Weekend thoughts: $IAC buys $MDP

This week, IAC’s Dotdash announced a deal to buy Meredith for ~$2.7B.

I’ll be honest: I’m a little annoyed I missed the deal (i.e. I didn’t have a position in MDP); I had mentioned in August’s links that MDP had lots of similarities to IAC. I was waiting for MDP sale of their TV stations to complete before really thinking about the company. ARGGGG.

Anyway, I had a few thoughts on the merger, and what better time to share those thoughts then in my aptly titled “weekend thoughts” series.

First, let me talk about the deal itself. I think it’s a homerun. IAC’s paying $2.7B for MDP. MDP’s LTM EBTIDA is $358m; about a third of that comes from print (magazines at the front of grocery stores and the like) and the other 2/3 (~$250m) comes from digital. The deal will have 50m in cost synergies, so let’s just make the numbers nice and round and say IAC is paying less than 10x post-synergy EBITDA for MDP’s digital business and getting the print business for free. That’s seems like a great deal; MDP’s digital business is asset light, growing quickly (15% annually for the past few years), has some great brands with a deep legacy, and IAC gave some great details on how they think the combo of MDP and IAC’s dotdash can help take each other to the next level on the call. My guess is that in a few year’s dotdash will get spun out, and when it does the whole thing will be valued at like 15x EBITDA (excluding the print assets, which will get valued as a terminally declining asset). To buy MDP now at 10x EBITDA, hopefully get something that will accelerate growth across the portfolio, and get another $100m in EBITDA from the print assets (albeit declining and a little more capital intensive) is just a fantastic trade.

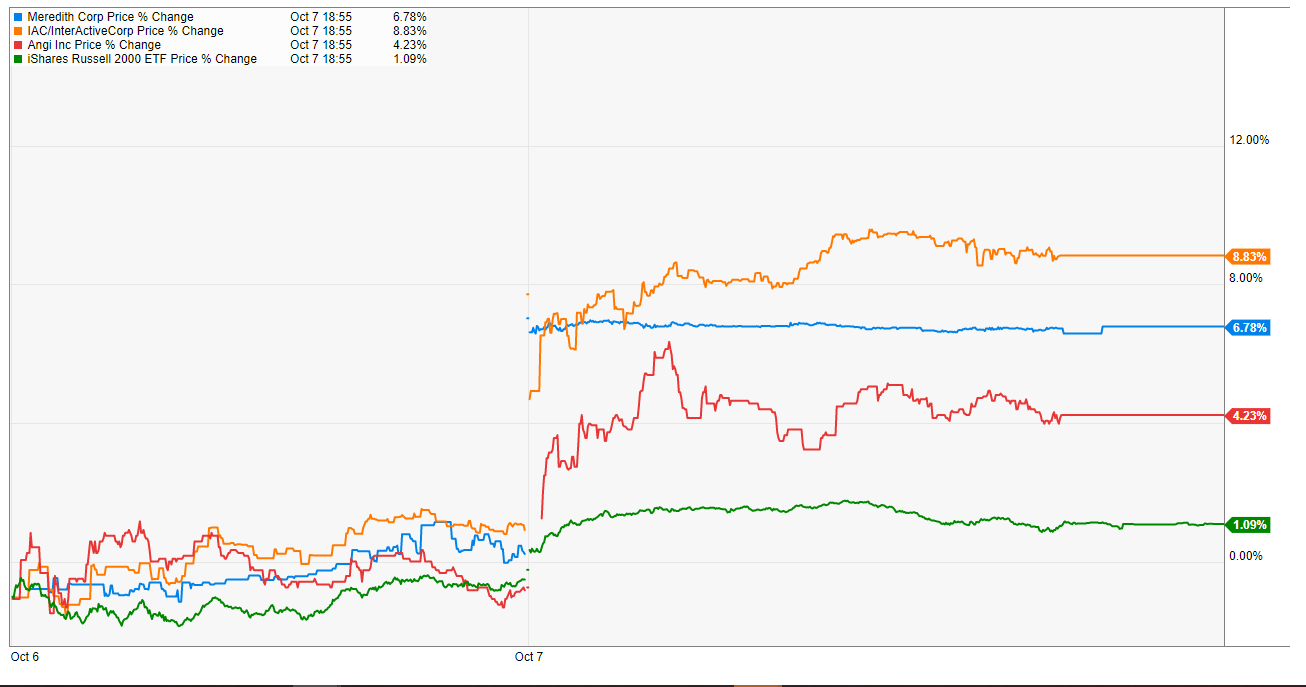

Speaking of spin-offs, I thought the markets reaction to the deal was interesting. IAC (a massive company) was up more than MDP, and ANGI was up almost as much as MDP!

Now, a lot of that price movement is driven by the fact deal rumors about IAC / MDP had broken a few weeks ago, and MDP’s stock had spiked on the news. So the deal announcement was more a confirmation for MDP shareholders / a sigh of relief that the deal was getting done.

Still, the reaction is interesting to me. I think the market is reading that this deal is

Quite value creative for IAC. IAC’s stock was up ~$10/share, which is ~$900m of market appreciation. ~$200m of that can be attributed to the pop in ANGI, so the market is saying IAC is creating ~$700m of value with this deal. That’s probably directionally correct, but honestly I’d take the “over” on value creation when we look at this in a few years

Likely to lead to some spin-offs or other moves in the near future; ANGI’s probably popping because the market sees this as getting IAC a step closer to spinning ANGI out.

Directionally, I agree with both those points from the market (though, again, I’d probably take the over on value creation from the deal).

(PS- My buddy David Kim at Scuttleblurb had a really nice overview of the deal and potential synergies when rumors first broke; I’d encourage you to check that out for thoughts a whole lot better than mine)

So that’s my thoughts on the IAC / MDP deal. But I wanted to talk about one more piece of the deal: why now? I heard lots of people ask, “Why didn’t IAC do this deal a year ago when MDP’s stock was in the teens?”

The answer is simple: the timing wasn’t right. It takes two to tango, and neither company was ready to tango then. Meredith probably wasn’t ready to sell, and IAC wasn’t ready to buy when Meredith still had their TV stations (they’re selling those to Gray in a separate deal).

But I wanted to build on that thought a little more. The “why didn’t Company X buy Company Y three years ago when the stock was 50% cheaper” argument comes up all the time. Sometimes when you’re talking about current / announced deals (like MDP / IAC), and sometimes when you’re talking about a hypothetical deal.

Look, I can promise you that major companies are aware of all of their competitors and have a rough idea of what they’re worth / what they would pay to buy them. I promise you IAC didn’t wake up this July with MDP’s stock at $40 and say “O man, who is this MDP company? Their assets would be great in our portfolio; why didn’t we buy them when they were $20.” Per the MDP / IAC conference call:

Little known or entirely unknown fact is we actually first started talking about putting these businesses together, Dotdash and Meredith, in a different fashion 5 years ago. That was the first time I think the Neil Vogel went to Des Moines to visit with Meredith people. And over the 5 years past, we have had multiple conversations with the company about different individual assets or multiple assets and trying to get something together. And finally, we had a conversation, I had a conversation with Tom Hardy a few months ago where we said, well, maybe the whole thing makes sense now. And that started off of a process which took a little while for us all to figure out how to get done, but just got done, and we couldn't really more thrilled about it.

So yes, IAC knew about MDP for years. But the timing was never right. In 2017/2018, MDP’s stock price was higher despite their business being worth less (the print side of the business was larger then than it is now, and the digital side was smaller). So the valuation probably didn’t work for IAC. And in 2020, the valuation probably didn’t work for MDP; it was simply too cheap, and the company wouldn’t sell at anywhere close to that price. Plus, IAC was tackling a kajillion other things at the height of COVID (spinning Match, buying MGM shares, dealing with a once in a hundred year pandemic, etc.), so the timing probably wasn’t right for them to try to negotiate anyway.

Sometimes it simply takes the stars to align to get a deal done: the valuation needs to work, both sides need to be in a transaction mood, etc.

I’d go so far as to say there are literally hundreds of companies that are obviously undervalued on the stock market versus their private market value. The issue is just the transaction timing; most companies that are obviously undervalued are controlled by someone who doesn’t want to sell (whether that be an actual controlling shareholder or an imperial CEO who doesn’t feel like giving up a cushy job and has a a weak board with no stock ownership), and investors need to discount that control (and that, in general, controlled companies that aren’t willing to sell are run by people who have objectives other than maximizing shareholder value). For example:

MSGS owns the Knicks and the Rangers. Their EV is right around $5B currently, which coincidentally is the value Forbes gives the Knicks alone. I can promise you that if the Knicks were put up for sale tomorrow, they’d go for significantly more than $5B, but ignore that. If you trust the Forbes value, then buying MSGS means you’re buying the Knicks at a fair price and getting the Rangers for free. The issue there is it appears James Dolan will never sell the team and will do lots of stupid things to destroy value (and keep the Knicks from realizing sustained success) while you're waiting.

Altice and Rogers teamed up to offer $123/share for Cogeco last year ($150/share for the voting shares). Prices for cable assets have only reason since that offer (well, excluding Altice’s stock!), and I guarantee you Cogeco could have gotten significantly more then that offer if they had been willing to negotiate. But the Cogeco family didn’t want to sell, and today Cogeco’s two share classes trade for significantly below the Rogers / Altice offer.

Nintendo’s EV is somewhere south of $50B. If they ever put themselves for sale, there would be a variety of strategic parties tripping over themselves to buy Nintendo. I think Comcast would be the ultimate winner and the price tag would be somewhere between $80-100B, but that’s a guess. Yet Nintendo’s share price continues to languish at these levels because the company clearly has no desire to sell.

Anyway, those are just three examples, but you could find hundreds of others. It’s one of the toughest things I’ve found about being an investor: when you find something that’s obviously undervalued, but with no catalyst in sight, how do you think about investing in it? Do you just buy it and wait? Fine, but then how do you determine which to buy and which to pass? MSGS sounds good as it trades at a big discount…. but MANU trades for ~$3B versus a $4.2B forbes valuation for many of the same reasons the Knicks trade so cheap. How do you differentiate between those?

Or consider something like Nintendo. They’ve got huge strategic value now, but every day that passes that they don’t sell is a day they they become a little strategically less valuable. If you buy for $50B today because you think their strategic value is $100B, there’s a chance that five years from now they are trading for $30B and their strategic value is only $50B. It’s not apples to apples at all, but that’s exactly what happened to Lionsgate: they turned down a Hasbro offer at >$50/share and an offer to sell Starz to CBS for $5B. Today, all of Lionsgate (which includes Starz, a very profitable TV studio, and a big film library) trades for just $6B; I think they’d be worth a lot more in a sale, but they wouldn’t be worth close to what Hasbro offered a few years ago and I’m not sure if Starz would be worth close to $5B as a standalone today.

It’s very cliche, but I think that’s one of the reasons buying companies that are growing / creating value creates so much more margin of safety and is critical particularly for concentrated investors. If you buy a company worth $1 for fifty cents, but that one dollar will stay static or shrink over time, then you’re really counting on a sale or transaction in the near term. In contrast, if you’re buying a company that’s worth a dollar for eighty cents, but you’re extremely confident that dollar will grow by 10% every year, then you can swing much harder at it. If a near term sale comes along, awesome! If not, then at least the value of your investment will continue to grow.

PS- this “static dollar / failing to sell” issue is one of the reasons activists can be so useful and why stocks normally pop when an activist discloses a position. Most management teams don’t care about their shareholders, and most boards don’t own much stock, so you can get into a place where a company is obviously undervalued and would be better off selling than remaining standalone, but no one at the top of the company wants to sell because it’s not in their best personal interest. An activist can step in and push for / force change, and the market rewards the company with a pop because the market is discounting the odds of the company selling or simply doing something rationale going up.

PPS- I’ve learned a lot of lessons over my career…. but one of the biggest is that you better be very, very positive that the controlling shareholder is on your side / interested in creating value when you invest in a controlled company. I can’t tell you how many companies (including MSGS!) I’ve invested in just salivating at the discount to private market value they were trading at. Invariable, if the controlling shareholder didn’t care about shareholder value, the stock would underperform the market over time. Without the prospect of an activist to step in and force the company to do something rational, the market is always going to discount those companies, and probably rightly so since those companies are always going to find a way to destroy shareholder value! The issue is particularly bad in smaller or microcap companies; I know of several that have had offers to sell themselves for huge premiums to the current share price and any reasonable calculation of standalone fair value, but have chosen not to because the management team was well paid and owned no stock and the company’s ultimately destroyed insane amounts of value.