Weekend thoughts: finding value in the rubble

My preferred benchmark, the Russell 2000, is currently down ~10% on the year and ~20% from its peak in early November.

I know it’s cliché to say, but it certainly feels worse than that. Most of the stocks I follow feel like they’ve been hit much, much harder than the index.

But with that carnage comes opportunity. Most of the places I’m finding value are tracking in one of three places:

Rumored deals:

What is this? I mentioned these a few weeks ago, but perhaps my favorite place currently is companies where a financial (not strategic) buyer has made a public bid for a company and the stock continues to languish below the offer price. The thinking here is simple: a financial buyer is making the offer because they think the stock is undervalued, so buying below that offer gives you multiple ways to win. The buyer could be right and the stock is undervalued, another buying group could step in, a strategic could step in at a big premium, etc.

Can you give an example? The post a few weeks ago focused on MGI and mentioned CNR as a possibility, and just this week we saw CNR pop when their “rumored’ deal went definitive. I’m still seeing lots of opportunities in this set of names (in fact, I wrote two up on the premium side in the past couple of weeks), and I suspect the opportunity set here will remain interesting. Markets are shaky, lots of companies trade for low multiples, and there’s tons of dry powder on the sidelines. That combo should make for a continued rich set of rumored deals.

COVID “winners” that have been slaughtered on fears of a return to normal.

What is this? A ton of businesses were massive beneficiaries of COVID, and investors are selling first and asking questions later as they worry that the huge pull forward from COVID is unsustainable. The headliner here are business like Zoom or Peloton, but there are plenty of others that have been sneakily decimated. For example, legacy retailers across the board generally benefitted from COVID. Mom and pop stores closed, consumers were desperate to spend, and supply chain issues meant the companies didn’t have to worry about discounting to move items, which juiced margins. Today, I can list probably a dozen retailers that are reporting record results but trade for low to mid single digit EBITDA multiples because investors are worried about a pending crash.

Can you give an example? Sure. Dicks (DKS) EBITDA jumped from $771mm in FY19 to ~$2.4B in FY21. They reported earnings this week and guided FY22 to roughly flat same store sales (SSS) and ~$12-13/share in EPS. As I write this, the stock is trading for ~$110/share, so they’re trading for maybe 4x LTM EBITDA and ~9x forward P/E. They’re also returning capital like crazy; the current market cap is just under $11B, and they repurchased ~$1.1B of shares in FY21 alongside paying out >$600m in dividends. So, no matter how you cut it, this company is cheap; the market is clearly saying current results are unsustainable and that they have zero confidence in the near terms earnings outlook. Maybe that’s true, but I think the stock’s are too cheap even if you assume a big reversion towards pre-pandemic earnings.

I went on the “hard money” podcast and we mainly talked sporting good retailers trading cheaply and hammering their share count if you’re interested. I enjoyed it!

Second derivative oil / commodity winners

What is this? For those of you living under a rock, oil and gas prices have absolutely ripped in the wake of Russia invading Ukraine. Most companies with direct oil and gas exposure have ripped in kind (though I believe most of their stock prices still imply some skepticism of the current commodities curve), but there are a variety of companies that will be second order beneficiaries of rising oil and gas prices that haven’t seen their share prices move much.

Can you give an example? Of course; heck, I’ll give you two interesting ones!

I’ve been following BSM since Andrew Carreon pitched it on the podcast last June. When he pitched it, BSM stock was at ~$10/share while oil was at ~$70/barrel and nat gas was at ~$3. Here we are ~9 months later; BSM has done well (the stock is at ~$12.50/share), but nat gas and oil have both exploded (nat is approaching $5, oil well over $100). BSM is a double beneficiary of rising commodity prices; not only do they make more money on the royalties from their wells, but higher prices encourages more drilling on their lands, which creates more cash flows / royalties in the longer term. BSM has basically no debt at this point, so any increase in cash flow can go back to shareholders through either share repurchases or increased dividends. The stock is under $13, and if oil/gas stay anywhere near the current strip prices I think it’s entirely possible BSM pays out >$2/share in annual dividends going forward.

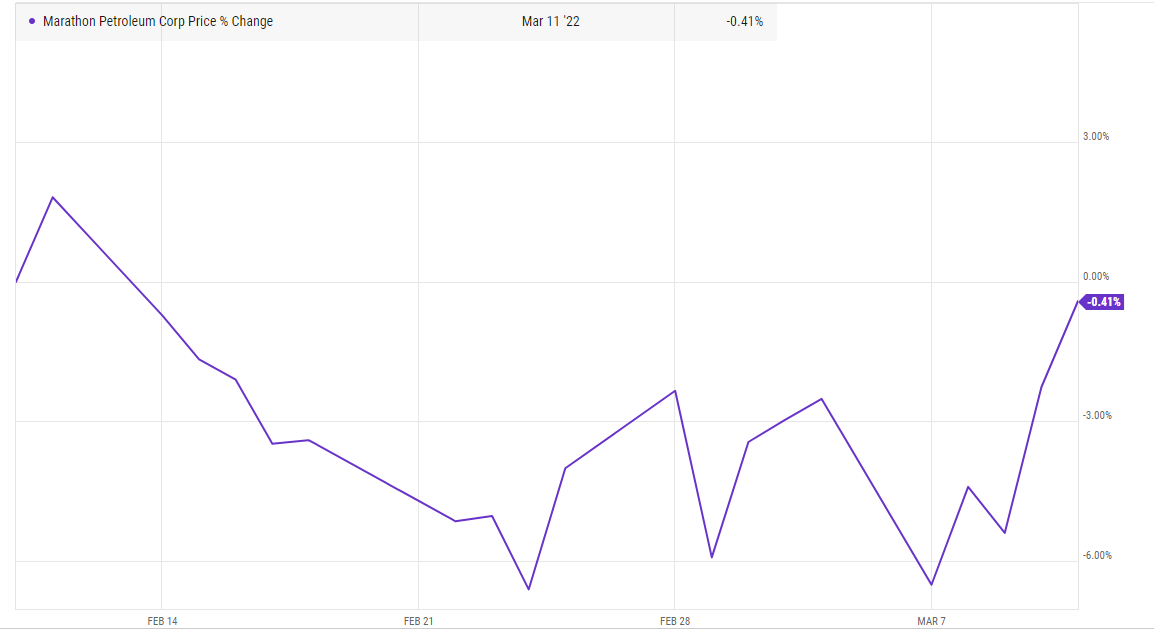

Oil refiners are absolutely minting money at current spreads. Oil refiners operate on “crack spreads”, and crack spreads have been ballooning given the rise in energy prices and tight supply for refined products. Plus, refiners operate in a global market, and U.S. refiners should have a mammoth advantage over their global counter parts given how much cheaper nat gas is domestically versus internationally. Despite that, many refiners stocks continue to languish. Consider MPC, the stock is flat over the past month despite their global peers getting demolished and crack spreads blowing out. The company is an aggressive share repurchaser (they bought back >10% of their shares outstanding last year), and I expect they’ll continue to be aggressive given they just authorized another $5B (>10% of their market cap). Their stock is at <$80, and I think a conservative SOTP is >$100/share before even factoring in the windfall from the current environment.

Anyway, those are my three favorite areas to look for opportunities currently (alongside cable, of course!). I know the current environment is scary, but there are a lot of companies that look way too cheap in any scenario outside a massive depression or World War 3. So I wanted to run through a few example as well as make a request: I’m always looking for both new opportunities and pushback on my current idea set. So, if you’ve got any opportunities that fit into any of those buckets (or some other bucket that I haven’t thought of yet!), I’d love to hear about them. Or if there’s some angle/risk to these opportunities that you think I’m missing, I’d love to be told what it is!

Happy Hunting.

(PS- I initially posted this “finding value in the ruble” not “finding value in the rubble”. An embarrassing typo, but particularly so given what’s going on. My bad / not what I was intending / probably seen rubles discussed too much recently / there is certainly a little irony there!)

Railroads are another second derivative commodity winner. Not the cheapest way to play it though.

What about DMLP? Similar to BSM but no hedges and much higher dividend.