Weekend thoughts: conviction and investing in other markets

Investing is not really about finding good ideas / stock pitches. There are literally hundreds of good ideas out there (many of which get pitched on my podcast!).

Investing is more about coming to really understand an idea / company and having differentiated insight into it. If you don’t have that conviction / insight, you’ll often make the exact wrong move at every turn.

An example might show this best. Say you hear a spectacular idea pitched on the podcast, and you just instantly buy the stock (don’t do that! Remember nothing on this blog / podcast is investing advice). Easy alpha, right?

Obviously, that’s not how it works. Here’s what’s going to happen: in a few weeks, there’s going to be some news that comes out that causes the stock to drop 10%, and the person who has actually done the work on the stock is going to know how to respond way better than you. Maybe the news is awful, and the stock should really be down 50% instead of 10%, so they sell while you hold. Or maybe the news is a nothing burger, so they buy more while you panic sell.

Or, alternatively, because they follow the company and industry closely, maybe there’s some news on a competitor that comes out that they notice and can adjust to quicker than you (and the market). Maybe they see evidence that their thesis was wrong and they need to get out before it’s invalidated completely. The “bad industry news” could come in a variety of forms, but the fact is the investor who has done the work and follows the industry is going to notice it and you’re not, and they’ll be able to get out before the shoe drops (or buy more before the market realizes things are getting even better).

Often the news the investor incorporates won’t matter in the short run. Buffett saw “cockroaches in the kitchen” at Fannie and sold almost a decade before the GFC. For years, that decision looked silly…. but then the stock went to zero and he looked brilliant (as always).

Anyway, why do I mention all of this?

In general, I find myself overwhelmingly attracted to and investing in domestic stocks.

It’s not that I can’t invest in international stocks. I can and have!

And I’m always impressed by the rocks some of my friends who focus more on international markets turn over. My friend Jeremy Raper is always finding crazy little companies trading for like 0.1x book and 2x cash flow to buy (and, increasingly, to go activist on).

Of course, Jeremy’s got the advantage of living internationally…. but my friend Dave Waters finds similarly quirky international stuff and he does it from the comfort of Pennsylvania.

About twice a year, I’ll get jealous of the stuff that my friends are turning over and say “I’m going to make a concentrated effort to focus more on international stocks.” Those forays are generally quite fruitful; sometimes I’ll find something new to invest in, but I’ll often just learn new stuff about countries and companies.

But, when I make those forays, I’ll also be reminded why I generally stick to domestic companies: it’s just so hard to understand all of the dynamics of a company that operates in a different country.

Last week, a friend suggested I should look at the African tower companies. There’s a lot to the pitch behind African tower companies, but if I had to boil it down to one thing it would be this: African tower companies today are roughly in the same spot American tower companies were in ~20 years ago, and if you had bought American tower companies 20 years ago you would be a very happy investor. Consider the 20 year chart of one American tower company (ironically, American Tower Company (AMT)) versus the index:

It’s a good pitch! So I was doing research on the African Tower companies and making all sorts of notes and due diligence questions, and in doing so I came on the story below (from Helios Tower’s 2022 investor day):

That is just crazy. I can’t tell you how many companies I’ve researched, and I’ve just never thought of “hey, will these guys have access to power 24/7” as an issue or even a question to consider when doing research. As a domestic / U.S. investor, I just take it for granted that I will have power and data access at all times, and that any company I’ll look at will have that access as well.

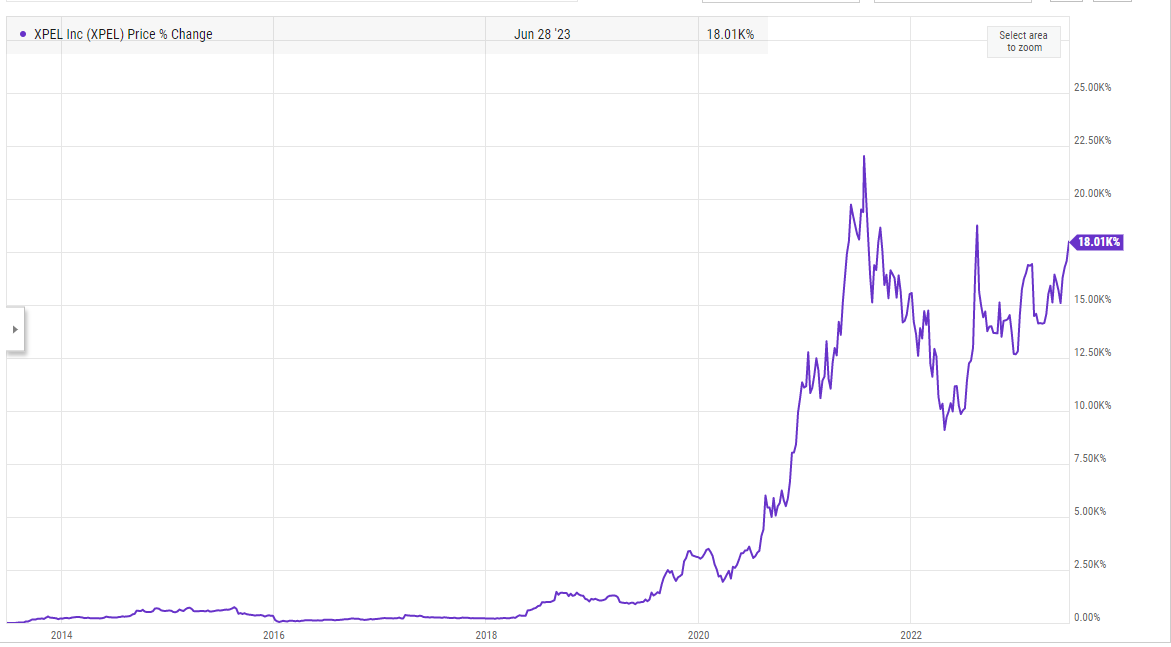

Obviously that “power access” issue is an extreme example of different considerations for different companies in different countries, but those types of biases / blindspots are always worth keeping in mind when researching companies. Like many investors, I’m based in NYC / Manhattan, and I find NYC / Manhattan investors will often quickly dismiss an idea or product as “silly” because it doesn’t fit into their life style. XPEL is one of the best performing stocks of the past ten years; it actually pains me to look at the stock chart because I owned a good chunk of it and sold for a small gain right before this insane run took place. With hindsight bias, I think a large reason I sold (other than being a complete idiot) is because I live in NYC and have absolutely no connection to cars; if I lived in a suburb and my car was my absolute pride and joy (like some of my friends), I might have understood the value prop of a film to protect the vehicle a little bit better.

You can find similar “bias” blind spots all across the market. For example, for years, Qurate / QVC argued (likely correctly) that the largely male investment community underestimated the brand loyalty of QVC’s largely female customer base.

There are no easy answers here. Is it better to stick only to markets and companies that fit into your every day lifestyle since you’ll understand their dynamics? Maybe…. but that feels quite limiting in terms of investment opportunities! Is it better to explore tons of international markets or companies outside your lifestyle wheelhouse? Maybe….. but it’s going to be a lot harder to build huge conviction in a company / country that you’re not intimately familiar with.

The correct answer is somewhere in between….. but I’ll certainly be thinking about access to the power grid as risk for some of my companies going forward!

Love the takeaway in this piece. Absolutely critical investors understand their own abilities. I have a fairly limited wheelhouse, but nonetheless make an effort to study assets outside of it. So many times I've come across considerations similar to this example of power availability. There's countless of them, all over the world. Very hard to appreciate them unless you see them firsthand.

Thoughtful piece. My immediate reaction was to be reminded of why Buffett and Munger (and really most great investors) think of themselves as learning machines. Much like the sports gambler who learns the game better in an effort to gain an edge -- and thus enjoys that sport all the more, investing is a wonderful motivation to learn about nearly everything, which ought to make one a better investor or at least make one a more interesting and thoughtful person. Thanks for letting me tag along as you engage in the process. It's been a joy to watch.