Weekend thoughts: $SMLR's bitcoin treasury strategy and feeding the ducks

This week, Semler Scientific (SMLR) announced a new Bitcoin Treasury strategy. The market responded…. very favorably to the news, with SMLR way outperforming the market and Bitcoin:

This makes SMLR the third company I know to run a Bitcoin treasury strategy: Microstrategy (MSTR) obviously pioneered the concept (and has been zealous in calling for other corporations to join them), and Block (SQ) has started dollar cost averaging 10% of their crypto profits into Bitcoin. A few other companies have touched on BTC; for example, Tesla made an investment back in 2021, some of the Bitcoin miners (which I discussed extensively here) practice a “HODL” strategy of keeping the bulk of the BTC they mine on their balance sheet, and I’m sure there are one or two other companies I am forgetting.

Anyway, I wanted to mention SMLR’s switch for four reasons:

I’m surprised by the SMLR pop on the announcement. Look, I get all attention is good attention…. but a few years ago a company investing their treasury into BTC was novel because stock investors didn’t have a great way to invest in BTC through the stock exchange, so I could understand a pop on scarcity premium. Today, with more than a handful of Bitcoin ETFs (IBIT, FBTC, etc.), I’m just kind of surprised that there’s any retail enthusiasm for a company to put money into BTC when an investor could easily do it themselves directly. If a company announced they were going to invest their excess cash in the S&P 500, the stock wouldn’t go up…. they’d be rightly roasted by investors. I’m not sure why BTC should be any different.

Point #1 out the way to express my clear skepticism…. I’m kind of surprised more companies aren’t pursuing a “BTC treasury” strategy. SMLR saw their stock go up 30% on the announcement. As I write this, MSTR is trading for a roughly 100% premium to the value of their BTC (with BTC just below $70k, MSTR’s BTC is worth ~$15B and their market cap is ~$30B (I’m adjusting for their converts). You have to make some assumptions about the core business value, but saying MSTR is trading for a 100% premium to their BTC is roughly right). There are a lot of companies out there sitting on a lot of cash… I can kind of understand why companies may have been skeptical to pursue this strategy when there were no easy ways to buy BTC, but today all you have to do is press “buy IBIT” in a brokerage account. If your stock is going to get a huge pop from a BTC treasury strategy, isn’t it good capital allocation to pursue one even if you’re a BTC skeptic (you could issue overvalued stock into the pop, you could change plans if the pop never came, etc.)?

Yes, I understand there’s a risk BTC goes down significantly (I’m a self-professed crypto skeptic!) and you’ve put all your treasury into BTC, but if the market is just begging for new BTC exposure, I think it’s actually prudent for a company to take advantage of that (and maybe issue a bunch of new stock / raise capital in response).

And I’m only talking about making the “BTC treasury” move from a shareholder focused mindset. I’m really surprised that there haven’t been a bunch of…. let’s be generous and call them lower quality, less shareholder oriented / more pump oriented companies that have seen what’s happening with these pops and started announcing BTC treasury strategies and issuing stock like wild. It seems like some of the more controversial / heavily shorted stocks and/or more meme oriented stocks in particular would see a big share price boost if they announced something like a BTC treasury strategy (and while a boost may be temporary, all of these companies have gotten very good at selling stock into manias, and selling stock into mania does increase your intrinsic value!).

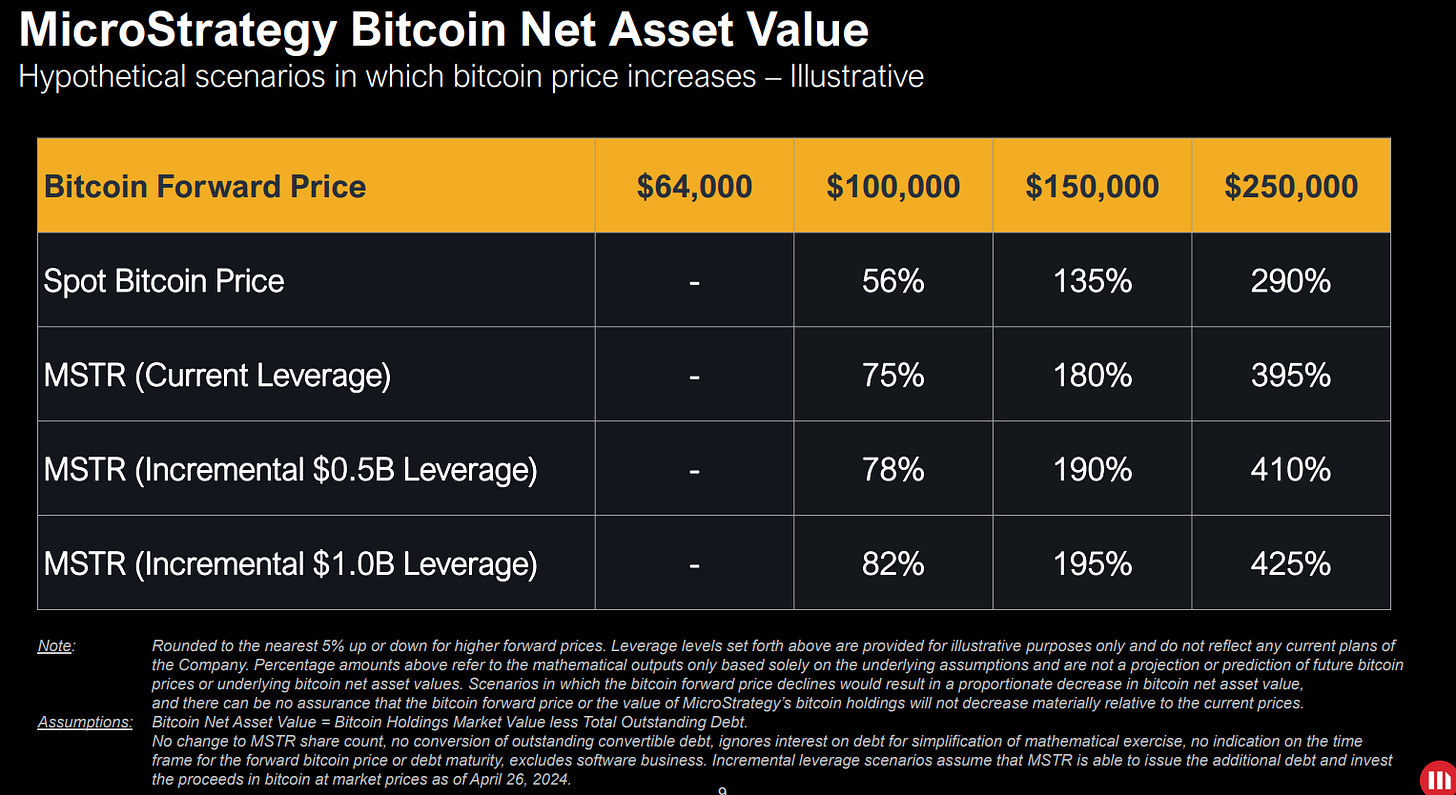

Speaking of MicroStrategy, this “every company looking for a pop can (maybe should) announce a BTC strategy” is one of the reasons I think it’s so crazy for MSTR to trade at a huge premium to their BTC holdings (Kerrisdale would agree). MSTR would argue they trade at a premium because they offer leverage to BTC that other options do not (i.e. because MSTR borrows to buy BTC, an investor into MSTR gets leveraged BTC exposure that they’d need to take on margin to get if they just bought the BTC themselves), and if you think BTC is going to the moon than MSTR will outperform BTC. Perhaps all of that is true…. but the issue with MSTR’s argument is that any capital markets strategy that results in a premium should get arbitraged away by copycats. To be honest, I’m surprised that we haven’t already seen a wave of MSTR copycats running levered BTC treasury strategies to try to lure in retail investors / issue a ton of stock.

There is one counter to that argument: MSTR is the original BTC treasury company. As we’ve seen with GME / AMC and meme stocks, there is something about the original that can command a bit of a premium just because of the investor mind share / attention. Perhaps, at the original, MSTR will always trade at a premium to copy cats! Either way, the current premium is pretty large, and I think it gets arbitraged away by other company’s running the MSTR strategy and slowly sucking away capital.

I wrote a post in early March (Crypto, mania, and reflexivity) that said it felt like we could get a bit of a crypto bubble. My reasoning was pretty simple: bitcoin had gone up a ton since the ETFs got approved, and that would create competitive pressure for advisors to add BTC exposure (if you were an advisor who added BTC right when the ETFs were released, BTC going up meant you outperformed, and any inflows would cause you to buy more BTC…. while if you were an advisor who had skipped BTC, you’d have competitive pressure to add just a little BTC as a selling point / hedge against it going up more). So far, we haven’t really seen that bubble play out…. but everything in points #1-3 could easily cause the bubble to inflate. If companies are getting rewarded for shifting their cash to BTC, then eventually companies are going to start doing just that (and eventually more will follow the MSTR “levered BTC” model), and that could drive a bunch of BTC demand in the near term. And if companies announcing that a BTC treasury see share price pops, sell stock into the pop, and use that to buy BTC…. well, that has all the makings of the beginnings of a mania!

Anyway, I remain a huge crypto skeptic. On the whole / all else equal, if a company I owned announced a BTC strategy, I’d likely be a seller (though I’d be a very happy seller if there was a big pop involved!). But, while I’m a skeptic, I also hope I’m a rationalist / pragmatist, and every thing I’m seeing suggests that a reflexive crypto bubble could still be in play.

There’s a saying in finance that is roughly “you’ve got to feed the ducks when they’re quacking.” It means that if there’s huge demand for something, eventually stock will be sold into it. This has always held true: SPACs and growth stocks in 2021, dividend growth stocks in the early 2010s (when interest rates were near zero for the first time and people were desperately hunting for yield), tech IPOs in the dotcom bubble. For the past ~year, the ducks haven’t just been quacking for more BTC equity exposure; they’ve been scream-quacking (if that’s a thing). Yet, somehow, the only person to really feed the ducks has been MSTR (again, at least to my knowledge).

SMLR’s BTC strategy shows that the ducks are eagerly quacking for more equity linked BTC exposure than just bitcoin ETFs, the BTC miners, and MSTR.

I expect the ducks will get fed in the very near future.

(And, of course, buyer beware / this isn’t investing advice! I think this is all very intellectually interesting, and there’s likely tons of opportunity if you can figure out ways to take advantage of some of this stuff…. but any time you’re talking about manias and bubbles, there’s obviously a very heightened degree of risk and I continue to think a lot of this ends in tears!)

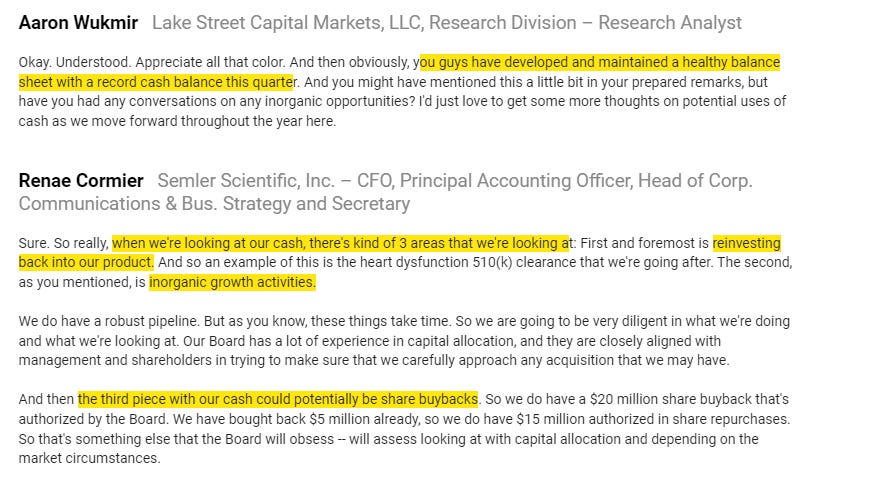

PS- I’m not the first to point it out, but man is it hilarious to look at how SMLR was talking about using their excess cash just a few weeks ago. Investing in the biz, M&A, and share repurchases…. how quaint! But, again, if you’re looking pragmatically as a shareholder, what would you prefer: SMLR to have bought back another $10m of stock and had the stock continue to languish, or SMLR to announce a BTC strategy and have the stock rocket 30%? It’s a tough call; obviously no intrinsic value is getting created by the BTC strategy (even if the stock says otherwise!), but shareholders might be a lot better off with selling into a big pop (either directly or from the company raising a lot of capital) than they are by share repurchases as the stock continues to languish. That assumes there’s enough liquidity to capitalize on the pop, and there are tax consequences and such to consider, but still…. I don’t think it’s as simple as a skeptic who would flat scoff / dismiss such a pop would have you believe.

Saylor recounted the following recently on the What Bitcoin Did podcast (paraphrasing from memory):

"It was 2020, and we noticed every mainstreet business was getting wrecked and every Wall St. business was thriving. So we thought we needed to get in the business of being a Wall St business, meaning we provided something that Wall St desired. We had an operating business that was profitable but wasn't able to grow. Revenue flat every year, retained earnings up every year, half the enterprise was in cash. And we're earning 0% on that cash while the Fed just created 40% more money. So our effective cost of capital is 40% and we needed to find an asset to invest in that would exceed our cost of capital or else we were going to die. So we considered what to do with the cash. We could return it to shareholders as dividends or buybacks, but that would just be hastening our death as a company. We could sit on it and continue to pay employees and management and continue as a going concern for a long time, but that is just waiting to die. And then you start to lose talent, because nobody wants your stock options as compensation because there is no volatility in the stock. But you can't overpay them in cash either, because then you stop making money.

So it was either a) return the cash to shareholders and die fast b) hold onto it and die slow or c) invest it an asset that would exceed our 40% cost of capital, make our stock desirable to Wall St. and employees and attract talent. Public companies have restrictions against investing the balance sheet in securities, so we considered gold. And when we considered gold, we realized bitcoin was better. It was digital gold with a technology network effect. So it became clear that bitcoin was really the only option, or else we might as well sell the company."

So the takeaway for me was it was an intentional choice to provide Wall St. with the securities it wanted in both the stock and the converts. You add volatility to the stock, you can opportunistically sell stock and add bitcoin to the balance sheet accretively.

Something that ETFs don't have yet are listed options. The listed options on MSTR are valuable as hedging tools for bitcoin investors. The convertible bonds are the best performing bond in any bond investors' portfolio. So MSTR is still giving Wall St. something it wants that it can't get anywhere else.

As far as SMLR goes, it seems to me they were faced with a similar situation. Before the stock pop, they had a market cap of $164mm with $63mm cash. So, 38% of the enterprise is in cash making 5%. M2 money supply has been growing ~7.5% a year for just about any time period beyond 5 years you want to measure, so without organic investment opportunities to grow the business (assumption! idk about their business), SMLR, like MSTR, is just waiting to die. They can't earn enough to exceed their cost of capital.

Through this lens, I actually read the adoption of a bitcoin strategy as BEARISH for the prospects of the operating business, because it PROBABLY tells me management doesn't think they can earn 8%+ ROIs investing in the business (even though they've historically grown revenue quite nicely and profitably? - I know nothing about their future business prospects). It MIGHT tell me that management doesn't think it can earn more investing in the biz than they think they can earn sitting on bitcoin, which is equivalent to them adopting a "bitcoin standard" -- i.e. measuring all potential uses of capital against their expected return of just holding bitcoin.

But, in investing in bitcoin, they've just breathed life into the company. Now, the stock has volatility and is garnering investor attention. Employees might be excited/motivated. Talent might find it attractive to go work there and effectively get paid in bitcoin. Adopting a bitcoin strategy I think creates optionality and life for an otherwise sleepy operating business waiting to die or be sold.

I agree with you we are going to see a lot more of this. There are a litany of zombie companies out there that can and probably should either sell themselves, liquidate or run the bitcoin playbook. As Saylor says in that same podcast, the beginning of the corporate bitcoin adoption era is marked with the a) approval of the ETFs and b) change in accounting rules in January 2024. Those two things paved the way for corproate adoption. His words, again paraphrasing: "we are in 1994 with the adoption of the internet, and people are asking well why don't more companies have websites? Well, give it a few years, they'll all have websites."

Is this good? I think so. The first order effect for these business I think is the discontinuation of malinvestment. Malinvestment = running a business earning 5% when your cost of capital is 7.5% so you can keep paying management team salaries. This probably describes a wide swath of the Russell 2000. With bitcoin now existing as an alternative, a lot of these business will probably be starved of capital unless they adopt bitcoin themselves.

I think Semler might be a bit unique as well because they are a microcap (approximately $200MM market cap) which means that their shareholder base should be uniquely concentrated with retail investors.

They also benefit by being "cheap" on a trailing earnings basis, with great trailing fundamentals (lots of growth, high margins, etc.) unlike MSTR. Investors who have been following Semler for longer would be more aware of the massive risks around charge codes, PAD standard of care, etc. and know why it trades at a "low" trailing multiple, but new crypto focused investors probably aren't aware of those risks.

So a lack of institutional investors and a sudden influx of new retail investors into a "cheap" trailing multiple with good trailing fundamentals could be uniquely positioned for a pop on crypto news.