Weekend thoughts: GLP-1 drugs and restaurant stocks

This month, I saw two friends I hadn’t seen in a few months, and they both look great. They’ve lost tons of weight (>20 pounds); honestly, they look like different people.

Of course, the natural question is how they did it. Both of them told me they got serious about diet and exercise, and I have no reason to doubt them….. but I found myself wondering if it was really all diet and exercise, or if they were also taking Wegovy / Ozempic. I went out for food with both, and I found myself looking to see if they had finished their order or not (as if finishing one meal would have any indication of their appetite or if they were taking drugs!).

Of course, it doesn’t matter if they’re taking it or not; all that really matters is they’ve lost the weight, look great, and are probably a lot healthier! But I was genuinely curious; I see tons of stories on Wegovy and Ozempic, but I personally don’t know of anyone who has told me they were taking it and I was just genuinely interested in hearing about the experience first hand.

Anyway, because of that experience / curiosity, I was thinking a lot about GLP-1 drugs and their impacts over the past few weeks, and that lead to me asking about GLP-1 as a tail risk to LW on my podcast with AJ…… which got me thinking: are restaurant stocks properly discounting GLP-1 drugs?

Maybe this is a question that’s been answered by the sell side. I don’t know; I don’t read much sell side research. Maybe it’s too early to answer.

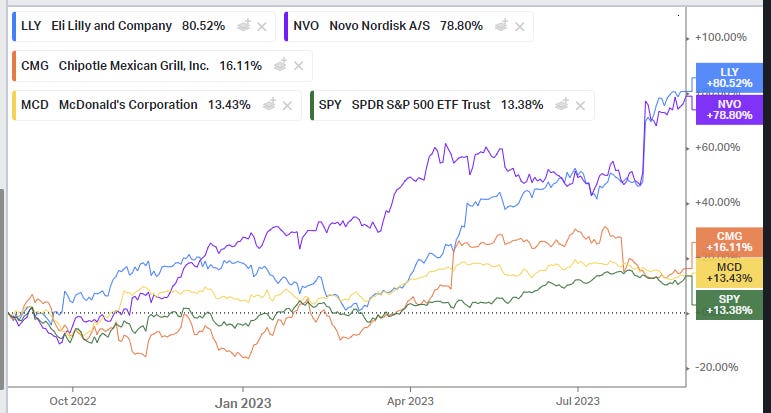

But the GLP-1 stocks have been huge homeruns (driving the market value of Novo Nordisk above its home country of Denmark’s GDP; a meaningless milestone but a fun one nonetheless!), and plenty of other areas of the market are taking notice (Walmart mentioned it leading to a change in sales mix; some weight loss products are losing clients to GLP-1s). So the market is clearly forecasting a huge impact from the GLP-1 drugs (and I’d guess rightly so; when manufacturers literally cannot keep up with demand for a drug and the WSJ can run an article talking about people taking second jobs to afford a drug, you know it’s going to be huge)… while the restaurant and fast food company stocks haven’t really seen any impact.

Obviously that chart is small sample size, but CMG and MCD have traded roughly inline with (or a bit better) than the market over the past year. Given the S&P has done pretty well (+13% in a year is nothing to sneeze at), CMG and MCD keeping up is kind of surprising as they are both less cyclical companies that should probably trail the markets in boom times but outperform in bear markets (particularly MCD). Yet they’ve both managed to match a racing market.

It seems LLY and NVO stocks are pricing in a huge impact for GLP-1 while CMG and MCD are saying that their futures haven’t changed at all as GLP-1 drugs continue to gain share.

That combination / outlook seems flat wrong to me. GLP-1s work (in part) by diminishing appetite (sometimes too well; in some cases GLP-1 drugs can lead to malnurishment). If GLP-1s are set to get more popular, it seems inevitable that the total calories consumed across society are ready to go down.

Maybe that prediction is wrong or ignoring second order effects. You could imagine a world where appetites and calories consumed decrease, but, because people are thinner and eating less, they spend more of their calories on indulgences like snacks or dining out. So maybe calories consumed in the home goes way down, calories consumed out of the house goes up, and calories of treats (deserts, fast foods, etc.) goes way way up because a now thinner population feels like they can treat themselves more to the food they love, so you actually see sales increase at these companies and margins scream higher as more of their sales comes from higher margin stuff (i.e. people shift more calories to french fries and ice cream, which carries better margins than burgers).

Perhaps!

But if you look at the stock charts of these companies, it seems like the market today is forecasting a better future for these companies than it did a year ago. And I think the worlds where GLP-1s gain popularity yet the future is brighter for restaurant stocks are few and far between.

When great investors find something really asymmetric, they swing hard at it. And I’m wondering if that’s the case with restaurant / fast food stocks as a short today (which is a lovely time to remind you: shorting is highly risky, and nothing on this blog is investing advice. Please check out our disclaimer).

If my “GLP-1 will impact restaurant stocks” thesis is wrong, the restaurant stocks seem priced pretty richly already. I just grabbed a few restaurant companies randomly and threw them into a Bloomberg model below; obviously each of these has very different business models (for example, DRI and CMG are almost completely company owned, while WING is almost exclusively franchised) and are at different places in their growth life cycle, so each deserves slightly (or massively!) different multiples and valuations, but, across the board, these multiples seem pretty rich even in a vacuum. Interest rates are no longer at zero; the ten year is yielding >4%, and that means a >20x P/E today needs to be looked at in a much different light than the same multiple two or three years ago.

So even if GLP-1 has no effect on these businesses, it’s hard to see how these stocks materially outperform the market from here given those starting multiples.

But if GLP-1 does have an effect, even a small one, restaurant stocks could be a disaster. There are a lot of fixed costs in running a restaurant; if you see even a small amount of consumer demand disappear, suddenly the nation could find itself over restaurant’d (the same way it was over-retailed a few years ago as online gained share). It could be a real bloodbath for restaurants: consumer demand drops, operating leverage works in reverse (remember, restaurants carry a decent amount of fixed cost given their operating lease commitments, so a small drop in demand would have huge effects on their bottom line), and we see tons of discounting as restaurants compete to lure a smaller dining pool.

Could I be missing something? Sure! But it does seem quite asymmetric to me; I took a little short position in a basket of some restaurant stocks while I keep ramping up and doing more work.

What do you think? Is the GLP-1 effect likely to be overblown? Are restaurants screwed? Are there other companies or sectors likely to be bigger losers (or winners; I know several people who think gyms and dating apps are huge winners here, and I tend to agree, though it’s tougher to make an argument of how much GLP-1 is / isn’t priced into those stocks)?

Making predictions is hard, particularly when you’re trying to predict the future…. but one corner of the stock market (the drug makers) is predicting a huge future for GLP-1, and that prediction matches with what I’m reading and how I think it’ll play out (assuming no huge adverse effects, which I’ve yet to see), while another corner (the fast food stocks) is forecasting basically no impact from GLP-1s. Both almost certainly can’t be right, and figuring out which is wrong could be hugely profitable.

My money is (literally) on the restaurant stocks being wrong (though in very small size).

Pharmacist take:

GLP-1 drugs are first line now in the fight against diabetes with metformin. They work incredibly well to reduce A1C and the data for weight loss is equally/more impressive. We counsel people who start new GLP-1 drugs to eat half of what they normally eat portion wise for every meal to avoid nausea/vomiting. Greasy foods can also trigger this side effect. Once major insurance plans start covering glp-1 drugs for WEIGHT LOSS instead of just DIABETES, this restaurant short thesis could really take effect by doubling or tripling the number of patients on these drugs. Then we should start seeing a significant reduction in food consumption.

The average in that set is basically meaningless: without WING the average PE is 25.6 (not great, not that outlandish) and the average EV/EBITDA is 17.6 (setting aside that averaging ratios is somewhat innumerate anyway). I'm short WING.

Fast food and delivery are going to be challenged by GLP-1: those models are fundamentally about calorie delivery. But sit-down will more likely be OK, as selling calories is a small part of that bundle: what's really being sold is a lease on a table or spot at the bar to socialize. The lease is now mostly monetized with alcohol (the GLP-1 impact on that demand seems under covered), but bundle monetization can shift: tapas and expensive sparkling water?