Weekend Thoughts: the risks of investing with the world's richest people

The other day, the tweets below popped into my feed.

To sum: the tweets mention an anecdote from BRK’s 1996 meeting. A woman says she has the simple investing strategy of investing alongside the world’s richest people, Gates and Buffett. The tweet’s author then notes her “simple strategy” has performed pretty well, and she’s probably beaten her father’s diversified portfolio (though the father may be frequently day trading; I’m not sure on that point).

Something about those tweets have stuck in my head. My first thought on reading them was the strategy of investing with the world’s richest people was silly and an easy recipe for consistent underperformance; the world’s richest people are going to tend to be people riding an asset bubble, and buying into them is going to get you invested right at the top of a bubble. Even if you dodge bubbles, just the sheer size of investing with the world’s richest people probably exposes you to more downside risk than upside risk; it’s terribly hard for a large company to consistently outperform the index, but it’s awfully easy for it to consistently underperform or collapse in epic fashion!

But then I thought a little more about it…. I mean, Buffett and Gates are two all time business greats. How many people and businesses have blown up since the mid-90s, yet somehow, despite giving away literally billions upon billions of dollars of wealth, Gates and Buffett are still toward the top of the world’s richest people. Is it possible to just identify a great, even after they’ve already hit it big, and continue to ride them to super-nova success for decades?

I figured I’d check for myself. If you’re looking for the tl;dr of the results, I think it’s this: my first instinct is right. If you pick the right person, you can outperform for a long time by investing with the world’s richest people…. but you’re really stepping through a field of land mines and you’re way more likely to get blown up / invest at the top of a bubble than to compound for decades.

This is not a scientific study by any means; this is just my gut after looking through the results. If anyone wants to have a discussion or has other data, I’d be happy to be proven wrong!

Anyway, to find out how investing with the world’s richest people worked, I went and looked at the Forbes billionaire lists. Forbes started publishing their billionaire list in 1987, so unfortunately we can’t go crazy far back in time and see how this would have gone if you had invested with the richest person in 50s or something (I’d guess some aspiring grad student could make a research paper out of that if they wanted), but the results are still instructive.

The rankings start in the late 1980s, and they’re dominated by one country: Japan. The late 80s is right in the mist of the Japanese asset bubble, and the Forbes list absolutely reflects that. Check out what the first two Forbes lists look like!

So right off the bat we have a swing and a miss for “investing with the world’s richest people.” If you invested with any of the top people from the 87 list, you absolutely lost your shirt with a few years (though, to be fair, a lot of the companies from the first lists were private, so execution might have been difficult!).

As the Japanese asset bubble busts, by the early 90s one family shoots to the top of the list: the Walton family, heirs to the Walmart (WMT) fortune. If you invest alongside them, you actually do alright. You’d outperform the index pretty nicely for the first few years of your holdings. That performance eventually levels out, but here we are ~30 years later and investing alongside of the Walton’s would have lead to ~index like performance. Not bad for what was already a huge company!

The early 90s see two other big names make their appearance on the list.

Bill Gates makes his first appearance on the list in 1992 with a $6.4B fortune

Warren Buffett makes his first appearance in 1993 with a $6.6B fortune.

By 1995, Gates is the second richest person in the world (trailing only the Walton family, so maybe he is the richest person?) and Buffett is #3.

If you started buying BRK and MSFT around that time, you’re probably pretty happy…..

But I think it’s fair to point one thing out: a ton of that MSFT outperformance comes from their epic run in the past decade, after they fired Ballmer and rethought their whole strategy. Given Gates is focused on his foundation, not MSFT, I’m not sure it’s fair to give him credit for all of that outperformance. If your thesis was “invest with the richest men in the world,” would you really have held on to MSFT after Gates had moved on?

Still, even if you had only held for ~20 years (from the mid 90s to the early 2010s), the strategy would have done really well.

So the mid 90s would have given you a great run: BRK, MSFT, and WMT….. but I think the late 90s again illustrate the perils of the strategy.

In 1999, a hot newcomer makes his way on to the list: 34 year old Michael Dell is sixth richer person in the world with a net worth of $16.5B.

If you have a strategy of investing with the world’s richest people, and you’re coming off a big success from investing with Gates and Buffett, Dell is going to be right up your alley. Here you have a young, self made CEO who is just getting his career started. He’s early in attacking and dominating a market that is going to be massive. You’ve found yourself the next MSFT, right?

Wrong! You just bought into the height of the tech bubble; depending on your exact purchase date; you’re probably down ~66% a few years later, and if you hold your stock all the way through to when Dell steals it…. I mean, takes it private in the early 2010s, you’re probably down ~75% and have massively, massively underperformed the index as the SPY >doubles over that time frame. Note: I can’t find a historical Dell chart as it went private in 2013, but here’s the yearly stock returns:

It’s not just Dell that would get you run over; both Masayoshi Son (Softbank) and Larry Ellison pop up on the list for the first time in 2000, and you would have been pretty sad if you had chosen either of them as your jockey bets!

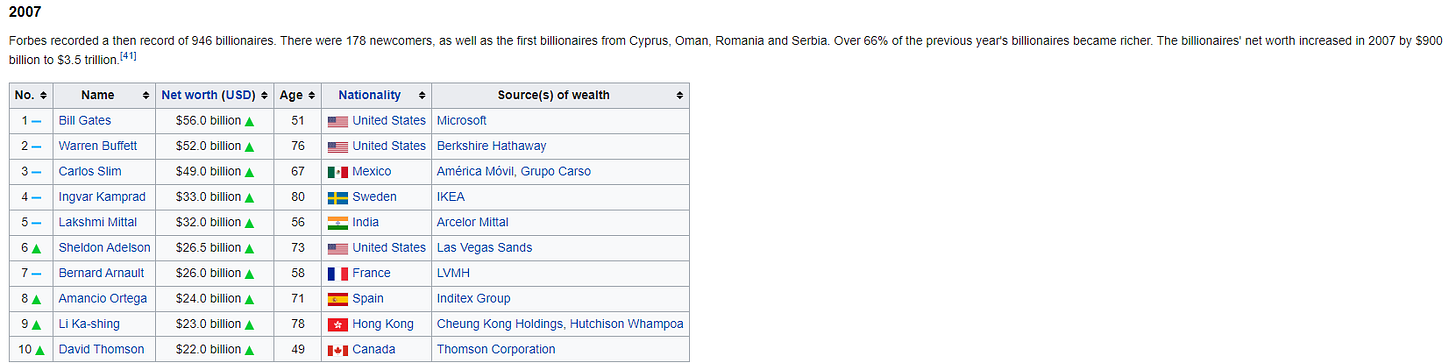

Gates, Buffett, and the Walton family generally dominate the lists in the early 2000s. It’s not till the mid 2000s when we start getting some new names…. well, actually, we start getting some old names back again. Carlos Slim, who had one appearance on the list in the early 90s (#10 in 1994!), comes back onto the list in 2005. Larry Ellison also returns to the list in 2005, and we get a newcomer on the list: Lakshmi Mittal, head of the Mittal Steel company.

I’d argue the 2005 list in particular shows exactly what’s wrong with using the “world’s richest people indicator.” Slim and Mittal both run emerging markets companies, and they shoot up the list as the world economy is booming and emerging markets are hot. If you invest alongside them, you do well for a little time….. until we come crashing into the Great Recession and emerging markets get destroyed. If you didn’t manage to cash out before then…. whelp, you’re looking at ~two decades of underperformance (note: Mittal merger with Arcelor in ~2006; I’ve just used the total return for the combined company as I’m too lazy to go and split the returns for a weekend project!).

Speaking of bubbles, Sheldon Adelson makes his way on the list in 2007; woe unto the shareholder that bought a gaming company right before the great recession!

But perhaps I’m being unfair; Bernard Arnault makes his first appearance in 2006 and investing alongside him has proven a very profitable strategy!

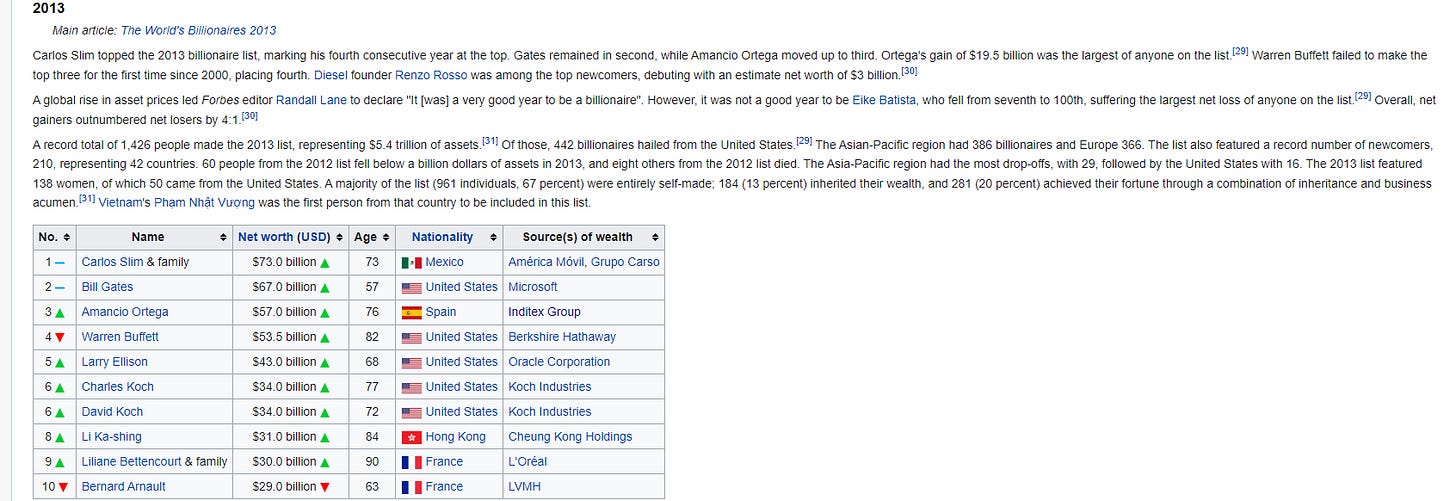

In the early 2010s, Carlos Slim is dominating the list. He’ll hold the top spot from 2010-2013.

I think this would be particularly difficult if you’re an “invest with the world’s richest people” investor; by 2013, Slim now has ~two decades of being at or around the top of the richest people list, and he tops the list for four years straight! He’d be making an absolutely compelling case to get your incremental “invest with the richest people” dollars, and that case would ultimately prove to be a disaster for you…. though, again to be fair, #2-4 on the list are Gates, Buffett, and Arnault (LVMH); if you picked them instead, you do really well!

The mid-2010s sees the rise of the tech kings. Gates is back to the top of the list, and Bezos and Zuckerberg start appearing on the list in 2016.

You’d have been really happy to follow Bezos and Zuckerberg once they start appearing on the list…. until the past year rapidly undid years of outperformance!

Finally, Elon Musk makes his way onto the list in 2021. He’s #2 that year, and #1 by 2022.

If you started riding Musk’s coattails right when he got added to the list…. well, you’re probably not going to be making that list yourself!

Anyway, that’s it for my review of the list. My overwhelming bias heading into the list was that it would encourage you to invest at the peak of every cycle. There is definitely some evidence of that…. but the list also would have pointed you to investing into a lot of world beating companies (LVMH, BRK, and MSFT being the highlights).

I don’t have a firm view one way or another. Honestly, the biggest takeaway for me was just how special Buffett’s track record is. As far as I can see, he’s the only “investor only” person on the list, and him (plus Gates) somehow manage to stay consistently on the list for almost three decades while bubbles are rising and falling and peers are dropping off the list like flies.

One could simply coatail Buffets specfic equity investments . Gates as well through his Cascade vehicle. Some were home runs a few 10 baggers. Or simply own Berkshire. Microsoft was dead money for quite a spell under Balmer .

Many of the folks not easily replicated . Still your observations helpfull.

Is there a word for getting lucky then looking for a strategy in hindsight?