Weekend thoughts, part 2: thoughts on TMTG / $DWAC

This is part 2 of my weekend thoughts on the TMTG / DWAC Spac deal. This part will dive into TMTG itself; you can see part 1 (on what DWAC means for the SPAC world) here. Part 3 (on the winners from the TMTG deal) will be posted later today or perhaps tmr morning. (Editor’s note: part 3 is now live here)

So, moving on from yesterday’s post on what DWAC means for the SPAC world in general, I just want to spend a little time talking about all of the curiosities about the DWAC deal.

I’ll be upfront with one caveat: back when Trump was running, you’d hear a lot of people say to take him seriously but not literally when he said something really controversial. I’m going to spend this whole section taking DWAC seriously; I’m assuming that they really plan on trying to launch a business here. That honestly might be giving them too much credit; as I’ll show below, this deal clearly came together really fast so everyone involved might have looked at it and said “let’s put something together and get it to the market while the getting is good” and worried about little details like operational execution and building a product later.

So let’s start with speed: the DWAC deal came together fast. Really fast. The SPAC priced on September 2nd; it took them 47 days to go from IPO to the TMTG deal. I can’t remember another SPAC going that fast from pricing to deal (Jacob Ma-Weaver suggested one SPAC beat them, and I’ll take his word for it). The speed from IPO to deal raises two questions, one on the technical / legal side and one on the due diligence side.

Let’s start with the technical / legal questions: SPACs are not allowed to IPO knowing what company they are planning to take public. That’s one of the reasons it generally takes a few months for even the fastest SPACs to announce a deal. After the SPAC goes public, the SPAC can then start reaching out to targets and trying to hammer home a deal. If they do the reach out before the IPO, that’s illegal. Now, I’m sure that a lot of SPACs have had informal talks with their targets before IPO’ing, but there’s a difference between informal talks and having the structures of an agreement in place. The SEC tends to ask lots of questions when deals are struck too fast; I wonder if the SEC is going to have questions here. If they find evidence that DWAC and TMTG had contact and deal structures in place before IPO’ing, you could see the SEC refuse to approve TMTG’s S-1 and the whole deal falling apart (more on that later).

The second question is on the due diligence side: I’ll be fascinated to read the proxy here. Less than two months from IPO to deal is really fast, particularly for a company with no product. How did DWAC and TMTG negotiate the deal? What projections are they basing the valuation on?

My gut is that the deal was negotiated on “YOLO, people are going to buy the shit out of this thing.” And that’s fine! But boards, the SEC, advisors, etc. need some stuff to cover their butts, and I’m curious what they will have.

There are three things that I think back my gut up (that there was very limited DD or thought behind this deal) here:

There was no PIPE in the deal

There was no call for the deal

There are no projections for the deal

That’s a really uncommon combination. While there are some SPACs that have come public without PIPEs recently, in general most SPACs want to do a PIPE because their target companies want some guarantee that they are going through all the headache of a SPAC merger with some cash at the end of the rainbow (i.e. if 95%+ of shares redeem, the company will still get cash because the PIPE will be there). Trump SPAC might be different; they probably figured “announce this thing and at the end of the day some Trump fans will buy the stock and hold it so there will be cash post redemptions.” But I can’t think of a single SPAC that has gone public without having a deal call the morning of the announcement, nor can I think of any SPACs that have gone public without providing some sort of projections. In fact, companies like TMTG, with no trailing financials but that are promising massive growth in the out years, tend to love the SPAC process because it allows them to provide really aggressive forecasts.

So the lack of all of those things (PIPE, call, and projection) I think backs up that this deal came together very quickly and likely without a lot of thought / diligence. I also wonder if DWAC was having trouble getting bankers to work on their projections / fairness opinion giving the speed of deal and the controversy that surrounds Trump, and the lack of projections / call / PIPE reflects that lack of banker interest.

Speaking of PIPE, I wonder if the company is going to try to raise one now that the deal’s been announced and the stock has raced and, if they did, I wonder what the PIPE would price at. Lucid / CCIV saw their stock skyrocket when rumors broke they were merging; they ended up raising PIPE money at $15/share (versus ~$10/share in trust). If DWAC went to a bunch of institutions with their stock trading at ~$100 (as it is now), I wonder where they could price a PIPE. Surely some institutions would fund a PIPE at, say, $25/share and just figure they can work out some type of a hedge strategy to lock in the profits.

Let’s move on from the deal background and talk about the go forward.

The first thing I’m very curious about is the SEC review process. What will happen if the SEC asks too many questions about the DWAC / TMTG deal process? What would happen if DWAC / TMTG didn’t like the SEC’s questions and stopped responding to them? Would the SEC fail to approve the proxy (and thus block the transaction)? I can’t imagine they would; it would cost investors literally hundreds of millions of dollars (as DWAC’s stock would fall from its current elevated levels to trust value) and infuriate the Republicans (I’d guess we’d see a “defund the deep state SEC” push at some point if they did). But, if the SEC just rolled over, what sort of precedent would they be setting for future SPACs? Why would anyone respond to any SEC probing after that process? The SEC is going to be in a real tough spot here; let this through without questions and you create precedent that SPACs can do basically anything and you’re going to see a wave of companies that makes the shenanigans at TMC or ATIP look mild by comparison. Block this, and you cost investors hundreds of millions and become a political pariah on the right.

Let’s assume that, eventually, TMTG and DWAC will merge; there’s just too much money involved for me to see a reasonable path to the SEC blocking the deal. Post-merger, I’m interested how the SEC will handle the company being public. Public companies need to report audited financials, and their execs can be held libel for making misleading statements. How is that combination going to work with the Trump family, who are very comfortable with divorcing themselves from the truth and saying anything that fits their narrative? That strategy works well in sales and marketing and politics…. not so much as the face of a public company. What happens when Trump says that TMTG’s audience is 10x bigger than Facebook? Or that the company is making record profits and growing faster than any company in the history of the universe? What happens if he says TMTG is approached all the time by acquirers desperate to buy their elite technology for tens of billions of dollars? Given what happened with the SEC and Elon / Tesla, I doubt they’d pursue anything against Trump or TMTG…. but failing to do so opens some more pretty scary doors for future fraudsters. (Matt Levine had some interesting thoughts on security fraud and TMTG I’d encourage you to check out).

Post merger, TMTG will eventually need to launch a product. It sounds easy to launch a social media network, but doing so requires things like building out a team, getting server space, and having a board of directors. I’m really curious how that plays out. Who is going to host TMTG? TMTG seems to be pushing that they won’t really moderate anything (as long as you don’t make fun of Trump); what happens when there’s some type of physical violence threatened on the platform? Is TMTG going to start censoring people? If not, aren’t there servers going to kick them off? Won’t the big servers (AWS and the like) see that controversy coming and refuse to work with them upfront? What about the app stores; are they really going to let this thing launch when TMTG seems to be promising they won’t moderate physical threats as long as you don’t criticize Trump?

Or think about something as simple as a board of directors. Directors generally want D&O insurance so if something bad happens at the company they won’t be held personally liable. If TMTG is going to take a loose stance on moderation, what insurance company is going to write D&O policies for TMTG? And, if no one would write policies, what director is going to join the board? What about auditors for TMTG? The Trump Organization and its CFO were recently charged with “sweeping and audacious” tax fraud; are auditors going to feel super comfy signing off on TMTG’s financials?

The interesting thing about TMTG is that it becomes a little reflexive. If the share price dropped and stayed low, then it’s going to be tough for them to pull their vision off. But with the current elevated stock price and with an implied market cap of $20B, TMTG has a lot of firepower to try to make something happen. AWS won’t host the product? Cool, we’ll raise some equity to buy our own servers. Having trouble getting a working prototype? Let’s use the stock to do some bolt-on M&A and get a working product. Having trouble getting a social network going? Go buy a conservative news outlet and change the story around the stock.

One last thing on DWAC / Trump. The question I think I saw most frequently on the heels of the merger announcement is what the deal meant for Trump running for President again in 2024. I can see both sides, but honestly I think it increases the chances. The equity that Trump’s getting from the SPAC deal gives him a massive war chest to fund a run, and with TMTG launched running for president becomes a little bit of a win/win for him. Just by announcing a run, Trump will drive enormous traffic to TMTG’s products. Any journalist, politician, fan, etc. will need to download the app just to see what he says directly from him, and running will give TMTG unbelievable earned media (before he was kicked off of Twitter, almost every news program would constantly run “breaking news: Trump tweets XXXX”. With TMTG launched, Trump and TMTG can look forward to similar publicity every time he uses the platform for something controversial). And if he runs and wins, basically every person in the world with an interest in U.S. policy needs to be on the app. If he loses, he still drove enormous traffic to the app, and he can use the app to shout how unfair the election was with no fear of reproach for spreading misinformation.

Two last thoughts before I wrap this up and move on to part three:

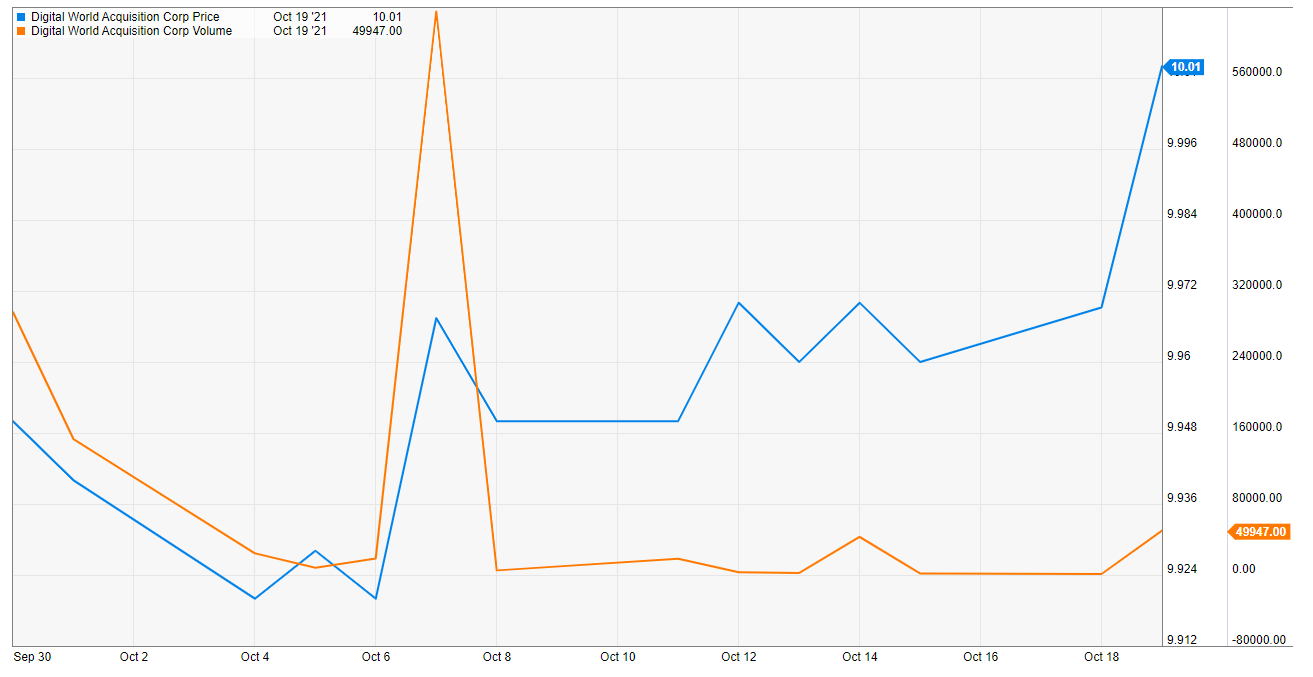

#1: The chart below shows DWAC’s volume for the ~month before Trump deal announcement (blue line stock price, orange line volume). Look at that big price and volume spike in early October. If I was the SEC, I’d be very interested in learning who made that trade and what they knew when they did it.

#2: I am going to take a mini victory lap and note that one of my predictions for 2021 was a Trump SPAC.

re: moderation: if they don't moderate hate speech / violent speech, how will TMTG avoid the same fate as Parler in the app stores?

(i know this was one of your questions, but it seems like the most important one?? if an app launches in the forest and nobody downloads it, does it make a sound)