at least considering backing out, or during the financial crisis you saw plenty of lenders pull their financing commitments), but it’s still pretty rare. The risk reward for an investor to pull out of a financing they committed to is really poor. An example will probably show this best: say you, me, and our friend Bob commit to fund a deal. When it comes time to fund, I think we overpaid and I don’t deliver the money. I’m in trouble now; the company can sue me for failing to deliver and I’ll have to prove that there’s some reason I can get out of the contract (i.e. fraud, breach of reps and warranties, etc.) while the company says “this is a classic case of buyer’s remorse; every other investor delivered their cash.” So now I’m looking at a losing lawsuit where I probably have to cover the company’s legal expenses, my legal expenses, end up funding the deal anyway, maybe have to pay penalties, I’ve burned my reputation for future deals, and I have to go explain to all of my LPs why I’m getting involved in this legal battle and why I committed to the deal in the first place (and note that there’s no good answer to those questions!). Not a great risk/reward!

Bottom line: you generally don’t see investors fail to deliver on investment agreements unless something has gone really wrong. And SOAC’s PR makes clear that multiple parties failed to deliver on their PIPE commitment (the PR says they’re trying to enforce the funding obligations of “the non-performing investors”; note the plural).

So here’s my question: what would have had to happen for multiple parties to look at the risk reward of not funding this deal and decide not to do it?

One answer could be that they think the deal was struck at such a hopelessly optimistic valuation that even a longshot chance of winning in court and not having to fund the PIPE is worth the reputation hit and legal fees.

There’s probably a little bit of that math at work here (after all, if the PIPE buyers believe that DeepGreen was actually worth multiples of their funding price, they would happily fund the PIPE no matter what other hair was on the deal). But a more likely answer is that several of the PIPE buyers believe that SOAC / DeepGreen are in breach of the PIPE contract in some way. This hypothetical breach could come in a bunch of different forms, but no matter what form it takes all of them are bad for the company (and, eventually, the equity). Really, really bad. I’ll let your imagination run wild and fill in the blanks on just what those bad things could be, but when you’re running wild remember that out of all of the awful SPAC deals we’ve seen this year, SOAC is the first I’m aware of where a PIPE buyer didn’t deliver on their commitment. ATIP completed their SPAC in June and reported results so bad that their stock was down ~60% by August, and even they had all of their PIPE buyers fund the deal. Maybe ATIP’s PIPE buyers would have tried to pull out if they had known how bad ATIP’s business was, maybe they knew and felt stuck…. but either way they funded their PIPE commitment. With SOAC / DeepGreen, the PIPE buyers looked at all the information they had and said “yeah, we’re not funding that; see you in court.” Again, I can’t imagine that the information that lead to not funding this deal is any better than what ATIP’s PIPE buyers had… and ATIP is a ~$4 stock now. What happens when whatever news that lead SOAC’s PIPE buyers not to fund comes out?

Note that I could be misreading this situation. Maybe a bunch of the PIPE buyers looked at the merger agreement, saw the $250m minimum cash condition, and thought, “Hey, we know redemptions are going to be high; if a ton of us don’t fund, maybe DeepGreen will tell SOAC the deal’s off and/or everyone will come back to the table and try to restrike the valuation lower.” It’s possible…. but again, this is the first SPAC I’ve seen PIPE buyers not fund. I’m sure there are plenty of overpriced SPAC deals PIPE buyers wanted a recut on. Why was this the first one where buyers didn’t deliver when push came to shove? Feels like something larger is going on.

Two other interesting things while I’m here.

First, SOAC’s investor deck gave a cash flow projection slide. Note they plan on burning $200m through the end of 2022, another ~$300m in 2023, and another >$3B through 2024-2026 before turning ridiculously cash flow positive in 2027.

Why does that cash burn matter? SOAC / DeepGreen were planning on the SPAC deal to deliver $570m (net of fees) to the company. With the PIPE investors failing to deliver, SOAC only got $137m (before fees!) from the deal. Even if all of the PIPE buyers end up delivering, DeepGreen will only get ~$350m (again, before fees!). That means the company will need to raise a lot of capital in the very near term. If you believe the PIPE buyers didn’t deliver because something really bad is going on, then that’s going to be a disaster for the company when it comes out. If you believe the PIPE buyers didn’t deliver because they simply thought the company was overvalued…. well, then good luck getting funding when it comes time to raise! Either way, TMC / Deepgreen is on a tight timeline here; at the latest, they will have to raise capital by the middle of 2022 if the PIPE buyers don’t deliver and by early 2023 if they do deliver.

(Note: to be fair to the company, their May deck did include a bunch of ways they thought they could fund the project without raising capex. I’m skeptical).

Speaking of funding, even if the PIPE buyers end up needing to deliver and DeepGreen doesn’t need to raise in the super near term, do you think PIPE buyers who just tried to get out of ~$200m of committed funding are going to be super happy to hold their stock if they end up needing to fund this? I don’t think so. Between their shares and the eventual equity issuance DeepGreen will need, that’s a lot of shares that will need to be sold / technical overhang.

Lastly, the quote and screenshot below are each from the company’s SPAC deal announcement in early March:

Now, let me turn to our deal. Our transaction values the business post-combination at $2.4 billion on an enterprise value basis. A valuation that allows our shareholders and PIPE investors the chance to participate in enormous value creation potential with $300 million of cash in trust combined with $330 million of capital committed in an oversubscribed and upsized PIPE, we believe the business will meet the minimum cash condition to close our transaction and provide for the liquidity The Metals Company needs to reach initial production and positive cash flows from its first project, Project Zero.

We believe that it is worth noting existing DeepGreen investors have committed to roll 100 percent of their equity and they anchored $50 million of the PIPE. These legacy investors, which include very successful natural resources investors and strategic partners alike, share our vision that The Metals Company can create substantial value, both for shareholders and society at large.

There’s just something on the edge of my brain screaming, “Hey, there seem to be a ton of people associated with the company who have super deep pockets and strategic interest around what DeepGreen is doing. Given that combo, why is the company having so much trouble with the PIPE? Why didn’t any of the other investors step up to cover the short fall? And, if the company is as exciting and undervalued as the rest of the deck pitches it as, why are they still years away from cash flow and why didn’t the other investors simply cover this capital instead of going the SPAC route?”

Again, I don’t know, and you could make the same argument about pretty much every company that decides to go the SPAC route (or IPO, or raise any type of capital from new investors)…. but something about this case strikes me as particularly strange.

If you’ve got thoughts on what’s going on or something I’m missing, I’d love to hear them!

PS- after I wrote the majority of this article, but before I posted, I saw this BB article on TMC. It has a really interesting point that 500 scientists and several large companies are trying to put a moratorium on deep sea mining, which would obviously be a disaster for TMC. The environmental concerns from this even got a Time cover story!

price action on deSPACs usually fades after the initial pop right (and breaks $10)? decent short opportunity, sized appropriately?

Can anyone with industry experience confirm or deny the 2.7 million float theory that is going around? The way i read the proxy float is more like 100 million as only ~55% of the deep green shares are locked

From here: https://www.sec.gov/Archives/edgar/data/0001798562/000121390021040480/fs42021a5_sustainableopp.htm

A significant portion of SOAC’s total outstanding shares are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of the TMC Common Shares to drop significantly, even if TMC’s business is doing well.

Sales of a substantial number of TMC Common Shares in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of the TMC Common Shares. Upon completion of the Business Combination, the initial shareholders will own approximately 2.3% of the outstanding TMC Common Shares, assuming no public shares are redeemed in connection with the Business Combination or approximately 2.5% of the outstanding TMC Common Shares assuming that all public shares are redeemed in connection with the Business Combination. In addition, certain Existing DeepGreen Securityholders that will be party to the Amended and Restated Registration Rights Agreement will own TMC Common Shares subject to lock-up restrictions representing approximately 49.7% of the outstanding TMC Common Shares, assuming no public shares are redeemed in connection with the Business Combination or approximately 55.4% of the outstanding TMC Common Shares assuming that all public shares are redeemed in connection with the Business Combination. While such Existing DeepGreen Security Holders and the initial shareholders will agree, and, in the case of the initial shareholders, will continue to be subject, to certain restrictions regarding the transfer of the TMC Common Shares, these shares may be sold after the expiration of the applicable lock-up restrictions. TMC may file one or more registration statements prior to or shortly after the Closing to provide for the resale of such shares from time to time. As restrictions on resale end and the registration statements are available for use, the market price of the TMC Common Shares could decline if the holders of currently restricted shares sell them or are perceived by the market as intending to sell them.