Weekend thoughts: electricity demand growth and opportunity

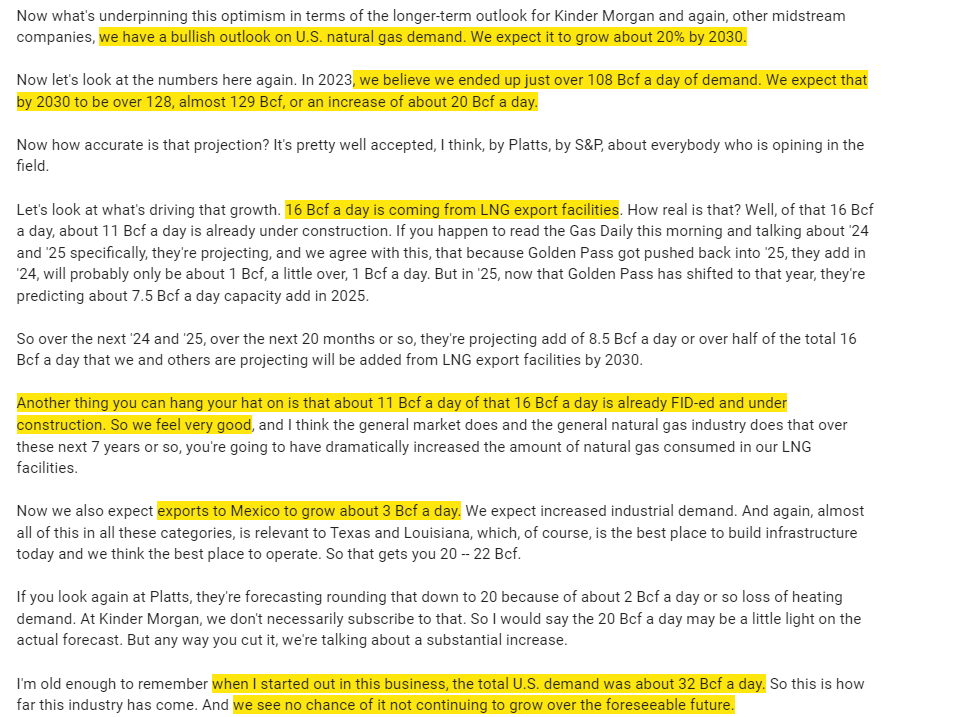

Last month, Kinder Morgan (KMI) hosted their Q1’24 earnings call. There was one part of their earnings call that set my little corner of the world on fire: they talked about how the insatiable demand for (reliable) power from AI / data centers could create huge new demand for nat gas.

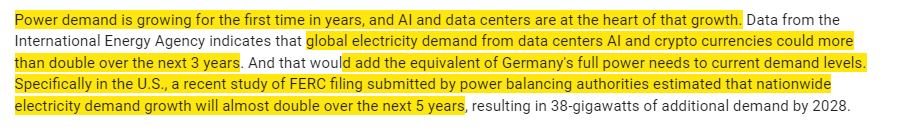

KMI’s not the only one calling out this increase in energy demand; for example, here’s HAL’s earnings call the following week:

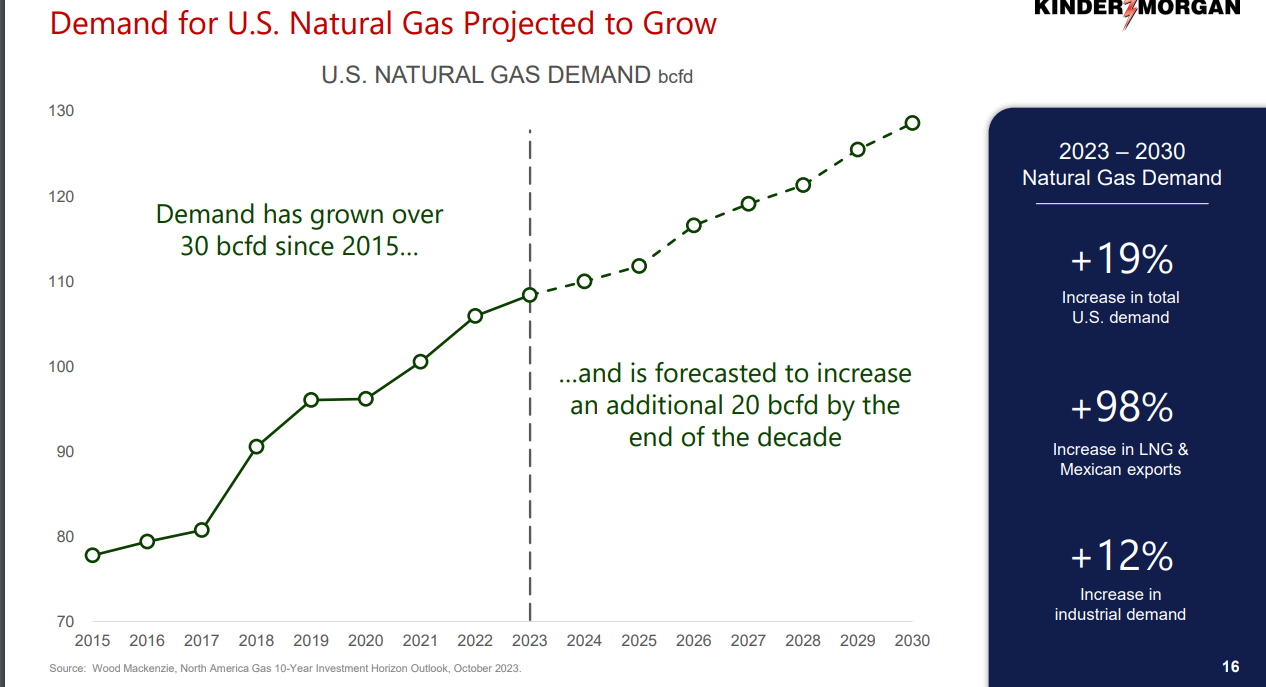

Now, I’ll caveat those predictions by noting that asking KMI (or anyone who supplies energy services, like HAL) about their outlook for nat gas demand is a little like asking your barber if you need a haircut. KMI is always bullish long term nat gas demand; they were talking up the long term growth prospects at their investor day in January and they were basically equally as bullish then without mentioning data centers / AI demand once.

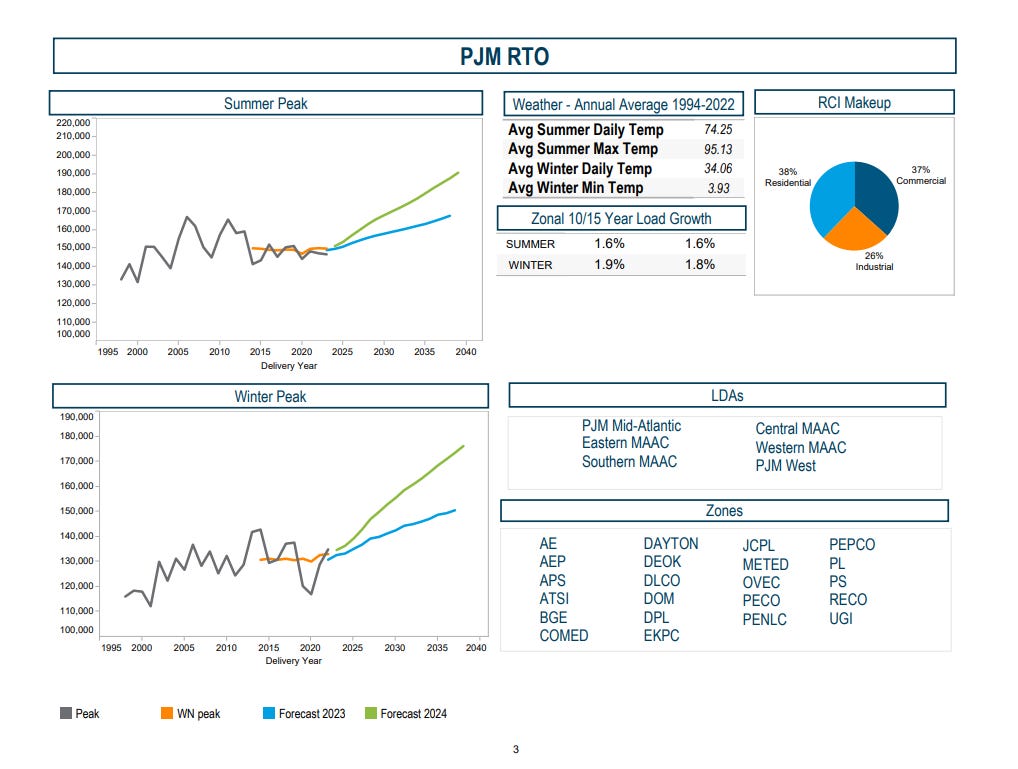

Caveat out the way, it does seem like the KMI / HAL calls for more energy demand is correct. AI / Data centers are voracious energy users (this WSJ article noted big data centers “use as much power as the city of Seattle”), and they require uninterrupted supply. Electricity usage in the U.S. had basically stalled out over the past few decades; the AI boom is causing a huge acceleration. Perhaps my favorite chart can be seen in PJM’s predictions for energy load; after years of ~flat demand, look how much they increased their outlook from 2023 to 2024!

TLNE frames that demand growth well in their Q4’23 earnings calls:

And here’s one more from TLNE:

For good measure, here’s how TLNE framed it on their most recent earnings call:

Or you could look at what Vertiv (and their stock price) is saying about the demand for data center infrastructure design:

Those statements / demand outlook underscores what has become an increasingly popular trend / theme for investors: one of the best “second order” way to invest in AI is by playing their energy demand. And you can see why it’s been popular; the returns from unregulated energy providers has been spectacular recently:

Obviously those returns are driven by hundreds of factors (the business of providing electricity is shockingly complex!), but you could simplify a lot of those gains to this statement: generating electricity involves a lot of fixed cost, and it takes a long time to bring new supply (particularly baseload, which AI needs) online (and NIMBY certainly doesn’t help there). When you combine a sudden rise in demand with operating leverage from the fixed cost and a slow supply response, you get a really attractive earnings / cash flow growth story.

So there’s been some clear winners, and they’ve run up quite a bit…. but I wanted to throw this post up because I’ve been wondering one thing: if the demand for energy continues growing at its current pace, do we see a bid for any and all power assets?

I think there are two areas where there would be an opportunity.

The first is coal. Obviously coal is a favorite among deep value investors (I’ve been overwhelmed by the response to my coal interview with Matt Warder earlier this year!), but if baseload demand grows enough, I wonder if we start seeing coal plant retirements delayed (or coal plants brought back online). When faced with a choice between having their residents suffer rolling blackouts or delaying the shutdown of a coal plant, I can guarantee you politicians will take option B every time (there are probably faster ways to getting voted out of office than having your residents suffer consistent blackouts, but there aren’t many!). This tegus interview was really interesting and put it succinctly:

So the opportunity in coal would be pretty simple: most things that touch coal are priced with limited terminal value / like they’re going out of business pretty quickly. If power demand grows enough, you could pick up multiple extra years of terminal value (and, given strong power prices due to demand, these extra years would likely carry juicy cash flow characteristics). Note that this thesis would apply to both coal plants (which get extra years of useful life) and to thermal coal (which get extra years of selling into the coal plants!).

Again, there are all sorts of caveats to that opportunity. Environmental concerns are real, and even if you think politicians would put them to the side if there was some type of electricity shortage, the tech companies behind data centers really want green energy, so they might refuse to take “coal energy.” Certainly possible…. but I could also imagine some weird accounting where 100% of green energy goes to powering data centers and 100% of dirty energy goes to powering consumers or something like that.

(PS- the “tech companies want green energy” line is a big piece of why companies with nuclear power (and particularly nuclear power in non-regulated markets), like CEG and VST or TLNE (the subject of this week’s pod!), have seen such big runs… not only is there a big increase in demand for power, but nuclear is literally perfectly situated for AI’s needs: 100% reliable, completely green, etc.)

The other area of opportunity that could be interesting is assets that could be (quickly) repurposed into AI. The thought process here is simple: there aren’t a lot of sites that are “AI ready”, meaning they are large and have consistent access to huge amounts of power. If you have one of those sites, it might have value getting repurposed into an AI data center.

We saw this process in action with Talen’s recent sale of their Cumulus Data Center to Amazon. Here’s what they had to say about the sale:

So AI has an absolutely voracious demand for these sites and (obviously) a near unlimited amount of money behind it; that combo suggests that any site that offers what AI needs could see a huge premium bid / get repurposed to a higher and better use.

I could imagine that there are a few small cap industrials that look something like this: they’ve got their plant seated right next to some type of power plant. Their core business earns kind of breaks even, and the stock is priced like it…. and then one day they get a bid from an AI play for their real estate that values it at 4x what the market that the whole company was worth because it turns out that plant / site is worth way more repurposed to AI (again, this is just a loose hypothetical; I’m not aware of any company that specifically fits this model (or else I’d be bidding on their real estate), and I’m sure there’s a hundred little details I’m missing in that conversion process).

There is one group of companies that would have you believe that they’re primed to take advantage of AI’s data center demand: the bitcoin miners. I briefly mentioned this in my “bitcoin halving and miners” post (and will dive into it further in a subsequent post), but bitcoin mining assets are theoretically perfect for AI / data center plays. Both bitcoin mining and AI data centers require enormous amounts of power, so theoretically you could just take a mining center, switch out the mining rigs for AI GPUs, and boom you’d have an AI data center.

Support from this line of thinking comes from two places:

We discussed this more on the podcast, but TerraWulf’s Nautilus facility is the sister facility to the site that AWS just bought from Talen. You’d have to imagine Nautilus could easily be repurposes to an AI facility.

Core Scientific signed a (potentially) $100m deal with CoreWeave for AI / HPC workload hosting

So we certainly could see more of these deals / miners getting converted to AI facilities. But I have to admit I’m a little skeptical we will, and even if we do, many of the miners are valued at such huge multiples that their stocks might not work even if they got big AI multiples.

But that’s probably a story for another day. I’m going to wrap it up here (though I’d love to hear if you have any other ideas for assets that could be retrofitted into AI plays).

PS- I was already clipping a ton of quotes at the start of this article, so I didn’t want to squeeze another in…. but this clip from this Tegus interview is interesting in thinking about how we’re probably going to see electrification coming / driving demand from other places than just AI.

PPS- natural gas is very hard to transport, so in a lot of the country there’s an abundance of cheap natural gas with no where to go because we don’t have the infrastructure to move it. Could AI / Data Centers think about building close to stranded natural gas to absorb some of that supply? CRK certainly thinks so, and if that plays out there are a host of natural gas producers who are currently getting paid almost nothing for their stranded-ish natural gas who could see some real benefits.

PS^3- I’d been working on this article off and on for a while, but what inspired me to push it out was my podcast yesterday on TLNE. It’s a really interesting idea / it was pretty informative, so I’d encourage you to give that a listen if of interest.

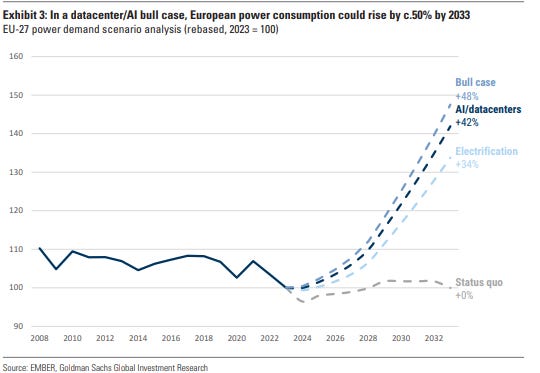

PS^4- someone shared this GS report on electricity demand in Europe; worth a read if you’re interested in thinking through this more, though the chart below is by far the killer takeaway.

PS^5- My friend Luis Sanchez tweeted out the exchange below, and I haven’t been able to get it out of my head. It seems like demand for electricity from data centers is going to get a whole lot wilder…..

Andrew, have you looked at HOLI recently?! The sread widened to very juicy level on what looks like a delay in closing.